Practice Note 1.2 Marginable Futures Contracts

| Issue Date | Cross Reference | Enquiries |

| Added on 21 January 201321 January 2013. | Rule 1.2 — Definition of Marginable Futures Contract | Please contact Clearing Risk: Facsimile No : 6532 0297 |

1 Introduction

2 Marginable Futures Contracts

Practice Note 3.5.4 — Business Continuity Requirements

| Issue Date | Cross Reference | Enquiries |

| Added on 22 January 200922 January 2009. | Rule 3.5.4 | Please contact Member Supervision: Facsimile No : 6538 8273 E-Mail Address: membersup@sgx.com |

1. Introduction

2. Business Continuity Plan

* Critical functions refer to business functions whose failure or disruption may incapacitate the firm.

^ Key service providers refer to third-parties who are performing functions that are not normally carried out by Clearing Members internally, but are critical to the Clearing Member's ability to carry on business operations. For example, IT system hardware/software vendors.

# Outsourcing service providers refer to third parties who are performing functions that would normally be performed by Clearing Members internally. For example, Operations and Technology.

3. Emergency Contact Persons

Refer to Appendix A of Practice Note 3.5.4.

Practice Note 3.9.1(3) — Pre-Execution Checks

| Issue Date | Cross Reference | Enquiries |

| Added on 18 September 201218 September 2012 and amended on 15 March 201315 March 2013. | Rule 3.9.1(3) | Please contact Member Supervision: Facsimile No : 6538 8273 E-Mail Address: membersup@sgx.com |

1. Introduction

2. Pre-Execution Checks

Added on 18 September 201218 September 2012 and amended on 15 March 201315 March 2013.

Practice Note 3.9.1(6) — Conflicts of Interest

| Issue Date | Cross Reference | Enquiries |

| Added on 18 September 201218 September 2012. | Rule 3.9.1(6) | Please contact Member Supervision: Facsimile No : 6538 8273 E-Mail Address: membersup@sgx.com |

1. Introduction

2. Separation of Key Functions

Added on 18 September 201218 September 2012.

Practice Note 3.9.2A, 3.9.3 Procedures to Suspend Qualification of a Trading Member

| Issue Date | Cross Reference | Enquiries |

| Added on 11 January 201111 January 2011. | Rule 3.9.2A Rule 3.9.3 | Please contact: Member Supervision Facsimile No : 6538 8273 E-Mail Address: membersup@sgx.com Market Control Hotline : 6236 8820 |

1 Introduction

2 Procedures for Suspending A Trading Member

Designated Officers

Notification of Suspension of Trading Member

Final Traded Position

Added on 11 January 201111 January 2011 and amended on 15 September 201715 September 2017 and 3 June 20193 June 2019.

Practice Note 5A.2.1, 5A.2.2 — Position Account Reporting

| Issue Date | Cross Reference | Enquiries |

| Added on 1 July 20161 July 2016 and amended on 3 June 20193 June 2019. | Rules 5A.2.1, 5A.2.2. | Please contact Member Supervision: Facsimile No : 6538 8273 Please contact Risk Management: Facsimile No : 6532 0297 E-Mail Address: rm-securities@sgx.com |

1. Introduction

2. Type of Information

| Description of origin | Criteria |

| Customer | The origin of a Position Account shall be reported as "Customer" if the Position Account holder is a customer, as defined in Part III of the Securities and Futures (Licensing and Conduct of Business) Regulations. |

| House | The origin of a Position Account shall be reported as "House" if the Position Account holder is neither a customer, as defined in Part III of the Securities and Futures (Licensing and Conduct of Business) Regulations, nor a Remisier, as defined in the SGX-ST Rules. |

| Remisier of the Member | The origin of a Position Account shall be reported as "Remisier" if the Position Account holder is a Remisier of the member, as defined in SGX-ST Rules. |

| Description of origin | Criteria |

| SGX Member | The ownership type of the account shall be reported as "SGX Member" if the account holder is the Clearing Member itself. |

| Individual Person | The ownership type of the account shall be reported as "Individual Person" if the account holder is an individual, except where such individual is an officer, employee, non-executive director or Trading Representative of the Clearing Member. This value shall be used for joint accounts of two or more individuals, except where any party to the account is an officer, employee, non-executive director or Trading Representative of the Clearing Member. |

| Officers and employees of the Member (excluding Trading Representatives) | The ownership type of the account shall be reported as "Officers and employees of Member (excluding Trading Representatives)" if the account holder is (a) a Chief Executive Officer of the Clearing Member (regardless of whether such approved executive director is a Trading Representative); or (b) an officer or employee of the Clearing Member, but not a Trading Representative of the Clearing Member. |

