Practice Note 2.13A — Business Continuity Requirements

| Issue Date | Cross Reference | Enquiries |

| Added on 22 January 200922 January 2009 | Rule 2.13A | Please contact Member Supervision: Facsimile No : 6538 8273 E-Mail Address: membersup@sgx.com |

1. Introduction

2. Business Continuity Plan

Rule 2.13A.1 requires Clearing Members to Clearing Members to maintain adequate business continuity arrangements, and document such arrangements in a business continuity plan. As a guide, a Clearing Member's business continuity plan should document the following elements:

* Critical functions refer to business functions whose failure or disruption may incapacitate the firm.

^ Key service providers refer to third-parties who are performing functions that are not normally carried out by Clearing Members internally, but are critical to the Clearing Member's ability to carry on business operations. For example, IT system hardware/software vendors.

# Outsourcing service providers refer to third parties who are performing functions that would normally be performed by Clearing Members internally. For example, Operations and Technology.

3. Emergency Contact Persons

Refer to Appendix A of Practice Note 2.13A.

Practice Note 2.28A Procedures to Suspend Qualification of a Trading Member

| Issue Date | Cross Reference | Enquiries |

| 11 January 201111 January 2011 | Clearing Rules Rule 2.28A.3 and 2.28A.5 | Please contact: Member Supervision Facsimile No : 6538 8273 E-Mail Address : membersup@sgx.com Market Control Hotline : 6236 8433 |

1 Introduction

2 Procedures for Suspending a Trading Member

Designated Officers

Notification of Suspension of Trading Member

Final Traded Position

Added on 11 January 201111 January 2011 and amended on 15 September 201715 September 2017.

Practice Note 2.28A.1.3 — Pre-Execution Checks

| Issue Date | Cross Reference | Enquiries |

| Added on 15 March 201315 March 2013 amended on 14 November 201614 November 2016, 29 July 2022 and 25 April 2023. | Rule 2.28A.1.3 | Please contact Member Supervision: Facsimile No : 6538 8273 E-Mail Address : membersup@sgx.com |

1. Introduction

2. Pre-Execution Checks

Added on 15 March 201315 March 2013 and amended on 14 November 201614 November 2016, 29 July 2022 and 25 April 2023.

Practice Note 2.28A.1.6 — Conflicts of Interest

| Issue Date | Cross Reference | Enquiries |

| Added on 15 March 201315 March 2013 | Rule 2.28A.1.6 | Please contact Member Supervision: Facsimile No : 6538 8273 E-Mail Address : membersup@sgx.com |

1. Introduction

2. Separation of Key Functions

Added on 15 March 201315 March 2013.

Practice Note 6.07A — Facilitator Agent

| Issue Date | Cross Reference | Enquires |

| Added on 1 October 20091 October 2009. | Rule 6.07A | Please contact: Operations, Clearing and Depository Email: otclear@sgx.com Clearing Hotline Tel: (65) 6236 5319 |

1. Introduction

2. Role of a Facilitator Agent

3. Facilitator Agent for Contracts Traded on the Singapore Commodity Exchange Limited ("SICOM") and Settled by Way of Physical Delivery

Practice Note 7.11.1.1 — Daily Settlement Procedures for Eligible Non-Relevant Market Contracts

| Issue Date | Cross Reference | Enquires |

| Added on 22 September 200622 September 2006 and amended on 23 November 200923 November 2009 and 8 November 20128 November 2012. | Rule 7.11.1.1 | Please contact: Operations, Clearing and Depository Clearing Hotline Tel: (65) 6236 5319 Email: otclear@sgx.com SGX OTC Clearing Business Email: sgxotc@sgx.com |

1. Introduction

Refer to Appendix 1.

2. Procedures

3. Price Contributors

Oil Swaps

Practice Note 7.11.1.2 — Daily Settlement Price Methodology

| Issue date | Cross Reference | Enquiries |

| Added on 22 September 200622 September 2006 and amended on 1 October 20091 October 2009, 24 January 201124 January 2011, 8 November 20128 November 2012 and 14 November 201614 November 2016. | Rule 7.11.1.2 | Please contact Derivatives: Telephone No: 6236 8888 |

1. Introduction

Rule 7.11.1.2 of the Clearing Rules states that the Daily Settlement Price for Contracts other than Non-Relevant Market Contracts shall be determined by the Clearing House in accordance with the relevant formula and procedures applicable to each Contract. In arriving at such formula, the Clearing House may, in consultation with the Exchange, take into account factors, including but not limited to:

This Practice Note sets out the formulas and methodologies used by the Clearing House to compute the Daily Settlement Price as contemplated in the above Rule.

2. Methodology for Computation of Daily Settlement Price

Save for exceptional situations, the Clearing House can use any one of the following methodologies to compute the Daily Settlement Price:

In exceptional cases when none of the methodologies set forth in paragraph 2.1 above yields a Daily Settlement Price that is reflective of market conditions, the Clearing House may use any of the following alternative methodologies for the computation of the Daily Settlement Price:

Practice Note 7.22 — Margins of Third Parties

| Issue date | Cross Reference | Enquiries |

| Added on 23 July 201423 July 2014 and amended on 25 January 201725 January 2017. | Rule 7.22 | Please contact Member Supervision: Facsimile No: 6538 8273 |

1. Introduction

2. Margin Rates and Acceptable Forms of Margins

2.1 Margin System

Standard Portfolio Analysis of Risk Margin System

2.2 Margin Rates and Requirements (Rule 7.22.1)

2.3 Acceptable Forms of Margins (Rule 7.22.2)

3. Margin Calls (Rules 7.22.1 and 7.22.4)

3.1 Issuance of Margin Calls

3.2 Computation of Margin Calls

XYZ — client omnibus A/C 2

Treatment : A/C 1 and A/C 2 should be treated as separate accounts for the purpose of computing margin calls.

XYZ — proprietary A/C 1B

Treatment : A/C 1A and A/C 1B should be combined when computing margin calls.

XYZ — client omnibus A/C 2B

Treatment : A/C 2A and A/C 2B should be combined when computing margin calls.

