1. Market Overview

The Exchange operates the Markets in accordance with applicable laws of Singapore. As an Approved Exchange we are committed to promoting a fair, orderly and transparent market in a manner consistent with the public interest as contemplated under the Act. This Rules is designed to facilitate the operation of efficient markets for the allocation of capital and transfer of risks. To the extent that the Markets function in an efficient manner, the Exchange will not intervene or impose unnecessary regulatory requirements that would inflate compliance or regulatory costs for its participants. This Rules seeks to achieve the above regulatory objectives while promoting robust and liquid Markets.

1.1 Market Title

The Markets comprise the SGX-DT Market and such other markets as provided under this Rules from time to time.

Amended on 26 November 200726 November 2007.

1.2.1 Rules Govern Market

This Rules governs the operation of the Markets as contemplated under the Act.

1.2.2 Products Available for Trading on the Market

The Contracts listed and traded on the Markets comprise Futures Contracts and Option Contracts as more fully described in Chapter 4.

1.3.1 Operation of Fair, Orderly and Transparent Market

The Exchange is obligated under the Act to ensure, as far as reasonably practicable, that each Market it operates is fair, orderly and transparent. In connection with this statutory obligation, the Exchange undertakes surveillance, supervision and enforcement actions to ensure compliance with this Rules. In discharging its obligations under the Act, the Exchange cannot act contrary to the interests of the investing public and is required to have particular regard to the interests of the investing public.

1.3.2 Regulatory Arrangements

The Exchange may take any action or enter into any agreement or arrangement it considers necessary or desirable in furtherance of its regulatory responsibilities under any applicable law or regulation with any Person including, without limitation, MAS, any other exchange, market, clearing house or Partner Market, or any Person which, in the opinion of the Exchange, exercises a legal or regulatory function under any law or regulation.

1.4.1 Confidentiality Undertaking

The Exchange shall not use, distribute, supply, provide, make available, sell or otherwise deal with Confidential Information to or for the benefit of any third party, including any third party who or which by himself or itself or by any director, officer, employee or representative that has, or at any time has had, any trading interests upon the Exchange. "Confidential Information" relates to information which is not in the public domain and includes information pertaining to a Member's Open Positions, Financial Resources, Members' Affairs and User Information.

1.4.2 Members' Affairs

All confidential information concerning a Member's affairs obtained or received by officials of the Exchange:

(collectively, "Members' Affairs") shall be confidential to such officials of the Exchange. For the avoidance of doubt, nothing in this Rule prohibits the disclosure by the Exchange of the outcome of any disciplinary proceedings or the grounds for a decision of the Disciplinary Committee or Appeals Committee.

1.4.3 Consensual Disclosure

Where the Exchange considers it necessary or desirable to use or disseminate any Confidential Information, the Exchange shall seek the prior consent of that Member to such use or dissemination, and shall provide to such Member:

Any Member approached by the Exchange under this Rule may give or withhold its consent to any use or dissemination of its information in its absolute discretion.

1.4.4 Permitted Disclosure

Notwithstanding anything to the contrary as set forth above, the Exchange may disclose any information, including Confidential Information concerning or associated with a Member, Approved Trader or Registered Representative (including, without limitation, information concerning any aspect of transactions made on the Markets) in connection with the discharge of its regulatory obligations under the Act or when compelled under applicable laws to do so or pursuant to any cross-border regulatory sharing arrangement subject to its obligation to maintain confidentiality under the Act. To the extent practicable, the Exchange shall use its best endeavors to notify the affected party of such disclosure(s) prior to disclosing the same.

1.5.1 Fidelity Fund Maintained by Exchange

Amended on 25 August 200925 August 2009.

1.5.2 Compensation Claims by Persons Claiming Compensation in the Case of Defalcation

Persons claiming compensation from the fidelity fund under Rule 1.5.1(1)(a) shall do so in accordance with the procedures set forth on the Exchange's website.

Amended on 25 August 200925 August 2009.

1.6.1 No Liability for Loss

Unless otherwise expressly provided in this Rules or in any other agreements to which the Exchange is a party, none of the Exchange, its related corporations, SGX RegCo, any person or entity referred to under Rule 1.7.4, or their respective directors, officers, employees, representatives or agents shall be liable to any Person for any loss (consequential or otherwise, including, without limitation, loss of profit), damage, injury, or delay, whether direct or indirect, arising from or in connection with the following, or anything done or not done as a direct or indirect consequence of the following:

"Exchange Systems" refers to any pre-trade, trade or post-trade systems, including the Trading System, operated by the Exchange in connection with the Markets. "Partner Market Facilities" refers to any relevant facilities and systems operated by the Exchange or otherwise in connection with the Partner Market.

Amended on 14 November 201614 November 2016, 15 September 201715 September 2017, 3 June 20193 June 2019 and 29 July 2022.

1.6.1A Indemnity

Added on 26 April 201326 April 2013 and amended on 15 September 201715 September 2017 and 3 June 20193 June 2019.

1.6.2 Statutory Immunity

As provided under the Act, the Exchange or any Person or entity acting on its behalf, including any person or entity referred to under Rule 1.7.4 and their respective directors, officers, employees, representatives, and agents, shall be immune from any criminal or civil liability for anything done (including any statement made) or omitted to be done with reasonable care and in good faith in the course of, or in connection with, the discharge or purported discharge of its obligations under the Act or this Rules.

Amended on 15 September 201715 September 2017 and 3 June 20193 June 2019.

1.6.3 Disclaimer of Warranties

All warranties and conditions, both express and implied as to condition, description, quality, performance, durability, or fitness for the purpose or otherwise of any of the Exchange Systems or Partner Market Facilities, or any component thereof are excluded except as required by law. The Exchange does not warrant or forecast that the Exchange Systems or Partner Market Facilities, any component thereof or any services performed in respect thereof will meet the requirements of any user, or that operation of the Exchange Systems or Partner Market Facilities will be uninterrupted or error-free, or that any services performed in respect of the Exchange Systems or Partner Market Facilities will be uninterrupted or error-free.

Amended on 29 July 2022.

1.6.4 Index Related Disclaimers

The Exchange, Index Provider and any other party involved in, or related to, making or compiling any index do not guarantee the originality, accuracy or completeness of such indices or any data included therein. Contracts on any index ("Index Contracts") are not sponsored, guaranteed or endorsed by the Index Provider or any other party involved in, or related to, making or compiling such indices. Neither the Index Provider nor any other party involved in, or related to, making or compiling any index makes any representations regarding the advisability of investing in such Index Contracts. Neither the Index Provider nor any other party involved in, or related to, making or compiling any index makes any warranty, express or implied, as to the results to be obtained by any person or any entity from the use of such index or any data included therein. Neither the Index Provider nor any other party involved in, or related to, making or compiling any MSCI Index makes any express or implied warranty, and expressly disclaims all warranties of merchantability and fitness for a particular purpose or use with respect to such index or any data included therein. Without limiting any of the foregoing, in no event shall an Index Provider or any other party involved in, or related to, making or compiling any index have any liability for any direct, special punitive, indirect, or consequential damages (including lost profits), even if notified of the possibility of such damages. In addition, neither the Exchange, an Index Provider nor any other party involved in, or related to, making or compiling any index shall have any liability for damages, claims, losses or expenses relating to any futures or options contracts that may be caused by any errors or delays in calculating or disseminating such index. "Index Provider" as used herein refers to MSCI, FTSE, IISL, NKS or such other index provider and their respective affiliates with whom the Exchange has or shall enter into agreements with for the creation and exploitation of indices and index-linked products.

1.6.5 Notification to Customers

Members shall notify Customers of the above exclusion of liability and disclaimer of warranty by the Exchange either by way of inclusion in the contracts granting access to the Markets or Partner Markets, or such other manner as approved by the Exchange.

Amended on 29 July 2022.

1.7.1 Binding Contract

This Rules shall operate as a binding contract as contemplated under the Act, between:

1.7.2 Deemed Consent

Each Member shall be deemed to have agreed to observe and perform the provisions of this Rules in force for the time being, so far as these provisions are applicable to the Exchange or the Member, as the case may be.