| Non-executive Director of Member | The ownership type of the account shall be reported as “Non-executive Director of Member” if the account holder is a non-executive director of the Clearing Member. |

| Trading Representative of Member – Remisier | The ownership type of the account shall be reported as "Trading Representative of Member – Remisier" if the account holder is a Remisier of the Clearing Member. |

| Trading Representative of Member – non-Remisier | The ownership type of the account shall be reported as "Trading Representative of Member – non-Remisier" if the account holder is a Trading Representative of the Clearing Member and not a Remisier of the Clearing Member. |

| Related Entity | The ownership type of the account shall be reported as "Related Entity" if the account holder is a related entity of the Clearing Member. "Entity" here includes corporates, unincorporated societies/associations, trusts, partnerships and limited liability partnerships, but excludes statutory boards and government bodies. |

| Non-Related Entity | The ownership type of the account shall be reported as "Non-Related Entity" if the account holder is an entity that is not a Related Entity. "Entity" here includes corporates, unincorporated societies/associations, trusts, partnerships and limited liability partnerships, but excludes statutory boards and government bodies. |

| Statutory Board/ Government Body | The ownership type of the account shall be reported as "Statutory Board/Government Body" if the account holder is a statutory board or government body, including those of a foreign jurisdiction. |

3. Manner of reporting to CDP

4. Timelines for Position Account reporting

Practice Note 5A.3.1, 5A.3.4 — Position Account Allocation

| Issue Date | Cross Reference | Enquiries |

| Added on 1 July 20161 July 2016 and amended on 10 December 201810 December 2018. | Rules 5A.3.1, 5A.3.4. | Please contact Member Supervision: Facsimile No: 6538 8273 |

1. Rule 5A.3.1 requires each Clearing Member to allocate the position of each trade cleared by the Clearing Member for a Customer to that Customer's Position Account or in accordance with that Customer's instructions, as soon as practicable, and in any event no later than such time as may be required for timely and orderly settlement of the relevant trade into the intended Securities Account. This Practice Note provides guidance on the timelines within which such allocation is to be completed by in various circumstances.

2. With the exception of warehoused trades, each Clearing Member shall allocate the position of each trade cleared by the Clearing Member for a Customer to that Customer's Position Account or in accordance with that Customer's instructions immediately upon the trade being cleared, or at the latest by the end of the next Market Day immediately following the trade date.

3. For warehoused trades under Rule 5A.3.4, each Clearing Member shall ensure that no trades are warehoused for more than one Market Day, unless under exceptional circumstances. Each Clearing Member shall allocate the position of each trade to the relevant Customer's Position Account or in accordance with that Customer's instructions, immediately after the order is completed, or at the latest by the end of the Market Day on which the order is completed.

Practice Note 5A.4.2, 5A.4.3 — Requirement for Clearing Member to Ensure Compliance of Position Account Rules by Authorized Trading Member

| Issue Date | Cross Reference | Enquiries |

| Added on 1 July 20161 July 2016. | Rules 5A.4.2., 5A.4.3. | Please contact Member Supervision: Facsimile No: 6538 8273 |

1. Rules 5A.4.2 and 5A.4.3 requires a Clearing Member who authorizes an Authorized Trading Member to open and maintain Authorized Accounts, or to open, maintain and allocate positions to Authorized Accounts, to ensure that the Authorized Trading Member performs the relevant obligations in relation to the Authorized Accounts.

2. There may be circumstances where a Clearing Member is unable to directly ensure that its Authorized Trading Member performs the relevant obligations in relation to the Authorized Accounts in compliance with Rules 5A.1 and 5A.2 or with Rules 5A.1, 5A.2, 5A.3 and 5A.6 (as may be applicable). This Practice Note clarifies the expectations on the Clearing Member in such circumstances.

3. Where a Clearing Member is unable to directly ensure that its Authorized Trading Member complies with the above-mentioned rules, the Clearing Member is to implement reasonable measures to ensure that the Authorized Trading Member complies with the relevant rules. The following are non-exhaustive examples of the steps which the Clearing Member should take:

Practice Note 6.5.1B(2), 6.6.2, 6.7.11 and 8.2.2(3E) — Determination of Cash Settlement Amount

| Issue Date | Cross Reference | Enquiries |

| Added on 10 December 201810 December 2018. | Rules Rule 6.5.1B(2), 6.6.2, 6.7.11, 8.4.1A, 8.5.2A, 8.6F.2. | Please contact Clearing Ops: E-Mail Address: securitiesclearing@sgx.com |

Cash settlement under Rules 6.5.1B(2), 6.7.11 and 8.2.2(3E)

Cash settlement under Rule 6.6.2

Amended on 6 September 2021.

