1 Introduction

1.1. This Practice Note sets out the procedures pursuant to

Rule 6A.5.2, for the calculation of the amount of Clearing Member Required Margins that a Clearing Member must deposit with CDP.

2 Composition of Clearing Member Required Margins

2.1. Pursuant to

Rule 6A.5.1, a Clearing Member is required to deposit Clearing Member Required Margins with CDP by such time as CDP prescribes.

2.2. Clearing Member Required Margins comprise margin requirements in respect of Marginable Futures Contracts and Novated Contracts other than Marginable Futures Contracts.

2.3. The procedures for the calculation of margin requirements in respect of Marginable Futures Contracts and Novated Contracts other than Marginable Futures Contracts differ, and their respective procedures are set out in this Practice Note.

3 Calculation of Clearing Member Required Margins for Novated Contracts other than Marginable Futures Contracts

3.1. The Clearing Member Required Margins for Novated Contracts other than Marginable Futures Contracts cannot be met by collateral belonging to customers of the Clearing Member, as defined under the SFA in relation to Part 3 of the SFA.

Calculation of Clearing Member Maintenance Margins for Novated Contracts other than Marginable Futures Contracts

3.2. The Clearing Member Maintenance Margins for Novated Contracts other than Marginable Futures Contracts is calculated based on the Valuation Price of securities in the Novated Contracts.

3.3. The Clearing Member Required Margins that a Clearing Member is required to place for Novated Contracts other than Marginable Futures Contracts is calculated with reference to all outstanding settlement obligations of such Clearing Member. The calculation methodology is set out below:

3.3.1. A margin rate will be applied on the Clearing Member's Aggregate Net Buy Position or Net Sell Position, whichever is higher.

3.3.2. The Clearing Member's Aggregate Net Buy Position or Aggregate Net Sell Position are derived by:

a) calculating the value of the Clearing Member's buy and sell positions in each security which have not been settled, based on the Valuation Price and quantity of securities in the buy and sell trades;

b) in respect of each security, netting the total value of the Clearing Member's buy positions, against the total value of its sell positions to arrive at a net buy value or a net sell value in respect of that security;

c) aggregating the net buy values and the net sell values separately in respect of all of the Clearing Member's unsettled Novated Contracts to arrive at the Aggregate Net Buy Position and Aggregate Net Sell Position. The net buy value for a security with an inverse payoff function (for example, put warrant and inverse ETFs) will be treated as a net sell value for aggregation purpose. Conversely, its net sell value will be treated as a net buy value.

3.3.3. Sell transactions for which the Clearing Member has not made available the required number of shares for delivery and therefore failed to deliver on Intended Settlement Day, will be included in the aggregation process set out in paragraph 3.3.2.

3.3.4. Presently, CDP clears securities denominated in Singapore Dollars, as well as the following foreign currencies: Australian Dollars, Chinese Yuan, US Dollars, Euros, British Pounds and Hong Kong Dollars. For the purpose of determining the Aggregate Net Buy Position and Aggregate Net Sell Position, CDP will convert net buy values and net sell values into a common currency for aggregation.

3.3.5. The margin rate comprises two components:

a) base rate calculated based on the volatility of the FTSE Straits Times Index; and

b) mark-up rate calculated based on the volatility of relevant indices of the Singapore securities market, subject to a minimum of 0.5%.

3.3.6. The margin rate is reviewed regularly by CDP and the applicable margin rate will be published on SGX's website.

3.3.7. CDP may prescribe higher margin rates in respect of specific securities that exhibit higher volatility or unusually high trading value to cover their potential future price fluctuations.

Calculation of Clearing Member Variation Margins for Novated Contracts other than Marginable Futures Contracts

3.4. Novated Contracts other than Marginable Futures Contracts are individually marked-to-market in order to determine the Clearing Member Variation Margins. The marked-to-market gain or loss of each Novated Contract is calculated based on the difference between the Valuation Price of the security of the Novated Contract and the price at which the Novated Contract is bought and sold, as well as the quantity of securities in the Novated Contract.

3.5. The marked-to-market gains and losses of a Clearing Member's Novated Contracts are aggregated to determine its Clearing Member Variation Margins:

Clearing Member Variation Margins = Sum of (Valuation Price − Traded Price) × (buy quantity − sell quantity) of securities in each Novated Contract across all unsettled Novated Contracts of the Clearing Member

Positive results are Clearing Member Variation Margin gains. Negative results are Clearing Member Variation Margin losses.

