Practice Note 1.2 Oversight of Issuers [Deleted]

Amended on 29 September 2011, 15 September 2017 and 7 February 2020 and deleted on 29 October 2025.

Practice Note 2.1 Equity Securities Listing Procedure

| Details | Cross References |

| Issue date: 7 January 2004 17 May 2004 7 June 2006 Effective date: 8 January 2004 1 June 2004 1 September 2006 | Chapter 2 |

1. Introduction

2. Exchange's Procedure

3. Comments Received

4. Due Diligence

5. Verification

6. Foreign Applicants' Connection to Singapore

7. Compliance Adviser

Amended on 29 September 201129 September 2011, 10 January 202010 January 2020 and 7 February 20207 February 2020.

Practice Note 2.1A Independence of Issue Managers

| Details | Cross References |

| Issue date: 10 January 2020 Effective date: 10 January 2020 | Listing Rule 112A |

1. Introduction

Issue managers play a major role in initial public offerings, listings by way of an introduction and reverse takeovers as they prepare listing applicants for the listing, lodge listing applications and deal with the Exchange on matters relating to listing applications.

Rule 112A requires at least one issue manager to be independent of an applicant so that the interests of investors may be safeguarded. All issue managers are expected to provide impartial advice and discharge their professional duties fully and professionally.

2. Independence of Issue Managers

The issue manager must consider whether there are any circumstances other than those set out in paragraph 2.1 above that may materially affect its independence. In the event of any uncertainty, the applicant should consult and clarify with the Exchange as soon as possible.

Added on 10 January 202010 January 2020 and 12 February 2021.

Practice Note 2.2 Global Depository Receipts

| Details | Cross References |

| Issue date: 21 June 2006 Revised date: 26 March 2018 Effective date: 22 June 2006 26 March 2018 | Listing Rule Chapter 2 Part XII |

1. Introduction

2. Documents to be Submitted as Part of the Listing Application

3. Documents to be Submitted After Approval In-Principle

Amended on 29 September 201129 September 2011 and 26 March 201826 March 2018.

Practice Note 2.3 Training for Directors with No Prior Experience

| Details | Cross References |

| Issue Date: 6 August 2018 Effective Date: 1 January 2019 1 February 2024 – Paragraph 2.2 applies to First-time Directors of REIT managers appointed on or after 1 February 2024 | Rule 210(5)(a) Appendix 7.4.1 |

1. Introduction

1.1 Rule 210(5)(a) provides that a director who has no prior experience as a director of an issuer listed on the Exchange (a "First-time Director") must undergo training in the roles and responsibilities of a director of a listed issuer as prescribed by the Exchange.

1.2 This Practice Note prescribes the training that a First-time Director must undergo within one year from the date of his appointment to the board ("Mandatory Training"). If any director of an issuer which is newly listed on the Exchange has not attended any training as prescribed in paragraph 2 below, such director must attend Mandatory Training by the end of the first year of the issuer's listing.

2. Mandatory Training

2.1 To fulfil the Mandatory Training requirements, First-time Directors must attend one of the training programmes conducted by a training provider as specified in Schedule 1 to this Practice Note.

2.2 A First-time Director of a REIT manager must also attend the training programme specified in Schedule 2. A director is considered a First-time Director of a REIT manager if he or she has no prior experience as a director of a REIT manager.

3. Persons with Relevant Experience

3.1 The Exchange expects all First-time Directors to attend Mandatory Training.

3.2 In exceptional circumstances, First-time Directors assessed by the issuer's Nominating Committee to possess relevant experience need not attend Mandatory Training. In assessing the relevant experience, the Nominating Committee must have regard to whether the experience is comparable to the experience of a person who has served as a director of an issuer listed on the Exchange. The issuer's Nominating Committee must disclose its reasons for its assessment that the First-time Director possesses relevant experience. Such reasons shall be disclosed in the announcement of the appointment of the First-time Director as director of the issuer or in the prospectus, offering memorandum or introductory document.

3.3 Notwithstanding paragraph 3.2 above, the Exchange has the discretion to direct a First-time Director to attend Mandatory Training.

Schedule 1

| Training Provider | Mandatory Training |

| Singapore Institute of Directors | Listed Entity Directors Programme The First-time Director must attend all the core modules. The First-time Director must also attend the elective modules relevant to his appointment on the board of the issuer. |

| Singapore Institute of Directors | Listed Entity Directors Bridging Programme The First-time Director must also have completed one of the recognised programmes, and attend the elective modules for the Listed Entity Directors Programme that are relevant to his appointment on the board of the issuer. |

| ISCA Academy Pte Ltd and SAC Capital | Board Of Directors (BOD) Masterclass Programme The First-time Director must attend all the mandatory classes and modules. The First-time Director must also attend the optional classes and modules relevant to his appointment on the board of the issuer. |

*Includes any training provider or programme that replaces or supersedes those stated, as agreed by the Exchange

Schedule 2

| Training Provider | Mandatory Training |

| REIT Association of Singapore | Essentials and Key Updates for Directors of REIT Managers |

*Includes any training provider or programme that replaces or supersedes those stated, as agreed by the Exchange

Added on 1 January 2019 and amended on 1 January 2022, 1 February 2024, 1 October 2024 and 6 February 2026.

Practice Note 2.4 Summary Property Valuation Report

Rule 222(3)(c) requires a summary property valuation report to contain the information required for prospectuses and circulars in accordance with the standards of the Singapore Institute of Surveyors and Valuers. The information required for prospectuses and circulars is set out in a Practice Guide published by the Singapore Institute of Surveyors and Valuers.

Please click here to view the Practice Guide.

Added on 12 February 2021.

Practice Note 3.1 Term Sheet For Debentures and Funds

| Details | Cross References |

| Issue date: 20 June 2011 Effective date: 1 August 2011 | Chapter 3 and 4 |

1. Introduction

2. Term sheets

| Issuer's Company Logo |

[Name of Issuer]

[NAME OF PRODUCT]

| A. PRODUCT DETAILS | |||

| SGX counter name (SGX stock code) | SGX-ST Listing Date | dd/mm/yyyy | |

| Product Type | Maturity Date | dd/mm/yyyy Issue Price | |

| Issue Price | Annualised Maximum loss | [in % term] | |

| Name of Guarantor | Annualised Maximum gain | [in % term] | |

| Capital Guaranteed | [Yes/No] | Callable by Issuer | [Yes/No] |

| Traded Currency | SGD /USD / AUD | Underlying Reference Asset | |

| Board Lots | Name of Market Maker | ||

| B. INFORMATION ON THE ISSUER / GUARANTOR / KEY SWAP COUNTERPARTIES (IF APPLICABLE) | |

| Name of Issuer | |

| Credit Rating of the Issuer | Moody's Investors Service Inc.: Standard & Poor's Ratings Group: Fitch Ratings Ltd., London: |

| Name of Guarantor (if any) | |

| Credit Rating of Guarantor (if any) | Moody's Investors Service Inc.: Standard & Poor's Ratings Group: Fitch Ratings Ltd., London: |

| Issuer / Guarantor Regulated by | |

| Issuer's / Guarantor's Website and any other Contact Information | |

| Name of Key Swap Counterparties (if applicable) | |

| Credit Rating of the Key Swap Counterparties (if applicable) | Moody's Investors Service Inc.: Standard & Poor's Ratings Group: Fitch Ratings Ltd., London: |

| C. INFORMATION ON THE TRUSTEE / CUSTODIAN | |

| Name of Trustee / Custodian | |

| Regulated by | |

| Trustee / Custodian's Website and any other Contact Information | |

| D. PRODUCT SUITABILITY | ||

| WHO IS THE PRODUCT SUITABLE FOR? • This product is only suitable for investors who: Example: • [State return objectives (eg. capital growth/income/capital preservation) which the product will be suitable for] • [State if the principal will be at risk] • [State how long investors should be prepared to hold the investment for, and highlight any lock-in periods or issuer-callable features] • [State other key characteristics of the product which will help investors determine whether the product is suitable for them] • The Notes are only suitable for investors who: • want regular income rather than capital growth • are prepared to lose their principal investment if the Issuer fails to repay the amount due under the Notes; and • are prepared to hold their investment for the full X years. However, after Y years the product may be callable by the issuer. | Further Information Refer to the "[Relevant Section]" on Pg XX of the Offering Document for further information on product suitability. | |