Practice Note 6.5.1B(2) — Priority Considerations when Selecting Buy Trades to Cash Settle

| Issue Date | Cross Reference | Enquiries |

| Added on 10 December 201810 December 2018. | Rule 6.5.1B(2). | Please contact Clearing Ops: E-Mail Address: securitiesclearing@sgx.com |

Appendix A to Practice Note 6.6A.1 [Rule has been deleted.]

Deleted on 21 January 201321 January 2013.

Practice Note 6.7.2(1A), 6.7.4(8), 6.7.7A and 6.7.11 — Buying-in, Procurement and Cash Settlement if Intended Settlement Day is Day with Half Day Trading

| Issue Date | Cross Reference | Enquiries |

| Added on 10 December 201810 December 2018. | Rule 6.7.2(1A), Rule 6.7.4(8), Rule 6.7.7A and Rule 6.7.11. | Please contact Clearing Ops: E-Mail Address: securitiesclearing@sgx.com |

Practice Note 6A.5.2 Calculation of Amount of Clearing Member Required Margins

| Issue Date | Cross Reference | Enquiries |

| Added on 21 January 201321 January 2013 and amended on 14 September 201714 September 2017, 10 December 201810 December 2018 and 21 October 201921 October 2019. | Rule 6A.5.2 | Please contact Clearing Risk: Facsimile No : 6532 0297 E-Mail Address: margins@sgx.com |

1 Introduction

2 Composition of Clearing Member Required Margins

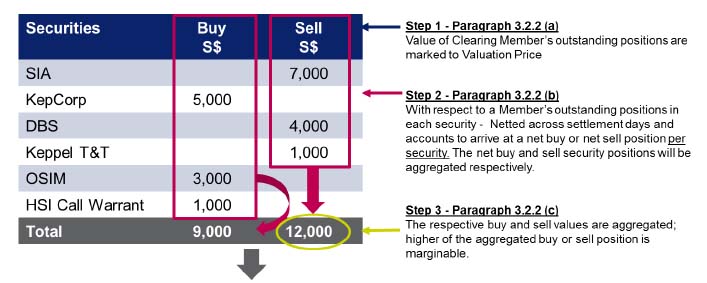

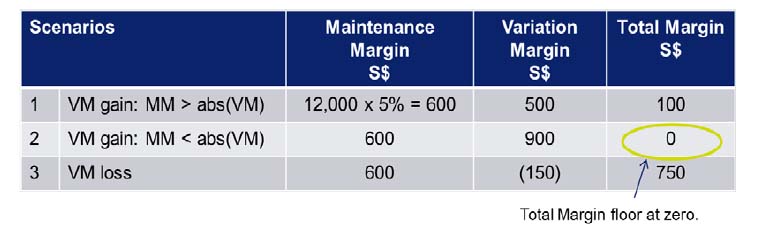

3 Calculation of Clearing Member Required Margins for Novated Contracts other than Marginable Futures Contracts

Calculation of Clearing Member Maintenance Margins for Novated Contracts other than Marginable Futures Contracts

Calculation of Clearing Member Variation Margins for Novated Contracts other than Marginable Futures Contracts

Clearing Member Variation Margins = Sum of (Valuation Price − Traded Price) × (buy quantity − sell quantity) of securities in each Novated Contract across all unsettled Novated Contracts of the Clearing Member

Positive results are Clearing Member Variation Margin gains. Negative results are Clearing Member Variation Margin losses.

Calculation of Clearing Member Required Margins for Novated Contracts other than Marginable Futures Contracts

Examples

Clearing Member Maintenance Margins for Novated Contracts other than Marginable Futures Contracts

Clearing Member Variation Margins for Novated Contracts other than Marginable Futures Contracts

Clearing Member Required Margins for Novated Contracts other than Marginable Futures Contracts

4 Calculation of Clearing Member Required Margins for Marginable Futures Contracts

Calculation of Clearing Member Required Margins for Marginable Futures Contracts

Calculation of Clearing Member Maintenance Margin for Marginable Futures Contracts

Calculation of Clearing Member Maintenance Margin in respect of a single account

Calculation of Clearing Member Variation Margin in respect of a single account

Clearing Member Variation Margins for each account = Sum of (Valuation Price − Traded Price) × (buy quantity − sell quantity) of securities in each unsettled Marginable Futures Contract across all unsettled Marginable Futures Contracts in the account

Calculation of Clearing Member Required Margin

Clearing Member Required Margin = Maximum of (Clearing Member Maintenance Margin − Clearing Member Variation Margin, 0)

Clearing Member Required Margin for Customer Accounts = Sum of Account Required Margin across all Accounts of the Clearing Member

Clearing Member Required Margin for House Accounts = Sum of Account Required Margin across all House Accounts of the Clearing Member

Amended on 18 January 2022.