1.7.3 No Third Party Rights

A Person who is not a Member has no rights under the Contracts (Rights of Third Parties) Act 2001 to enforce any provisions under this Rules.

Amended on 18 January 2022

1.7.4 Delegation and assignment

The Exchange may delegate, assign or grant authority to exercise any of its rights, powers, authorities and discretions under these Rules, including any right to enforce these Rules, to such person or entity as it may determine in its sole discretion, without consent from any Trading Member.

Where these Rules provide that any power, authority or discretion is to be exercised by the Board, the Board may delegate, assign or grant authority to exercise such power, authority or discretion to any person or entity. The Board may authorise a delegate to sub-delegate.

Added on 15 September 201715 September 2017.

1.7.5 SGX RegCo's authority

SGX RegCo shall have the authority to exercise any rights, powers, authorities and discretions under these Rules, including the right to enforce these Rules. In the exercise of any such rights, powers, authorities and discretions under these Rules, SGX RegCo shall be bound to the same extent as the Exchange in respect of any obligations arising from the exercise of such rights, powers, authorities and discretions.

Added on 15 September 201715 September 2017.

1.8 Waiver by Exchange

Unless otherwise indicated, the Exchange may waive compliance with this Rules or portion thereof or grant waivers subject to such terms and conditions as it deems fit. All waivers shall be notified to Members via Regulatory Notices or Circulars as the Exchange deems fit.

1.9.1 Rule Amendment Process

The Exchange is prohibited from making any amendments to this Rules unless it complies with such requirements as contemplated under the Act. In addition to these requirements, Board approval is required to effect any Rule amendments. These safeguards are designed to promote regulatory transparency and accountability on the part of the Exchange with respect to its rulemaking process and thereby promote investor confidence in the Markets.

1.9.2 New Rule — Effective Date

Any amendment to this Rules shall not come into force unless the prescribed time periods as contemplated under the Act are met and a Circular announcing the effective date of the revised Rules is issued by the Exchange.

1.9.3 Mandatory Rule Amendments

Notwithstanding anything to the contrary as set forth above, the Exchange may effect Rule amendments in such manner as directed by MAS or pursuant to the Act or other applicable laws.

1.10.1 Issuance of Supplementary Instruments

The Exchange may, from time to time, issue Directives, Regulatory Notices or Practice Notes to supplement this Rules or to provide guidance on the interpretation or application of this Rules.

1.10.2 Authorised Use of Directives, Regulatory Notices and Practice Notes

Directives, Regulatory Notices and Practice Notes may only be used in the manner and for such purposes as expressly contemplated under this Rules. "Directives" are binding notices directing Members to take corrective or other actions in the interests of a fair, orderly and transparent market or to address investor protection concerns. "Regulatory Notices" are binding notices issued by the Exchange regarding regulatory matters pertaining to the Markets and Partner Markets. "Practice Notes" are guidelines that seek to explain the application and interpretation of a Rule. Practice Notes do not bind the Exchange in the application of a Rule.

Amended on 29 July 2022.

1.10.3 Precedence

The order of precedence in the construction and interpretation of the various legislative and quasi-legislative instruments governing the Markets and their participants shall be, in descending order of precedence, as follows:

1.10.4 Supremacy

In the event of a conflict between any provision in the aforesaid instruments the provisions contained in the instrument at a higher precedence level shall prevail.

1.11 Governing Law and Jurisdiction

This Rules is governed by the laws of Singapore. Save as provided in Chapter 6 of this Rules, the courts of Singapore shall have exclusive jurisdiction to determine any dispute arising from or in connection with this Rules.

1.12.2 Transitional Arrangements

The Exchange may, from time to time, publish transitional arrangements in relation to this Rules.

1.12.3 Floor Rules

The floor trading rules in the Old Rules shall continue to apply to the extent that floor trading is still available for discrete Contracts on the Effective Date. With respect to generic, non-floor specific rules, in the event of a conflict between this Rules and the Old Rules, this Rules shall prevail. "Old Rules" refers to the collection of rules applicable to the Markets and commonly referred to as the "DT Rules" that were in force before this Rules came into effect.

1.12.4 Survival of Accrued Rights and Obligations

The rescission of the Old Rules shall not impair, modify or discontinue the status, operation or effect of any act or omission under the Old Rules.

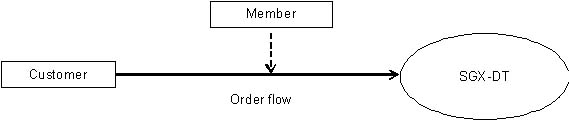

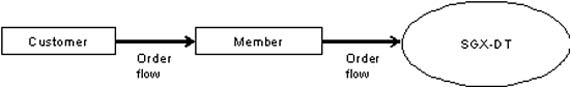

2. Overview of Access and Membership

Unless otherwise indicated, the Exchange operates wholly electronic Markets. Electronic trading access to the Markets is solely via the Trading System. Subject to this Rules, Direct Market Access is available to all customers and is not conditioned on Membership. "Direct Market Access" refers to direct access to the Trading System via an Exchange-provided or Exchange-approved OMS. Direct Market Access does not include Internet Trading.

Amended on 15 March 201315 March 2013 and 14 November 201614 November 2016

2.1.1 Access to the Trading System

A Member or Customer may access the Trading System via:

"OMS" refers to an order management system through which orders are routed to the Trading System. "Exchange-approved OMS" refers to an OMS that has passed conformance testing and meets appropriate technical specifications as required by the Exchange.

Amended on 15 March 201315 March 2013 and 14 November 201614 November 2016.

2.1.2 Conditions Governing Direct Market Access

Amended on 15 March 201315 March 2013 and 14 November 201614 November 2016.

2.1.2A Conditions Governing Sponsored Access

For the purpose of this Rule 2.1.2A, "recognised regulatory authority" refers to a signatory to the International Organization of Securities Commissions' Multilateral Memorandum of Understanding Concerning Consultation and Cooperation and the Exchange of Information, and "regulated activity" shall have the same meaning as in the Act.

Added on 15 March 201315 March 2013 and Amended on 18 January 2022.

2.1.2B Suspension and Termination of Direct Market Access

Added on 15 March 201315 March 2013.

2.1.3 Access to Partner Market

The Exchange or its related corporations may provide access facilities to enable Persons to execute trades on contracts listed on a Partner Market. Such Persons accessing the Partner Market are required to comply with this Rules as well as applicable rules, laws and regulations governing trading in the Partner Market.

Amended on 14 November 201614 November 2016 and 29 July 2022.

2.1.3A Conditions Governing Access to Connect Market

Refer to Regulatory Notice 2.1.3A(4); 4.1.11.

Added on 29 July 2022.

2.1.4 Trading Capacity — House and Agency

Amended on 1 April 20141 April 2014.

2.2.1 Overview

Membership shall:

2.2.2 Trading Member

There are 2 classes of Trading Members:

A Trading Member shall observe this Rules and any requirements as prescribed by the Exchange from time to time.

Amended on 25 August 200925 August 2009.

2.2.3 Clearing Member

To the extent that a Clearing Member has trading privileges, it is required to observe this Rules, the Clearing Rules and any requirements as prescribed by the Exchange or the Clearing House from time to time.

2.2.4 Dual Member

A Dual Membership entitles a Member to certain Membership privileges and subjects it to certain additional Membership obligations as set out in the applicable rules, including this Rules, the Clearing Rules, the CDP Clearing Rules and the Securities Rules. A "Dual Member" refers to a Member of more than one (1) Approved Exchange or more than one (1) Designated Clearing House owned by the Singapore Exchange Limited, as the case may be.

2.2.5 Honorary Member

The Exchange reserves the right to confer the distinction of Honorary Member to any person who has made a significant contribution to the promotion and development of a Market or Markets.

2.3.1 Licensing, Financial, Integrity, Clearing and Other Requirements

To be eligible for admission as a Member, an applicant shall satisfy the Exchange of its ability to satisfy the following requirements, where relevant, both at the time of admission as well as on a continuous basis until the termination of the Membership:

Amended on 25 August 200925 August 2009.

2.3.2 Membership in Other Exchanges

The following requirements apply in relation to membership in other exchanges:

Amended on 24 January 201124 January 2011.