| E. KEY PRODUCT FEATURES | ||

| WHAT ARE YOU INVESTING IN? [State key features of the product, such as the legal classification of the product, payoff and factors determining the payoff, underlying securities and whether and how they would affect the payoff, any capital guarantee, etc. Include a diagram of the structure of the product, if necessary.] Example: • You are investing in a X-year equity-linked structured note in which you may receive quarterly coupons between W% and Y% p.a. issued by [name of issuer of the Notes]. • During the term of the investment, the issuer agrees to pay you quarterly coupons which depend on the share price performance of: • Company A • Company B • Company C • The amount of coupons is calculated as follows: • [Formula for calculation of coupons] • At maturity, the issuer agrees to pay you 100% of your principal investment, unless [list circumstances where investor may not receive 100% of principal investment] • The product is secured by [type of underlying securities] issued by [name of issuer of underlying securities]. | Refer to the "[Relevant Section]" on Pg XX of the Offering Document for further information on features of the product, including how redemption amount is calculated. | |

| Possible Outcomes | ||

| WHAT WOULD YOU GAIN OR LOSE IN DIFFERENT SITUATIONS? • Best case scenario: • [Describe payoff to investor in best case scenario and factors that could lead to this scenario.] • Worst case scenario: • [Describe payoff to investor in worst case scenario and factors that could lead to this scenario.] • Other possible scenarios: • [Describe payoff to investor in other possible scenarios and factors that could lead to this scenario. Include scenario where issuer calls the debenture if applicable.] | ||

| F. KEY RISKS | ||

| WHAT ARE THE KEY RISKS OF THIS INVESTMENT? [State key risks which are either commonly occurring events, or which may cause significant losses if they occur, or both. While the risks may overlap into multiple categories below, there is no need to repeat the same risk in more than one section. Product-specific market or liquidity risks should be included under the market or liquidity risks section respectively. Where there is a risk that an investor may lose all of his initial principal investment, emphasise this with bold or italicised formatting.] These risk factors may cause you to lose some or all of your investment: | Refer to the "[Relevant Section]" on Pg XX of the Offering Document for further information on risks. | |

| Market and Credit Risks | ||

| [State market risks (including currency risks) and counterparty risks which may result in the loss of capital or affect the payoff of the investment and their consequences.] Example: • You are exposed to the credit risk of [name of issuer]. • The Notes are debt obligations of [name of issuer]. If [name of issuer] is unable to fulfil its obligations under the Notes, you may lose all your principal investment. | ||

| Liquidity Risks | ||

| [State the risks that an investor would face in trying to exit the product, eg: illiquid secondary market, limitations on redemption or factors that may delay the payment of redemption proceeds.] Example: • The Notes may have limited liquidity. • Trading market for the Notes may not exist at any time and the secondary market may not provide enough liquidity to trade or sell the Notes easily. If you exit from your investment before maturity, you may receive an amount which is substantially less than your principal. | ||

| Product Specific Risks | ||

| [State product structure-related risks which may result in capped upside potential, unfavourable pricing if redeemed before maturity, potential legal risks, etc] Example: • The Issuer is established overseas. • If the Issuer becomes insolvent or is the subject of a winding-up or liquidation order or similar proceedings, the insolvency laws in the country in which it is incorporated would apply. The process of making a claim under the foreign law may be complex and time-consuming. • The underlying securities are held overseas. If the Issuer has to redeem the notes early, due to taxation and other reasons, you may receive less than your principal investment. • There may be difficulties realising the underlying securities which are held overseas. Even if the underlying securities are realised, the foreign law may not recognize that the payments to you should be made before other claimants and creditors. | ||

| G. FEES AND CHARGES | ||

| WHAT ARE THE FEES AND CHARGES OF THIS INVESTMENT? [State all fees and charges paid/payable to the product providers. If product providers do not charge a fee, describe briefly how product providers will profit from the sale of the Notes. Indicate if the fees are payable once-off or on a recurring basis. If fees may later be increased or new fees introduced, such as fees related to the unwinding of investments, state so here.] Example: • The fees for any series of the Notes is calculated using the formula below: • The product providers make a profit through the structuring of the Notes. This profit is factored into the risk and return of the Notes. | Refer to the "[Relevant Section]" on Pg XX of the Offering Document for further information on fees and charges. | |

| Issuer's Company Logo |

[Name of Issuer]

[NAME OF PRODUCT]

| A. FUND DETAILS | |||

| SGX counter name (SGX stock code) | XX | SGX-ST Listing Date | dd/mm/yyyy |

| Product Type | Exchange-Traded Fund | Underlying Reference Asset | |

| Issuer | Investment Manager (if applicable) | ||

| Designated Market Maker | Expense Ratio (for Exchange-Traded Funds) | ||

| Traded Currency | SGD /USD / AUD | ||

| B. INFORMATION ON THE ISSUER / KEY SWAP COUNTERPARTIES (IF APPLICABLE) | |

| Name of Issuer / Guarantor | |

| Issuer / Guarantor Regulated by | |

| Issuer's / Guarantor's Website and any other Contact Information | |

| Name of Key Swap Counterparties (if applicable) | |

| Credit Rating of the Key Swap Counterparties (if applicable) | |

| C. INFORMATION ON THE TRUSTEE / CUSTODIAN | |

| Name of Trustee / Custodian | |

| Regulated by by | |

| Trustee / Custodian's Website and any other Contact Information | |

| D. PRODUCT SUITABILITY | |||||||

| WHO IS THE PRODUCT SUITABLE FOR? • This product is only suitable for investors who: Example: • [State return objectives (eg. capital growth/income/capital preservation) which the product will be suitable for] • [State if the principal will be at risk] • [State other key characteristics of the product which will help investors determine whether the product is suitable for them, especially unique features eg: daily resetting of prices] • The Fund is only suitable for investors who: • want capital growth rather than regular income; • believe that the XXX Index will increase in value; and • are comfortable with the greater volatility and risks of an equity fund. | Further Information Refer to the "[Relevant Section]" on Pg XX of the Offering Document for further information on product suitability. | ||||||

| E. KEY PRODUCT FEATURES | |||||||

| WHAT ARE YOU INVESTING IN? [State key features of the product, such as the legal classification of the product, the broad investment objective of the product, whether it intends to offer regular dividends and when those are paid. Describe the underlying index, including how they would affect the payoff. Also describe how the payoff is calculated. Where the index has unique features of its construction or its payoff, describe these features, with the assistance of tables and diagrams if necessary.] Example: • You are investing in an Exchange Traded Fund constituted in [Place of constitution] that aims to track the XXX index (the "Underlying Index") by entering into a derivative swap transaction with another party known as the swap counterparty. The Underlying Index is maintained by [Name of index sponsor] and represents the [eg: leading 500 large-cap companies in the U.S.] The index constituents are reviewed quarterly, and are diversified across all sectors. | [Describe where an investor can find published figures for the value of the index eg: the index provider's website. Also describe where more details on the construction methodology or any unique features can be found.] | ||||||

