| Details | Cross References |

| Issue date: 20 June 2011 Effective date: 1 August 2011 | Chapter 3 and 4 |

1. Introduction

1.1 This Practice Note provides guidance on the information to be included in a term sheet issued in connection with a listing, where the offer is not accompanied by an MAS-registered prospectus, of:

(1) debentures in the form of debentures or units of debentures issued pursuant to a securitisation transaction ("asset-backed securities"), exchange traded notes ("ETNs") and structured notes; and

(2) funds (including collective investment schemes1 ("CIS") and exchange-traded funds ("ETFs")).

2. Term sheets

2.1 The term sheet should highlight key features and risks of the investment product to investors in a clear and concise manner in the formats provided below. The term sheets should not contain any information that is:

(1) not included in the listing documents; or

(2) false or misleading.

2.2 An indicative term sheet should be submitted to SGX-ST at the time of the submission of the listing application and the final term sheet should form part of the listing documents to be made available to investors.

3. Format for term sheets

3.1 This section sets out the formats for the term sheets of listed debentures and funds (including collective investment schemes and exchange traded funds). Issuers are responsible for preparing the term sheets in accordance with the guidelines and formats provided in this Practice Note.

3.2 Issuers should answer the questions provided in the templates in clear and simple language that investors can easily understand. Issuers should avoid using technical terms in the term sheet. Where technical terms are unavoidable, issuers should attach a glossary to the term sheet to explain these technical terms.

3.3 The use of diagrams such as graphs, charts, flowcharts, tables or numerical explanations to explain structures or payoffs of the investment products to investors is encouraged.

3.4 Information in the term sheets should be presented in a font size of at least 10-point Times New Roman. It should not be longer than four pages. Diagrams and a glossary, if included, would not count towards the four-page limit. However, the term sheet including diagrams and the glossary should not exceed eight pages.

3.5 Where the investment product has different features, the format for term sheets provided in this Practice Note should be used with necessary adaptations. When changes are made to the offering documents such as the introductory document, offering circular or information memorandum, the term sheet should be updated if the change has a material effect on the key features and risks of the investment product.

3.6 Format for term sheet of debentures in the form of asset-backed securities, exchange traded notes and structured notes:—

KEY TERMS SHEET

[Name of Issuer]

[NAME OF PRODUCT]

| Issuer's Company Logo |

[Name of Issuer]

[NAME OF PRODUCT]

• The terms set out in this term sheet are a summary of, and are subject to the terms and conditions set out in the Issuer's offering document dated [dd/mm/yyyy] ("Offering Document") and any other listing documents issued by the issuer for the purpose of this listing (the "Listing Documents").

• If you are in doubt whether the product is suitable for you, please consult your financial advisers or such advisers to the extent you consider necessary.

• Please read the Listing Documents and this term sheet carefully. You should not invest in the product if you do not understand the risks or are not willing to assume the risks.

| A. PRODUCT DETAILS | |||

| SGX counter name (SGX stock code) | SGX-ST Listing Date | dd/mm/yyyy | |

| Product Type | Maturity Date | dd/mm/yyyy Issue Price | |

| Issue Price | Annualised Maximum loss | [in % term] | |

| Name of Guarantor | Annualised Maximum gain | [in % term] | |

| Capital Guaranteed | [Yes/No] | Callable by Issuer | [Yes/No] |

| Traded Currency | SGD /USD / AUD | Underlying Reference Asset | |

| Board Lots | Name of Market Maker | ||

| B. INFORMATION ON THE ISSUER / GUARANTOR / KEY SWAP COUNTERPARTIES (IF APPLICABLE) | |

| Name of Issuer | |

| Credit Rating of the Issuer | Moody's Investors Service Inc.: Standard & Poor's Ratings Group: Fitch Ratings Ltd., London: |

