Regulatory Notice 4.1 — Adequacy of Systems

Added on 3 June 20193 June 2019.

Regulatory Notice 4.13.1 — Audit Trails and Records

Record of all Fields Relating to Order Entry

| 1. | Connection ID |

| 2. | Trader ID and name |

| 3. | Client ID and name — from customer account carried on the books of the Trading Member |

| 4. | Trading Account code |

| 5. | Position Account code |

| 6. | User ID and name — used to log into Trading Member's systems |

| 7. | Order ID — assigned by the Trading System |

| 8. | Order type — e.g. good-till-cancelled order, all-or-none order, etc |

| 9. | Buy/sell |

| 10. | Counter name and quantity to be bought/sold |

| 11. | Order price — including original trigger price for stop orders |

| 12. | Settlement instructions — e.g. settlement with CPF funds, contra etc |

| 13. | Force Key usage |

| 14. | Flow of order — if order passes through multiple systems prior to reaching the market |

| 15. | Identity of order reviewer — if any |

| 16. 17. | Description of amendments made — if any Date and time of order entry, and of any actions taken relating to the order—including transmission, rejection, amending, routing, filtering, execution, withdrawal, etc and should include orders that are progressively released. |

| 18. | Error messages and subsequent actions taken by the user, reviewer or system |

| 19. | Status of order — such as the order being partially filled, fulfilled, unfilled, withdrawn, amended, rejected, etc |

| 20. | Executed order number — assigned by the Trading System |

| 21. | Traded price — for executed orders |

| 22. | Counter name and quantity bought/sold — for executed orders |

| 23. | Counterparty Trading Member identity — for executed orders |

| 24. | Orders and trades in Trading Member records not stored electronically — to be referenced to Order ID and executed order numbers assigned by the Trading System |

| 25. | Any other relevant records/instructions |

Added on 3 June 20193 June 2019.

Regulatory Notice 4.13, 4.16, 4.24, 4.25 and 4.29 — Operational Requirements for Remote Trading Members

Pursuant to Rule 4.13.1, the Remote Trading Member should:

Pursuant to Rule 4.24.1 the Remote Trading Member should issue to its customer a contract note that should contain the following information:

Pursuant to Rule 4.25.1, the Remote Trading Member should send to its customer statements of account that should contain the following information:

Pursuant to Rule 4.16.1, the Remote Trading Member should provide its customer a risk disclosure statement that should clearly state the features of securities and futures contracts and the risks associated with holding and trading these instruments.

Pursuant to Rule 4.29.1, the Remote Trading Member should:

Added on 3 June 20193 June 2019.

Regulatory Notice 4.24.1 — Contract Notes

Added on 3 June 20193 June 2019.

Regulatory Notice 4.34.4 and 4.34.5 — Allocation of Trades to Position Accounts

Added on 3 June 20193 June 2019.

Regulatory Notice 6.6.2 — Bid & Offer Quotations

1. Introduction

2. Instruments prescribed for Rule 6.6.2(b) and (c)

Refer to Appendix A to Regulatory Notice 6.6.2.

Added on 1 December 2025.

Appendix A to Regulatory Notice 6.6.2

Prescribed Instruments

| 1 | Daily leverage certificates |

| 2 | Structured warrants |

| 3 | Structured certificates |

Added on 1 December 2025.

Regulatory Notice 8.2.1 — Trading Hours, Market Phases, Application of Market Phases and Principles and Rules for Trade Matching

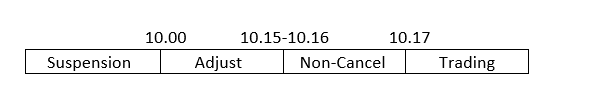

SGX-ST specifies the Adjust Phase is to be followed immediately by a Non-Cancel Phase and further specifies that the Non-Cancel Phase will begin from 10:15 hours to 10:16 hours. In this case, the Adjust Phase will end simultaneously with the beginning of the Non-Cancel Phase at any time from 10:15 hours to 10:16 hours. Normal trading will begin at 10:17 hours.