2.4.1 Licensing and Registration Requirements for General Trading Members

A General Trading Member and its employees and agents are required to procure and maintain the requisite licence(s) and registration(s) with the Relevant Regulatory Authority to conduct regulated activities. The General Trading Member and its employees and agents shall independently satisfy such licensing and registration requirements as follows:

Amended on 25 August 200925 August 2009, 29 November 201029 November 2010, 1 April 20141 April 2014 and 18 January 2022.

2.4.2 Credit Rating Requirements for Bank Trading Members

A Bank Trading Member is required to satisfy the Exchange that it, or its parent bank, has obtained a credit rating that indicates, at least, adequate intrinsic safety and soundness, excluding external credit support, and a limited ability to withstand adverse business or economic conditions from any rating agency registered with an appropriate authority.

Added on 25 August 200925 August 2009 and amended on 26 April 201326 April 2013.

2.4.3 Downgrades in Credit Rating of Bank Trading Members

Upon admission as a Bank Trading Member, if there is any downgrade in the rating of the Bank Trading Member or its parent bank such that it falls below the minimum prescribed rating, the Exchange may, at its discretion, impose additional conditions as it deems fit, for permitting the Bank Trading Member to continue its trading activities as a Bank Trading Member.

Added on 25 August 200925 August 2009.

2.5.1 Overview of Base Capital, Total Risk Requirement and Statutory Requirements

A Member is required to comply with the financial requirements set forth in Rule 2.5, including, where applicable, requirements for Base Capital, Net Head Office Funds, Adjusted Net Head Office Funds, Financial Resources and Aggregate Resources. "Financial Resources", "Base Capital", "Net Head Office Funds", "Adjusted Net Head Office Funds", "Total Risk Requirement", "Aggregate Indebtedness", and "Aggregate Resources" shall have the meanings ascribed to them under Chapter 8 of this Rules.

Amended on 25 August 200925 August 2009, 1 April 20141 April 2014 and 22 April 201922 April 2019.

2.5.2 Trading Members

The following requirements apply in relation to Trading Members:

Amended on 25 August 200925 August 2009, 1 April 20141 April 2014 and 22 April 201922 April 2019.

2.5.4 Additional Financial, Capital and Other Requirements Imposed by the Exchange or the Clearing House

The Exchange or the Clearing House may from time to time prescribe additional financial and capital requirements for any Member or category or group of Members. Without limiting the foregoing, the Exchange may prescribe with respect to particular Members, capital, financial and other requirements in excess of the requirements prescribed under the Act, relevant applicable laws and regulatory requirements relating to the regulation of markets and licenced entities, or this Rules with respect to volume, risk exposure of positions carried, risk concentration, margin policies, nature of business conducted or to be conducted, their memberships in any exchange or market, and such other matters as deemed fit by the Exchange.

Amended on 1 April 20141 April 2014.

2.5.5 Calculation of Financial Resources

In the calculation of Financial Resources, a corporate Member may include Qualifying Subordinated Loan(s), subject to such conditions and restrictions as prescribed under the Financial and Margin Regulations and in such form as prescribed by the Exchange or the Clearing House.*

* Refer to Annex A — Deed of Subordination (Term Loan)Annex A — Deed of Subordination (Term Loan) and Annex B — Deed of Subordination (Revolving Credit Facility)Annex B — Deed of Subordination (Revolving Credit Facility).

Amended on 25 August 200925 August 2009, 7 February 20147 February 2014 and 29 December 201429 December 2014.

2.5.6 Notification Requirements of General Trading Members

The following requirements apply in relation to material changes to Financial Resources or Adjusted Net Head Office Funds:

Amended on 25 August 200925 August 2009 and 22 April 201922 April 2019.

2.5.6A Notification requirements of General Trading Members that hold a licence specified in Rule 2.4.1(b)

The following requirements apply in relation to material changes to the Base Capital requirements specified in Rule 2.5.2(b1):

Added on 1 April 20141 April 2014 and amended on 22 April 201922 April 2019.

2.5.6B Notification Requirements of Bank Trading Members

The following requirements apply in relation to material changes to the capital and financial requirements specified in Rule 2.5.2(c):

Added on 22 April 201922 April 2019.

2.5.7 Requirements Relating to Preference Shares, Unsecured Loans and Others for General Trading Members

The following additional financial requirements apply to General Trading Members:

Amended on 25 August 200925 August 2009, 1 April 20141 April 2014 and 29 December 201429 December 2014.

2.6.1 Overview

A Member shall comply with such technical, operational, information technology, security, risk management and other requirements or restrictions as specified in this Rule 2.6 or as prescribed by the Exchange from time to time.

2.6.2 Controlling Access

A Member shall have security arrangements in place to ensure that unauthorised persons are denied access to the Markets.

Amended on 15 March 201315 March 2013.

2.6.2A Adequacy of Systems

A Member must ensure that its systems and connections to the Markets operate properly, and have adequate and scalable capacity to accommodate trading volume levels.

Refer to Regulatory Notice 2.6.2A.

Added on 15 March 201315 March 2013.

2.6.3 Risk Management and Financial Controls

^ Refer to Practice Note 2.6.3(1)(d).

#Refer to Practice Note 2.6.3(1)(g).

Refer to Practice Note 2.6.3(2).

Amended on 15 March 201315 March 2013, 14 November 201614 November 2016 and 29 July 2022.

2.6.4 Audit Trails and Records

A Member is required to:—

Refer to Regulatory Notice 2.6.4.

Amended on 15 March 201315 March 2013 and 1 April 20141 April 2014.

2.6.5 Accounting and Book-keeping

A corporate Member shall comply with such accounting, reporting and book-keeping requirements as prescribed by the Exchange from time to time.

2.6.6 Business Continuity Requirements

The following requirements apply:

Added on 22 January 200922 January 2009 and amended on 1 April 20141 April 2014.

2.7.1 Directors, Chief Executive Officer and Other Personnel

A corporate Member shall demonstrate to the reasonable satisfaction of the Exchange that it employs and appoints fit and proper persons* as:

* The Exchange shall evaluate "Fit and proper" criteria in this Rule 2.7.1 in a manner similar to the MAS Guidelines on Fit and Proper Criteria.

2.7.2 Exchange Approval for Chief Executive Officer and Deputy Chief Executive Officer of General Trading Member

A corporate General Trading Member shall procure the prior approval of the Exchange with respect to the appointment of its chief executive officer and deputy chief executive officer.

Amended on 25 August 200925 August 2009.

2.7.3 Notification of Appointment of Chief Executive Officer or Deputy Chief Executive Officer for Bank Trading Member

A Bank Trading Member shall notify the Exchange at least seven (7) days prior to the appointment of its chief executive officer or deputy chief executive officer.

Added on 25 August 200925 August 2009.

2.9.1 Member Register

The Exchange shall maintain a register of all Members (the "Register"). The names of Members on the Register which are undertaking Agency Trades or clearing activities shall be available for public inspection. Members on the Register may refer to themselves as "Members of SGX-DT Limited".

2.9.2 Trading Member

Amended on 25 August 200925 August 2009.

2.10.1 Clearing House and Clearing Member Guarantee

All trades executed on the Markets shall be cleared exclusively by the Clearing House through a Clearing Member pursuant to the Clearing Rules. A Trading Member shall be required to have the requisite clearing arrangement with a Clearing Member.

2.10.2 Revocation of Access Rights

If a Clearing Member notifies the Exchange that it has suspended or revoked its clearing arrangement with a Trading Member, such Trading Member shall be denied trading access to the Trading System until its clearing arrangement is reinstated with a Clearing Member.

Amended on 14 November 201614 November 2016.

2.11.1 Application

An application for Membership shall be made to the Exchange in writing and the applicant shall pay the requisite fees prior to admission as a Member. The Exchange may require from the applicant such information, and may institute such investigation to verify information submitted by the applicant, as it deems fit. The Exchange may require the applicant, or one (1) or more representatives of the applicant, to attend an interview by the Exchange.

2.11.2 Publication of Successful Applicants

Save for individual Trading Members, the Exchange shall publish from time to time the names of successful applicants for Membership by means of a Circular or such other means as the Exchange may determine.