Assume proprietary A/C A & proprietary A/C B are owned by the same Customer:

| A/C A $ | A/C B $ | Combined $ | |

| Total net equity | 8,000 | 42,000 | 50,000 |

| Initial margins | 26,000 | 50,000 | 76,000 |

| Maintenance margins | 21,000 | 40,000 | 61,000 |

| Under-margined | 18,000 | Nil | 26,000 |

| Margin Call Required | 18,000 | Nil | 26,000 |

In the above example, if the two accounts are not combined, the Customer as a whole would be subjected to a lesser margin call of $18,000 instead of $26,000.

3.3 Reduction and Deletion of Margin Calls

3.4 Recording and Monitoring

3.5 Ageing of Margin Calls

1 = first Trading Day after the date that the Customer's total net equity falls below the maintenance margins

2 = second Trading Day after the date that the Customer's total net equity falls below the maintenance margins

3 = third Trading Day after the date that the Customer's total net equity falls below the maintenance margins

Reasonable period shall have the meaning ascribed to it in Rule 7.22.

3.6 Examples

The following examples illustrate how margin calls are aged, reduced and deleted.

Assumptions:

Example 1 — Issuing of margin calls due to unfavourable market movements

Margin calls must be issued no later than one Trading Day after the date that the Customer's total net equity falls below the maintenance margins.

| Monday | Tuesday | Wednesday | Thursday | |

| Total net equity | 50,000 | 49,000 | 44,000 | 44,000 |

| Initial margins | 60,000 | 60,000 | 60,000 | 60,000 |

| Maintenance margins | 50,000 | 50,000 | 50,000 | 50,000 |

| UNDER-MARGINED | Nil | 11,000 | 16,000 | 16,000 |

| Unfavourable market movements [UMM] of $1,000 occurred on Tuesday and $5,000 on Wednesday. No margins were deposited. | ||||

| CALL RE'QD/(AGE) | -0- | 11,000 (T) | 11,000 (1) | 11,000 (2) |

| 5,000 (T) | 5,000 (1) | |||

| Customer Account is under-margined | Clearing Member must issue margin call of $11,000 no later than today. | Clearing Member must issue margin call of $5,000 no later than today. | ||

| Additional margin call of $5,000 required due to UMM. | ||||

Example 2 — Impact on margin calls due to liquidation of positions

Margin calls cannot be reduced/deleted if the liquidation does not restore the Customer's total net equity to or above initial margins.

| Monday | Tuesday | Wednesday | Thursday | |

| Total net equity | 45,000 | 45,000 | 45,000 | 45,000 |

| Initial margins | 60,000 | 55,000 | 55,000 | 50,000 |

| Maintenance margins | 55,000 | 53,000 | 53,000 | 48,000 |

| UNDER-MARGINED | 15,000 | 10,000 | 10,000 | 5,000 |

| Positions were liquidated on Tuesday reducing initial margins by $5,000 and maintenance margins by $2,000 and on Thursday reducing initial margins by $5,000 and maintenance margins by $5,000. No margins were deposited. | ||||

| CALL RE'QD/(AGE) | 15,000 (T) | 15,000 (1) | 15,000 (2) | 15,000 (3) |

| Margin call cannot be reduced or deleted as the liquidation did not result in total net equity equal to or exceed initial margins. | Margin call cannot be reduced or deleted as the liquidation did not result in total net equity equal to or exceed initial margins. | |||

Example 3 — Impact on margin calls due to receipt of margin deposits

Margin calls can be reduced by the amount of margins actually received.

| Monday | Tuesday | Wednesday | Thursday | |

| Total net equity | 50,000 | 45,000 | 44,000 | 47,000 |

| Initial margins | 60,000 | 60,000 | 60,000 | 60,000 |

| Maintenance margins | 55,000 | 55,000 | 55,000 | 55,000 |

| UNDER-MARGINED | 10,000 | 15,000 | 16,000 | 13,000 |

| Unfavourable market movements [UMM] of $5,000 occurred on Tuesday and $1,000 on Wednesday. Cash of $3,000 was deposited on Thursday. | ||||

| CALL RE'QD/(AGE) | 10,000 (T) | 10,000 (1) | 10,000 (2) | 7,000 (3) |

| 5,000 (T) | 5,000 (1) | 5,000 (2) | ||

| 1,000 (T) | 1,000 (1) | |||

| Additional margin call of $5,000 required due to UMM. | Additional margin call of $1,000 required due to UMM. | Margin call of $10,000 can be reduced by the cash receipt of $3,000. | ||

Example 4 — Impact on margin calls due to favourable market movements that are less than total margin call outstanding

Margin calls cannot be reduced/deleted if favourable market movements do not restore the Customer's total net equity to or above initial margins.

| Monday | Tuesday | Wednesday | Thursday | |

| Total net equity | 55,000 | 58,000 | 52,000 | 58,000 |

| Initial margins | 60,000 | 60,000 | 60,000 | 60,000 |

| Maintenance margins | 58,000 | 58,000 | 58,000 | 58,000 |

| UNDER-MARGINED | 5,000 | No (see below) | 8,000 | No (see below) |

| Favourable market movements [FMM] of $3,000 occurred on Tuesday. Unfavourable market movements [UMM] of $6,000 occurred on Wednesday. FMM of $6,000 occurred on Thursday. No margins were deposited. | ||||

| CALL RE'QD/(AGE) | 5,000 (T) | 5,000 (1) | 5,000 (2) | 5,000 (3) |

| 3,000 (T) | 3,000 (T) | |||

| Margin call of $5,000 cannot be reduced or deleted as FMM did not result in total net equity equal to or exceed initial margins. | Additional margin call of $3,000 required due to UMM. | Margin call of $5,000 and $3,000 cannot be reduced or deleted as FMM did not result in total net equity equal to or exceed initial margins. | ||

Example 5 — Impact on margin calls due to favourable market movements that exceed total margin call

Margin calls can be deleted if favourable market movements restore the Customer's total net equity to or above initial margins.