3.1 Summary

Opens/Starts at: 08:30 hours

Closes/Ends at: 17:16 hours

| 08.30 | 08.58-59 | 9.00 | 12.00 | 12.58-59 | 13.00 | 17.00 | 17.04-05 | 17.06 | 17.16 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pre-Open | Non-Cancel | Trading | Pre-Open | Non-Cancel | Trading | Pre-Close | Non-Cancel | Trade at Close | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Opening Routine | Mid-Day Break | Closing Routine | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Opens/Starts at: 08:30 hours

Closes/Ends at: 12:16 hours

| 08.30 | 08.58-59 | 9.00 | 12.00 | 12.04-05 | 12.06 | 12.16 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Pre-Open | Non-Cancel | Trading | Pre-Close | Non-Cancel | Trade at Close | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Opening Routine | Closing Routine | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

3.2 Opening Routine

The methodology for computing the single price at which orders are matched ("Equilibrium Price") at the end of the Opening Routine, Mid-Day Break, Closing Routine and Adjust Phase is as follows1:

Example 1

| Bid Volume | Price | Ask Volume | Cumulative Bid Volume (a) | Cumulative Ask Volume (b) | Tradable Volume | Imbalance (a)–(b) | Pressure |

| 90 | 3.810 | 20 | 90 | 250 | 90 | 160 | Sell |

| 30 | 3.800 | 40 | 120 | 230 | 120 | 70 | Sell |

| 70 | 3.790 | 30 | 190 | 190 | 190 | 0 | Nil |

| 100 | 3.780 | 80 | 290 | 160 | 160 | 130 | Buy |

| 50 | 3.770 | 50 | 340 | 80 | 80 | 260 | Buy |

| 0 | 3.760 | 20 | 340 | 30 | 30 | 310 | Buy |

| 0 | 3.750 | 10 | 340 | 10 | 10 | 330 | Buy |

In this example, the Equilibrium Price is $3.790 where the tradable volume is the largest and the imbalance is the lowest. If the highest tradable volume occurs at more than one price the algorithm will then consider imbalance, see sub-paragraph (b).

Example 2

| Bid Volume | Price | Ask Volume | Cumulative Bid Volume (a) | Cumulative Ask Volume (b) | Tradable Volume | Imbalance (a)–(b) | Pressure |

| 90 | 3.810 | 20 | 90 | 270 | 90 | 180 | Sell |

| 30 | 3.800 | 40 | 120 | 250 | 120 | 130 | Sell |

| 70 | 3.790 | 20 | 190 | 210 | 190 | 20 | Sell |

| 100 | 3.780 | 110 | 290 | 190 | 190 | 100 | Buy |

| 50 | 3.770 | 50 | 340 | 80 | 80 | 260 | Buy |

| 0 | 3.760 | 20 | 340 | 30 | 30 | 310 | Buy |

| 0 | 3.750 | 10 | 340 | 10 | 10 | 330 | Buy |

In this example, the Equilibrium Price is $3.790 where the tradable volume is the largest (190) and the imbalance is the lowest (20).

If market orders are present a situation may arise in which the lowest imbalance occurs at "Market Price", see paragraph (4.3).

If the highest tradable volume and lowest imbalance occur at more than one price the algorithm will then consider market pressure, see paragraph (4.4).

Example 3

| Bid Volume | Price | Ask Volume | Cumulative Bid Volume (a) | Cumulative Ask Volume (b) | Tradable Volume | Imbalance (a)–(b) | Pressure |

| 30 | MKT | 30 | 20 | 20 | 10 | Buy | |

| 3.810 | 30 | 20 | 20 | 10 | Buy | ||

| 10 | 3.800 | 40 | 20 | 20 | 20 | Buy | |

| 3.790 | 40 | 20 | 20 | 20 | Buy | ||

| 10 | 3.780 | 50 | 20 | 20 | 30 | Buy | |

| 3.770 | 10 | 50 | 20 | 20 | 30 | Buy | |

| 3.760 | 50 | 10 | 10 | 40 | Buy | ||

| 3.750 | 10 | 50 | 10 | 10 | 40 | Buy | |

| MKT | 50 | 0 |

In this example, the lowest imbalance (10) occurs where market order bid volume (30) exceeds cumulative ask volume (20). One tick has therefore been added on the bid side, and the Equilibrium Price is $3.810.

Example 4

| Bid Volume | Price | Ask Volume | Cumulative Bid Volume (a) | Cumulative Ask Volume (b) | Tradable Volume | Imbalance (a)–(b) | Pressure |

| 90 | 3.810 | 20 | 90 | 250 | 90 | 160 | Sell |

| 30 | 3.800 | 40 | 120 | 230 | 120 | 110 | Sell |

| 90 | 3.790 | 0 | 210 | 190 | 190 | 20 | Buy |

| 0 | 3.780 | 110 | 210 | 190 | 190 | 20 | Buy |

| 50 | 3.770 | 50 | 260 | 80 | 80 | 180 | Buy |

| 0 | 3.760 | 20 | 260 | 30 | 30 | 230 | Buy |

| 0 | 3.750 | 10 | 260 | 10 | 10 | 250 | Buy |

In this example there is only buy pressure in price overlap, the Equilibrium Price is $3.790 which is the highest price in the price overlap.