2.11.3 Rejection of Application

If the Exchange is of the view that the requirements for admission are not met or that the applicant is otherwise not fit for Membership, the Exchange is entitled to reject the application for Membership.

2.11.4 Deemed Domicile

A Member shall be deemed to have elected domicile at the address stated by it in its application or at the last address subsequently specifically notified by it in writing to the Exchange, as the case may be.

2.12.1 Imposition of Fees and Notification of Changes to Fees

The Exchange may, from time to time, impose fees, levies and charges to be paid by Members on such terms as the Exchange may prescribe. The Exchange shall give notice of any changes to fees, levies and charges by means of a Circular or by posting a schedule of fees, levies and charges on the Exchange's website.

2.12.2 Late Interest

A Member which fails to pay any fees, levies or charges within thirty (30) days of such fees, levies or charges becoming payable shall be notified in writing by the Exchange of such arrears ("Arrears Notice"). Late interest charges at the prevailing interest rate may be imposed by the Exchange on late payments by Members.

2.12.3 Suspension of Rights

If the arrears are not paid by the Member within ten (10) days of the date of dispatch of an Arrears Notice, the Exchange may suspend Membership rights until all monies for the time being owed by it to the Exchange, together with any other sums that shall accrue due and payable by it and remain unpaid during the period of suspension, have been paid.

2.13.1 Registration Criteria for Approved Traders and Registered Representatives

A Member shall register with the Exchange any person acting on its behalf as an Approved Trader or a Registered Representative. To qualify for registration with the Exchange as an Approved Trader or Registered Representative, each applicant:

* The Exchange shall evaluate "fit and proper" criteria in this Rule 2.13.1 in a manner similar to the MAS Guidelines on Fit and Proper Criteria.

Amended on 8 August 20088 August 2008, 25 August 200925 August 2009, 29 November 201029 November 2010 and 1 April 20141 April 2014.

2.13.1A

In approving an application to be an Approved Trader or a Registered Representative, the Exchange may consult the Relevant Regulatory Authority.

Added on 1 April 20141 April 2014.

2.13.2 Registration of Approved Traders

Every Approved Trader shall be required to register with the Exchange before he acts or holds himself out as having the authority to execute trades on the Markets for:

For the avoidance of doubt, an Approved Trader shall not hold himself out as a sales representative of the respective Member or undertake any activities of a Registered Representative unless he is so registered with the Exchange as contemplated under this Rules.

2.13.3 Registration of Registered Representatives

Every Registered Representative shall be required to register with the Exchange before he acts or holds himself out as a sales representative of the respective Member. A Registered Representative shall not act or hold himself out as having the authority to execute trades on the Markets, unless he is registered as an Approved Trader with the Exchange as contemplated under this Rules. Upon being registered as a Registered Representative with the Exchange, a Registered Representative may, in the name of such Member:

Amended on 29 November 201029 November 2010 and 1 April 20141 April 2014.

2.13.4 Register of Approved Traders and Registered Representatives

The Exchange shall maintain a register of Approved Traders and Registered Representatives.

2.13.5 Approved Traders and Registered Representatives Obligations

Approved Traders and Registered Representatives are required to comply with the relevant provisions and other safeguards as prescribed under the Act, this Rules and applicable laws.

2.13.6 Revocation of Registration of Approved Traders and Registered Representatives

A Member shall immediately notify the Exchange if:

The Exchange may terminate the registration of an Approved Trader or a Registered Representation upon notification under Rule 2.13.6(ab) The registration of an Approved Trader or a Registered Representative shall automatically lapse upon such other notification under Rule 2.13.6, or the cessation of his sponsoring Member's Membership.

Amended on 25 August 200925 August 2009, 29 November 201029 November 2010 and 1 April 20141 April 2014.

2.13.7 Summary Powers of Suspension of Registration of Approved Traders and Registered Representatives

Notwithstanding and without prejudice to the powers of the Appeals Committee or the Disciplinary Committee, the Exchange may suspend in whole or in part the privileges of any Approved Trader or a Registered Representative for a period of up to one (1) year upon the occurrence of any of the following events:

Amended on 25 August 200925 August 2009, 29 November 201029 November 2010 and 1 April 20141 April 2014.

2.13.7A Duty to Notify the Exchange of Matters Concerning Approved Traders and Registered Representatives

A Member shall immediately notify the Exchange upon the occurrence of any of the events in Rule 2.13.7(c), (d), (e), (f) and (fa).

Added on 25 August 200925 August 2009 and amended on 29 November 201029 November 2010.

2.13.8 Liability of Members

A Member is responsible for all trades done through it. A corporate Member is responsible for the conduct and execution of trades by its Approved Traders and Registered Representatives and shall monitor and ensure that its Approved Traders and Registered Representatives comply with this Rules. For the avoidance of doubt, the Exchange retains disciplinary and supervisory authority over Approved Traders and Registered Representatives as contemplated in this Rules and applicable laws.

2.13.9 Registration Form

A Member shall submit an application to register a person as an Approved Trader or a Registered Representative in such form as the Exchange may prescribe from time to time. The Exchange may require from the Member or the prospective Approved Trader or Registered Representative such information, and may institute such investigation to verify information submitted by the Member or the prospective Approved Trader or Registered Representative, as it deems necessary. Registration as an Approved Trader or a Registered Representative of the Member takes effect upon the grant of approval by the Exchange.

2.14.1 Notification to Exchange

Unless otherwise provided in this Rules, a corporate Member shall notify, or, where practicable, pre-notify, the Exchange in writing of any Change of Control. "Change of Control" refers to:

Amended on 25 August 200925 August 2009 and 18 January 2022.

2.14.2 Reviewing Suitability

Upon receipt by the Exchange of any notice of Change of Control from a corporate Member the Exchange shall review the suitability of that Member for Membership in the Exchange. The Exchange may require that Member to furnish such additional information as the Exchange may from time to time consider material in the course of such review.

2.14.3 Suspension of Rights

If, upon completion of the review referred to in Rule 2.14.2, the Exchange is not satisfied that the corporate Member continues to satisfy the applicable criteria for Membership set forth in Rule 2.3, it may suspend the rights of the corporate Member for up to a period of one (1) year.

Refer to Exchange's obligation to refer a suspended Member, Approved Trader or Registered Representative to the Disciplinary Committee within 14 days under Rule 7.2.5.

2.15.1 Member's Suspension or Resignation

The following requirements apply in relation to a Member's suspension or resignation:

2.15.2 Summary Powers of Suspension of Trading Privileges of Members

Notwithstanding and without prejudice to the powers of the Appeals Committee and the Disciplinary Committee, the Exchange may suspend in whole or in part a Member's trading privileges for up to a period of one (1) year upon the occurrence of any of the following events:

2.15.3 Termination of Membership

The Exchange shall have the power to terminate any Membership upon the occurrence of any of the following events:

Amended on 25 August 200925 August 2009, 16 July 201216 July 2012, 1 April 20141 April 2014 and 18 January 2022.

2.15.4 Effect of Suspension or Termination

In the event of suspension or termination of trading privileges, the Exchange may direct the affected Member to Close Out any Open Positions or take such other steps that the Exchange deems fit for the protection of Customers or the maintenance of a fair, orderly and transparent market. The affected Member shall cooperate fully with the Exchange with respect to such directions. A suspension or termination of trading privileges does not in any way affect the liabilities of the Member to the Exchange and other Members and all such liabilities shall subsist until satisfied or discharged.

2.15.5 Accrued Obligations Survive

A Member which ceases to be a Member shall remain subject to this Rules and to the jurisdiction of the Exchange in respect of acts and omissions while it was a Member and in respect of any investigation or disciplinary proceedings relating thereto (including the application of any Sanction imposed) as if it was a Member.

2.15.6 Exchange to Inform Clearing House

The Exchange shall promptly inform the Clearing House of the resignation, termination or suspension, as well as of the lifting of such suspension, of the Membership of any Member.