Practice Note 6A.6 Forms of Collateral Acceptable by CDP as Margins

| Issue Date | Cross Reference | Enquiries |

| Added on 21 January 201321 January 2013 and amended on 29 July 201329 July 2013. | Rule 6A.6 | Please contact Clearing Risk: Facsimile No : 6532 0297 E-Mail Address: margins@sgx.com |

1 Introduction

2 Forms of Monies and Assets Acceptable by CDP as Margins

Cash

Singapore and US government securities, and selected common stocks

3 Collateral is subject to appropriate hair-cuts

http://www.sgx.com/wps/portal/sgxweb/home/clearing/securities/acceptable_collaterals.

Practice Note 6A.9A — Additional Margins

| Issue Date | Cross Reference | Enquiries |

| Added on 21 January 201321 January 2013 and amended on 8 August 20168 August 2016 and 15 September 201715 September 2017. | Rule 6A.9A | Please contact Risk Management: rm-securities@sgx.com |

1 Introduction

2 Concentration risk add-on

3 Default Fund risk add-on

4 Credit risk add-on

5 Specific security add-on

ILLUSTRATION ON THE CALCULATION OF THE DEFAULT FUND RISK ADD-ON

Assumptions:

| Loss exceeds threshold | Potential add-on | ||||

| Loss | Threshold 1 | Threshold 2 | Threshold 1 | Threshold 2 | |

| X + Weak 1 + Weak 2 | 85 | No | |||

| X | 80 | Yes | 80-70=10 | ||

| Weak 1 | 5 | No | |||

| Weak 2 | 0 | No | |||

| Loss exceeds threshold | Potential add-on | ||||

| Loss | Threshold 1 | Threshold 2 | Threshold 1 | Threshold 2 | |

| X + Weak 1 + Weak 2 | 95 | Yes | 95-90=5 | ||

| X | 65 | No | |||

| Weak 1 | 15 | No | |||

| Weak 2 | 15 | No | |||

1 Principles for Financial Market Infrastructures issued by the Committee on Payments and Market Infrastructure (CPMI) and the Technical Committee of the International Organization of Securities Commissions (IOSCO).

2 Threshold 1 and 2 is currently defined as 70% and 90% respectively, but may be revised from time to time.

3 The threshold is currently defined as 15%, but may be revised from time to time.

Practice Note 7.10.5, 7.10.6 — Limit on Non-Defaulting Clearing Members’ Liability for Multiple Events of Default

1. Introduction

1.1 Rule 7.10.5 states that the aggregate amount of a non-Defaulting Clearing Member’s Collateralised Contribution and Contingent Contribution that can be applied for all Events of Default occurring within a period of 30 calendar days shall not exceed an amount equal to three times of that Clearing Member's Prescribed Contributions as at the start of that 30-day period.

1.2 Rule 7.10.6 states that where an Event of Default occurs, the amount of a non-Defaulting Clearing Member’s Collateralised Contribution and Contingent Contribution that is available for application in respect of that Event of Default is the lower of:

1.2.1 an amount equal to three times of the Clearing Member’s Prescribed Contributions as at the start of the 30-day period that ends on the day of the Event of Default less the aggregate amount of that Clearing Member’s Collateralised Contribution and Contingent Contribution that has already been utilised for all other preceding Events of Default that had occurred in that 30-day period; or

1.2.2 where the Clearing Member’s Collateralised Contribution was adjusted during the aforementioned 30-day period, an Adjusted Amount equal to three times of the consequently adjusted Prescribed Contributions less the aggregate amount of the Clearing Member’s Collateralised Contribution and Contingent Contribution that has already been utilised for Events of Default that occurred after the day of that adjustment but before the Event of Default.

In the event the Clearing Member’s Collateral Contribution is adjusted multiple times during the 30-day period, a separate Adjusted Amount shall be calculated for each adjustment and the lowest Adjusted Amount shall apply for the purpose of Rule 7.10.6(2).

1.3 This Practice Note illustrates the operation of Rules 7.10.5 and 7.10.6. The scenarios set out are meant only to illustrate the calculation of the usage limits applicable under the Rules in various hypothetical scenarios, and are not representative of how Events of Defaults are managed by CDP nor the actions that CDP can and may take to maintain a fair, orderly, safe and efficient market.