| Investment Objective / Strategy | |||||||

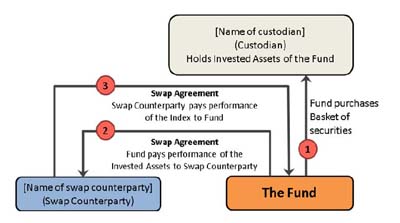

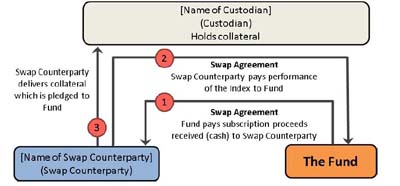

| [Describe how the product intends to track the index/securities. For instance, if the product uses a representative sampling method or synthetic replication method, describe how this is carried out. If an investment strategy other than the direct investment method is used, explain why. Any processes and structures which introduce significant risk should be included in the description. Include diagrams of the structure of the product or pie charts of asset allocation as at a date near the date of the term sheet to show sectoral/country/asset type allocation, if applicable.] Example: • In order to achieve the investment objective, the Fund may use either or both of the following methods: • Method 1: Invest in a basket of securities (step 1 in the diagram on the next page) and exchange the performance of the basket of securities (step 2) with the swap counterparty for the performance of the Underlying Index (step 3). If the value of the basket of securities grows by 5% and the underlying index grows by 6%, the Fund will pay the swap counterparty 5% and the swap counterparty will pay the fund 6%. And/Or:  • Method 2: Pass the subscription proceeds received from investors to a swap counterparty (step 1 in the diagram below) in exchange for the performance of the Underlying Index (step 2). The counterparty will give collateral to the Fund which will be held by the Custodian (step 3).  | Refer to the "[Relevant Section]" on Pg XX of the Offering Document for the full diagrams of the structure of the Fund. | ||||||

| F. KEY RISKS | |||||||

| WHAT ARE THE KEY RISKS OF THIS INVESTMENT? [State key risks which are either commonly occurring events, or which may cause significant losses if they occur, or both. While the risks may overlap into multiple categories below, there is no need to repeat the same risk in more than one section. Product-specific market or liquidity risks should be included under the market or liquidity risks section respectively. Where there is a risk that an investor may lose all of his initial principal investment, emphasise this with bold or italicised formatting.] The value of the product and its dividends or coupons may rise or fall. These risk factors may cause you to lose some or all of your investment: | Refer to the "[Relevant Section]" on Pg XX of the Offering Document for further information on risks of the product. | ||||||

| Market and Credit Risks | |||||||

| [State market risks (including currency risks) and counterparty risks which may affect the traded price of the product.] Example: • Market prices for Units may be different from their Net Asset Value (NAV) • The price of any Units traded on the SGX-ST will depend, amongst other factors, on market supply and demand, as well as the prevailing financial market, corporate, economic and political conditions, and their price may be different from the NAV of the Fund. | |||||||

| Liquidity Risks | |||||||

| [State the risks that an investor would face in trying to exit the product.] Example: • You can redeem your Units with the manager only if you meet the minimum redemption amount of USD$100,000. • The secondary market may be illiquid. • You can sell your Units on the SGX. However, you may not be able to find a buyer on the SGX-ST when you wish to sell your Units. While the Fund intends to appoint at least one market maker to assist in creating liquidity for investors, liquidity is not guaranteed and trading of Units on the SGX-ST may be suspended in various situations. • If the Units are delisted from the SGX-ST or if the CDP is no longer able to act as the depository for the Units listed on the SGX-ST, the Units in the investors' securities accounts with the CDP or held by the CDP will be compulsorily repurchased by the Market Maker at a price calculated by reference to the NAV of the Fund calculated as of the second Singapore trading day following the delisting date. | Refer to the "[Relevant Section]" on Pg XX of the Offering Document for situations in which trading of units may be suspended. | ||||||

| Product Specific Risks | |||||||

| [State product-specific risks, which include structure-related risks, investment objective related risks, potential legal risks, potential risks leading to tracking errors etc] Example: • You are exposed to counterparty risk related to derivative transactions • The Fund may enter into derivative transactions (such as swap agreements) and be exposed to the risk that the counterparties to such transactions may default on their obligations. However, the Fund is required to limit its exposure to any single counterparty to 10% of its NAV. • If the Swap Counterparty defaults on its obligations, you may sustain a loss on your investment in the Fund. The Fund limits its net exposure to the Swap Counterparty by obtaining collateral from the Swap Counterparty. In the event the Swap Counterparty defaults on its obligations, the value of the Fund will depend on the value of the collateral or basket of securities held. • You are exposed to the risk that the USD will depreciate in value against the SGD. • The Fund is denominated and traded in SGD whereas the underlying investments are denominated in USD. Therefore, investors may lose money if the USD were to depreciate against the SGD, even if the market value of the relevant underlying shares actually goes up. • The Fund, Management Company and Custodian are not constituted in Singapore and are governed by foreign laws. Certain investments by the Fund such as swaps are also governed by foreign laws. • Any winding up of these investments may involve delays and legal uncertainties for Singaporean investors. | Refer to "[Relevant Section]" on Pg XX of the Offering Document for details on mitigating counterparty risk exposure in the swap agreements and what happens if the swap counterparty defaults. | ||||||

| G. FEES AND CHARGES | |||||||

| WHAT ARE THE FEES AND CHARGES OF THIS INVESTMENT? [State all fees and charges payable. This includes management fees, distribution fees, and any other substantial fees of more than 0.1% of NAV or of subscription value. Distinguish between fees payable via the investors' investments in the product and fees payable directly by the investors. Indicate if the fees are payable once-off or on a perannum basis. If fees may later be increased or new fees introduced, such as fees related to the unwinding of investments, state so here.] Example: Payable by the Fund from invested proceeds:

Payable directly by you: • For purchases and sales on the SGX-ST: Normal brokerage and other fees apply. Please contact your broker for further details. | Refer to the "[Relevant Section]" on Pg XX of the Offering Document for further information on fees and charges. | ||||||

Added on 1 August 20111 August 2011.

1 In the case of CIS where multiple sub-funds are covered in a single listing document, a separate term sheet should be prepared for each sub-fund.

Practice Note 3.2 Seasoning of Debt Securities

| Details | Cross References |

| Issue date: 19 May 2016 Effective date: 19 May 2016 | Part VI of Chapter 3 |

1. Introduction

2. Procedures Applicable to the Seasoning of Debt Securities

Application to List the Initial Issuance of Debt Securities on the Exchange for Seasoning

Application for Confirmation that the Debt Securities are Eligible for Trading by Non-Specified Investors

Application to List Additional Debt Securities for Offer to Non-Specified Investors through a Re-Tap in conjunction with the Commencement of Trading of the Debt Securities by Non-Specified Investors

Application to List Additional Debt Securities for Offer to Non-Specified Investors through a Re-Tap after the Commencement of Trading of the Debt Securities by Non-Specified Investors

Withdrawing debt securities from the seasoning framework

3. Assessment Criteria for Debt Securities to be Eligible for Trading by Non-Specified Investors

4. Disclosures

Added on 19 May 201619 May 2016.

Practice Note 4.1 Profit Forecasts and Right of First Refusals

| Details | Cross References |

| Issue date: 14 September 2011 8 September 2023 Effective date: 29 September 2011 29 September 2023 | Chapter 4 |

- Introduction

- This Practice Note provides guidance in connection with profit forecasts and right of first refusal arrangements for real estate investment trusts (REITs) and business trusts (the "Trusts").

- Profit Estimates, Forecasts and Projections

- Listing Rule 409(3) states that the annual accounts of the investment fund for each of the last 3 financial years, if applicable must be submitted when applying for a listing. In the event the investment fund is unable to provide the annual accounts for each of the last 3 financial years, the investment fund is expected to provide profit estimates, forecasts and/or projections.

- Listing Rule 609(b) further states that the proforma income statement or statement of comprehensive income should be presented for the latest 3 financial years and for the most recent interim period (if applicable) as if the restructured group had been in existence at the beginning of the period reported on. The proforma statement of financial position should be presented as at the date to which the most recent proforma income statement or statement of comprehensive income has been made up. In the event the issuer is unable to present the required proforma financial information, the Exchange may request for the provision of profit estimates, forecasts and projections.

- As a guide, the Exchange will normally expect up to 2 years of full year profit estimates, forecasts or projections to be provided in relation to Rule 409(3) and Rule 609(b).