3.1 Overview

This Chapter is targeted at the ongoing obligations of Members, Approved Traders and Registered Representatives upon admission to or registration with the Exchange. This Chapter is divided into three (3) main parts: (a) duties applicable to all Members, Approved Traders and Registered Representatives; (b) duties applicable to Members engaging in Agency Trades and their Approved Traders and Registered Representatives; and (c) trading practices. The obligations of Members, Approved Traders and Registered Representatives are more onerous when a Member undertakes Agency Trades and handles Customer monies as opposed to when it engages solely in House Trades.

3.2.1 General Duties of Integrity, Fair Dealing and Care

When trading on the Markets, Members, Approved Traders and Registered Representatives are required to:

3.2.2 Constitutive Documents

A corporate Member shall ensure that its memorandum and articles of association or its constitutive documents conform to this Rules so as to enable that Member to perform the obligations, terms and covenants contemplated in this Rules. A corporate Member shall amend its memorandum and articles of association or its constitutive documents to the extent necessary to ensure consistency with this Rule 3.2.2.

3.2.3 Reporting of Change in Member's Circumstances

Without prejudice to Rule 2.14.1, a Member shall immediately inform the Exchange in writing of:

3.2.3A Reporting and Other Requirements Pertaining to Specific Contracts

Each Member shall comply with such reporting and/or other requirements pertaining to specific Contracts as may be prescribed by the Exchange from time to time.

Refer to Regulatory Notice 3.2.3A.

Added on 22 November 2021.

3.2.4 Other Reporting Obligations of Members

A Member shall inform the Exchange in writing immediately if the Member, or any of its Approved Traders, Registered Representatives, directors, officers or employees, as the case may be:

The reporting obligations under this Rule 3.2.4 apply whenever any of the abovementioned events occurs, or threatens to occur.

Amended on 1 April 20141 April 2014.

3.2.5 Prohibitions on Conduct of Other Business

A Member may carry on its business on any market, unless the carrying-on of such business on such market has been prohibited by the Exchange. The Member shall fully comply with the prevailing constitution, rules, by-laws, regulations, customs and practices of such other markets.

3.2.6 Settlement of Margins Due

A Trading Member shall promptly settle all margin liabilities owed to its sponsoring Clearing Member.

3.2.7 Speculative Long and Short Positions for the Same Contract Month

A Member shall not be permitted to carry a speculative long position and a speculative short position for the same legal and beneficial owner in the same Contract, as well as in the same Connect Contract, for the same Contract Month.

Amended on 29 July 2022.

3.2.8 Advertising Guidelines

A Member, Approved Trader and Registered Representative shall ensure that any advertising, market letters or similar information that they issue, in the form and context in which such advertisements, market letters or similar information appear or are used:

If the Exchange finds any advertising, market letters or similar information issued by a Member, Approved Trader or Registered Representative to be in contravention of this Rule 3.2.8, it may require all such prospective advertising, market letters or similar information issued by that Member, Approved Trader or Registered Representative to be submitted to the Exchange for approval prior to release.

A General Trading Member that holds a licence specified in Rule 2.4.1(b) shall not direct any advertising, market letters or similar information to deal in securities or Futures Contracts on the Exchange to customers domiciled in Singapore or to the extent that it may be acted upon by persons in Singapore.

Amended on 29 November 201029 November 2010 and 1 April 20141 April 2014.

3.3 Duties of Members Undertaking Agency Trades

A Member which undertakes Agency Trades shall comply with the following additional obligations.

3.3.1 Customer Account and Know-Your-Customer Requirements

A Customer Account shall be identified and designated by the full name of the Customer and an account code. Prior to opening a Customer Account, a Member shall satisfy itself that it has:

in a manner consistent with industry best practices on know-your-customer requirements.

Refer to Regulatory Notice 3.3.1.

3.3.2 Management Approval Required for Opening Customer Accounts

At least one (1) management staff, or a management staff of a Related Corporation of that Member charged with the account approval function, is required to approve the opening of a Customer Account. Such management staff shall be independent of the Member's sales and dealing functions. The management staff's approval shall be in writing, maintained as a permanent record and obtained prior to the execution of the first trade of the Customer in that account.

3.3.3 Risk Disclosure Statement

*Refer to Regulatory Notice 3.3.3.

Amended on 25 August 200925 August 2009, 16 July 201216 July 2012, 1 April 20141 April 2014, 22 November 2021 and 18 January 2022.

3.3.4 Customer Instructions and Power of Attorney

A Member shall execute orders only upon receipt of instructions from a Customer which has opened accounts with the Member. Unless otherwise authorised by a Customer, the Member shall communicate solely with that Customer in respect of statements, contract notes, or any other information relating to the activities of that Customer. The Member shall obtain a power of attorney or proper written authorisation from its Customer before:

3.3.5 Customer Education

Save for Accredited Investors, a Member shall provide its Internet Trading Customers with adequate information, guidance and training with respect to the following matters:

With respect to Accredited Investors, a Member's obligation relates solely to the provision of adequate information, guidance and training in relation to prohibited trading practices.

Refer to Practice Note 3.3.5.

Amended on 15 March 201315 March 2013.

3.3.6 Orders Only Via Registered Representatives

Other than orders made via Internet Trading by Customers, a Member may only accept orders on behalf of Customers through its Registered Representatives.

Amended on 15 March 201315 March 2013.

3.3.7 Accepting Orders without Executing

A Member or a Registered Representative shall not accept orders from a Customer for contracts without causing such orders to be executed on the relevant markets and in accordance with the rules applicable to such markets. An Approved Trader shall execute such orders in accordance with the rules applicable to such markets.

3.3.8 Recording of Orders

Refer to Regulatory Notice 3.3.8.

Amended on 1 April 20141 April 2014.

3.3.8A Preventing Unauthorised Changes to Order Information

A Member must have in place controls to prevent unauthorised changes to order information entered into the Trading System.

Added on 15 March 201315 March 2013 and 14 November 201614 November 2016.

3.3.9 Customer's Statement of Account and Contract Note

Amended on 1 April 20141 April 2014.

3.3.10 Segregation of Customers' Monies and Assets and Fiduciary Obligations

Subject to Rule 3.3.10(b)(ii), the following requirements apply in relation to a Member's fiduciary obligations to its Customers:

"Customer" as used in this Rule 3.3.10 in relation to a General Trading Member that holds a licence to engage in a Regulated Activity and a Bank Trading Member does not include: (a) a director, officer, employee, Approved Trader or Registered Representative of the Member; or (b) an Affiliate of the Member.

Amended on 1 April 20141 April 2014 and 2 May 20162 May 2016.

3.3.11 Trading or Accepting Customer's Monies or Assets After Insolvency

Unless otherwise approved by the Exchange, a Member shall not trade, accept any Customer's monies or assets, or solicit any new orders after the Member's insolvency.

3.3.12 Customer Margins

Margins payable by a Clearing Member to the Clearing House shall be governed by the Clearing Rules. For margins applicable to Customers, margin calls and related matters, the following requirements apply:

For settlement currency denominated in Japanese Yen, 'reasonable period' in this Rule 3.3.12(e) means a period which shall not exceed three (3) Trading Days from the date that the Customer's Total Net Equity falls below the Maintenance Margins. For all other settlement currencies, it means a period which shall not exceed two (2) Trading Days from the date that the Customer's Total Net Equity falls below the Maintenance Margins;

Refer to Regulatory Notice 3.3.12

Amended on 1 April 20141 April 2014, 25 January 201725 January 2017, 18 January 2022 and 29 July 2022.

3.3.14 Inter-Exchange Cross Margining

Notwithstanding Rule 3.3.12, a Member may grant margin credit at a rate not exceeding that which is prescribed by the Clearing House, to a Customer which holds long and short positions on futures contracts (on the same underlying) which are traded on the Exchange and another exchange, to the extent that the risk on the position in one (1) exchange is set-off against another ("Inter-exchange Cross Margining") if the following conditions are satisfied:

*Refer to Regulatory Notice 3.3.14(g).

For the avoidance of doubt, Inter-exchange Cross Margining is not allowed for positions carried in Customer Accounts opened with different Members.

Amended on 1 April 20141 April 2014 and 22 April 201922 April 2019.

3.3.15 Transfer of Error Trades to House Account

The following requirements apply in relation to the transfer of error trades:

Amended on 2 May 20162 May 2016.

