Section A demonstrates the calculation of the collateral requirement in Scenario 1 for a Clearing Member who contributes above the required Minimum Collateralised Contribution set out in CDP Clearing Rule 7.2.3.

Section B demonstrates the calculation for a Clearing Member who contributes at the required Minimum Collateralised Contribution.

A. Clearing Member contributes above the required Minimum Collateralised Contribution

1 Sample Information for this example 1.1 Information for Clearing Member ABC is as follows:

ABC's preceding 12-month total (two-sided) traded value2 = S$50b

ABC's Collateralised Contribution to the CDP Clearing Fund = S$2.5m Assumptions:

Multiple = 2

Margin Rate = 5% 3-day outstanding trades for Clearing Member ABC: | Account Number | Counter Name | Settlement Date | Buy / Sell Type | Contract Value (S$) |

| 111 | SIA | 1/6/09 | Buy | 375m |

| 111 | SIA | 1/6/09 | Sell | 365m |

| 111 | SPH | 3/6/09 | Buy | 404m |

| 111 | Singtel | 1/6/09 | Sell | 6m |

| 111 | Singtel | 2/6/09 | Buy | 33m |

| 111 | Singtel | 3/6/09 | Buy | 56m |

| 222 | SGX | 1/6/09 | Buy | 300m |

| 222 | Starhub | 2/6/09 | Sell | 152m |

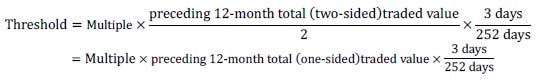

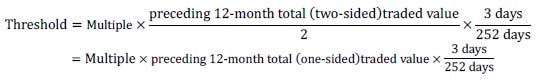

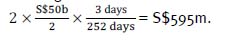

2 Calculating the Threshold 2.1 The Threshold for a Clearing Member who contributes more than the minimum Collateralised Contribution is computed as:

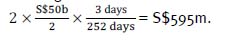

2.2 Clearing Member ABC's Threshold is computed as:

3 Comparing Clearing Member's 3-day gross buy or sell outstanding traded value against its Threshold 3.1 Clearing Member ABC's 3-day gross buy outstanding is S$1,168m (S$375m + S$404m + S$33m + S$56m + S$300m) and 3-day gross sell outstanding is S$523 (S$365m + S$6m + S$152m). As the higher of the 3-day gross buy or sell outstanding traded value (i.e. buy of S$1,168m) exceeds its Threshold of S$595m, Clearing Member ABC may be required to deposit collateral with CDP.

4 Estimating Collateralisation Requirement 4.1 The amount of collateral which Clearing Member ABC may be required to deposit with CDP is calculated in the following manner. a) Clearing Member ABC's outstanding trades in each counter for an account are netted to obtain a net buy or net sell value for each settlement date and counter in an account: | Account Number | Counter | Settlement Date | Net Buy Values | Net Sell Values |

| Account 111 | SIA | 1/6/09 | S$375m − S$365m = S$10m | |

| Singtel | 1/6/09 | | S$6m |

| Singtel | 2/6/09 | S$33m | |

| Singtel | 3/6/09 | S$56m | |

| SPH | 3/6/09 | S$404m | |

| Account 222 | SGX | 1/6/09 | S$300m | |

| Starhub | 2/6/09 | | S$152m |

In establishing the Clearing Member's netted position, sell put warrants are aggregated with buy trades while buy put warrants are aggregated with sell trades.

b) The net buy and net sell values for the Clearing Member are aggregated: | Aggregate Net Buy Position | Aggregate Net Sell Position |

| S$10m + S$33m + S$56m + S$404m + S$300m = S$803m | S$6m + S$152m = S$158m |

c) The estimated collateral requirement before taking into account other relevant factors is computed as:

Assuming a Margin Rate of 5%,

Estimated Collateral Requirement

= Margin Rate x (Higher of Aggregate Net Buy or Sell Position − Threshold)

= 5% x (S$803m − S$595m)

= S$10.4m

5 Final Collateral Requirement after taking into account other relevant factors

CDP will review other factors to determine the final collateral amount that the Clearing Member will have to deposit with CDP.