Example 5

| Bid Volume | Price | Ask Volume | Cumulative Bid Volume (a) | Cumulative Ask Volume (b) | Tradable Volume | Imbalance (a)–(b) | Pressure |

| 90 | 3.810 | 20 | 90 | 270 | 90 | 180 | Sell |

| 30 | 3.800 | 40 | 120 | 250 | 120 | 130 | Sell |

| 90 | 3.790 | 0 | 210 | 210 | 210 | 0 | Nil |

| 0 | 3.780 | 130 | 210 | 210 | 210 | 0 | Nil |

| 50 | 3.770 | 50 | 260 | 80 | 80 | 180 | Buy |

| 0 | 3.760 | 20 | 260 | 30 | 30 | 230 | Buy |

| 0 | 3.750 | 10 | 260 | 10 | 10 | 250 | Buy |

In this example, assuming that the last traded price was $3.800, the Equilibrium Price is $3.790.

Added on 3 June 20193 June 2019 and 3 June 20193 June 2019.

1 The examples shown are not exhaustive.

Regulatory Notice 8.3 — Closing Price of Prescribed Instrument

Refer to Appendix A To Regulatory Notice 8.3.

Added on 3 June 20193 June 2019 and amended on 9 November 2020.

Appendix A to Regulatory Notice 8.3

Prescribed Instruments

| 1 | Exchange traded funds |

| 2 | Daily leverage certificates |

| 3 | Structured certificates |

Added on 9 November 2020 and amended on 3 July 2023.

Regulatory Notice 8.4 — Procedures for Contingency Order Withdrawal

"Technical Faults" as used herein refers to any loss of connection to the Trading System or any technical defects in any equipment, system, device or market facility that prevents a Trading Member from effecting order withdrawals without SGX-ST's assistance.

| (a) Individual Order level | based on Order ID number |

| (b) Firm level | based on Trading Member Company Code/SGX Access User ID number (where the firm has more than one SGX Access connection, it is possible to withdraw orders based on specific SGX Access User ID number) |

| (c) Client level | based on Client Account number of a specific SGX Access User ID number |

Added on 3 June 20193 June 2019.

Regulatory Notice 8.5.2 — Minimum Bid Size

| S/N | Product | Price Range ($) | Minimum Bid Size ($) |

| 1 | Stocks (excluding preference shares), real estate investment trusts (REITs), business trusts, company warrants and any other class of securities or futures contracts not specified in this paragraph 2.1 | Below 0.20 | 0.001 |

| 0.20 – 0.995 | 0.005 | ||

| 1.00 and above | 0.01 | ||

| 2 | Structured warrants | Below 0.20 | 0.001 |

| 0.20 – 1.995 | 0.005 | ||

| 2.00 and above | 0.01 | ||

| 3 | Exchange traded funds, exchange traded notes | All | $0.01 or $0.001 as determined by SGX-ST |

| 4 | Debentures, bonds, loan stocks and preference shares | All | $0.001 |

For the avoidance of doubt, the minimum bid sizes above apply to securities and futures contracts denominated in all currencies, except the Hong Kong Dollar ("HKD"), Renminbi ("RMB") or Japanese Yen ("JPY"). For securities and futures contracts traded in HKD, RMB and JPY, the minimum bid sizes shall as far as practicable be aligned to the minimum bid sizes applicable in Hong Kong and Japan respectively.

Added on 3 June 20193 June 2019.

Regulatory Notice 8.10 — Direct Business

1. Introduction

Added on 1 September 2025.

Appendix A to Regulatory Notice 8.10

| Description of Direct Business | Reporting Timeline |

| Direct Business in an exchange traded fund contract that is executed after market close | Within 90 minutes from the start of the Opening Routine on the following Market Day or such longer time as SGX-ST may allow in writing. |

Added on 1 September 2025.