| Name of Guarantor (if any) | |

| Credit Rating of Guarantor (if any) | Moody's Investors Service Inc.: Standard & Poor's Ratings Group: Fitch Ratings Ltd., London: |

| Issuer / Guarantor Regulated by | |

| Issuer's / Guarantor's Website and any other Contact Information | |

| Name of Key Swap Counterparties (if applicable) | |

| Credit Rating of the Key Swap Counterparties (if applicable) | Moody's Investors Service Inc.: Standard & Poor's Ratings Group: Fitch Ratings Ltd., London: |

| C. INFORMATION ON THE TRUSTEE / CUSTODIAN | |

| Name of Trustee / Custodian | |

| Regulated by | |

| Trustee / Custodian's Website and any other Contact Information | |

| D. PRODUCT SUITABILITY | ||

| WHO IS THE PRODUCT SUITABLE FOR? • This product is only suitable for investors who: Example: • [State return objectives (eg. capital growth/income/capital preservation) which the product will be suitable for] • [State if the principal will be at risk] • [State how long investors should be prepared to hold the investment for, and highlight any lock-in periods or issuer-callable features] • [State other key characteristics of the product which will help investors determine whether the product is suitable for them] • The Notes are only suitable for investors who: • want regular income rather than capital growth • are prepared to lose their principal investment if the Issuer fails to repay the amount due under the Notes; and • are prepared to hold their investment for the full X years. However, after Y years the product may be callable by the issuer. | Further Information Refer to the "[Relevant Section]" on Pg XX of the Offering Document for further information on product suitability. | |

| E. KEY PRODUCT FEATURES | ||

| WHAT ARE YOU INVESTING IN? [State key features of the product, such as the legal classification of the product, payoff and factors determining the payoff, underlying securities and whether and how they would affect the payoff, any capital guarantee, etc. Include a diagram of the structure of the product, if necessary.] Example: • You are investing in a X-year equity-linked structured note in which you may receive quarterly coupons between W% and Y% p.a. issued by [name of issuer of the Notes]. • During the term of the investment, the issuer agrees to pay you quarterly coupons which depend on the share price performance of: • Company A • Company B • Company C • The amount of coupons is calculated as follows: • [Formula for calculation of coupons] • At maturity, the issuer agrees to pay you 100% of your principal investment, unless [list circumstances where investor may not receive 100% of principal investment] • The product is secured by [type of underlying securities] issued by [name of issuer of underlying securities]. | Refer to the "[Relevant Section]" on Pg XX of the Offering Document for further information on features of the product, including how redemption amount is calculated. | |

| Possible Outcomes | ||

| WHAT WOULD YOU GAIN OR LOSE IN DIFFERENT SITUATIONS? • Best case scenario: • [Describe payoff to investor in best case scenario and factors that could lead to this scenario.] • Worst case scenario: • [Describe payoff to investor in worst case scenario and factors that could lead to this scenario.] • Other possible scenarios: • [Describe payoff to investor in other possible scenarios and factors that could lead to this scenario. Include scenario where issuer calls the debenture if applicable.] | ||

| F. KEY RISKS | ||

| WHAT ARE THE KEY RISKS OF THIS INVESTMENT? [State key risks which are either commonly occurring events, or which may cause significant losses if they occur, or both. While the risks may overlap into multiple categories below, there is no need to repeat the same risk in more than one section. Product-specific market or liquidity risks should be included under the market or liquidity risks section respectively. Where there is a risk that an investor may lose all of his initial principal investment, emphasise this with bold or italicised formatting.] These risk factors may cause you to lose some or all of your investment: | Refer to the "[Relevant Section]" on Pg XX of the Offering Document for further information on risks. | |

| Market and Credit Risks | ||

| [State market risks (including currency risks) and counterparty risks which may result in the loss of capital or affect the payoff of the investment and their consequences.] Example: • You are exposed to the credit risk of [name of issuer]. • The Notes are debt obligations of [name of issuer]. If [name of issuer] is unable to fulfil its obligations under the Notes, you may lose all your principal investment. | ||