| Monday | Tuesday | Wednesday | Thursday | |

| Total net equity | 54,000 | 51,000 | 58,000 | 60,000 |

| Initial margins | 60,000 | 60,000 | 60,000 | 60,000 |

| Maintenance margins | 55,000 | 55,000 | 55,000 | 55,000 |

| UNDER-MARGINED | 6,000 | 9,000 | No (see below) | -0- |

| Unfavourable market movements [UMM] of $3,000 occurred on Tuesday. Favourable market movements [FMM] of $7,000 occurred on Wednesday and $2,000 on Thursday. No margins were deposited. | ||||

| CALL RE'QD/(AGE) | 6,000 (T) | 6,000 (1) | 6,000 (2) | -0- |

| 3,000 (T) | 3,000 (1) | |||

| Additional margin call of $3,000 required due to UMM. | Margin call of $6,000 was not reduced or deleted as FMM did not result in total net equity equal to or exceed initial margins. | Total margin call of $9,000 deleted as total net equity equals initial margins. | ||

Example 6 — Impact on margin calls due to favourable market movements plus receipt of margins that exceed total margin call

Margin calls can be deleted if favourable market movements and receipt of margins restore the Customer's total net equity to or above initial margins.

| Monday | Tuesday | Wednesday | Thursday | |

| Total net equity | 50,000 | 52,000 | 52,000 | 61,000 |

| Initial margins | 60,000 | 60,000 | 60,000 | 60,000 |

| Maintenance margins | 58,000 | 58,000 | 58,000 | 58,000 |

| UNDER-MARGINED | 10,000 | 8,000 | 8,000 | -0- |

| Favourable market movements [FMM] of $2,000 occurred on Tuesday. Cash of $9,000 was deposited on Thursday. | ||||

| CALL RE'QD/(AGE) | 10,000 (T) | 10,000 (1) | 10,000 (2) | -0- |

| Margin call of $10,000 was not reduced or deleted as FMM did not result in total net equity equal to or exceed initial margins. | As both cash receipt and FMM caused total net equity to exceed initial margins, the margin call of $10,000 was deleted. | |||

4. Under-Margined Accounts (Rule 7.22.3)

4.1 Acceptance of Orders

Allowable Trading Activity Within The Reasonable Period

| Trading Activity | Risk Increasing | Risk Neutral | Day Trading | Risk Reducing |

| Allowed for Customer | Yes | Yes | Yes | Yes |

Allowable Trading Activity Within The Reasonable Period

| Trading Activity | Risk Increasing | Risk Neutral | Day Trading | Risk Reducing |

| Allowed for Customer | No | No | No | Yes |

Allowable Trading Activity Beyond The Reasonable Period

| Trading Activity | Risk Increasing | Risk Neutral | Day Trading | Risk Reducing |

| Allowed for Customer | No | No | No | Yes |

A risk increasing trade is the establishment or closure of a position in a contract which increases a Customer's maintenance margins requirement (e.g. closing one leg of a spread position).

A risk neutral trade is the establishment of a position in a contract which does not impact a Customer's maintenance margins requirement (e.g. spread trades that do not impact maintenance margins requirements).

A risk reducing trade is the establishment or closure of a position in a contract which reduces the Customer's maintenance margins requirement (e.g. liquidation of a naked open position).

4.2 Prohibition of Financing of Trading Margins

4.3 Monitoring Procedures

4.4 Examples

Assumptions:

Example 1 — Under-margined beyond reasonable period — Deletion of margin calls

Trading is allowed within reasonable period but no trading is allowed beyond reasonable period except for risk reducing trades until the Customer's total net Equity is restored to the initial margins level.

Week 1

| Monday | Tuesday | Wednesday | Thursday | Friday | |

| AMT U/M | 5,000 | 5,000 | 5,000 | 5,000 | -0- |

| CALL/AGE | 5,000 (T) | 5,000 (1) | 5,000 (2) | 5,000 (3) | |

| TRADING | All* | All | All | RR** | All |

* All trading activity

** Only risk reducing trades

Assuming the margin call is in US Dollars, the reasonable period is T + 2, which is as of the close of business on Wednesday. As of Thursday, the Customer cannot be allowed to incur any risk increasing, risk neutral or day trades. The Customer can only be allowed to incur risk reducing trades.

On Friday, a cash deposit of $5,000 was received to delete the margin call. Once the Customer's total net equity is restored to the initial margins level, all trading activities would be allowed.

Example 2 — Under-margined beyond reasonable period — Deletion and reduction of margin calls

Trading is allowed within reasonable period but no trading is allowed beyond reasonable period except for risk reducing trades until the Customer's total net equity is restored to the initial margins level.

Week 1

| Monday | Tuesday | Wednesday | Thursday | Friday | |

| AMT U/M | 10,000 | 10,000 | 10,000 | 10,000 | 15,000 |

| CALL/AGE | 10,000 (T) | 10,000 (1) | 10,000 (2) | 10,000 (3) | 10,000 (4) 5,000 (T) |

| TRADING | All* | All | All | All | RR** |

| Unfavourable market movements of JPY 5,000 occurred on Friday. | |||||

Assuming the margin call is in Japanese Yen, the reasonable period is T + 3, which is as of the close of business on Thursday. As of the close of business on Thursday, the Customer's total net equity was not restored to the initial margins level. Thus on Friday, the Customer can only be allowed to incur risk reducing trades.

Week 2

| Monday | Tuesday | Wednesday | Thursday | Friday | |

| AMT U/M | 15,000 | 5,000 | 4,000 | 1,000 | 1,000 |

| CALL/AGE | 10,000 (5) 5,000 (1) | 5,000 (2) | 5,000 (3) | 2,000 (4) | 2,000 (5) |

| TRADING | RR** | All* | All | RR | RR |

| Favourable market movements of JPY 1,000 occurred on Wednesday. | |||||

* All trading activity

** Only risk reducing trades

On Tuesday of Week 2, cash deposit of JPY 10,000 was received which deleted the outstanding margin call of JPY10,000. After this, the only margin call of JPY 5,000 is still within the reasonable period of T + 3. Thus during this period, Tuesday and Wednesday, all trading is allowed. On the close of business on Wednesday, the Customer's total net equity was not restored to the initial margins level. On Thursday, cash of JPY3,000 was received which reduced the margin call to JPY2,000. As the Customer Account is still under-margined with a margin call of JPY2,000 outstanding beyond the reasonable period, the Customer on Thursday and Friday can only be allowed to incur risk reducing trades.

