1. Introduction

1.1 Rule 7.10.5 states that the aggregate amount of a non-Defaulting Clearing Member’s Collateralised Contribution and Contingent Contribution that can be applied for all Events of Default occurring within a period of 30 calendar days shall not exceed an amount equal to three times of that Clearing Member's Prescribed Contributions as at the start of that 30-day period.

1.2 Rule 7.10.6 states that where an Event of Default occurs, the amount of a non-Defaulting Clearing Member’s Collateralised Contribution and Contingent Contribution that is available for application in respect of that Event of Default is the lower of:

1.2.1 an amount equal to three times of the Clearing Member’s Prescribed Contributions as at the start of the 30-day period that ends on the day of the Event of Default less the aggregate amount of that Clearing Member’s Collateralised Contribution and Contingent Contribution that has already been utilised for all other preceding Events of Default that had occurred in that 30-day period; or

1.2.2 where the Clearing Member’s Collateralised Contribution was adjusted during the aforementioned 30-day period, an Adjusted Amount equal to three times of the consequently adjusted Prescribed Contributions less the aggregate amount of the Clearing Member’s Collateralised Contribution and Contingent Contribution that has already been utilised for Events of Default that occurred after the day of that adjustment but before the Event of Default.

In the event the Clearing Member’s Collateral Contribution is adjusted multiple times during the 30-day period, a separate Adjusted Amount shall be calculated for each adjustment and the lowest Adjusted Amount shall apply for the purpose of Rule 7.10.6(2).

1.3 This Practice Note illustrates the operation of Rules 7.10.5 and 7.10.6. The scenarios set out are meant only to illustrate the calculation of the usage limits applicable under the Rules in various hypothetical scenarios, and are not representative of how Events of Defaults are managed by CDP nor the actions that CDP can and may take to maintain a fair, orderly, safe and efficient market.

2. Operation of Rule 7.10.5

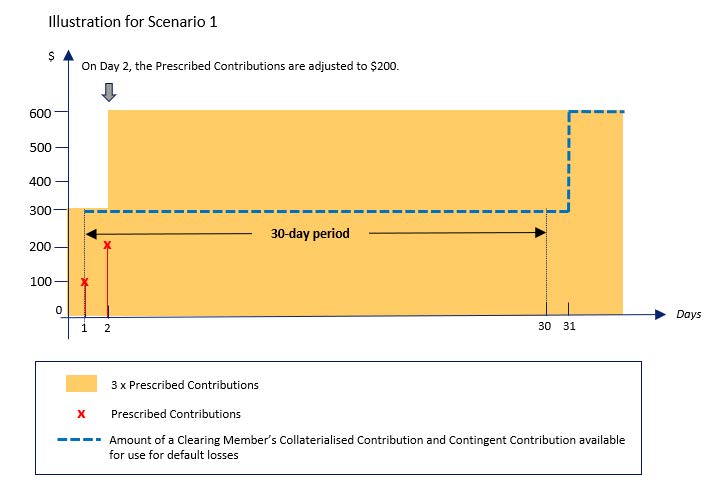

Scenario 1

2.1 Scenario 1: On Day 1, the non-Defaulting Clearing Member’s Prescribed Contributions is $100. On Day 2, the Clearing Member’s Prescribed Contributions is increased to $200. This scenario illustrates how the aggregate amount of a non-Defaulting Clearing Member’s Collateralised Contribution and Contingent Contribution that can be applied in respect of all Events of Default occurring within a 30-day period shall not exceed an amount equal to three times of the Clearing Member’s Prescribed Contributions as at the start of the 30-day period.

2.2 In accordance with Rule 7.10.5, the aggregate amount of the Clearing Member’s Collateralised Contribution and Contingent Contribution that can be applied in respect of all Events of Default occurring within Day 1 to Day 30 shall not exceed an amount equal to three times of that Clearing Member's Prescribed Contributions on Day 1. Therefore, even though the Clearing Member’s Prescribed Contributions were increased to $200 on Day 2, the aggregate amount of the Clearing Member’s Collateralised Contribution and Contingent Contribution which can be applied to meet default losses occurring within Day 1 to Day 30 will not exceed $300 (i.e. 3 x $100).