| Liquidity Risks | ||

| [State the risks that an investor would face in trying to exit the product, eg: illiquid secondary market, limitations on redemption or factors that may delay the payment of redemption proceeds.] Example: • The Notes may have limited liquidity. • Trading market for the Notes may not exist at any time and the secondary market may not provide enough liquidity to trade or sell the Notes easily. If you exit from your investment before maturity, you may receive an amount which is substantially less than your principal. | ||

| Product Specific Risks | ||

| [State product structure-related risks which may result in capped upside potential, unfavourable pricing if redeemed before maturity, potential legal risks, etc] Example: • The Issuer is established overseas. • If the Issuer becomes insolvent or is the subject of a winding-up or liquidation order or similar proceedings, the insolvency laws in the country in which it is incorporated would apply. The process of making a claim under the foreign law may be complex and time-consuming. • The underlying securities are held overseas. If the Issuer has to redeem the notes early, due to taxation and other reasons, you may receive less than your principal investment. • There may be difficulties realising the underlying securities which are held overseas. Even if the underlying securities are realised, the foreign law may not recognize that the payments to you should be made before other claimants and creditors. | ||

| G. FEES AND CHARGES | ||

| WHAT ARE THE FEES AND CHARGES OF THIS INVESTMENT? [State all fees and charges paid/payable to the product providers. If product providers do not charge a fee, describe briefly how product providers will profit from the sale of the Notes. Indicate if the fees are payable once-off or on a recurring basis. If fees may later be increased or new fees introduced, such as fees related to the unwinding of investments, state so here.] Example: • The fees for any series of the Notes is calculated using the formula below: • The product providers make a profit through the structuring of the Notes. This profit is factored into the risk and return of the Notes. | Refer to the "[Relevant Section]" on Pg XX of the Offering Document for further information on fees and charges. | |

3.7 Format for term sheet of funds (including collective investment schemes and exchange traded funds):—

KEY TERMS SHEET

[Name of Issuer]

[NAME OF PRODUCT]

| Issuer's Company Logo |

[Name of Issuer]

[NAME OF PRODUCT]

• The terms set out in this term sheet are a summary of, and are subject to the terms and conditions set out in the Issuer's offering document dated [dd/mm/yyyy] ("Offering Document") and any other listing documents issued by the issuer for the purpose of this listing (the "Listing Documents").

• If you are in doubt whether the product is suitable for you, please consult your financial advisers or such advisers to the extent you consider necessary.

• Please read the Listing Documents and this term sheet carefully. You should not invest in the product if you do not understand the risks or are not willing to assume the risks.

| A. FUND DETAILS | |||

| SGX counter name (SGX stock code) | XX | SGX-ST Listing Date | dd/mm/yyyy |

| Product Type | Exchange-Traded Fund | Underlying Reference Asset | |

| Issuer | Investment Manager (if applicable) | ||

| Designated Market Maker | Expense Ratio (for Exchange-Traded Funds) | ||

| Traded Currency | SGD /USD / AUD | ||

| B. INFORMATION ON THE ISSUER / KEY SWAP COUNTERPARTIES (IF APPLICABLE) | |

| Name of Issuer / Guarantor | |

| Issuer / Guarantor Regulated by | |

| Issuer's / Guarantor's Website and any other Contact Information | |

| Name of Key Swap Counterparties (if applicable) | |

| Credit Rating of the Key Swap Counterparties (if applicable) | |

| C. INFORMATION ON THE TRUSTEE / CUSTODIAN | |

| Name of Trustee / Custodian | |

| Regulated by by | |

| Trustee / Custodian's Website and any other Contact Information | |

| D. PRODUCT SUITABILITY | |||||||

| WHO IS THE PRODUCT SUITABLE FOR? • This product is only suitable for investors who: Example: • [State return objectives (eg. capital growth/income/capital preservation) which the product will be suitable for] • [State if the principal will be at risk] • [State other key characteristics of the product which will help investors determine whether the product is suitable for them, especially unique features eg: daily resetting of prices] • The Fund is only suitable for investors who: • want capital growth rather than regular income; • believe that the XXX Index will increase in value; and • are comfortable with the greater volatility and risks of an equity fund. | Further Information Refer to the "[Relevant Section]" on Pg XX of the Offering Document for further information on product suitability. | ||||||