5. Omnibus Accounts and Other Margin Policies (Rule 7.22.1)

5.1 Omnibus Accounts

5.2 Grouping of Accounts

5.3 Excess Margins Payments

5.4 Examples

Note: In the computation, if the net option value is greater than the initial margin risk component, the maximum amount of Excess Margins available for disbursement shall be equal to the total net equity.

Example 1 — Excess Margins Payments

| Customer Account | Balance |

| Total net equity | $5,000 |

| Net option value | $1,200 |

| Initial margins risk component | $3,000 |

* An Excess Margins payment can be made from the Customer Account for $3,200 {$5,000 − [($3,000 − $1,200) which = $1,800]}

Example 2 — Excess Margins Payments

| Customer Account | Balance |

| Total net equity | $-0- |

| Net option value | $9,000 |

| Initial margins risk component | $7,000 |

* As total net equity is zero, no payment can be made. {$-0- − [($7,000 − $9,000) which = 0]}. The only margin asset in the Customer Account is long option value which cannot be used to make an Excess Margins payment.

Example 3 — Excess Margins Payments

| Customer Account | Balance |

| Total net equity | $32,800 |

| Net option value | $<12,000> |

| Initial margins risk component | $14,000 |

* An Excess Margins payment can be made from the Customer Account for $6,800 {$32,800 − [($14,000 − <$12,000>) which = $26,000]}

Example 4 — Accounts owned by the same Customer

Assume client A/C A & client A/C B are owned by the same Customer.

| A/C A $ | A/C B $ | COMBINED $ | |

| Total net equity | 8,000 | 80,000 | 88,000 |

| Initial margins | 25,000 | 50,000 | 75,000 |

| Maintenance margins | 20,000 | 40,000 | 60,000 |

| Excess Margins for withdrawal | (17,000) | 30,000 | 13,000 |

If client A/C A and client A/C B are not combined, then the amount of Excess Margins that is available for withdrawal, ie $30,000, is greater than what is actually available for the Customer as a whole.

5.5 Concurrent Long and Short Positions

Added on 23 July 201423 July 2014 and amended on 25 January 201725 January 2017.

1 "Futures Contract" refers to any Contract, over any Underlying, designated by the Exchange as a futures contract.

2 "Option Contract" refers to any Contract which grants an option in respect of an Underlying or a Futures Contract.

3 "Excess Margins" refers to credits in excess of initial margins.

Practice Note 7.23 — Additional Margins

| Issue date | Cross Reference | Enquiries |

| Added on 8 August 20168 August 2016 | Rule 7.20 and Rule 7.23 | Please contact Risk Management: rmd@sgx.com |

1. Introduction

2. Default Fund risk add-on

3. Credit risk add-on

4. Liquidity risk add-on

5. Position risk add-on

6. Discretionary risk add-on

ILLUSTRATION ON THE CALCULATION OF THE DEFAULT FUND RISK ADD-ON

Threshold 1: 70% x 800 = 560 (Any Member Group)

Threshold 2: 90% x 800 = 720 (Any Member Group + Weak 1 + Weak 2)

Assume only one stress testing scenario generates exposure that exceed the thresholds,

| Loss exceeds threshold | Potential add-on | ||||

| Loss | Threshold 1 | Threshold 2 | Threshold 1 | Threshold 2 | |

| X + Weak 1 + Weak 2 | 700 | No | |||

| X | 640 | Yes | 640-560=80 | ||

| Weak 1 | 60 | No | |||

| Weak 2 | 0 | No | |||

Assume only one stress testing scenario generates exposure that exceed the thresholds,

| Loss exceeds threshold | Potential add-on | ||||

| Loss | Threshold 1 | Threshold 2 | Threshold 1 | Threshold 2 | |

| X + Weak 1 + Weak 2 | 760 | Yes | 760-720=40 | ||

| X | 520 | No | |||

| Weak 1 | 200 | No | |||

| Weak 2 | 40 | No | |||

Assume only one stress testing scenario generates exposure that exceed the thresholds,

| Loss exceeds threshold | Potential add-on | ||||

| Loss | Threshold 1 | Threshold 2 | Threshold 1 | Threshold 2 | |

| X + Weak 1 + Weak 2 | 820 | Yes | 820-720=100 | ||

| X | 640 | Yes | 640-560=80 | ||

| Weak 1 | 180 | No | |||

| Weak 2 | 0 | No | |||

^ The loss for X is taken as 560 here because it has been partially offset by the 80 from Threshold 1. (When X exceeds Threshold 1, the calculation for its pro rata assignment under Threshold 2 will be based on Threshold 1.)

Assume a stress testing scenario generates exposure that exceed the thresholds,

| First stress scenario | |||||

| Loss exceeds threshold | Potential add-on | ||||

| Loss | Threshold 1 | Threshold 2 | Threshold 1 | Threshold 2 | |

| X + Weak 1 + Weak 2 | 820 | Yes | 820-720=100 | ||

| X | 640 | Yes | 640-560=80 | ||

| Weak 1 | 180 | No | |||

| Weak 2 | 0 | No | |||

| Second stress scenario | |||||

| Loss exceeds threshold | Potential add-on | ||||

| Loss | Threshold 1 | Threshold 2 | Threshold 1 | Threshold 2 | |

| Y + Weak 1 + Weak 2 | 790 | Yes | 790-720=70 | ||

| Y | 620 | Yes | 620-560=60 | ||

| Weak 1 | 170 | No | |||

| Weak 2 | 0 | No | |||

1 Principles for Financial Market Infrastructures issued by the Committee on Payments and Market Infrastructure (CPMI) and the Technical Committee of the International Organization of Securities Commissions (IOSCO)

2 Threshold 1 and 2 is currently defined as 70% and 90% respectively, but may be revised from time to time.

3 The threshold is currently defined as 15%, but may be revised from time to time.

Added on 8 August 20168 August 2016 and amended on 17 July 201917 July 2019.