3.3.16 Transfer of Unsuccessful Give-Up Trades to House Account

A Member may enter into a give-up arrangement with a Customer and an accepting Clearing Member, provided that such arrangement is supported by a duly executed give-up agreement. If an executed trade is not successfully given up to and accepted by the accepting Clearing Member by the end of the Trading Day following the trade date (T+1), the Member shall transfer the give-up trade to a designated account meant for unsuccessful give-up trades. This designated account shall be a House Account, or such other account as the Exchange may permit. The Member shall conduct regular reviews and take action to clear the designated account.

Refer to Regulatory Notice 3.3.16.

Amended on 2 May 20162 May 2016.

3.3.16A Separate Accounts

A Member must maintain separate accounts for each Person whose account is carried on the books of the Member.

Added on 26 April 201326 April 2013.

3.3.17 Reporting of Account Identity

A Member shall submit to the Clearing House, in the manner as prescribed from time to time, the identities of the owners or controlling parties of any House Account or Customer Account which:

Refer to Regulatory Notice 3.3.17; 3.3.18; 3.3.26; 3.3.27.

"Customer Account" as used in this Rule 3.3.17 does not include an account owned by: (a) a director, officer, employee, Approved Trader or Registered Representative of the Member; or (b) an Affiliate of the Member. "House Account" as used in this Rule 3.3.17, is an account which is not a Customer Account as defined in this Rule 3.3.17.

Amended on 2 May 20162 May 2016.

3.3.18 Reporting of Open Positions

The following requirements apply in relation to the reporting of Open Positions:

* Refer to Regulatory Notice 3.3.17; 3.3.18; 3.3.26; 3.3.27.

3.3.19 Omnibus Accounts

A Member may carry Omnibus Accounts subject to such requirements and procedures as the Exchange may prescribe from time to time.

3.3.20 Limits on Omnibus Accounts

The Exchange may place limitations on a Member carrying Omnibus Accounts depending on:

- the number of Omnibus Accounts carried and volume of business of the Member; and

- the financial condition of the Member and the Omnibus Account holders in light of requirements or standards determined by the Exchange. A Member that carries Omnibus Accounts shall ensure that the Omnibus Accounts are operated at all times in accordance with this Rules including the relevant rules on position limits and position accountability, and shall, without prejudice to any other liability it may incur, indemnify the Exchange in relation to any claim referable to such violation.

Amended on 3 August 2020.

3.3.21 Disclosures Relating to Omnibus Accounts

An Omnibus Account holder shall at all times disclose to the Member carrying that account the gross long and short positions held in that Omnibus Account in each contract. Such Member shall immediately notify the Exchange and shall promptly comply with all orders of the Exchange if the Omnibus Account holder fails to make such disclosure. A Member that carries Omnibus Accounts shall ensure that its Omnibus Account holders are aware of this Rule.

3.3.22 Audit Trail

A Member shall be required to produce a complete audit trail of transactions, from the receipt of an order to its settlement, when so requested by the Exchange.

Refer to Regulatory Notice 2.6.4.

3.3.23 Record Keeping

A Member shall ensure that data and records are:

Amended on 1 April 20141 April 2014 and 18 January 2022.

3.3.23A Register of Securities

The following requirements apply in relation to the maintenance of a register of securities for Members, Registered Representatives and Approved Traders executing Agency Trades, except for General Trading Members that holds a licence specified in Rule 2.4.1(b) and their Registered Representatives and Approved Traders, that deal in Contracts that are classified as securities under the Act:

Added on 16 July 201216 July 2012 and amended on 1 April 20141 April 2014 and 18 January 2022.

3.3.24 IT and Data Security Requirements

A Member shall comply with all information technology and data security requirements the Exchange may prescribe from time to time including installing measures to prevent tampering of data and records.

3.3.25 ID Tags and Passwords

A Member shall issue unique identification tags and passwords to Customers and Approved Traders which have access to the Trading System through that Member.

Amended on 14 November 201614 November 2016.

3.3.26 Computations of Financial and Capital Requirements

A Member shall make and keep as a record, formal computations of its financial and capital requirements. The computations shall be in such form as the Exchange may prescribe and be submitted to the Exchange within such time as stipulated by the Exchange.

3.3.27 Submission of Financial Statements and Other Information to the Exchange

The Exchange may at any time require a Member to submit to the Exchange financial statements or other information in such form and pertaining to such matters and within such time as stipulated by the Exchange. The Member shall thereafter comply with such directions as the Exchange may in its sole discretion issue.

3.3.28 Certification by Auditor

The following requirements apply in relation to auditor certification of a Member's accounts:

within five (5) months of the end of its financial year or within such longer period as may be permitted in writing by the Exchange.

Amended on 25 August 200925 August 2009, 1 April 20141 April 2014 and 22 April 201922 April 2019.

3.3.29 Reporting Obligations of Auditors

A Member shall cause the external auditor referred to in Rule 3.3.28 to immediately report to the Exchange if:

Amended on 1 April 20141 April 2014.

3.3.30 Change of Auditors

Amended on 25 August 200925 August 2009 and 1 April 20141 April 2014.

3.3.31 Prohibition Against General Trading Member Acting as Guarantor

Unless approved by the Exchange, a General Trading Member that holds a licence to engage in a Regulated Activity and its Foreign Branches shall not act as guarantors or furnish a guarantee for the benefit of any Person, including a Related Corporation of such Member. For the avoidance of doubt, this prohibition does not apply to a Clearing Member's obligation to guarantee all trades to the Clearing House.

A General Trading Member that holds a licence specified in Rule 2.4.1(b) shall notify the Exchange immediately if it acts as guarantors or furnish a guarantee for the benefit of any Person, including a Related Corporation of such Member and such activity has or may have a financial or capital impact on the Trading Member and required to be reported to the Relevant Regulatory Authority.

Amended on 25 August 200925 August 2009 and 1 April 20141 April 2014.

3.3.32 Foreign Branch of General Trading Member

A General Trading Member licensed under the Act shall satisfy the following requirements prior to opening an overseas branch (the "Foreign Branch") and on a continuous basis:

* Refer to Annex F — Undertaking of Foreign BranchAnnex F — Undertaking of Foreign Branch.

Amended on 25 August 200925 August 2009 and 29 December 201429 December 2014.

3.3.33 Application of Rule 3.3

The following Rules shall not apply to a Trading Member that holds a licence specified in Rule 2.4.1(b).

| Rule | Heading |

| 3.3.1 | Customer Account and Know-Your- Customer Requirements |

| 3.3.2 | Management Approval Required for Opening Customer Accounts |

| 3.3.4 | Customer Instructions and Power of Attorney |

| 3.3.5 | Customer Education |

| 3.3.15 | Transfer of Error Trades to House Account |

| 3.3.31 | Prohibition Against General Trading Member Acting as Guarantor |

A Trading Member that holds a licence specified in Rule 2.4.1(b) shall comply with such requirements established by the Relevant Regulatory Authority, if any, and principles of good business practice in relation to the areas set out in Rule 3.3.33.

Added on 1 April 20141 April 2014.

3.4 Trading Practices and Conduct Rules of Members, Approved Traders and Registered Representatives

Market manipulation, market rigging and other forms of trading misconduct set forth in the Act distort the operation of a fair, orderly and transparent market and are serious offences. A Member, Approved Trader or Registered Representative shall at all times observe the trading practices and conduct rules set forth in the Act and this Rules.

3.4.1 Market Manipulation

A Member, Approved Trader or Registered Representative shall not manipulate or attempt to manipulate the price of a contract or of any underlying, or corner, or attempt to corner, any underlying.

3.4.2 Churning

A Member, Approved Trader or Registered Representative is prohibited from churning or generating commissions through creating excessive transactions in a Customer's Account.

3.4.3 False Trading, Bucketing, Fraudulent Inducement to Trade and Employment of Fraudulent Device

A Member, Approved Trader or Registered Representative shall not:

3.4.3A Duty to Monitor for Trading Misconduct

A Member must have in place processes to review orders and trades for the purpose of detecting suspicious trading behaviour.

Refer to Practice Note 3.4.3A.

Added on 15 March 201315 March 2013.