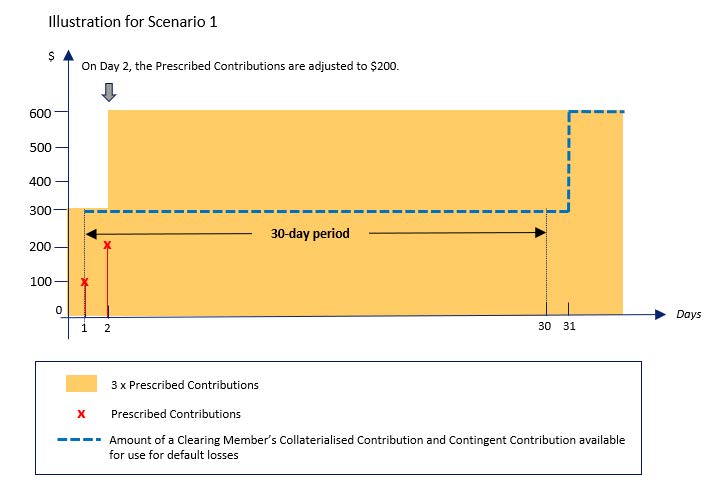

2. Operation of Rule 7.10.5

Scenario 1

2.1 Scenario 1: On Day 1, the non-Defaulting Clearing Member’s Prescribed Contributions is $100. On Day 2, the Clearing Member’s Prescribed Contributions is increased to $200. This scenario illustrates how the aggregate amount of a non-Defaulting Clearing Member’s Collateralised Contribution and Contingent Contribution that can be applied in respect of all Events of Default occurring within a 30-day period shall not exceed an amount equal to three times of the Clearing Member’s Prescribed Contributions as at the start of the 30-day period.

2.2 In accordance with Rule 7.10.5, the aggregate amount of the Clearing Member’s Collateralised Contribution and Contingent Contribution that can be applied in respect of all Events of Default occurring within Day 1 to Day 30 shall not exceed an amount equal to three times of that Clearing Member's Prescribed Contributions on Day 1. Therefore, even though the Clearing Member’s Prescribed Contributions were increased to $200 on Day 2, the aggregate amount of the Clearing Member’s Collateralised Contribution and Contingent Contribution which can be applied to meet default losses occurring within Day 1 to Day 30 will not exceed $300 (i.e. 3 x $100).