Practice Note 7.30 — Enhanced Customer Collateral Protection

| Issue date | Cross Reference | Enquiries |

| Added on 31 December 201331 December 2013 and amended on 17 July 201917 July 2019 | Rule 7.30 | Please contact: Operations, Clearing and Depository Clearing Hotline Tel: (65) 6236 5319 Email: otclear@sgx.com SGX OTC Clearing Business Email: sgxotc@sgx.com SGX AsiaClear Commodities Clearing Business Email: asiaclear@sgx.com |

1. Introduction

2. Requirement to inform Customers of the availability of the choice for ECCP

3. Treatment of position and Collateral under the ECCP model

Positions

Collateral

4. Benefits and Costs

Non-Applicable Customers are technically exposed to a degree of risk in the default of another non-Applicable Customer. Section 60(1)(b) of the SFA and Regulation 24(1) of the Securities and Futures (Clearing Facilities) Regulations 2013 ("SFR (Clearing Facilities)") provide that the Clearing House may use Customer Collateral of non-Applicable Customers to meet obligations of a Clearing Member that arise from other non-Applicable Customers' contracts where certain conditions are met.

In contrast, Applicable Customers are protected from fellow-customer risk because SFR (Clearing Facilities) Regulation 24(2) provides that in the event of a default of a Clearing Member caused by a Customer, Collateral of a non-defaulting Applicable Customer will not be used to satisfy the obligations arising from the Contracts of such defaulting Customer. In the event of a default of a Clearing Member caused by an Applicable Customer, only the Collateral of such defaulting Applicable Customer will be used. Other Customers' Collateral will not be used.

Clear identification of positions and associated Collateral in respect of each Applicable Customer Account enables Clearing House to accurately determine the minimum amount of Collateral each Applicable Customer has to deposit and will potentially expedite the porting of positions and associated Collateral in an event of default.

Practice Note 7A.01A.2A — Apportionment of Clearing Fund Contributions across Contract Classes and across OTCF auctions [This Practice Note has been deleted.]

Deleted on 17 July 201917 July 2019.

Practice Note 7A.01A.2B.2 — Apportionment and application of Clearing Fund Contributions when one or more auctions are held in respect of a Contract Class

| Issue Date | Cross Reference | Enquiries |

| Added on 17 July 201917 July 2019. | Clearing Rules 7A.01A.2C, 7A.01A.2D and 7A.01A.2E | Please contact: Risk Management E-Mail Address : rmd@sgx.com |

1. Introduction

2. Apportionment of Clearing House First Loss Contribution and Clearing House Intermediate Contribution to auctions held in respect of the ETD and NMC Contract Class

3. Apportionment of a Required Participant's Clearing Fund Deposit to an ETD and NMC Auction

4. Illustration of how the Clearing Fund Deposits of Required Participants who have submitted bids for an ETD and NMC auction are pro-rated pursuant to Rule 7A.01A.2D.2

A and B are Required Participants who had submitted bids that were below the Winning Bid Price. Their liabilities under Rule 7A.01A.2D.2.b will be in the following proportions:

Practice Note 7A.01B — Illustrations of the Application of Clearing Member's Clearing Fund Deposit and Further Assessment Amounts in respect of OTCF Contracts [This Practice Note has been deleted.]

Deleted on 17 July 201917 July 2019.

Practice Note 7A.06.9 — Limit on Non-defaulting Clearing Members’ Liability for Multiple Events of Default

- Introduction

- Rule 7A.06.9.1 states that the aggregate amount of a non-defaulting Clearing Member’s Clearing Fund Deposit (“CFD”) and Further Assessment Amount ("FAA”) that can be applied to meet losses arising from or in connection with all events of default occurring within a period of thirty (30) calendar days shall not exceed an amount equal to three (3) times of that Clearing Member's Prescribed Contributions as at the start of that 30-day period.

- Rule 7A.06.9.2 states that where an event of default occurs, the amount of a non-defaulting Clearing Member’s CFD and FAA that is available to meet losses arising suffered by the Clearing House arising from or in connection with that event of default is the lower of:

- an amount equal to three (3) times of the Clearing Member’s Prescribed Contributions as at the start of the 30-day period that ends on the day of the event of default less the aggregate amount of that Clearing Member’s CFD and FAA that has already been utilised to meet losses arising from or in connection with all other preceding events of default that had occurred in that 30-day period; or

- where the Clearing Member’s CFD was adjusted during the aforementioned 30-day period, an Adjusted Amount equal to three (3) times of the consequently adjusted Prescribed Contributions less the aggregate amount of the Clearing Member’s CFD and FAA that has already been utilised to meet losses arising from or in connection with events of default that occurred after the day of that adjustment but before the event of default.

In the event the Clearing Member’s CFD is adjusted multiple times during the 30-day period, a separate Adjusted Amount shall be calculated for each adjustment and the lowest Adjusted Amount shall apply for the purpose of Rule 7A.06.9.2.b.

- This Practice Note illustrates the operation of Rules 7A.06.9.1 and 7A.06.9.2. The scenarios set out are meant only to illustrate the calculation of the usage limits applicable under the Rules in various hypothetical scenarios, and are not representative of how defaults are managed by the Clearing House nor the actions that the Clearing House can and may take to maintain a fair, orderly, safe and efficient market.