- Right of First Refusals ("ROFRs")

- For any disposal of assets owned by the controlling unitholder and/or any of its subsidiaries that would fall within the investment mandate ("the competing assets"), a ROFR granted by the controlling unitholder to the Manager of the Trust will effectively mitigate conflicts of interest when the ROFR:—

- gives the Trust the first right to acquire the competing assets from the controlling unitholder and/or any of its subsidiaries; and

- is valid for as long as (i) the Manager remains the manager of the Trust; and (ii) the controlling unitholder together with its related corporations, remains a controlling shareholder of the Manager,

where "related corporation" has the meaning ascribed to it under the Companies Act.

In lieu of the grant of ROFR by the controlling unitholder and/or any of its subsidiaries, the issue manager and Manager of the Trust must demonstrate how alternative measures in place will effectively mitigate conflicts of interest for disposal of competing assets.

- For any disposal of assets owned by the controlling unitholder and/or any of its subsidiaries that would fall within the investment mandate ("the competing assets"), a ROFR granted by the controlling unitholder to the Manager of the Trust will effectively mitigate conflicts of interest when the ROFR:—

Added on 29 September 2011 and Amended on 8 September 2023.

Practice Note 4.2 Corporate Governance Requirements for Real Estate Investment Trusts and Business Trusts

| Details | Cross References |

| Issue Date: 21 December 2018 Effective Date: 1 January 2019 1 January 2022 11 January 2023 | Rule 210(5)(d)(iii) Rule 210(5)(e) Rule 720(5) Transitional Practice Note 3 |

1. Introduction

2. Real Estate Investment Trusts

3. Business Trusts

Added on 1 January 2019 and amended on 11 January 2023.

Practice Note 4.3 Actively Managed Exchange Traded Funds

| Details | Cross References |

| Issue date: 4 December 2023 Effective date: 15 December 2023 | Chapter 4 Rule 703 Appendix 7.1 |

- 1. Introduction

- 1.1This Practice Note provides guidance on the Exchange’s requirements for the listing of actively managed exchange traded funds ("Active ETFs"). An Active ETF is an ETF in which the investment manager makes investment decisions on the portfolio of the ETF without being subject to the set rules of an index.

- 1.2Active ETFs must comply with the listing rules applicable to investment funds.

- 2.Listing Requirements for Active ETFs

- Disclosure

- 2.1An Active ETF shall ensure that it prominently discloses in the prospectus or offering document that the ETF will be actively managed. Such disclosure shall also be made in the marketing materials of the Active ETF.

- Investment style

- 2.2As best practice, an Active ETF should adopt the applicable disclosures and practices set out in MAS Circular No. CMI 32/2020 Good Disclosure Practices for Actively Managed Funds.

- 2.3Notwithstanding paragraph 2.2, an Active ETF shall disclose:

- (a)that it will be an actively managed ETF;

- (b)its investment style, in a manner that would be plainly understood by retail investors;

- (c)its investment limits and constraints and how such limits and constraints may affect the risks and expected returns of the Active ETF; and

- (d)the following, where it is not managed in reference to any benchmark:

- (i)a clear statement that the Active ETF is not managed in reference to any benchmark, with an accompanying explanation of why a reference benchmark is not used; and

- (ii)the associated risks of not being managed in reference to any benchmark.

- 2.4An Active ETF shall also have in place processes to ensure that:

- (a)its directors or senior management, as the case may be, have effective oversight of the Active ETF’s operations; and

- (b)the Active ETF’s promotional materials are clear, fair, balanced, non-misleading and fully comply with relevant rules and regulations.

- Investment manager

- 2.5Rule 404(5) states that the management company (if there is no management company, the sponsor or trustee) must be reputable and have an established track record in managing investments. Generally, the management company (sponsor or trustee) must have been in operation for at least five years.

- 2.6For an Active ETF, the management company must have an established track record in managing other actively managed funds to satisfy Rule 404(5).

- 2.7Rule 404(6) states that the persons responsible for managing the investments of the investment fund must be reputable and have a track record in managing investments for at least 5 years. They must have satisfactory experience in managing the particular types of funds for which listing is sought.

- 2.8For an Active ETF, the persons responsible for managing the investments must have satisfactory experience in managing actively managed funds.

- 3.Continuing Listing Obligations

- Net asset value ("NAV") disclosure

- 3.1Rule 748(1) states that an investment fund must announce via SGXNET its net tangible assets per share or per unit at the end of each week.

- 3.2An Active ETF will be in compliance with Rule 748(1) if it:

- (a)publishes its daily NAV per share or per unit on its website, on the business day following each trading day before the market opens; and

- (b)announces, via SGXNET, its NAV per share or per unit at the end of each week.

- Indicative Net Asset Value ("iNAV") Disclosure

- 3.3An Active ETF shall publish, on its website, the iNAV per share or per unit at least every 15 seconds during trading hours on the Exchange.

- 3.4An Active ETF shall ensure that, as far as practicable, the iNAV provides an accurate indication of the Active ETF’s NAV. In appropriate cases, an Active ETF may use suitable proxies for the calculation of iNAV.

- 3.5An Active ETF shall disclose in its prospectus or offering document:

- (a)the iNAV calculation methodology, including any use of proxies to determine iNAV;

- (b)the relevant risks and limitations of iNAV; and

- (c)a statement that the iNAV is not independently verified by the Exchange.

- Disclosure of portfolio holdings

- 3.6An Active ETF shall publish, at least once a month, its full portfolio holdings on SGXNET and on its website. The report must reflect the full portfolio holdings of the Active ETF with no more than a one month lag.

- 3.7For example, where an Active ETF publishes its full portfolio holdings on 15 November, the published portfolio holdings shall reflect the Active ETF’s actual holdings as at a date no earlier than 16 October.

- 3.8An Active ETF must comply with Rule 703 on the disclosure of material information. Rule 703 states that an issuer must observe the Corporate Disclosure Policy set out in Appendix 7.1. Under Appendix 7.1, the Exchange recognises that there may be limited instances where selective disclosure is necessary. Disclosure may be made to Participating Dealers of the Active ETF to facilitate creation and redemption. Disclosure for market making purposes may only be made to the Designated Market Makers of the Active ETF. These disclosures must be made on a ‘need to know’ basis and subject to appropriate confidentiality restraints. Such arrangements must also be in compliance with insider trading regulations.

- 3.9An Active ETF must have effective controls and segregation of duties to address any conflict of interest that may arise from these arrangements with the Participating Dealers of the Active ETF or the Designated Market Makers of the ETF to ensure that the Active ETF will, at all times, act in the best interest of its unitholders.

- Tracking performance

- 3.10An Active ETF shall publish, no less frequent than on a monthly basis, its performance and where applicable, the performance of its reference benchmark, covering the following periods of time: 3-month, 6-month, 1-year, 3-year, 5-year, 10-year and since inception.

Added on 4 December 2023.

Practice Note 5.1 Term Sheet for Structured Warrants

| Details | Cross References |

| Issue date: Jan 2003 20 June 2011 Effective date: Jan 2003 1 August 2011 | Listing Rule 518 |

1. Introduction

2. Listing Rule 518

"When applying for the listing of structured warrants, an issuer must submit an indicative term sheet to the Exchange for its consideration. The indicative term sheet must set out the principal features of the structured warrants."