3. Operation of Rule 7.10.6

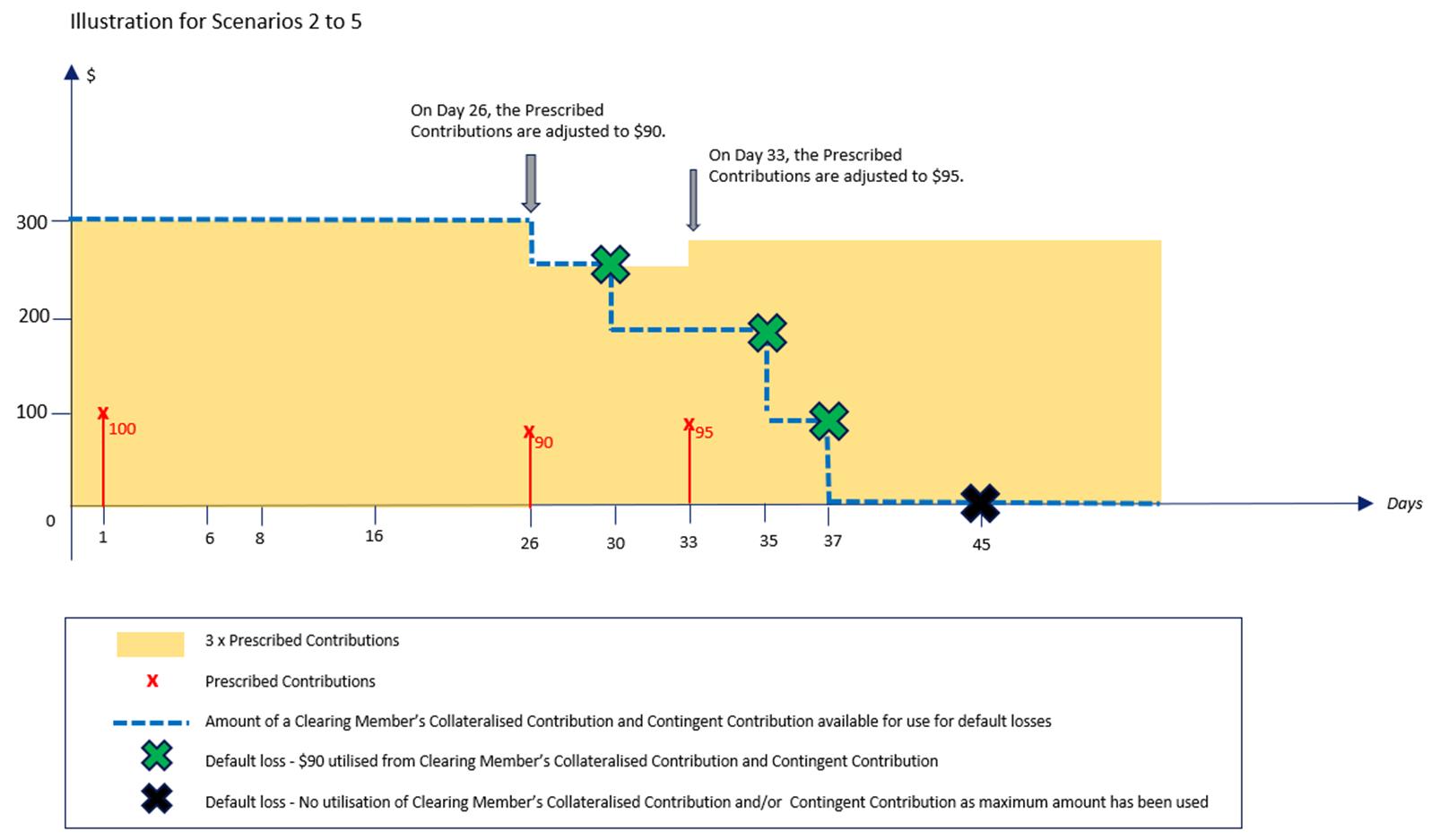

3.1 The following scenarios (Scenarios 2 to 5) illustrate how the amount of a non-Defaulting Clearing Member’s Collateralised Contribution and Contingent Contribution that can be used to meet losses is capped in the event of multiple defaults within a 30-day period.

Scenario 2

3.2 Scenario 2: On Day 1, the non-Defaulting Clearing Member’s Prescribed Contributions is $100. On Day 26, the Clearing Member’s Prescribed Contributions is reduced to $90. Subsequently, an Event of Default occurred on Day 30. This scenario illustrates the amount of a non-Defaulting Clearing Member’s Collateralised Contribution and Contingent Contribution that is available for application in respect of the Event of Default that occurred on Day 30.

3.3 Pursuant to Rule 7.10.6, the amount of a non-Defaulting Clearing Member’s Collateralised Contribution and Contingent Contribution that is available in respect of the Event of Default on Day 30 is the lower of:

(a) an amount equal to three times of the Clearing Member’s Prescribed Contributions as at the start of the 30-day period that ends on the day of the Event of default (i.e. Day 1) less the aggregate amount utilised for all preceding events of default (i.e. from Day 1 up until the current Event of Default); or | 3 x Prescribed Contributions on Day 1 | = 3 x $100 = $300 |

| Aggregate amount utilised for all preceding Events of Default from Day 1 until the current Event of Default on Day 30 | = $0 | |

| Amount that results under limb (a) | = $300 - $0 =$300 | |

(b) where the Clearing Member’s Collateralised Contribution was adjusted during the 30-day period, an Adjusted Amount equal to three times of the consequently adjusted Prescribed Contributions (i.e. the Prescribed Contributions on Day 26) less the aggregate amount of the Clearing Member’s Collateralised Contribution and Contingent Contribution that has already been utilised in respect of Events of Default that occur after the day of that adjustment but before the Event of Default (i.e. from Day 26 up until the current Event of Default). | 3 x adjusted Prescribed Contributions on Day 26 | = 3 x $90 = $270 |

| Aggregate amount utilised for all Events of Default from Day 26 until the current Event of Default on Day 30 | = $0 | |

| Adjusted Amount that results under limb (b) | = $270 - $0 = $270 |

3.4 Under this scenario, the amount that results under limb (b) is lower than the amount that results under limb (a). Therefore, the amount of the non-Defaulting Clearing Member’s Collateralised Contribution and Contingent Contribution that is available for the Event of Default that occurred on Day 30 is the amount that results under limb (b), which is $270.

Scenario 3

3.5 Scenario 3: Continuing from Scenario 2, $90 of the Clearing Member’s Collateralised Contribution and Contingent Contribution was used for the Event of Default on Day 30. On Day 33, the Clearing Member’s Prescribed Contributions is increased to $95. A second default occurs on Day 35. This scenario illustrates the amount of the non-Defaulting Clearing Member’s Collateralised Contribution and Contingent Contribution that is available for application in respect of the second Event of Default that occurred on Day 35.