3. Operation of Rule 7.10.6

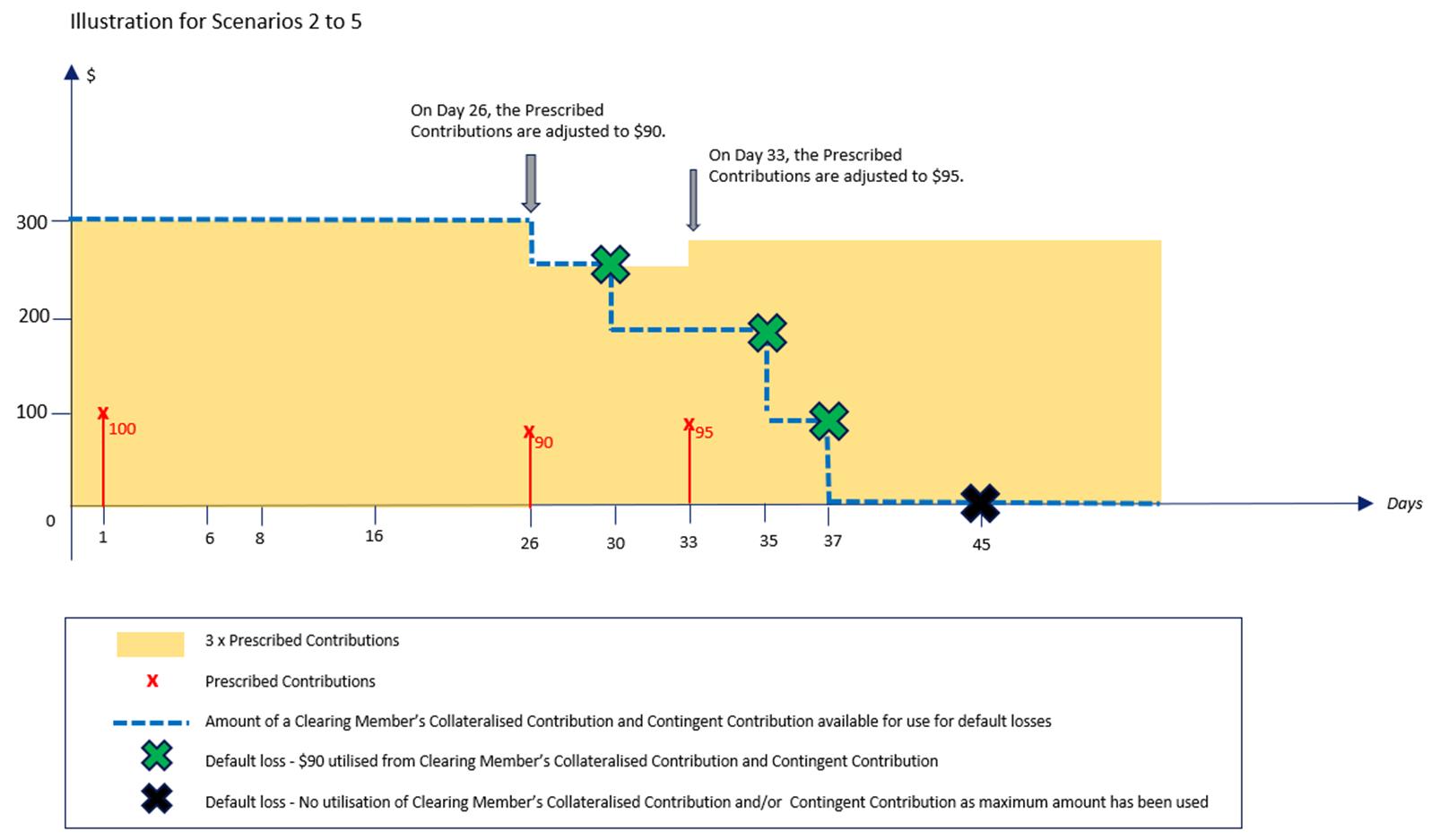

3.1 The following scenarios (Scenarios 2 to 5) illustrate how the amount of a non-Defaulting Clearing Member’s Collateralised Contribution and Contingent Contribution that can be used to meet losses is capped in the event of multiple defaults within a 30-day period.