3. Disclosure in Term Sheet

4. Format for term sheets

| Issuer's Company Logo |

[Name of Issuer]

XX million European Style [Cash/Physically] Settled [Call/Put] Warrants due [expiry date] relating to [Underlying]

| A. TERMS OF THE ISSUE | |||

| SGX counter name (SGX stock code) | Issue Size | XX million warrants | |

| Type | European style cash/physically settled call/put warrants | Launch Date | dd/mm/yyyy |

| Underlying Reference Asset | (To also state the Reuters Instrument Code (RIC) of the underlying) | Expiry Date | dd/mm/yyyy |

| Board Lot | Initial Settlement Date | dd/mm/yyyy | |

| Issue Price | Expected Listing Date | dd/mm/yyyy | |

| Exercise Price | Settlement Date | dd/mm/yyyy | |

| Price Source for Underlying | Reuters/Bloomberg etc. | Valuation Dates | |

| Last Trading Date | dd/mm/yyyy | Gearing | |

| Entitlement Ratio | xx warrant(s) : 1 share/index unit | Volatility (Implied & Historical) | |

| Warrant Agent | Premium | ||

| Clearing System | The Central Depository (Pte) Limited | Listing | SGX-ST |

| Settlement Method | Settlement Currency | ||

| Governing Law | Reference Currency | ||

| Cash Settlement Amount | |||

| Form | |||

| Final Reference Level | |||

| Exchange Rate | |||

| Adjustments and Extraordinary Events | |||

| Further Issuance | |||

| Documents | The Base Listing Document, Addendum and the relevant Supplemental Listing Document are/will be available for inspection at the following address: [Address] | ||

| Selling Restrictions | |||

| B. INFORMATION ON THE ISSUER AND GUARANTOR | |

| Name of Issuer | |

| Name of Guarantor (if any) | |

| Credit Rating of the Issuer / Guarantor | Moody's Investors Service Inc.: Standard & Poor's Ratings Group: Fitch Ratings Ltd., London: |

| Issuer / Guarantor Regulated by | |

| Issuer's / Guarantor's Website and any other Contact Information | |

| C. INFORMATION ON MARKET MAKING | |

| Name of Designated Market Maker | |

| Maximum bid and offer spread | |

| Minimum quantity subject to bid and offer spread | |

| Circumstances where a quote will/may not be provided | |

| D. PRODUCT SUITABILITY | |

| WHO IS THE PRODUCT SUITABLE FOR? • This product is only suitable for investors who: • believe that the price level of the underlying reference asset will increase/decrease and are seeking a short term leveraged exposure to the underlying reference asset. | Further Information |

| Key Product Features | |

| WHAT ARE YOU INVESTING IN? • You are investing in cash-settled call/put warrants that allow you to take advantage of any increase/decrease in the price level of the underlying reference asset, which is <Name of underlying>. | Information relating to the underlying can be obtained from Refer to Section xx on Pg xx of the Supplemental Listing Document. |

| Calculation of Cash Settlement Amount | |

| • The Cash Settlement Amount in respect of each Exercise Amount of Warrants, shall be an amount (if positive) payable in the Settlement Currency equal to the Entitlement in respect of each Exercise Amount for the time being multiplied by: WHAT WOULD YOU GAIN OR LOSE IN DIFFERENT SITUATIONS? (i) (a) the arithmetic mean of the closing prices of one underlying unit (as derived from the daily publications of the Relevant Stock Exchange subject to any adjustments to such closing prices determined by the Issuer to be necessary) for each Valuation Date LESS (b) the Exercise Price (subject to adjustment as provided in the Terms and Conditions of the Warrants) and divided by (ii) the Exchange Rate. • Best case scenario: • The value of the underlying index increases substantially resulting in a significant increase in the price of the Warrants. You then sell the warrants and realise a profit. The issuer is required to provide liquidity in the warrants to ensure that there will generally be a market price available for the purchase and sale of the warrants. • Worst case scenario: • If you buy the warrants and the value of the underlying reference asset decreases sharply. If you have not sold the warrants, you will lose your entire investment. | |

| E. KEY RISKS | |

| WHAT ARE THE KEY RISKS OF THIS INVESTMENT? | |

| Market Risks | |

| • Market price of the warrants may be affected by many factors • Investors should note that the market price of the warrants may be affected by different factors, including but not limited to the level and volatility of the underlying reference asset, the time left to the expiry of the warrants, the strike level of the warrants, the prevailing interest rate climate, the currency exchange rates and the creditworthiness of the Issuer. • You may lose your entire investment • If the underlying reference asset falls to levels such that the cash settlement amount at expiry is calculated to be less than or equal to zero, you will lose your entire investment. • You are exposed to the credit risk of <Issuer> • The warrants are unsecured contractual obligations of <Issuer> and of no other person. If <Issuer> is unable to meet its obligations under the warrants, you may lose your entire investment. • As <Issuer> is not incorporated in Singapore, any insolvency proceedings in respect of <Issuer> will be subject to foreign insolvency laws and procedures. | |

| Liquidity Risks | |

| • The secondary market may be illiquid. • The issuer acting through its designated market-maker may be the only market participant buying and selling the warrants. Therefore, the secondary market for the warrants may be limited and you may not be able to realise the value of the warrants. Do note that the bid-ask spread increases with illiquidity. | |

| Product Specific Risks | |

| • Exchange rate risks • There may be exchange rate risks as the warrants will be issued and traded in Singapore dollars while <the underlying> are traded in <foreign currency>. The value of the warrants may therefore be affected by, amongst other factors, the relative exchange rates of the Singapore dollar and the <foreign currency>. | Refer to “Risk Factors” on Pg xx in the Supplemental Listing Document for the complete list of risks and details of the risks. |

| F. FEES AND CHARGES | |

| WHAT ARE THE FEES AND CHARGES OF THIS INVESTMENT? • Normal transaction and brokerage fees apply, similar to fees that you would pay for other transactions on SGX-ST. | |

Amended on 1 August 20111 August 2011 and 7 February 20207 February 2020.

Practice Note 6.1 Disclosure Requirements: Pre-listing Information

Cross-referenced from Listing Rules 603 and 606

1. Introduction

1.1 The Fifth Schedule of the Securities & Futures (Offers of Investments) (Securities and Securities-based Derivatives Contracts) Regulations 2018 stipulates prospectus disclosure requirements. In addition to complying with these regulations, the Exchange may require additional information to be disclosed, either to enable the Exchange to determine whether an issuer meets the SGX-ST's admission criteria, or to provide sufficient information for the secondary market as set out under the Exchange's continuing listing rules. To assist issuers, this Practice Note lists some of the disclosures that the Exchange will consider when reviewing an application. It is not an exhaustive list.

1.2 In instances where the Exchange requires further information to be disclosed, the issuer is to decide whether it is more appropriate to disclose such information in the prospectus or as a pre-quotation announcement via SGXNET before listing.

1.3 [Deleted]

2. Disclosure Relating to Admission Criteria

2.1 In determining whether an issuer meets the requirements in Rule 203, the Exchange will need to make an assessment of the viability of the issuer's business. To enable the Exchange to make this assessment:

2.1.1 An issuer which has not been profitable may have to disclose the group's burn rates and expenditures and for how long it is estimated that the proceeds will support the group's operations.

2.1.2 An issuer will have to consider if the viability of its business depends on any governmental or regulatory approvals and whether such approvals, if not granted, would have a material adverse impact on the Group. The issuer may be required to obtain such approvals before its listing application.

2.1.3 An issuer may have to quantify and disclose the effects on its business of material risks occurring.

2.2 In relation to Rule 210 (2) to (4), if any of the financial statements of any entity included in the pro forma financial statements is unaudited, the scope of work done on the unaudited financial statements by the auditor and the reasons why unaudited accounts have been used may require further disclosure.

2.3 Rule 210(3)(d) sets out the requirement that an issuer must not change or propose to change its financial year end to take advantage of exceptional or seasonal profits to show a better profit record. If an issuer proposes to change its financial end, or if it has done so for the recent three completed financial years, it must inform the Exchange and state the reasons for these changes. The Exchange may require the information to be disclosed.

2.4 Rule 210(4)(a) sets out the requirement for an issuer to have a healthy financial position with no shortfall in working capital. To enable the Exchange to determine if an issuer complies with Rule 210(4)(a), an issuer will have to disclose any shortfall in working capital, the reasons for the shortfall, the company's views on the viability of the issuer, and the bases for these views.

2.5 Rule 210(5) sets out the requirements for an issuer's directors and management. To enable the Exchange to determine if the issuer meets Rule 210(5), the issuer will have to disclose information such as in Rule 704(7), (8) and (9). In the disclosure of past working experience, the issuer may have to disclose the specific areas of responsibility, designation, period of employment, a brief description of the employer's business and scale of operations, and any other relevant information to enable the Exchange to assess whether the issuer's directors and executive officers have the experience and expertise to meet Rule 210(5)(a).