3.6 Pursuant to Rule 7.10.6, the amount of a non-defaulting Clearing Member’s Collateralised Contribution and Contingent Contribution that is available for application in respect of the Event of Default on Day 35 is the lower of:

(a) an amount equal to three times of the Clearing Member’s Prescribed Contributions as at the start of the 30-day period that ends on the day of the Event of Default (i.e. Day 35 – 29 days = Day 6) less the aggregate amount utilised for all preceding Events of Default (i.e. from Day 6 up until the current Event of Default); or | 3 x Prescribed Contributions on Day 6 | = 3 x $100 = $300 |

| Aggregate amount utilised for all preceding events of default from Day 6 until the current Event of Default on Day 35 | = $90* | |

| * From the default on Day 30 | ||

| Amount that results under limb (a) | = $300 - $90 =$210 | |

(b) where the Clearing Member’s Collateralised Contribution was adjusted during the 30-day period, an Adjusted Amount equal to three times of the consequently adjusted Prescribed Contributions less the aggregate amount of the Clearing Member’s Collateralised Contribution and Contingent Contribution that has already been utilised in respect of Events of Default that occurred after the day of that adjustment but before the Event of Default. | Rule 7.10.6 also states that in the event the Clearing Member’s Collateralised Contribution is adjusted multiple times during the 30-day period, a separate Adjusted Amount shall be calculated for each adjustment and the lowest Adjusted Amount shall apply for the purpose of Rule 7.10.6(2). | |

In this case, the Clearing Member’s Collateralised Contribution was adjusted twice resulting in two adjusted Prescribed Contributions within the relevant 30-day period. Therefore two separate Adjusted Amounts will be calculated. | ||

| Adjusted Amount A: | ||

| 3 x adjusted Prescribed Contributions on Day 26 | = 3 x $90 = $270 | |

| Aggregate amount utilised for Events of Default from Day 26 until the current Event of Default on Day 30 | = $90* | |

| * From the default on Day 30 | ||

| Adjusted Amount A | = $270 - $90 =$180 | |

| Adjusted Amount B: | ||

| 3 x adjusted Prescribed Contributions on Day 33 | = 3 x $95 = $285 | |

| Aggregate amount utilised for Events of Default from Day 33 until the current Event of Default on Day 35 | = $0 | |

| Adjusted Amount B | = $285 - $0 =$285 | |

Adjusted Amount A ($180) is lower than Adjusted Amount B ($285), therefore Adjusted Amount A applies for the purpose of Rule 7.10.6(2) and the amount that results under limb (b) is $180. | ||

3.7 In this scenario, the amount of the non-Defaulting Clearing Member’s Collateralised Contribution and Contingent Contribution that is available for the second Event of Default that occurred on Day 35 is the lowest Adjusted Amount calculated pursuant to limb (b), which is $180.

Scenario 4

3.8 Scenario 4: Continuing from Scenario 3, $90 of the Clearing Member’s Collateralised Contribution and Contingent Contribution was used in respect of the second default on Day 35. A third default occurred on Day 37. This scenario illustrates the amount of the non-Defaulting Clearing Member’s Collateralised Contribution and Contingent Contribution that is available for the default that occurred on Day 37.

3.9 Pursuant to Rule 7.10.6, the amount of a non-Defaulting Clearing Member’s Collateralised Contribution and Contingent Contribution that is available for utilisation in respect of the Event of Default on Day 37 is the lower of:

(a) an amount equal to three times of the Clearing Member’s Prescribed Contributions as at the start of the 30-day period that ends on the day of the Event of Default (i.e. Day 37 – 29 days = Day 8) less the aggregate amount utilised for all preceding Events of Default (i.e. from Day 8 up until the current Event of Default); or | 3 x Prescribed Contributions on Day 8 | = 3 x $100 = $300 |

| Aggregate amount utilised for all preceding Events of Default from Day 8 until the current Event of Default on Day 37 | = $90*+ 90** = $180 | |

| * From the default on Day 30 | ||

| ** From the default on Day 35 | ||

| Amount that results under limb (a) | = $300 - $180 = $120 | |

(b) where the Clearing Member’s Collateralised Contribution was adjusted during the 30-day period, an Adjusted Amount equal to three times of the consequently adjusted Prescribed Contributions less the aggregate amount of the Clearing Member’s Collateralised Contribution and Contingent Contribution that has already been utilised in respect of Events of Default that occurred after the day of that adjustment but before the Event of Default. | Rule 7.10.6 states that in the event the Clearing Member’s Collateralised Contribution is adjusted multiple times during the 30-day period, a separate Adjusted Amount shall be calculated for each adjustment and the lowest Adjusted Amount shall apply for the purpose of Rule 7.10.6(2). | |