Regulatory Notice 8.7 and 8.9 — Obligations of Trading Members to Mark Sell Orders

Clear procedures should be in place to require Trading Representatives to ask a customer whether a sell order is a Short Sell Order or a normal sell order. Procedures should also be in place to ensure that the Trading Representative or the dealing assistant correctly enters the sell order into the Trading System. The Trading Member is not required to put in place voice recording facilities beyond its existing practices.

The trading interface should require the customer to indicate whether a sell order is a Short Sell Order or a normal sell order at the point of order entry. It should also ensure that a sell order cannot be transmitted to the Trading System if it is not marked either as a Short Sell Order or a normal sell order.

A Trading Member must ensure that all customers with Sponsored Access to the Trading System ("Sponsored Customers") can fulfil the requirements of Rule 8.7.5. A Trading Member must ensure that all Sponsored Customers have the necessary operational and technical systems and procedures in place:

A Trading Member's daily record of orders received from customers, maintained in accordance with Rule 5.13, should show whether a sell order is a Short Sell Order or a normal sell order.

The customer has actually short sold only 6,000 shares (8,000 executed minus 2,000 owned). He will have to report the erroneously marked Short Sell Order, stating the volume that was disclosed as short sold (8,000 shares) and the actual short sales volume (6,000 shares).

The customer has actually short sold only 2,000 shares (4,000 executed minus 2,000 owned). He will have to report the erroneously marked Short Sell Order, stating the volume that was disclosed as short sold and that was executed (4,000 shares) and the actual short sales volume (2,000 shares).

Added on 3 June 20193 June 2019.

Regulatory Notice 8.14.1 — Circuit Breaker

Therefore, at 11:00 hours:

As the reference price of Security B at 10:00 hours is $0.90:

Added on 3 June 2019 and Amended on 18 July 2022.

Regulatory Notice 11.4.2(d) — Computation of Monetary Loss

Added on 3 June 20193 June 2019.

Regulatory Notice 11.4.2(g) — Application of the Force Key

- Introduction

- SGX-ST provides a pre-execution Error Trade prevention mechanism, known as the "Force Key" function to minimise the occurrence of Error Trades arising from the erroneous entry of order prices. The Force Key is intended to complement, and not replace, Trading Members' responsibility to adopt adequate and appropriate measures and practices to safeguard against the execution of Error Trades.

- This Regulatory Notice sets out the application of the Force Key.

- Application of Force Key

- Orders entered at prices outside the price range specified by SGX-ST ("Forced Order Range") must be confirmed using the Force Key, before they may be submitted.

Unless otherwise determined by SGX-ST, the Forced Order Range of the following products shall be as follows:

S/N Product Price Range ($) Minimum Bid Size ($) Forced Order Range 1 Stocks (excluding preference shares), real estate investment trusts (REITs), business trusts, company warrants and any other class of securities or futures contracts not specified in paragraph 2.2 Below 0.20 0.001 +/- 30 bids 0.20 – 0.995 0.005 1.00 and above 0.01 2 Structured warrants Below 0.20 0.001 +/- 30 bids 0.20 – 1.995 0.005 2.00 and above 0.01 2A Daily Leverage Certificates 0.001 to 0.005 0.001 +/- 300% 0.006 to 0.195 0.001 +/- 50% 0.20 – 1.995 0.005 2.00 and above 0.01 3 Exchange traded funds and exchange traded notes All 0.01 or 0.001 as determined by

SGX-ST+/- 10% 4 Debentures, bonds, loan stocks and preference shares quoted in the $1 price convention All 0.001 +/- 30 bids 5 Debentures, bonds, loan stocks and preference shares quoted in the $100 price convention All 0.001 +/- 1,000 bids - The Forced Order Range and Force Key will not be applicable prior to the first trade on the first day of trading of any newly-listed instrument.

- SGX-ST may, at its discretion apply the Force Key in particular cases notwithstanding paragraph 2.3. If SGX-ST uses its discretion to apply the Force Key to any such case SGX-ST will give prior notice to Members.

- Use of the Force Key

- In order to minimise the occurrence of Error Trades resulting from the erroneous entry of order prices, Trading Members should:

- ensure that the Force Key alert is available;

- encourage Trading Representatives to exercise judgment when accepting an instruction from a customer to execute an order priced outside the Forced Order Range; and

- ensure that procedures are in place to determine if there are legitimate commercial reasons for orders priced outside the Forced Order Range.

- In order to minimise the occurrence of Error Trades resulting from the erroneous entry of order prices, Trading Members should:

Added on 3 June 20193 June 2019 , Amended on 17 January 2022 and Amended on 2 September 2024.