3.6. Clearing Member Variation Margins will be collateralised. This means that:

a) Mark to market losses must be met by depositing acceptable collateral with CDP; and

b) Mark to market gains will not paid out by CDP, but will be used to offset Clearing Member Maintenance Margins.

3.7. The Clearing Member Variation Margins is calculated separately for Marginable Futures Contracts and Novated Contracts other than Marginable Futures Contracts. Mark to market gains for Novated Contracts other than Marginable Futures Contracts cannot be used to offset margin requirements for Marginable Futures Contracts, and vice versa.

Calculation of Clearing Member Required Margins for Novated Contracts other than Marginable Futures Contracts

3.8. The Clearing Member Required Margins for Novated Contracts other than Marginable Futures Contracts is the sum of the Clearing Member Maintenance Margins and Clearing Member Variation Margins for such Novated Contracts: Clearing Member Required Margins = Maximum of (Clearing Member Maintenance Margins − Clearing Member Variation Margins, 0)

3.9. Clearing Member Variation Margins gains decrease the Clearing Member Required Margins and Clearing Member Variation Margins losses increase the Clearing Member Required Margins.

3.10. Where the Clearing Member Variation Margins is greater than the Clearing Member Maintenance Margins, the Clearing Member Required Margins is zero. This means the Clearing Member's Maintenance Margins is fully met through its Clearing Member Variation Margins gains.

3.11. Clearing Member Variation Margins will reset to zero when all outstanding positions are settled.

Examples

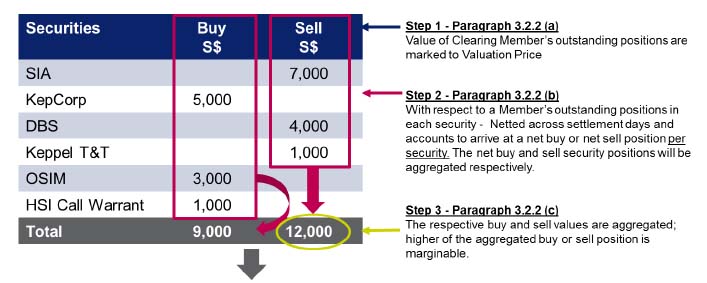

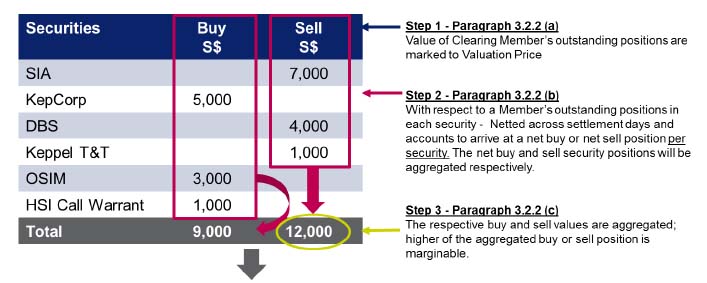

3.12. An example of the calculation of Clearing Member Maintenance Margins for Novated Contracts other than Marginable Futures Contracts is set out below.

Clearing Member Maintenance Margins for Novated Contracts other than Marginable Futures Contracts• Calculation of Maintenance Margin ("MM") requirement

• Hypothetical member's outstanding positions for cash securities (in S$),

• Clearing Member MM requirements = S$12,000 × Maintenance Margin Rate

3.13. An example of the calculation of Clearing Member Variation Margins for Novated Contracts other than Marginable Futures Contracts is set out below.

Clearing Member Variation Margins for Novated Contracts other than Marginable Futures Contracts• Calculation of Clearing Member Variation Margins ("VM")

• This VM gains will be collateralized (ie not paid out by CDP), and can be used to meet Clearing Member's Maintenance Margin requirements.

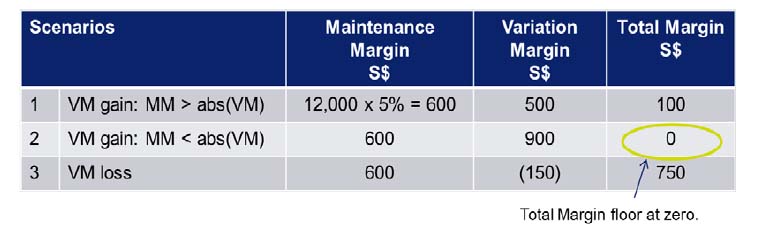

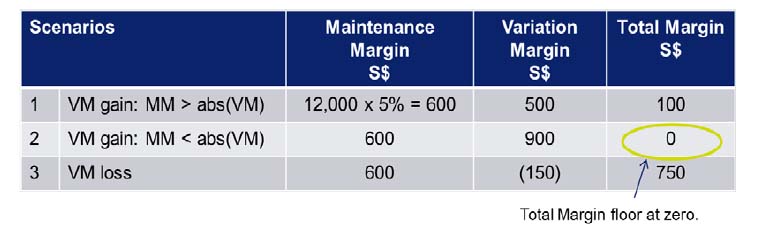

3.14. An example of the calculation of Clearing Member Required Margin for Novated Contracts other than Marginable Futures Contracts is set out below.