- Operation of Rule 7A.06.9.1

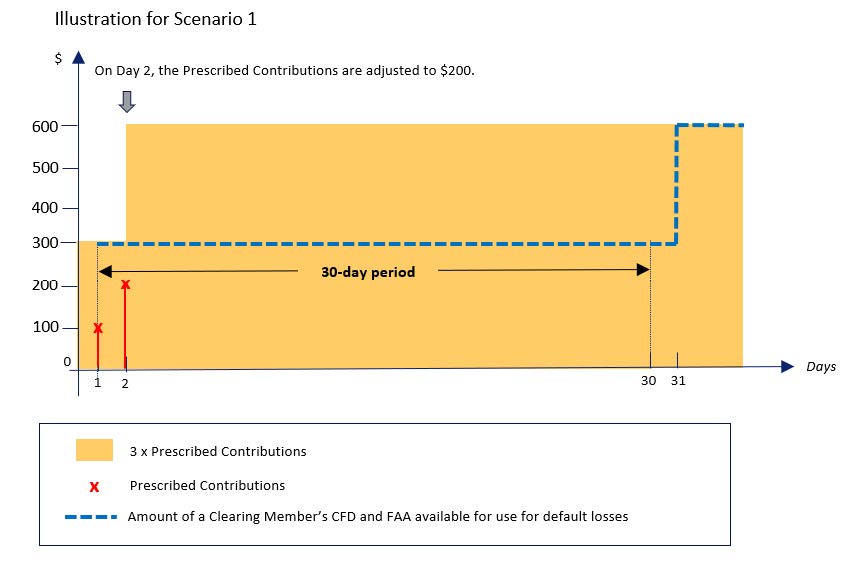

Scenario 1

- Scenario 1: On Day 1, the non-defaulting Clearing Member’s Prescribed Contributions is $100. On Day 2, the Clearing Member’s Prescribed Contributions is increased to $200. This scenario illustrates how the aggregate amount of a non-defaulting Clearing Member’s CFD and FAA that can be applied to meet losses arising from events of default occurring within a 30-day period shall not exceed an amount equal to three (3) times of the Clearing Member’s Prescribed Contributions as at the start of the 30-day period.

- In accordance with Rule 7A.06.9.1, the aggregate amount of the Clearing Member’s CFD and FAA that can be applied to meet losses arising from or in connection with all events of default occurring within Day 1 to Day 30 shall not exceed an amount equal to three (3) times of that Clearing Member's Prescribed Contributions on Day 1. Therefore, even though the Clearing Member’s Prescribed Contributions were increased to $200 on Day 2, the aggregate amount of the Clearing Member’s CFD and FAA which can be applied to meet default losses occurring within Day 1 to Day 30 will not exceed $300 (i.e. 3 x $100).

- Operation of Rule 7A.06.9.2

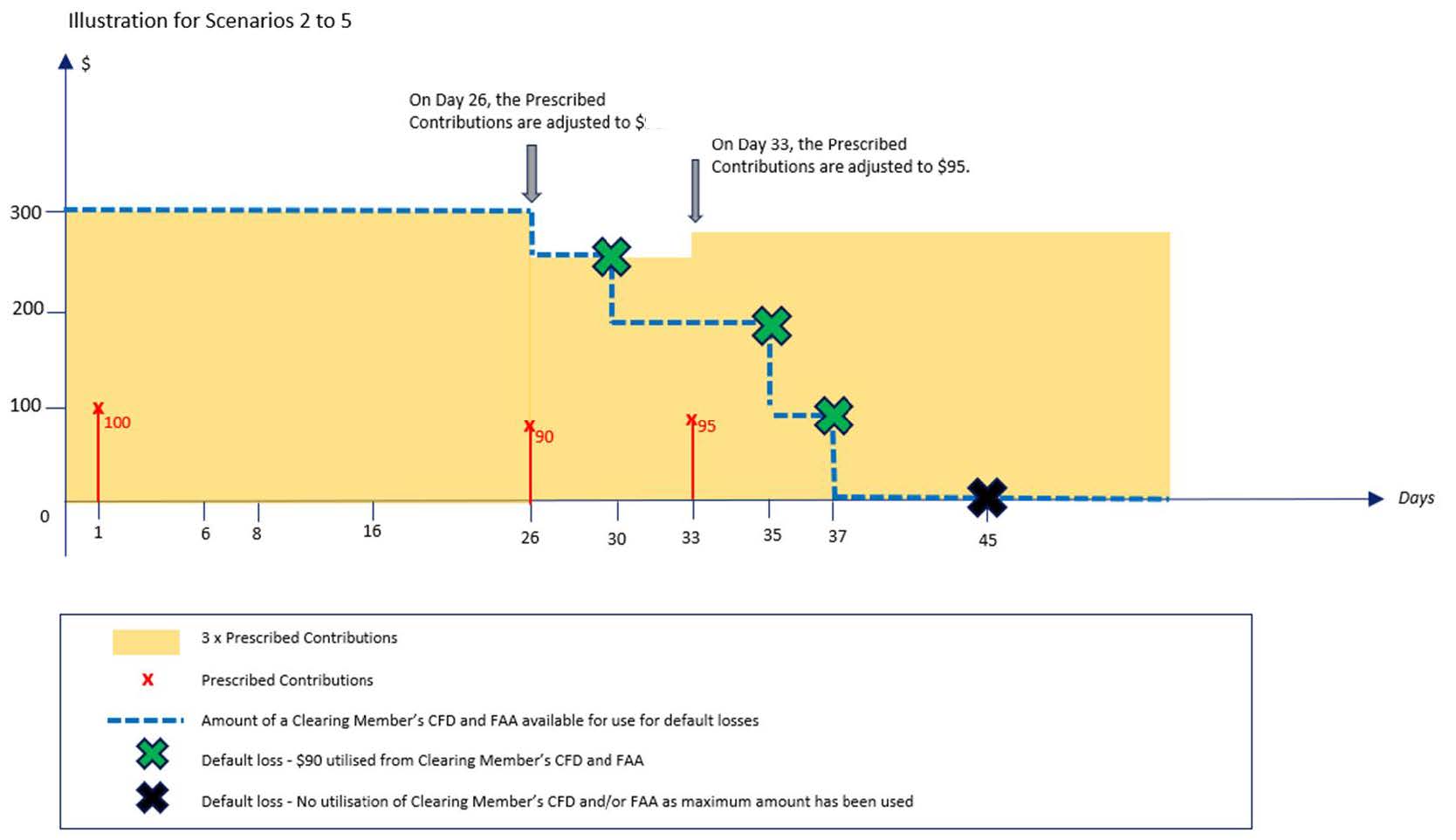

- The following scenarios (Scenarios 2 to 5) illustrate how the amount of a non-defaulting Clearing Member’s CFD and FAA that can be used to meet losses is capped in the event of multiple defaults within a 30-day period.