In Scenario 3 from which this scenario continues, the Clearing Member’s Collateralised Contribution was adjusted twice resulting in two adjusted Prescribed Contributions within the relevant 30-day period. Therefore two separate Adjusted Amounts will be calculated. | ||

| Adjusted Amount A: | ||

| 3 x adjusted Prescribed Contributions on Day 26 | = 3 x $90 = $270 | |

| Aggregate amount utilised for Events of Default from Day 26 until the current Event of Default on Day 37 | = $90*+$90** =$180 | |

| * From the default on Day 30 | ||

| ** From the default on Day 35 | ||

| Adjusted Amount A | = $270 - $180 =$90 | |

| Adjusted Amount B: | ||

| 3 x adjusted Prescribed Contributions on Day 33 | = 3 x $95 = $285 | |

| Aggregate amount utilised for Events of Default from Day 33 until the current Event of Default on Day 37 | = $90** | |

| ** From the default on Day 35 | ||

| Adjusted Amount B | = $285 - $90 =$195 | |

Adjusted Amount A ($90) is lower than Adjusted Amount B ($195), therefore Adjusted Amount A applies for the purpose of Rule 7.10.6(2) and the amount that results under limb (b) is $90. | ||

3.10 The amount of the non-defaulting Clearing Member’s Collateralised Contribution and Contingent Contribution that is available for the third Event of Default that occurred on Day 37 is the lowest Adjusted Amount calculated pursuant to limb (b), which is $90.

Scenario 5

3.11 Scenario 5: Continuing from Scenario 4, $90 of the Clearing Member’s Collateralised Contribution and Contingent Contribution was used to meet losses suffered by the Clearing House arising from the third default on Day 37. A fourth default occurred on Day 45. This scenario illustrates the amount of the non-defaulting Clearing Member’s Collateralised Contribution and Contingent Contribution that is available to meet losses suffered by the Clearing House arising from or in connection with the default that occurred on Day 45.

3.12 Pursuant to Rule 7.10.6, the amount of a non-defaulting Clearing Member’s Collateralised Contribution and Contingent Contribution that is available for use in respect of the Event of Default on Day 45 is the lower of:

(a) an amount equal to three times of the Clearing Member’s Prescribed Contributions as at the start of the 30-day period that ends on the day of the Event of Default (i.e. Day 45 – 29 days = Day 16) less the aggregate amount used to meet default losses from all preceding events of default (i.e. from Day 16 up until the current Event of Default); or | 3 x Prescribed Contributions on Day 16 | = 3 x $100 = $300 |

| Aggregate amount utilised for all preceding Events of Default from Day 16 until the current Event of Default on Day 45 | = $90* + $90** + $90^ = $270 | |

| * From the default on Day 30 | ||

| ** From the default on Day 35 | ||

| ^ From the default on Day 37 | ||

| Amount that results under limb (a) | = $300 - $270 = $30 | |

(b) where the Clearing Member’s Collateralised Contribution was adjusted during the 30-day period, an Adjusted Amount equal to 3 times of the consequently adjusted Prescribed Contributions less the aggregate amount of the Clearing Member’s Collateralised Contribution and Contingent Contribution that has already been utilised in respect of Events of Default that occurred after the day of that adjustment but before the Event of Default. | Rule 7.10.6(2) states that in the event the Clearing Member’s Collateralised Contribution is adjusted multiple times during the 30-day period, a separate Adjusted Amount shall be calculated for each adjustment and the lowest Adjusted Amount shall apply for the purpose of Rule 7.10.6(2). | |

In Scenario 3 from which this scenario continues, the Clearing Member’s Collateralised Contribution had been adjusted twice resulting in two adjusted Prescribed Contributions within the relevant 30-day period. Therefore two separate Adjusted Amounts will be calculated. | ||

| Adjusted Amount A: | ||

| 3 x adjusted Prescribed Contributions on Day 26 | = 3 x $90 = $270 | |

| Aggregate amount utilised for Events of Default from Day 26 until the current Event of Default on Day 45 | = $90* + $90** + $90^ = $270 | |

| * From the default on Day 30 | ||

| ** From the default on Day 35 | ||

| ^ From the default on Day 37 | ||

| Adjusted Amount A | = $270 - $270 =$0 | |

| Adjusted Amount B: | ||

| 3 x adjusted Prescribed Contributions on Day 33 | = 3 x $95 = $285 | |

| Aggregate amount utilised for Events of Default from Day 26 until the current Event of Default on Day 45 | = $90** + $90^ = $180 | |

| ** From the default on Day 35 | ||

| ^ From the default on Day 37 | ||

| Adjusted Amount B | = $285 - $180 =$105 | |

Adjusted Amount A ($0) is lower than Adjusted Amount B ($105), therefore Adjusted Amount A applies for the purpose of Rule 7.10.6(2) and the amount that results under limb (b) is $0. | ||

3.13 In this case, the non-Defaulting Clearing Member’s Collateralised Contribution and Contingent Contribution cannot be utilised for the fourth Event of Default that occurred on Day 45 as the lowest Adjusted Amount calculated pursuant to limb (b) is $0.

Added on 31 October 2024.