Clearing Member Required Margins for Novated Contracts other than Marginable Futures Contracts• Clearing Member Required Margins = Higher of [ (Maintenance Margin − Variation Margin), 0 ]

• Examples of Clearing Member Required Margins (in S$). Assume margin rate = 5%

4 Calculation of Clearing Member Required Margins for Marginable Futures Contracts

Calculation of Clearing Member Required Margins for Marginable Futures Contracts

4.1. The Clearing Member Required Margin for Marginable Futures Contracts is calculated on a gross basis with reference to all accounts carried by the Clearing Member, by aggregating the margin requirements for all such accounts. In addition, Marginable Futures Contracts that fail to settle on the Intended Settlement Day are added to the Clearing Member Required Margin in respect of House Accounts.

Calculation of Clearing Member Maintenance Margin for Marginable Futures Contracts

4.2. The calculation methodology is set out below:

4.2.1. An outright margin rate and a spread margin rate are determined for each underlying security of Marginable Futures Contract. A delivery margin rate is determined for each contract month of Marginable Futures Contract.

4.2.2. The relevant outright margin rate for each underlying security is based on the volatility for the price of the corresponding Marginable Futures Contracts.

4.2.3. The relevant spread margin rate for each underlying security is based on the volatility for the spread differential between different contract months of the corresponding Marginable Futures Contracts.

4.2.4. The margin rates are reviewed regularly by CDP and the applicable margin rates will be published on SGX's website.

Calculation of Clearing Member Maintenance Margin in respect of a single account

4.3. The outright margin requirement for each underlying security for each account is determined by multiplying the net buy or sell quantity across all contract months by the valuation price and outright margin rate of the underlying security.

4.4. The spread margin requirement for each underlying security for each account is determined as follows:

a) determine net position in each contract month by netting the total quantity of securities in outstanding buy contracts against total quantity of securities in outstanding sell contracts to obtain net long position or net short position in the contract month;

b) aggregate the net positions across all contract months with net long positions to obtain gross long position and gross short position;

c) determine the number of spreads formed by taking the minimum of gross long and gross short positions; and

d) determine spread margin requirement by multiplying the number of spreads formed by spread margin rate and valuation price of the underlying security.

4.5. The Clearing Member Maintenance Margin in respect of an account is the sum of outright margin requirement and spread margin requirement of each underlying security across all underlying securities of Marginable Futures Contracts in unsettled contracts held in the account.

Calculation of Clearing Member Variation Margin in respect of a single account

4.6. The Clearing Member Variation Margin for each account is calculated based on the difference between the Valuation Price of such Marginable Futures Contracts and the price at which such Marginable Futures Contracts are bought and sold, in accordance with the methodology below:

Clearing Member Variation Margins for each account = Sum of (Valuation Price − Traded Price) × (buy quantity − sell quantity) of securities in each unsettled Marginable Futures Contract across all unsettled Marginable Futures Contracts in the account

4.7. Mark to market gains will not be paid out, but can be used to offset the Clearing Member Maintenance Margins for the same account.

Calculation of Clearing Member Required Margin

4.8. The Clearing Member Maintenance Margin and Clearing Member Variation Margin for each account are aggregated to arrive at the Clearing Member Required Margin for the account, in accordance with the formula below:

Clearing Member Required Margin = Maximum of (Clearing Member Maintenance Margin − Clearing Member Variation Margin, 0)

4.9. The Clearing Member Required Margin for each Customer Account is aggregated across all Customer Accounts of the Clearing Member.

Clearing Member Required Margin for Customer Accounts = Sum of Account Required Margin across all Accounts of the Clearing Member

4.10. The Clearing Member Required Margin for each House Account is aggregated across all House Accounts of the Clearing Member.

Clearing Member Required Margin for House Accounts = Sum of Account Required Margin across all House Accounts of the Clearing Member

Amended on 18 January 2022.