Scenario 2

- Scenario 2: On Day 1, the non-defaulting Clearing Member’s Prescribed Contributions is $100. On Day 26, the Clearing Member’s Prescribed Contributions is reduced to $90. Subsequently, a default occurs on Day 30. This scenario illustrates the amount of a non-defaulting Clearing Member’s CFD and FAA that is available to meet losses suffered by the Clearing House arising from or in connection with the default that occurred on Day 30.

- Pursuant to Rule 7A.06.9.2, the amount of a non-defaulting Clearing Member’s CFD and FAA that is available to meet losses suffered by the Clearing House arising from or in connection with the event of default on Day 30 is the lower of:(a) an amount equal to 3 times of the Clearing Member’s Prescribed Contributions as at the start of the thirty-day period that ends on the day of the event of default (i.e. Day 1) less the aggregate amount used to meet default losses from all preceding events of default (i.e. from Day 1 up until the current event of default); or

3 x Prescribed Contributions on Day 1 = 3 x $100

= $300Aggregate amount used to meet default losses from all preceding events of default from Day 1 until the current event of default on Day 30 = $0 Amount that results under limb (a) = $300 - $0

= $300(b) where the Clearing Member’s CFD was adjusted during the 30-day period, an Adjusted Amount equal to three (3) times of the consequently adjusted Prescribed Contributions (i.e. the Prescribed Contributions on Day 26) less the aggregate amount of the Clearing Member’s CFD and FAA that has already been utilised to meet losses arising from or in connection with events of default that occurred after the day of that adjustment but before the event of default (i.e. from Day 26 up until the current event of default).3 x adjusted Prescribed Contributions on Day 26 = 3 x $90

= $270Aggregate amount used to meet default losses from all events of default from Day 26 until the current event of default on Day 30 = $0 Adjusted Amount that results under limb (b) = $270 - $0

= $270 - Under this scenario, the amount that results under limb (b) is lower than the amount that results under limb (a). Therefore, the amount of the non-defaulting Clearing Member’s CFD and FAA that is available to meet losses suffered by the Clearing House arising from the default that occurred on Day 30 is the amount that results under limb (b), which is $270.

Scenario 3

- Scenario 3: Continuing from Scenario 2, $90 of the Clearing Member’s CFD and FAA was used to meet losses suffered by the Clearing House arising from a default on Day 30. On Day 33, the Clearing Member’s Prescribed Contributions is increased to $95. A second default occurs on Day 35. This scenario illustrates the amount of the non-defaulting Clearing Member’s CFD and FAA that is available to meet losses suffered by the Clearing House arising from or in connection with the second default that occurred on Day 35.

- Pursuant to Rule 7A.06.9.2, the amount of a non-defaulting Clearing Member’s CFD and FAA that is available to meet losses suffered by the Clearing House arising from or in connection with the event of default on Day 35 is the lower of:(a) an amount equal to 3 times of the Clearing Member’s Prescribed Contributions as at the start of the thirty-day period that ends on the day of the event of default (i.e. Day 35 – 29 days = Day 6) less the aggregate amount used to meet default losses from all preceding events of default (i.e. from Day 6 up until the current event of default); or

3 x Prescribed Contributions on Day 6 = 3 x $100

= $300Aggregate amount used to meet default losses from all preceding events of default from Day 6 until the current event of default on Day 35 = $90* * From the default on Day 30 Amount that results under limb (a) = $300 - $90

= $210(b) where the Clearing Member’s CFD was adjusted during the 30-day period, an Adjusted Amount equal to three (3) times of the consequently adjusted Prescribed Contributions less the aggregate amount of the Clearing Member’s CFD and FAA that has already been utilised to meet losses arising from or in connection with events of default that occurred after the day of that adjustment but before the event of default.Rule 7A.06.9.2 also states that in the event the Clearing Member’s CFD is adjusted multiple times during the 30-day period, a separate Adjusted Amount shall be calculated for each adjustment and the lowest Adjusted Amount shall apply for the purpose of Rule 7A.06.9.2.b. In this case, the Clearing Member’s CFD was adjusted twice resulting in two adjusted Prescribed Contributions within the relevant 30-day period. Therefore two separate Adjusted Amounts will be calculated. Adjusted Amount A: 3 x adjusted Prescribed Contributions on Day 26 = 3 x $90

= $270Aggregate amount used to meet default losses from all events of default from Day 26 until the current event of default on Day 35 = $90* * From the default on Day 30 Adjusted Amount A = $270 - $90

= $180Adjusted Amount B: 3 x adjusted Prescribed Contributions on Day 33 = 3 x $95

= $285Aggregate amount used to meet default losses from all events of default from Day 33 until the current event of default on Day 35 = $0 Adjusted Amount B = $285 - $0

= $285Adjusted Amount A ($180) is lower than Adjusted Amount B ($285), therefore Adjusted Amount A applies for the purpose of Rule 7A.06.9.2.b and the amount that results under limb (b) is $180. - In this scenario, the amount of the non-defaulting Clearing Member’s CFD and FAA that is available to meet losses suffered by the Clearing House arising from the second default that occurred on Day 35 is the lowest Adjusted Amount calculated pursuant to limb (b), which is $180.

Scenario 4

- Scenario 4: Continuing from Scenario 3, $90 of the Clearing Member’s CFD and FAA was used to meet losses suffered by the Clearing House arising from the second default on Day 35. A third default occurs on Day 37. This scenario illustrates the amount of the non-defaulting Clearing Member’s CFD and FAA that is available to meet losses suffered by the Clearing House arising from or in connection with the default that occurred on Day 37.