| E. KEY PRODUCT FEATURES | |||||||

| WHAT ARE YOU INVESTING IN? [State key features of the product, such as the legal classification of the product, the broad investment objective of the product, whether it intends to offer regular dividends and when those are paid. Describe the underlying index, including how they would affect the payoff. Also describe how the payoff is calculated. Where the index has unique features of its construction or its payoff, describe these features, with the assistance of tables and diagrams if necessary.] Example: • You are investing in an Exchange Traded Fund constituted in [Place of constitution] that aims to track the XXX index (the "Underlying Index") by entering into a derivative swap transaction with another party known as the swap counterparty. The Underlying Index is maintained by [Name of index sponsor] and represents the [eg: leading 500 large-cap companies in the U.S.] The index constituents are reviewed quarterly, and are diversified across all sectors. | [Describe where an investor can find published figures for the value of the index eg: the index provider's website. Also describe where more details on the construction methodology or any unique features can be found.] | ||||||

| Investment Objective / Strategy | |||||||

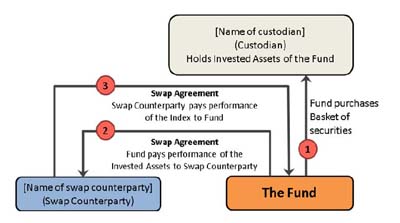

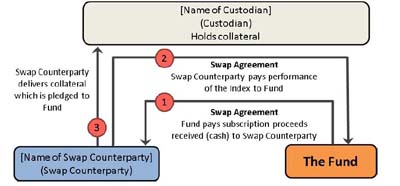

| [Describe how the product intends to track the index/securities. For instance, if the product uses a representative sampling method or synthetic replication method, describe how this is carried out. If an investment strategy other than the direct investment method is used, explain why. Any processes and structures which introduce significant risk should be included in the description. Include diagrams of the structure of the product or pie charts of asset allocation as at a date near the date of the term sheet to show sectoral/country/asset type allocation, if applicable.] Example: • In order to achieve the investment objective, the Fund may use either or both of the following methods: • Method 1: Invest in a basket of securities (step 1 in the diagram on the next page) and exchange the performance of the basket of securities (step 2) with the swap counterparty for the performance of the Underlying Index (step 3). If the value of the basket of securities grows by 5% and the underlying index grows by 6%, the Fund will pay the swap counterparty 5% and the swap counterparty will pay the fund 6%. And/Or:  • Method 2: Pass the subscription proceeds received from investors to a swap counterparty (step 1 in the diagram below) in exchange for the performance of the Underlying Index (step 2). The counterparty will give collateral to the Fund which will be held by the Custodian (step 3).  | Refer to the "[Relevant Section]" on Pg XX of the Offering Document for the full diagrams of the structure of the Fund. | ||||||

| F. KEY RISKS | |||||||

| WHAT ARE THE KEY RISKS OF THIS INVESTMENT? [State key risks which are either commonly occurring events, or which may cause significant losses if they occur, or both. While the risks may overlap into multiple categories below, there is no need to repeat the same risk in more than one section. Product-specific market or liquidity risks should be included under the market or liquidity risks section respectively. Where there is a risk that an investor may lose all of his initial principal investment, emphasise this with bold or italicised formatting.] The value of the product and its dividends or coupons may rise or fall. These risk factors may cause you to lose some or all of your investment: | Refer to the "[Relevant Section]" on Pg XX of the Offering Document for further information on risks of the product. | ||||||