Scenario 2

3.2 Scenario 2: On Day 1, the non-Defaulting Clearing Member’s Prescribed Contributions is $100. On Day 26, the Clearing Member’s Prescribed Contributions is reduced to $90. Subsequently, an Event of Default occurred on Day 30. This scenario illustrates the amount of a non-Defaulting Clearing Member’s Collateralised Contribution and Contingent Contribution that is available for application in respect of the Event of Default that occurred on Day 30.

3.3 Pursuant to Rule 7.10.6, the amount of a non-Defaulting Clearing Member’s Collateralised Contribution and Contingent Contribution that is available in respect of the Event of Default on Day 30 is the lower of:

(a) an amount equal to three times of the Clearing Member’s Prescribed Contributions as at the start of the 30-day period that ends on the day of the Event of default (i.e. Day 1) less the aggregate amount utilised for all preceding events of default (i.e. from Day 1 up until the current Event of Default); or | 3 x Prescribed Contributions on Day 1 | = 3 x $100 = $300 |

| Aggregate amount utilised for all preceding Events of Default from Day 1 until the current Event of Default on Day 30 | = $0 | |

| Amount that results under limb (a) | = $300 - $0 =$300 | |

(b) where the Clearing Member’s Collateralised Contribution was adjusted during the 30-day period, an Adjusted Amount equal to three times of the consequently adjusted Prescribed Contributions (i.e. the Prescribed Contributions on Day 26) less the aggregate amount of the Clearing Member’s Collateralised Contribution and Contingent Contribution that has already been utilised in respect of Events of Default that occur after the day of that adjustment but before the Event of Default (i.e. from Day 26 up until the current Event of Default). | 3 x adjusted Prescribed Contributions on Day 26 | = 3 x $90 = $270 |

| Aggregate amount utilised for all Events of Default from Day 26 until the current Event of Default on Day 30 | = $0 | |

| Adjusted Amount that results under limb (b) | = $270 - $0 = $270 |

3.4 Under this scenario, the amount that results under limb (b) is lower than the amount that results under limb (a). Therefore, the amount of the non-Defaulting Clearing Member’s Collateralised Contribution and Contingent Contribution that is available for the Event of Default that occurred on Day 30 is the amount that results under limb (b), which is $270.

Scenario 3

3.5 Scenario 3: Continuing from Scenario 2, $90 of the Clearing Member’s Collateralised Contribution and Contingent Contribution was used for the Event of Default on Day 30. On Day 33, the Clearing Member’s Prescribed Contributions is increased to $95. A second default occurs on Day 35. This scenario illustrates the amount of the non-Defaulting Clearing Member’s Collateralised Contribution and Contingent Contribution that is available for application in respect of the second Event of Default that occurred on Day 35.

3.6 Pursuant to Rule 7.10.6, the amount of a non-defaulting Clearing Member’s Collateralised Contribution and Contingent Contribution that is available for application in respect of the Event of Default on Day 35 is the lower of:

(a) an amount equal to three times of the Clearing Member’s Prescribed Contributions as at the start of the 30-day period that ends on the day of the Event of Default (i.e. Day 35 – 29 days = Day 6) less the aggregate amount utilised for all preceding Events of Default (i.e. from Day 6 up until the current Event of Default); or | 3 x Prescribed Contributions on Day 6 | = 3 x $100 = $300 |

| Aggregate amount utilised for all preceding events of default from Day 6 until the current Event of Default on Day 35 | = $90* | |

| * From the default on Day 30 | ||

| Amount that results under limb (a) | = $300 - $90 =$210 | |

(b) where the Clearing Member’s Collateralised Contribution was adjusted during the 30-day period, an Adjusted Amount equal to three times of the consequently adjusted Prescribed Contributions less the aggregate amount of the Clearing Member’s Collateralised Contribution and Contingent Contribution that has already been utilised in respect of Events of Default that occurred after the day of that adjustment but before the Event of Default. | Rule 7.10.6 also states that in the event the Clearing Member’s Collateralised Contribution is adjusted multiple times during the 30-day period, a separate Adjusted Amount shall be calculated for each adjustment and the lowest Adjusted Amount shall apply for the purpose of Rule 7.10.6(2). | |