2.6 If the prospectus, offering memorandum or introductory document refers to any material weaknesses in the issuer's internal control and accounting systems, there must be adequate disclosure of such weaknesses and the steps to address them in the prospectus, offering memorandum or introductory document pursuant to Rule 246(9).

2.7 A confirmation from the issue manager must be submitted to the Exchange pursuant to Rule 246(4). If a profit forecast has been made, the issue manager may be asked to confirm that it is satisfied that the profit forecast has been made by the directors after reasonable enquiry.

2.8 In relation to the structure of the IPO, the Exchange will look at the following matters when considering whether an eligibility-to-list letter will be issued:

2.8.1 The specific circumstances under which the termination clause in an underwriting agreement may be invoked.

2.8.2 For a non-underwritten issue, whether it is likely that the spread and distribution guidelines in Rule 210(1)(a) will be met, and whether there is disclosure that the issue is not underwritten and the reasons.

2.8.3 What disclosure is made if the issuer makes, or intends to make, a preferential offer or allotment of securities to any group of targeted investors (including persons listed in Rule 240, employees, or persons having a preferential relationship with the issuer such as the reporting accountant, valuer and solicitor). The issuer may be required to disclose the reasons for the allocation or allotment, whether they are made or to be made at a discount to the issue price, the number of securities allocated and allotted or to be allocated and allotted, and the basis of allocation and allotment.

2.8.4 Where material, the impact on earnings per share and net tangible assets per share of the aggregate remuneration of controlling shareholders and their relatives (where these expenses are expected to increase after the offering of its securities) who have not entered into service agreements with the Company and of any proposed service agreements.

3. Disclosure Showing Compliance with Continuing Listing Rules

3.1 To comply with Rules 712 to 718, an issuer must appoint suitable auditors for the group and for significant foreign-incorporated subsidiaries and associated companies. The Exchange will consider the disclosures made in relation to the auditors (such as the names of auditors for the group, its principal subsidiaries and associated companies and the date of appointment and name of the company's audit partner) when assessing the issuer's compliance.

3.2 Rule 806 sets out the limits under which an issuer can issue shares under a general mandate from shareholders. If an issuer wishes to obtain a general mandate under Rule 806 and includes this information in its IPO prospectus or offering memorandum, the Exchange will treat Rule 806 as satisfied by reason of investors subscribing for the issuer's securities. Otherwise, the issuer must take steps to meet the requirements of Rule 806 upon its listing on SGX-ST.

3.3 Rules 843 to 861 set out the requirements for Share Option Schemes or Share Schemes. If an issuer's IPO prospectus or offering memorandum includes the disclosure required under Rules 855–858 and 861, the Exchange will treat Rule 843(3) as satisfied by reason of investors subscribing for the issuer's securities. Otherwise, the issuer must take steps to meet the requirements of Rule 843(3) upon its listing on SGX-ST.

3.4 Rule 920 sets out the requirements for seeking a general mandate from shareholders for recurrent interested person transactions. If an issuer's IPO prospectus or offering memorandum includes the disclosure required under Rule 920, the Exchange will treat Rule 920 as satisfied by reason of investors subscribing for the issuer's securities. Otherwise, the issuer must take steps to meet the requirements of Rule 920 upon its listing on SGX-ST.

3.5 To comply with Rule 1207(11), an issuer must disclose the breakdown of the aggregate value between freehold and leasehold assets and other information. The Exchange will consider the disclosures made in relation to freehold and leasehold assets when assessing the issuer's compliance.

4. Transitional Arrangements

4.1 [Deleted]

Amended on 29 September 2011, 7 February 2020 and 29 October 2025.

Practice Note 6.2 Prospectus Disclosure Requirements and Guidance for Life Science Companies

Cross-referenced from Listing Rule 210(8) and Chapter 6

1. Introduction

1.1 This Practice Note sets out the prospectus disclosure requirements and guidance of what constitutes the successful development of products beyond the concept stage for life science companies seeking a listing on the Exchange.

2. Disclosure Guidelines

2.1 The issuer should disclose in its prospectus:

(1) Details of its operations in laboratory research and development, to the extent material to investors, including:

(a) details of patents granted or details of progress of patent applications. Unless otherwise required under the Securities and Futures (Offers of Investments) (Securities and Securities-based Derivatives Contracts) Regulations 2018, such details need not be disclosed if disclosure would result in the issuer disclosing highly sensitive confidential information. In that case, the issuer must disclose the reasons for the non-disclosure; and

(b) in relation to its identified products, details of the successful development of at least one of its identified products beyond the concept stage;

(2) Details of the relevant expertise and experience of its key management and technical staff;

(3) The salient terms of any service agreements between the issuer and its key management and technical staff;

(4) The safeguards and arrangements that the issuer has in place, in the event of the departure of any of its key management or technical staff;

(5) The risk and impact, financially or otherwise, from such departure of key management or technical staff on the group's business and operations;

(6) Information on whether the issuer has engaged in collaborative research and development agreements with other organisations, to the extent material to investors;

(7) A comprehensive description of each product, the development of which may have a material effect on the future prospects of the issuer;

(8) The directors' opinion which must state, without requiring a profit forecast, that in their reasonable opinion, the working capital available to the issuer, as at the date of lodgement of the prospectus, is sufficient for the present requirements and for at least 18 months after listing; and

(9) Where relevant and appropriate, an expert technical assessment and industry report.

3. Guidance on what constitutes the successful development of products beyond the concept stage

3.1 For the purposes of Rule 210(8)(d)(ii) and paragraph 2.1(1) above, the Exchange would consider a life science product to have been developed beyond the concept stage if it has met the milestones specified below for the product, including (a) pharmaceuticals (small molecule drugs), (b) biologics, and (c) medical devices (including diagnostics), as categorised by a competent authority:

(1) Drug (including pharmaceuticals and biologics): (a) Completed Phase I clinical trials for a new drug or at least one clinical trial for a drug based on a previously approved product or biosimilar, and (b) a competent authority has no objection to the commencement of Phase II (or later) clinical trials;

(2) Medical device (including diagnostic devices): (a) Completed at least one clinical trial for a Class II or above medical device (under the classification criteria of the relevant competent authority), and (b) a competent authority has no objection to commencement of the next phase of clinical trials, or sales of the device; and

(3) A life science product that does not fall under the “Drug” or “Medical device” categories based on the classification of a competent authority will be assessed on a case-by-case basis with reference to all relevant facts and circumstances, including whether (a) it has been developed beyond the concept stage by reference to the developmental milestones set out in paragraphs 3.1(1) and (2) above, and (b) there is an appropriate framework or objective indicators to enable investors to make an informed investment decision.

3.2 References to “competent authority” in paragraph 3.1 above means the Singapore Health Sciences Authority, the U.S. Food and Drug Administration, the China Food and Drug Administration, or the European Medicines Agency, as well as any other national or supranational authority that the Exchange may, at its discretion, consider as a competent authority for the purpose of paragraph 3.1 above (depending on the nature of the life science product). This also includes any institution, body, or committee duly authorised or recognised by, or registered with, a competent authority to conduct, assess, and supervise clinical trials in the relevant clinical fields.

Amended on 29 September 2011 and 29 October 2025.

Practice Note 6.3 Requirements for Mineral, Oil and Gas Companies

| Details | Cross References |

| Issue date: 5 September 2013 Effective date: 27 September 2013 | Listing Rules 624, 749, 750, 1014(2) and 1207(21) |

1. Introduction

The issuer is required to make an announcement when any of the above situation occurs and will thereafter be required to comply with all the continuing listing rules applicable to mineral, oil and gas companies.

2. General Requirements for Disclosure of Reserves, Resources or Exploration Results

3. Additional Disclosure Requirements for Offer Document

4. Additional Continuing Obligations

5. Qualified Person's Report

| Asset name/ Country | Issuer's interest (%) | Development Status | Licence expiry date | Licence Area | Type of mineral, oil or gas deposit | Remarks |

6. Summary Qualified Person's Report

7. Valuation Report

8. Farm-in and Farm-out Transactions

Added on 27 September 201327 September 2013 and amended on 23 August 201823 August 2018.