- Pursuant to Rule 7A.06.9.2, the amount of a non-defaulting Clearing Member’s CFD and FAA that is available to meet losses arising suffered by the Clearing House arising from or in connection with the event of default on Day 37 is the lower of:(a) an amount equal to 3 times of the Clearing Member’s Prescribed Contributions as at the start of the thirty-day period that ends on the day of the event of default (i.e. Day 37 – 29 days = Day 8) less the aggregate amount used to meet default losses from all preceding events of default (i.e. from Day 8 up until the current event of default); or

3 x Prescribed Contributions on Day 8 = 3 x $100

= $300Aggregate amount used to meet default losses from all preceding events of default from Day 8 until the current event of default on Day 37 = $90* + $90**

= $180* From the default on Day 30 ** From the default on Day 35 Amount that results under limb (a) = $300 - $180

= $120(b) where the Clearing Member’s CFD was adjusted during the 30-day period, an Adjusted Amount equal to three (3) times of the consequently adjusted Prescribed Contributions less the aggregate amount of the Clearing Member’s CFD and FAA that has already been utilised to meet losses arising from or in connection with events of default that occurred after the day of that adjustment but before the event of default.Rule 7A.06.9.2 states that in the event the Clearing Member’s CFD is adjusted multiple times during the 30-day period, a separate Adjusted Amount shall be calculated for each adjustment and the lowest Adjusted Amount shall apply for the purpose of Rule 7A.06.9.2.b. In Scenario 3 from which this scenario continues, the Clearing Member’s CFD was adjusted twice resulting in two adjusted Prescribed Contributions within the relevant 30-day period. Therefore two separate Adjusted Amounts will be calculated. Adjusted Amount A: 3 x adjusted Prescribed Contributions on Day 26 = 3 x $90

= $270Aggregate amount used to meet default losses from all events of default from Day 26 until the current event of default on Day 37 = $90* + $90**

=$180* From the default on Day 30 ** From the default on Day 35 Adjusted Amount A = $270 - $180

= $90Adjusted Amount B: 3 x adjusted Prescribed Contributions on Day 33 = 3 x $95

= $285Aggregate amount used to meet default losses from all events of default from Day 26 until the current event of default on Day 37 = $90** ** From the default on Day 35 Adjusted Amount B = $285 - $90

= $195Adjusted Amount A ($90) is lower than Adjusted Amount B ($195), therefore Adjusted Amount A applies for the purpose of Rule 7A.06.9.2.b and the amount that results under limb (b) is $90. - The amount of the non-defaulting Clearing Member’s CFD and FAA that is available to meet losses suffered by the Clearing House arising from the third default that occurred on Day 37 is the lowest Adjusted Amount calculated pursuant to limb (b), which is $90.

Scenario 5

- Scenario 5: Continuing from Scenario 4, $90 of the Clearing Member’s CFD and FAA was used to meet losses suffered by the Clearing House arising from the third default on Day 37. A fourth default occurs on Day 45. This scenario illustrates the amount of the non-defaulting Clearing Member’s CFD and FAA that is available to meet losses suffered by the Clearing House arising from or in connection with the default that occurred on Day 45.

- Pursuant to Rule 7A.06.9.2, the amount of a non-defaulting Clearing Member’s CFD and FAA that is available to meet losses arising suffered by the Clearing House arising from or in connection with the event of default on Day 45 is the lower of:(a) an amount equal to 3 times of the Clearing Member’s Prescribed Contributions as at the start of the thirty-day period that ends on the day of the event of default (i.e. Day 45 – 29 days = Day 16) less the aggregate amount used to meet default losses from all preceding events of default (i.e. from Day 16 up until the current event of default); or

3 x Prescribed Contributions on Day 16 = 3 x $100

= $300Aggregate amount used to meet default losses from all preceding events of default from Day 16 until the current event of default on Day 45 = $90* + $90** + $90^

= $270* From the default on Day 30 ** From the default on Day 35 ^ From the default on Day 37 Amount that results under limb (a) = $300 - $270

= $30(b) where the Clearing Member’s CFD was adjusted during the 30-day period, an Adjusted Amount equal to three (3) times of the consequently adjusted Prescribed Contributions less the aggregate amount of the Clearing Member’s CFD and FAA that has already been utilised to meet losses arising from or in connection with events of default that occurred after the day of that adjustment but before the event of default.Rule 7A.06.9.2 states that in the event the Clearing Member’s CFD is adjusted multiple times during the 30-day period, a separate Adjusted Amount shall be calculated for each adjustment and the lowest Adjusted Amount shall apply for the purpose of Rule 7A.06.9.2.b. In Scenario 3 from which this scenario continues, the Clearing Member’s CFD had been adjusted twice resulting in two adjusted Prescribed Contributions within the relevant 30-day period. Therefore, two separate Adjusted Amounts will be calculated. Adjusted Amount A: 3 x adjusted Prescribed Contributions on Day 26 = 3 x $90

= $270Aggregate amount used to meet default losses from all events of default from Day 26 until the current event of default on Day 45 = $90* + $90** + $90^

= $270* From the default on Day 30 ** From the default on Day 35 ^ From the default on Day 37 Adjusted Amount A = $270 - $270

= $0Adjusted Amount B: 3 x adjusted Prescribed Contributions on Day 33 = 3 x $95

= $285Aggregate amount used to meet default losses from all events of default from Day 33 until the current event of default on Day 45 = $90** + $90^

= $180** From the default on Day 35 ^ From the default on Day 37 Adjusted Amount B = $285 - $180

= $105Adjusted Amount A ($0) is lower than Adjusted Amount B ($105), therefore Adjusted Amount A applies for the purpose of Rule 7A.06.9.2.b and the amount that results under limb (b) is $0. - In this case, the non-defaulting Clearing Member’s CFD and FAA cannot be used to meet losses suffered by the Clearing House arising from the fourth default that occurred on Day 45 as the lowest Adjusted Amount calculated pursuant to limb (b) is $0.

Added on 31 October 2024.

Practice Note 9.01.1 — OTCF Product Groups [This Practice Note has been deleted.]

Deleted on 17 July 201917 July 2019.