In this case, the Clearing Member’s Collateralised Contribution was adjusted twice resulting in two adjusted Prescribed Contributions within the relevant 30-day period. Therefore two separate Adjusted Amounts will be calculated. | ||

| Adjusted Amount A: | ||

| 3 x adjusted Prescribed Contributions on Day 26 | = 3 x $90 = $270 | |

| Aggregate amount utilised for Events of Default from Day 26 until the current Event of Default on Day 30 | = $90* | |

| * From the default on Day 30 | ||

| Adjusted Amount A | = $270 - $90 =$180 | |

| Adjusted Amount B: | ||

| 3 x adjusted Prescribed Contributions on Day 33 | = 3 x $95 = $285 | |

| Aggregate amount utilised for Events of Default from Day 33 until the current Event of Default on Day 35 | = $0 | |

| Adjusted Amount B | = $285 - $0 =$285 | |

Adjusted Amount A ($180) is lower than Adjusted Amount B ($285), therefore Adjusted Amount A applies for the purpose of Rule 7.10.6(2) and the amount that results under limb (b) is $180. | ||

3.7 In this scenario, the amount of the non-Defaulting Clearing Member’s Collateralised Contribution and Contingent Contribution that is available for the second Event of Default that occurred on Day 35 is the lowest Adjusted Amount calculated pursuant to limb (b), which is $180.

Scenario 4

3.8 Scenario 4: Continuing from Scenario 3, $90 of the Clearing Member’s Collateralised Contribution and Contingent Contribution was used in respect of the second default on Day 35. A third default occurred on Day 37. This scenario illustrates the amount of the non-Defaulting Clearing Member’s Collateralised Contribution and Contingent Contribution that is available for the default that occurred on Day 37.

3.9 Pursuant to Rule 7.10.6, the amount of a non-Defaulting Clearing Member’s Collateralised Contribution and Contingent Contribution that is available for utilisation in respect of the Event of Default on Day 37 is the lower of:

(a) an amount equal to three times of the Clearing Member’s Prescribed Contributions as at the start of the 30-day period that ends on the day of the Event of Default (i.e. Day 37 – 29 days = Day 8) less the aggregate amount utilised for all preceding Events of Default (i.e. from Day 8 up until the current Event of Default); or | 3 x Prescribed Contributions on Day 8 | = 3 x $100 = $300 |

| Aggregate amount utilised for all preceding Events of Default from Day 8 until the current Event of Default on Day 37 | = $90*+ 90** = $180 | |

| * From the default on Day 30 | ||

| ** From the default on Day 35 | ||

| Amount that results under limb (a) | = $300 - $180 = $120 | |

(b) where the Clearing Member’s Collateralised Contribution was adjusted during the 30-day period, an Adjusted Amount equal to three times of the consequently adjusted Prescribed Contributions less the aggregate amount of the Clearing Member’s Collateralised Contribution and Contingent Contribution that has already been utilised in respect of Events of Default that occurred after the day of that adjustment but before the Event of Default. | Rule 7.10.6 states that in the event the Clearing Member’s Collateralised Contribution is adjusted multiple times during the 30-day period, a separate Adjusted Amount shall be calculated for each adjustment and the lowest Adjusted Amount shall apply for the purpose of Rule 7.10.6(2). | |

In Scenario 3 from which this scenario continues, the Clearing Member’s Collateralised Contribution was adjusted twice resulting in two adjusted Prescribed Contributions within the relevant 30-day period. Therefore two separate Adjusted Amounts will be calculated. | ||

| Adjusted Amount A: | ||

| 3 x adjusted Prescribed Contributions on Day 26 | = 3 x $90 = $270 | |

| Aggregate amount utilised for Events of Default from Day 26 until the current Event of Default on Day 37 | = $90*+$90** =$180 | |

| * From the default on Day 30 | ||

| ** From the default on Day 35 | ||

| Adjusted Amount A | = $270 - $180 =$90 | |

| Adjusted Amount B: | ||

| 3 x adjusted Prescribed Contributions on Day 33 | = 3 x $95 = $285 | |

| Aggregate amount utilised for Events of Default from Day 33 until the current Event of Default on Day 37 | = $90** | |

| ** From the default on Day 35 | ||

| Adjusted Amount B | = $285 - $90 =$195 | |

Adjusted Amount A ($90) is lower than Adjusted Amount B ($195), therefore Adjusted Amount A applies for the purpose of Rule 7.10.6(2) and the amount that results under limb (b) is $90. | ||

3.10 The amount of the non-defaulting Clearing Member’s Collateralised Contribution and Contingent Contribution that is available for the third Event of Default that occurred on Day 37 is the lowest Adjusted Amount calculated pursuant to limb (b), which is $90.