Practice Note 6.4 Requirements for Special Purpose Acquisition Companies

Cross-referenced from Listing Rules 210(11)(a), 210(11)(i)(i) and (v), 626 and 754(3)

1. Introduction

This Practice Note sets out guidance on the requirements for SPACs. Issuers should apply the principles outlined in the Practice Note flexibly and sensibly.

2. Guidance on Suitability Assessment Factors of a SPAC

2.1 The Exchange may, in its discretion, take into account any factor it considers relevant in assessing the suitability of a SPAC for listing. In exercising its discretion, the Exchange will consider factors including, but not limited to, the following:

(a) the profile including the track record and repute of the founding shareholders and experience and expertise of the management team of the issuer;

(b) the business objective and strategy of the issuer;

(c) the nature and extent of the management team’s compensation;

(d) the extent and manner of the founding shareholders and the management team’s securities participation in the issuer, including equity interests acquired by the founding shareholders, management team and their associates at nominal or no consideration prior to or at the IPO;

(e) the alignment of interests of the founding shareholders and the management team with the interest of other shareholders;

(f) the proportion of rewards to be enjoyed by the founding shareholders, the management team, and their associates;

(g) the amount of time permitted for completion of the business combination prior to the liquidation distribution;

(h) the dilutive features and events of the issuer, including those which may impact shareholders and whether there are any mitigants for such dilution;

(i) the percentage of amount held in the escrow account that must be represented by the fair market value of the business combination;

(j) the provisions in the Articles of Association and other constituent documents of the issuer (including comparability of shareholder protection and the liquidation rights with that of Singapore-incorporated companies, and whether the issuer will be subject to the Insolvency, Restructuring and Dissolution Act of Singapore ("IRDA") for liquidation procedures or the incorporation of such equivalent provisions of the IRDA);

(k) the intended use of IPO proceeds not placed in the escrow account;

(l) the escrow arrangements governing the funds in the escrow account; and

(m) such other factors as the Exchange believes are consistent with the goals of investor protection and the public interest.

2.2 The management team should have the appropriate experience and track record and demonstrate that it will be capable of identifying and evaluating acquisition targets and completing the business combination sustainably based on the business objective and strategy disclosed in the prospectus. The issue manager must demonstrate that the management team has the requisite collective experience and track record, which include having:

(a) sufficient and relevant technical and commercial experience and expertise;

(b) positive track record in relevant industry and business activities including (i) specific contribution to business growth and performance; (ii) ability to manage relevant business operations risks; and (iii) ability to identify and develop acquisition opportunities; and

(c) positive corporate governance and regulatory compliance history.

2.3 In demonstrating the suitability of a SPAC for listing, the issue manager must consider the SPAC proposal holistically and take into consideration factors including those set out in paragraphs 2.1 and 2.2 above.

3. Additional Requirements for Escrow Agreement

3.1 The escrow agreement provisions should include the following:

(a) the governing law is Singapore law;

(b) the obligation by the escrow agent to disclose any confidential or other information to the Exchange upon request;

(c) the obligation by the escrow agent to take appropriate measures to ensure proper safekeeping, custody and control of the funds held in the escrow account, including that proper accounting records and other related records as necessary are retained in relation to the escrow account; and

(d) where the escrow agent resigns or ceases to act for the issuer prior to the liquidation of the escrow account, the escrow agent is required to give three months’ notice in writing to the Exchange if it wishes to resign, stating its reasons for resignation. The issuer is similarly required to give three months’ notice in writing to the Exchange if it wishes to terminate the escrow agent’s appointment, stating its reasons for termination. Any resignation or termination arrangement shall be carried out in compliance with Rule 210(11)(i)(iii).

4. Contents of Quarterly Updates via SGXNET

4.1 The SGXNET announcement update required under Rule 754(3) must include the following information:

(a) general description of the issuer’s operating expenses and the total amounts spent;

(b) detailed description, analysis and discussion on the top 5 highest amount of operating expenses;

(c) a statement by the directors of the issuer on whether there is any circumstance that has affected or will affect the business and financial position of the issuer;

(d) commentary from the directors of the issuer on the direction of the business combination, including any change to the objective, strategy, status and capital of the issuer;

(e) in relation to the funds placed in the escrow account, the composition of the permitted investments, the issuer’s investment strategy, market and credit risks for such investments; and

(f) brief explanation of the status of (i) utilisation of proceeds from IPO, compared with the disclosure of the intended use of proceeds in the prospectus, segregated between those placed in the escrow account from those which are not, including explanation for any material deviation in the use of proceeds; and (ii) utilisation of any interests and income derived from the amounts placed in the escrow account.

5. Event of Material Change prior to Business Combination

5.1 Examples of circumstances that may constitute an event of material change as described in Rule 210(11)(n)(i) includes:-

(a) a change in control of the founding shareholders; and

(b) resignation and/or replacement of key members of the management team (which are not due to natural cessation events).

The circumstances above are not intended to be exhaustive. In the event of any uncertainty, the issuer should consult and clarify with the Exchange as soon as possible. The Exchange retains discretion to determine a circumstance an event of material change.

6. Circumstances for Escrow Funds Draw Down

6.1 The issuer may draw down the amount placed in the escrow account prior to completion of a business combination in the following circumstances:

(a) upon election by a shareholder to have its shares redeemed by the issuer at the time of business combination vote and if the business combination is approved and completed within the permitted time frame;

(b) upon a liquidation of the issuer;

(c) solely in respect of the interest earned and income derived from the amount placed in the escrow account, such interest and income is permitted for draw down by the issuer as payment for administrative expenses incurred by the issuer in connection with the IPO, general working capital expenses and related expenses for the purposes of identifying and completing a business combination; and

(d) upon such other exceptional circumstances apart from those stipulated in (a) to (c).

The issuer must obtain (i) the Exchange’s approval; and (ii) at least 75% of the votes cast by shareholders at a general meeting to be convened, for a draw down on the amount held in escrow account for the purposes of (d). For the purpose of voting on a draw down under (d), the founding shareholders, the management team, and their associates, are not permitted to vote with shares acquired at nominal or no consideration prior to or at the IPO of the issuer.

7. Additional Disclosure Requirements for Shareholders’ Circular for the Business Combination

7.1

(a) Aggregate fair market value of the business combination in monetary terms and as a percentage of the amount held in the escrow account, net of any taxes payable (including basis of such value);

(b) The details of how the target business(es) or asset(s) was identified, evaluated and decided for business combination;

(c) A statement on whether the selection criteria or factors of the business combination are in line with those disclosed in the prospectus and relevant commentary on any variations from such selection criteria or factors, if any;

(d) The status of the utilisation of proceeds raised from the IPO, compared with the disclosure of the intended use of proceeds in the prospectus, segregated between those placed in the escrow account from those which are not, including explanation for any material deviation in the use of proceeds;

(e) Information required in Rules 1015(5)(a) and (b);

(f) Valuation methodologies (if applicable) used in valuing the business combination, and explanation if such methodologies is not in line with that disclosed in the prospectus of the IPO;

(g) The limit as to the maximum number of shares with respect to which an independent shareholder, together with any associates or persons acting jointly or in concert, may exercise a redemption right (if applicable);

(h) Where an independent valuer is not appointed, statements from the financial adviser and the directors of the issuer on why obtaining an independent valuation on the business combination is not necessary and the basis for forming such views;

(i) A responsibility statement by the founding shareholders and the directors of the issuer, the proposed directors of the resulting issuer, and the financial adviser, in the form set out in Practice Note 12.1;

(j) The details of any additional financing including issuance of securities and credit facility entered into, including the salient terms and proposed utilisation of funds;

(k) Voting, redemption and liquidation rights of shareholders in relation to the business combination. This includes:

(i) basis of computation for pro rata entitlement in the event of a redemption of shares and liquidation of the issuer;

(ii) any threshold on the aggregate percentage of shares owned by shareholders who exercise their redemption rights beyond which the issuer will not proceed with the business combination, and the basis for the quantum set;