| Market and Credit Risks | |||||||

| [State market risks (including currency risks) and counterparty risks which may affect the traded price of the product.] Example: • Market prices for Units may be different from their Net Asset Value (NAV) • The price of any Units traded on the SGX-ST will depend, amongst other factors, on market supply and demand, as well as the prevailing financial market, corporate, economic and political conditions, and their price may be different from the NAV of the Fund. | |||||||

| Liquidity Risks | |||||||

| [State the risks that an investor would face in trying to exit the product.] Example: • You can redeem your Units with the manager only if you meet the minimum redemption amount of USD$100,000. • The secondary market may be illiquid. • You can sell your Units on the SGX. However, you may not be able to find a buyer on the SGX-ST when you wish to sell your Units. While the Fund intends to appoint at least one market maker to assist in creating liquidity for investors, liquidity is not guaranteed and trading of Units on the SGX-ST may be suspended in various situations. • If the Units are delisted from the SGX-ST or if the CDP is no longer able to act as the depository for the Units listed on the SGX-ST, the Units in the investors' securities accounts with the CDP or held by the CDP will be compulsorily repurchased by the Market Maker at a price calculated by reference to the NAV of the Fund calculated as of the second Singapore trading day following the delisting date. | Refer to the "[Relevant Section]" on Pg XX of the Offering Document for situations in which trading of units may be suspended. | ||||||

| Product Specific Risks | |||||||

| [State product-specific risks, which include structure-related risks, investment objective related risks, potential legal risks, potential risks leading to tracking errors etc] Example: • You are exposed to counterparty risk related to derivative transactions • The Fund may enter into derivative transactions (such as swap agreements) and be exposed to the risk that the counterparties to such transactions may default on their obligations. However, the Fund is required to limit its exposure to any single counterparty to 10% of its NAV. • If the Swap Counterparty defaults on its obligations, you may sustain a loss on your investment in the Fund. The Fund limits its net exposure to the Swap Counterparty by obtaining collateral from the Swap Counterparty. In the event the Swap Counterparty defaults on its obligations, the value of the Fund will depend on the value of the collateral or basket of securities held. • You are exposed to the risk that the USD will depreciate in value against the SGD. • The Fund is denominated and traded in SGD whereas the underlying investments are denominated in USD. Therefore, investors may lose money if the USD were to depreciate against the SGD, even if the market value of the relevant underlying shares actually goes up. • The Fund, Management Company and Custodian are not constituted in Singapore and are governed by foreign laws. Certain investments by the Fund such as swaps are also governed by foreign laws. • Any winding up of these investments may involve delays and legal uncertainties for Singaporean investors. | Refer to "[Relevant Section]" on Pg XX of the Offering Document for details on mitigating counterparty risk exposure in the swap agreements and what happens if the swap counterparty defaults. | ||||||

| G. FEES AND CHARGES | |||||||

| WHAT ARE THE FEES AND CHARGES OF THIS INVESTMENT? [State all fees and charges payable. This includes management fees, distribution fees, and any other substantial fees of more than 0.1% of NAV or of subscription value. Distinguish between fees payable via the investors' investments in the product and fees payable directly by the investors. Indicate if the fees are payable once-off or on a perannum basis. If fees may later be increased or new fees introduced, such as fees related to the unwinding of investments, state so here.] Example: Payable by the Fund from invested proceeds:

Payable directly by you: • For purchases and sales on the SGX-ST: Normal brokerage and other fees apply. Please contact your broker for further details. | Refer to the "[Relevant Section]" on Pg XX of the Offering Document for further information on fees and charges. | ||||||

Added on 1 August 20111 August 2011.

1 In the case of CIS where multiple sub-funds are covered in a single listing document, a separate term sheet should be prepared for each sub-fund.