Scenario 5

3.11 Scenario 5: Continuing from Scenario 4, $90 of the Clearing Member’s Collateralised Contribution and Contingent Contribution was used to meet losses suffered by the Clearing House arising from the third default on Day 37. A fourth default occurred on Day 45. This scenario illustrates the amount of the non-defaulting Clearing Member’s Collateralised Contribution and Contingent Contribution that is available to meet losses suffered by the Clearing House arising from or in connection with the default that occurred on Day 45.

3.12 Pursuant to Rule 7.10.6, the amount of a non-defaulting Clearing Member’s Collateralised Contribution and Contingent Contribution that is available for use in respect of the Event of Default on Day 45 is the lower of:

(a) an amount equal to three times of the Clearing Member’s Prescribed Contributions as at the start of the 30-day period that ends on the day of the Event of Default (i.e. Day 45 – 29 days = Day 16) less the aggregate amount used to meet default losses from all preceding events of default (i.e. from Day 16 up until the current Event of Default); or | 3 x Prescribed Contributions on Day 16 | = 3 x $100 = $300 |

| Aggregate amount utilised for all preceding Events of Default from Day 16 until the current Event of Default on Day 45 | = $90* + $90** + $90^ = $270 | |

| * From the default on Day 30 | ||

| ** From the default on Day 35 | ||

| ^ From the default on Day 37 | ||

| Amount that results under limb (a) | = $300 - $270 = $30 | |

(b) where the Clearing Member’s Collateralised Contribution was adjusted during the 30-day period, an Adjusted Amount equal to 3 times of the consequently adjusted Prescribed Contributions less the aggregate amount of the Clearing Member’s Collateralised Contribution and Contingent Contribution that has already been utilised in respect of Events of Default that occurred after the day of that adjustment but before the Event of Default. | Rule 7.10.6(2) states that in the event the Clearing Member’s Collateralised Contribution is adjusted multiple times during the 30-day period, a separate Adjusted Amount shall be calculated for each adjustment and the lowest Adjusted Amount shall apply for the purpose of Rule 7.10.6(2). | |

In Scenario 3 from which this scenario continues, the Clearing Member’s Collateralised Contribution had been adjusted twice resulting in two adjusted Prescribed Contributions within the relevant 30-day period. Therefore two separate Adjusted Amounts will be calculated. | ||

| Adjusted Amount A: | ||

| 3 x adjusted Prescribed Contributions on Day 26 | = 3 x $90 = $270 | |

| Aggregate amount utilised for Events of Default from Day 26 until the current Event of Default on Day 45 | = $90* + $90** + $90^ = $270 | |

| * From the default on Day 30 | ||

| ** From the default on Day 35 | ||

| ^ From the default on Day 37 | ||

| Adjusted Amount A | = $270 - $270 =$0 | |

| Adjusted Amount B: | ||

| 3 x adjusted Prescribed Contributions on Day 33 | = 3 x $95 = $285 | |

| Aggregate amount utilised for Events of Default from Day 26 until the current Event of Default on Day 45 | = $90** + $90^ = $180 | |

| ** From the default on Day 35 | ||

| ^ From the default on Day 37 | ||

| Adjusted Amount B | = $285 - $180 =$105 | |

Adjusted Amount A ($0) is lower than Adjusted Amount B ($105), therefore Adjusted Amount A applies for the purpose of Rule 7.10.6(2) and the amount that results under limb (b) is $0. | ||

3.13 In this case, the non-Defaulting Clearing Member’s Collateralised Contribution and Contingent Contribution cannot be utilised for the fourth Event of Default that occurred on Day 45 as the lowest Adjusted Amount calculated pursuant to limb (b) is $0.

Added on 31 October 2024.