3.4.5 Dissemination of False or Misleading Information

A Member, Approved Trader or Registered Representative shall not disseminate false or misleading reports concerning market information or conditions that may affect the price of any contract, if the Member, Approved Trader or Registered Representative:

This prohibition includes circulation or aiding in the circulation in any manner of rumours which cast doubt on the integrity of any contract or underlying.

3.4.6 Professional Misconduct

A Member, Approved Trader or Registered Representative shall not:

3.4.7 Disclosing Orders Prohibited

A Member, Approved Trader or Registered Representative shall not disclose an order to any Person, except to the following for official purposes:

3.4.8 Good Faith Bids and Offers.

A Member or an Approved Trader shall not knowingly enter, or cause to be entered, bids or offers into the Trading System other than in good faith for the purpose of executing bona fide transactions.

Refer to Practice Note 3.4.8.

Amended on 14 November 201614 November 2016.

3.4.9 Fictitious Transactions Without Change In Ownership

The creation of fictitious transactions or the placing of orders which do not involve any change in ownership, or the execution of such an order with knowledge of its character by a Member, Approved Trader or Registered Representative is prohibited. A Member, Approved Trader or Registered Representative shall not accept buying and selling orders at the same time and price from a Customer for the same contract month of the same futures contract or in the case of option contracts, a put or call option contract with the same class of options, the same strike price and expiration month. This Rule does not apply if orders are entered in the following circumstances:

Refer to Practice Note 3.4.9.

3.4.10 Overtrading by a Member, Approved Trader or Customer

The following provisions apply in relation to overtrading:

Amended on 15 March 201315 March 2013.

3.4.11 Knowingly Taking Advantage of an Error Prohibited

A Member, Approved Trader or Registered Representative shall not knowingly take advantage of a situation arising from:

Amended on 14 November 201614 November 2016.

3.4.12 Deemed Rule Violations

A Member, Approved Trader or Registered Representative shall be deemed to be in violation of this Rules if it is convicted of any offence relating to fraud, any act of bad faith, dishonest conduct, dishonorable conduct or uncommercial conduct before any court of law.

3.4.13 Front Running — Priority of Customers' Orders

A Member, Approved Trader or Registered Representative shall not trade in contracts for its own accounts or for an account associated with or connected to that Member, Approved Trader or Registered Representative, if that Member, Approved Trader or Registered Representative also has in hand Customers' orders (including discretion orders) to do the same at the prevailing market price or at the same price. This Rule does not apply if:

"Customer" as used in this Rule 3.4.13 does not include the Member's Approved Traders, Registered Representatives or Persons associated with or connected to the Member, Approved Trader or Registered Representative.

3.4.14 Trading Against Customers' Orders Prohibited

A Member, Approved Trader or Registered Representative shall not knowingly effect a transaction to buy from or sell to a Customer any contract for:

This Rule does not apply if the Member, Approved Trader or Registered Representative has first entered the Customer's order into the Trading System and waited at least 10 seconds before entering an opposite order, or if the Member, Approved Trader or Registered Representative has obtained the Customer's prior written consent. "Customer" as used in this Rule 3.4.14 does not include the Member's Approved Traders, Registered Representatives or Persons associated with or connected to the Member, Approved Trader or Registered Representative.

Amended on 14 November 201614 November 2016.

3.4.15 Prohibited Conduct

A Member, a Registered Representative or an Approved Trader shall not participate in any prohibited market conduct or in any insider trading, or knowingly assist a person in such conduct.

Added on 16 July 201216 July 2012.

3.5.1 Scope of Inspection and Audit Rights

The Exchange, in its discretion, may inspect, audit and take copies of the accounts, books, contracts and other records and documents of that Member to the extent that is necessary or desirable in connection with the discharge of the Exchange's regulatory obligations. The Exchange may also appoint or cause the Member to appoint independent Persons to do the same. Such Person shall report to the Exchange on all or any of the following:

3.5.2 Access and Cooperation

A Member shall cooperate with the Exchange and procure for the Exchange or the duly appointed Person:

Amended on 2 May 20162 May 2016.

3.5.3 Use of Report and Costs

The Exchange may rely on the information obtained and reports prepared pursuant to Rule 3.5.1 and act on the recommendations set forth therein. The Exchange may also refer a report prepared pursuant to Rule 3.5.1 to the Clearing House or Disciplinary Committee for further action if appropriate. The Exchange may charge a fee for any inspection under Rule 3.5.1. The fee is payable immediately by the Member concerned.

4. Introduction to Contracts Traded on the Market

The Exchange offers Contracts which are broadly divided into Futures Contracts and Option Contracts.

Amended on 26 November 200726 November 2007.

4.1.1 Listing of Contracts

Subject to the Act and compliance with the necessary conditions in the Act, the Exchange may list or permit the trading of any Contract on the Markets.

Amended on 8 October 20188 October 2018.

4.1.2 De-listing of Contracts

Subject to the Act, the Exchange may, from time to time and in its absolute discretion, de-list any Contract. If there are no Open Positions in the relevant Contract which the Exchange wishes to de-list, any de-listing shall become effective at such time as the Exchange shall determine. If there are Open Positions in the relevant Contract which the Exchange wishes to de-list, the Exchange may require that such Open Positions be cash settled immediately or restrict trading only to enable the Closing Out of those Open Positions, except to the extent that the Exchange deems such trading to be necessary for the maintenance of a fair, orderly and transparent market.

4.1.3 Dormant Contracts

The Exchange may designate certain Contracts as dormant Contracts for various reasons including extended periods of illiquidity. Such Contracts are currently not available for trading on the Markets but may become available for trading at a future date.

4.1.4 Contract Specifications and Supremacy

Each Contract shall be governed by this Rules and the relevant Contract Specifications.* In the event of a conflict between this Rules and the Contract Specifications, this Rules shall prevail.

*Contract Specifications will be posted on the Exchange's website .

4.1.5 Trading Hours, Opening and Closing Routines and Closing Range

Trades may only be executed during the hours in which the Markets are open for trading. The Markets' normal trading hours for each Contract are set forth in the relevant Contract Specifications. The Exchange may determine for a Contract:

4.1.6 Trade Matching Algorithms

Trade matching algorithms may be specific to the Market and the Contract. The applicable trade matching algorithms are set out more fully in the Regulatory Notice. The Exchange may determine the applicable trade matching algorithms for a Contract. If the Exchange wishes to apply a new or different trade matching algorithm to a new or an existing Contract, the Exchange shall notify all Members of its intention to do so via a Regulatory Notice, at least three (3) weeks prior to the application of such algorithm to a Contract.

Refer to Regulatory Notice 4.1.6.

Amended on 26 November 200726 November 2007.

4.1.7 Strategy Transactions

Unless otherwise specified by the Exchange, strategy transactions do not set off stops in any Futures Contract except for strategy stop orders. Members shall not combine outright orders received from different principals and execute the orders as strategy transactions.

4.1.8 Error Trades

An error trade occurs when a transaction is effected on the Trading System as a result of an error in the entry of a bid or offer that is subsequently matched. The following procedures apply in relation to error trades:

* Refer to Regulatory Notice 4.1.8.

For the avoidance of doubt, the Exchange is not liable for any loss or damage (including consequential loss or damage) which may be suffered as a result of the cancellation or price adjustment of an error trade in accordance with this Rule 4.1.8.

Amended on 26 November 200726 November 2007, 19 January 201519 January 2015 and 14 November 201614 November 2016.

4.1.9 Withholding and Order Withdrawal

A Member, Approved Trader or Registered Representative shall not withhold or withdraw from the Trading System any Customer's order or any part of a Customer's order for any reason, unless it is for the benefit of the Customer or pursuant to the Customer's instruction.

Refer to Practice Note 4.1.9.

Amended on 14 November 201614 November 2016.

4.1.10 Cross Trades

A Member or Approved Trader who knowingly receives buy and sell orders from different Customers at the same time and price, for the same Contract Month of the same Contract, shall first expose the leg which is the better bid or offer than the prevailing bid or offer in the Trading System. If there is no prevailing bid or offer, the Member or Approved Trader shall first expose the leg which has the better price than the last traded price, or if there is no last traded price, the last settlement price. This Rule 4.1.10 does not apply if the orders are entered by:

However, if the Exchange suspects that a cross trade was pre-arranged in either one of the above circumstances in contravention of Rule 4.1.13, the onus is on the Member or the Approved Trader to show otherwise.