B. Clearing Member contributes at the required Minimum Collateralised Contribution

1 Sample Information for this example 1.1 Information for Clearing Member XYZ is as follows:

XYZ's preceding 12-month total (two-sided) traded value3 = S$10b

XYZ's Collateralised Contribution to the CDP Clearing Fund = S$1m

Assumptions:

Multiple = 2

Collateralised Contribution rate = 0.5 basis points

Margin Rate = 5%

3-day outstanding trades for Clearing Member XYZ:

| Account Number | Counter Name | Settlement Date | Buy / Sell Type | Contract Value (S$) |

| 888 | SIA | 1/6/09 | Buy | 10m |

| 888 | SIA | 1/6/09 | Sell | 4m |

| 555 | SPH | 2/6/09 | Buy | 115m |

| 555 | Starhub | 2/6/09 | Sell | 6m |

| 333 | Singtel | 3/6/09 | Buy | 122m |

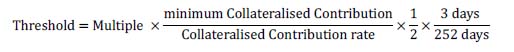

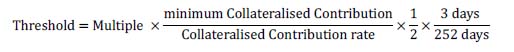

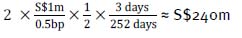

2 Determining the Threshold 2.1 The Threshold for a Clearing Member who contributes at the minimum Collateralised Contribution is computed as:

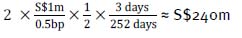

2.2 Clearing Member XYZ's Threshold is calculated as:

3 Comparing Clearing MemberÂÂÂfs 3-day buy or sell outstanding traded value against its Threshold 3.1 Clearing Member XYZ's 3-day gross buy outstanding traded value is S$247m (S$10m + S$115m + S$122m) and 3-day gross sell outstanding traded value is S$10m (S$4m + S$6m). As the higher of the 3-day gross buy or sell outstanding traded value (i.e. buy of S$247m) exceeds its Threshold of S$240m, Clearing Member XYZ may be required to deposit collateral with CDP.

4 Estimating Collateralisation Requirement 4.1 The amount of collateral which Clearing Member XYZ may be required to deposit with CDP is calculated in the following manner. a) Clearing Member XYZ's outstanding trades in each counter for an account are netted to obtain a net buy or net sell value for each settlement date and counter in an account: | Account Number | Counter | Settlement Date | Net Buy Values | Net Sell Values |

| Account 888 | SIA | 1/6/09 | S$10m − S$4m = S$6m | |

| Account 555 | SPH | 2/6/09 | S$115m | |

| Starhub | 2/6/09 | | S$6m |

| Account 333 | Singtel | 3/6/09 | S$122m | |

In establishing the Clearing Member's netted position, sell put warrants are aggregated with buy trades while buy put warrants are aggregated with sell trades.

b) The net buy and net sell values for the Clearing Member are aggregated: | Aggregate Net Buy Position | Aggregate Net Sell Position |

| S$6m + S$115m + S$122m = S$243m | S$6m |

c) The estimated collateral requirement before taking into account other relevant factors is computed as:

Assuming a Margin Rate of 5%,

Estimated Collateral Requirement

= Margin Rate x (Higher of Aggregate Net Buy or Sell Position − Threshold)

= 5% x (S$243m − S$240m)

= S$0.15m

5 Final Collateral Requirement after taking into account other relevant factors

CDP will review other factors to determine the final collateral amount that the Clearing Member will have to deposit with CDP.

Added on 3 May 20113 May 2011.

2 A Clearing Member's preceding 12-month total (two-sided) traded value will be established on a monthly basis.

3 A Clearing Member's preceding 12-month total (two-sided) traded value will be established on a monthly basis.