(iii) the process for those who elect to redeem their shares for cash and the timeframe for payment; and

(iv) the terms and procedures for the liquidation distribution upon failure to meet the permitted time frame to complete a business combination;

(l) Prominent disclosure on dilutive impact to shareholders arising from known dilutive features and events including (i) additional financing obtained for the business combination and new issuance of securities; (ii) the conversion of any warrants or other convertible securities issued by the issuer in connection with the IPO including the maximum percentage dilution limit established in accordance with Rule 210(11)(k) and the basis for the established limit; and (iii) the aggregate equity interests in the issuer acquired by the founding shareholders, management team, and their associates at nominal or no consideration;

(m) Pertinent terms of any side voting arrangement or agreement respectively entered into by the SPAC and/or founding shareholders with other shareholders including the impact of such arrangement or agreement to shareholders;

(n) Potential conflicts of interest between the issuer and the founding shareholders, the directors and the management team, and their associates (including measures (if any) to address potential conflicts of interest where the issuer pursues a business combination target in which the aforementioned persons or entity have an interest in);

(o) Potential conflicts of interests a financial adviser and underwriters may have in providing additional services to the issuer such as identifying potential business combination targets, including description of the additional services, fees and commissions, and whether any commissions were conditional and deferred;

(p) The details of any benefits and compensation received by the founding shareholders, the directors and the management team, and their associates arising from the completion of the business combination; and

(q) The details of the ownership interest in and continuing relationship of the founding shareholders, the directors and the management team, and their associates with the resulting issuer.

Added on 3 September 2021 and amended on 29 October 2025.

Practice Note 7.1 Continuing Disclosure

Cross-referenced from Listing Rule 703 and Appendix 7.1

1. Introduction

1.1 This Practice Note provides guidance on the continuing obligations of issuers in respect of Listing Rule 703 on the disclosure of material information and Appendix 7.1 on the Exchange's Corporate Disclosure Policy. Issuers should apply the principles outlined in the Practice Note flexibly and sensibly. Issuers are still obliged to make their own judgments when determining whether a particular piece of information is material and requires disclosure. The purpose of timely disclosure of material information is to allow the operation of a fair, orderly and transparent market. The following discussion should be read in that light.

1.2 In case of doubt, issuers are encouraged to consult the Exchange with respect to the application of the rules.

2. Interaction with the SFA

2.1 The Exchange's continuous disclosure rules are given statutory backing under Section 203 of the SFA. A breach of the Exchange's continuous disclosure obligations may be considered an offence under the SFA and may have serious legal consequences for the issuer and its officers.

3. Guidance on what constitutes material information

3.1 Rule 703(1) requires an issuer to announce any information known to the issuer concerning it or any of its subsidiaries or associated companies which:

(a) is necessary to avoid the establishment of a false market in the issuer's securities (Rule 703(1)(a)). Appendix 7.1 explains that a false market may exist if information is not made available that would, or would be likely to, influence persons who commonly invest in securities in deciding whether or not to subscribe for, or buy or sell the securities. Such information may be referred to as “trade-sensitive” information; or

(b) would be likely to materially affect the price or value of the issuer's securities (Rule 703(1)(b)). Information would be likely to have such material price impact if it is likely to prompt a significant change in the price or value of the issuer's securities. Such information may be referred to as “materially price-sensitive” information.

3.2 Information is considered material and required to be disclosed under Rule 703(1) as long as it is either trade-sensitive or materially price-sensitive. Issuers must exercise judgment when deciding whether information is material using both these tests. If an issuer is unable to ascertain whether the information is material, the recommended course of action is to announce the information via SGXNET.

Materially price-sensitive information

3.3 The test of whether information is materially price-sensitive is an objective one. Issuers must assess, on an ex-ante basis, if the information is likely to have a material impact to the price of its securities. It requires issuers to foresee how investors will react to any particular information when it is disclosed.

3.4 Issuers' assessment should consider the significance of the information in the context of the issuer's business. Information that might be immaterial to another entity may be material to the issuer, as the impact to the issuer would depend on its business and market expectations of the issuer's performance. Issuers should therefore rely on experience and knowledge of past market impact of similar type of disclosures made under comparable circumstances to form their assessment.

3.5 Issuers should also consider prevailing market conditions in their assessment of price impact. Factors to be considered could include liquidity of the issuer's securities, macroeconomic or sector-specific factors and the general market sentiment. Information that might be considered immaterial during stable macroeconomic and industry conditions but could become material when the industry is undergoing extreme volatility or a protracted downcycle.

3.6 For the purposes of assessing if a breach of Rule 703(1)(b) has occurred, the Exchange will examine actual market reaction to the information when it is disclosed. If information that is disclosed does not result in a significant change in price of the securities, then it is likely that the information may not be considered to be materially price-sensitive. The Exchange may examine market reaction over a length of time suitable for the liquidity of the securities. For example, if the securities are not actively traded, it may be necessary to look at a longer period of activity.

Trade-sensitive information

3.7 The test for trade-sensitive information does not focus on the potential price impact of information, but rather the likelihood that the omission or failure to disclose such information will result in the market trading on an uninformed basis. Such information must be disclosed to avoid the establishment of a false market in the securities. As set out in the Corporate Disclosure Policy in Appendix 7.1, a false market may exist if information is not made available that would, or would be likely to, influence persons who commonly invest in securities in deciding whether or not to subscribe for, or buy or sell the securities.

3.8 The test of whether information is trade-sensitive is also an objective one. The question to ask is, is the information expected to influence an investor who commonly invests in securities to subscribe for, or buy or sell the issuer's securities in reliance of that information, if it had been known beforehand? If so, the information is trade-sensitive.

3.9 The term “persons who commonly invest” is defined in Section 214 of the SFA. MAS has also issued guidelines on the interpretation of the term, which set out that the class of investors that are considered “persons who commonly invest” will be product-specific, and will include retail investors for listed shares. The Exchange will employ the same definition and interpretation for the purposes of the Listing Rules.

3.10 For practical purposes, information which is materially price-sensitive would likely also be trade-sensitive. If information has a material price impact, it would also influence investors in their investment decisions. However, trade-sensitive information need not necessarily have a material price impact. For example, information on a transaction may have a neutral effect on share price, but may be considered to be trade-sensitive if the transaction is material to the issuer and likely to influence investors' decision to invest in the securities.

3.11 Therefore, the Exchange's assessment of whether information is trade-sensitive is broader than that for materially price-sensitive information. The test for trade-sensitive information assesses the likelihood that the information, if undisclosed, will cause investors to trade on an uninformed basis. In that regard, the Exchange may consider information to be trade-sensitive, even if there is no significant market reaction to the information when disclosed.

3.12 Issuers should make their own judgment on whether information would be trade-sensitive. In particular, an issuer should consider whether a person who commonly invests in that security would likely trade in the security in reliance of that piece of information. As with the test for materially price-sensitive information, which requires issuers to assess the impact of the information to the price of the issuer's securities, issuers should review the information in the context of the issuer's business as well as prevailing market conditions in making their assessment.

4. Exceptions to Rule 703(3)

4.1 Rule 703(3) allows exception from disclosure provided that three conditions are met. These conditions are that (a) a reasonable person would not expect information to be disclosed, (b) the information is confidential and (c) the information either (i) concerns an incomplete proposal or negotiation, (ii) comprises matters of supposition or is insufficiently definite to warrant disclosure, (iii) is generated for internal management purposes, or (iv) is a trade secret. Information should be disclosed if any one of the three conditions is not satisfied.

Confidential information

4.2 Where material, non-public information has been reported but not released via SGXNET, the Exchange will require clarification from an issuer to ensure that the market is trading on accurate information. If information has been reported in a reasonably specific manner or from a reliable identified source, the Exchange is likely to consider that the information is no longer confidential. For example, should the report contain the salient terms of a contract or the information has been attributed to the issuer or a reliable source, this indicates that there may have been a leakage of material information. Leakage of material information would result in a loss of confidentiality and thus an issuer can no longer rely on the confidentiality exemption under Rule 703(3).