Refer to Practice Note 4.1.10.

Amended on 14 November 201614 November 2016.

4.1.11 Negotiated Large Trades

The Exchange may, from time to time, designate and approve a Contract for Negotiated Large Trade transactions. Contracts eligible for Negotiated Large Trade transactions shall comply with the minimum volume thresholds, related notification requirements and such other procedures as prescribed by the Exchange from time to time.

Refer to Regulatory Notice 4.1.11.

4.1.12 Exchange of Underlying for Futures Contracts

An exchange of Underlying for Futures Contracts shall be permitted upon the satisfaction of the following conditions:

4.1.13 Pre-arranged Trades Prohibited

A Member or Approved Trader shall not make any purchase or sale which has been pre-arranged except for:

For the avoidance of doubt, a request for a quote from a designated market maker approved by the Exchange does not constitute a pre-arranged trade.

4.1.15 Price Limits and Cooling Off

The Exchange may prescribe, for certain Contracts, Price Limits which are designed to temporarily restrict trading when the Market(s) becomes volatile. "Price Limit" refers to the maximum price advance or decline during any trading session(s), as provided under the relevant Contract Specifications, upon which the Exchange may signal a Cooling Off Period.

Save as provided in the relevant Contract Specifications, the Price Limits for a Contract will not apply to a trade in that Contract if it is executed as part of a strategy transaction whereby trades in two or more Contracts that are related to each other are executed simultaneously as a unit on the strategy order book.

With respect to an Option Contract, trading in the Option Contract shall be halted:

"Cooling Off Period" means such period as set forth in the relevant Contract Specifications during which each Contract may be traded at or within its Price Limits. Trading may resume upon the lapse of the Cooling Off Period, for the remainder of the Trading Day, or such other period as may be prescribed in the relevant Contract Specifications.

Amended on 26 January 200726 January 2007, 16 July 201216 July 2012 and 14 November 201614 November 2016.

4.1.16 Trading Halt

In the event that trading in the Underlying is halted, or where there has been a major market movement without any apparent economic or fundamental basis for the movement to have occurred, the Exchange may declare a trading halt in the relevant Contract. This is irrespective of whether trading in the Contract has reached the Price Limits.

4.1.17 Position Limits

The Exchange may, from time to time, establish limits on the positions owned or controlled by any Person or Persons acting in concert with respect to any Contract. A Clearing Member may apply on behalf of any Person for an increase in that Person's position limits in applicable Contracts, subject to the conditions set forth in the Clearing Rules.

Amended on 3 August 2020.

4.1.17A Position Accountability

- The Exchange may establish position accountability thresholds on the positions owned or controlled by any Person or Persons acting in concert with respect to any Contract where limits on positions are not applied.

- Upon request by the Exchange, a Member shall provide information, including but not limited to, the nature and size of the position, the trading strategy employed with respect to the position, and hedging information (if applicable), of any Person or Persons acting in concert with respect to any Contract when such position accountability thresholds have been exceeded.

Added on 3 August 2020.

4.1.18 Accumulation of Positions

With respect to the computation of position limits and position accountability, the positions of all accounts directly or indirectly owned or controlled by a Person or Persons, and the positions of all accounts of any Person or Persons acting in concert and the positions of all accounts in which a Person or Persons have a proprietary or beneficial interest, shall be accumulated and deemed to be positions of each of such Persons as if each owned or controlled all the accumulated positions individually. The Exchange may from time to time provide exemptions to this Rule 4.1.18.

Amended on 3 August 2020.

4.1.18A Reduction of Positions

Where any person has exceeded such position limits imposed or approved by the Clearing House, or exceeds such position accountability thresholds, the Exchange, if it deems it necessary in the interest of maintaining a fair, orderly and transparent market, may subject the Member to one or more of the following:

- to cease any further increase in the person’s positions;

- to liquidate the person’s positions to comply with the position limits or to reduce it below the position accountability thresholds within such time as may be prescribed by the Exchange; or

- to trade under such conditions and restrictions as the Exchange may consider necessary to ensure compliance with the prescribed position limits or to reduce the positions below such position accountability thresholds.

Added on 3 August 2020.

4.1.19 Daily Settlement Price

The Daily Settlement Price for each Contract shall be determined by the Clearing House in accordance with the relevant formulae and procedures set out in the relevant Contract Specifications.

4.1.20 Final Settlement Price

The Final Settlement Price for each Contract shall be determined by the Exchange and the Clearing House in accordance with the relevant formulae and procedures set out in the relevant Contract Specifications. The Final Settlement Price so determined by the Exchange and Clearing House shall be final. If a situation is developing or has developed, which prevents the Exchange or the Clearing House from declaring the Final Settlement Price in accordance with the relevant Contract Specifications, the Exchange and Clearing House shall resolve the Final Settlement Price by such other means as they deem fit.

4.1.21 Modification of Contract Specifications

The Exchange may modify Contract Specifications in response to market developments. In the event of such modification the Exchange shall provide its Members with no less than two (2) weeks' prior notice before any modification to Contract Specifications takes effect. For the avoidance of doubt, modifications to the calculation of the Final Settlement Price, Price Limits, position limits, accumulation of positions and delivery obligations set forth in any Contract Specifications shall be subject to public consultation and rule amendment procedures as contemplated in the Act.

4.1.22 Emergencies

Amended on 26 April 201326 April 2013 and 14 November 201614 November 2016.

4.1.23 Revocation or Suspension of Access to the Trading System

The Exchange may revoke or suspend access to the Trading System for such period or periods as the Exchange may determine, if, in the opinion of the Exchange, it is necessary or desirable for the maintenance of a fair, orderly and transparent market.

Amended on 14 November 201614 November 2016.

4.2.1 Default in a Cash Settled Futures Contract or Option Contract

A Buyer or Seller who fails to settle a cash settled Futures Contract or Option Contract, as contemplated under this Rules or the Clearing Rules, shall be in default. In the event of default at Settlement of a cash settled Futures Contract or Option Contract on the part of a Buyer or Seller, the Member shall, unless otherwise provided in this Rules or the Clearing Rules, have the right of Closing Out any Open Position in any Market on behalf of the Buyer or Seller, without further notice and without in any way prejudicing any other legal action for recovery which the Member may take or has taken.

4.2.2 Default in a Deliverable Futures Contract

A Seller of a deliverable Futures Contract who does not effect delivery as required by this Rules or the Contract Specifications, and a Buyer of a deliverable Futures Contract who does not take delivery as required by this Rules or the Contract Specifications, shall be in default. In the event of default at Settlement of a deliverable Futures Contract, the rights and obligations of the Member of the Buyer or Seller who is in default, shall be as specified in the relevant Contract Specifications.

4.3.1 Types of Option Contracts

Option Contracts may be:

4.3.2 Cash Settled Call Option Contract

In the case of a cash settled call Option Contract:

4.3.3 Cash Settled Put Option Contract

In the case of a cash settled put Option Contract:

4.3.4 Deliverable Call Option Contract

In the case of a deliverable call Option Contract:

4.3.5 Deliverable Put Option Contract

In the case of a deliverable put Option Contract:

4.3.6 American Style and European Style

The Contract Specifications shall indicate whether an Option Contract is an American Style Option or a European Style Option. An "American Style Option" is an Option Contract that can be exercised at any time before its expiry. A "European Style Option" is an Option Contract that can only be exercised at expiry. This Rules applies to both American Style Options and European Style Options.

4.3.7 Cash Settled Option Contracts which are in-the-Money

A cash settled Option Contract is in-the-money if the settlement price lies above the exercise price in the case of a call Option Contract, or below the exercise price in the case of a put Option Contract.

4.3.8 Exercise/Expiry of All Option Contracts on Expiration Day

On the Expiration Day of both cash settled and deliverable Option Contracts, the Clearing House shall, unless otherwise directed by the holder of the Option Contract or otherwise stated in the relevant Contract Specifications:

Amended on 16 July 201216 July 2012.

5. Overview