Practice Note 2.6.3(1)(c) — Pre-Execution Checks

| Issue Date | Cross Reference | Enquiries |

| Added on 22 September 2006 and amended on 15 March 201315 March 2013, 14 November 201614 November 2016, 29 July 2022 and 25 April 2023. | Rule 2.6.3(1)(c) | Please contact Member Supervision: Facsimile No : 6538 8273 E-Mail Address: membersup@sgx.com |

1. Introduction

2. Pre-Execution Checks

Amended on 15 March 201315 March 2013, 14 November 201614 November 2016, 29 July 2022 and 25 April 2023.

Practice Note 2.6.3(1)(d) — Error-Prevention Alerts

| Issue Date | Cross Reference | Enquiries |

| Added on 15 March 201315 March 2013 and amended on 14 November 201614 November 2016. | Rule 2.6.3(1)(d) | Please contact Member Supervision: Facsimile No : 6538 8273 E-Mail Address: membersup@sgx.com |

1. Introduction

2. Types of Error-Prevention Alerts

Added on 15 March 201315 March 2013 and amended on 14 November 201614 November 2016.

Practice Note 2.6.3(1)(g) — Procedures for Separation of Key Functions

| Issue Date | Cross Reference | Enquiries |

| Added on 22 September 2006 and amended on 15 March 201315 March 2013. | Rule 2.6.3(1)(g) | Please contact Member Supervision: Facsimile No : 6538 8273 E-Mail Address: membersup@sgx.com |

1. Introduction

2 Separation of Key Functions

Amended on 15 March 201315 March 2013.

Practice Note 2.6.3(2) — Firm-Level Monitoring of Capital and Financial Requirements and Prudential Limits

| Issue Date | Cross Reference | Enquiries |

| Added on 15 March 201315 March 2013. | Rule 2.6.3(2) | Please contact Member Supervision: Facsimile No : 6538 8273 E-Mail Address: membersup@sgx.com |

1. Introduction

2. Firm-Level Monitoring of Capital Requirements and Prudential Limits

Amended on 15 March 201315 March 2013.

Practice Note 2.6.6 — Business Continuity Requirements

| Issue Date | Cross Reference | Enquiries |

| Added on 22 January 200922 January 2009 and 1 April 20141 April 2014. | Rule 2.6.6 | Please contact Member Supervision: Facsimile No : 6538 8273 E-Mail Address: membersup@sgx.com |

1. Introduction

2. Business Continuity Plan

* Critical functions refer to business functions whose failure or disruption may incapacitate the firm.

^ Key service providers refer to third-parties who are performing functions that are not normally carried out by Member firms internally, but are critical to Member firms' ability to carry on business operations. For example, IT system hardware/software vendors.

# Outsourcing service providers refer to third parties who are performing functions that would normally be performed by Members firms internally. For example, Operations and Technology.

3. Emergency Contact Persons

Refer to Appendix A of Practice Note 2.6.6.

Practice Note 2.6.6; 3.3.3; 3.3.9; 3.3.10; 3.3.23 — Operational Requirements for Trading Members Referred to in Rule 2.4.1(b)

| Issue Date | Cross Reference | Enquiries |

| Issued on 1 April 20141 April 2014 | Rule 2.6.6 Rule 3.3.3 Rule 3.3.9 Rule 3.3.9A Rule 3.3.10 | Please contact Member Supervision:— Facsimile No : 6538 8273 |

1. Introduction

2. Factors that the Exchange considers relevant

3. Determination of Comparability of Operational Requirements

4. Business Continuity Requirements

Emergency Contact Persons

Added on 1 April 20141 April 2014.

Appendix A to Practice Note 2.6.6; 3.3.3; 3.3.9; 3.3.10; 3.3.23

Business Continuity Management Emergency Contact Person(s)

Company Name: __________________________________________________

| Name | Department | Designation | Office No. | Mobile No. | E-mail address |

Prepared by:

_______________________________

Name: _________________________

Designation: ___________________

Added on 1 April 20141 April 2014.

Practice Note 2.8.1 — Direct Market Access And Sponsored Access

| Issue Date | Cross Reference | Enquiries |

| Added on 15 March 201315 March 2013. | Rule 2, Rule 8.1 | Please contact Member Supervision: Facsimile No : 6538 8273 E-Mail Address: membersup@sgx.com |

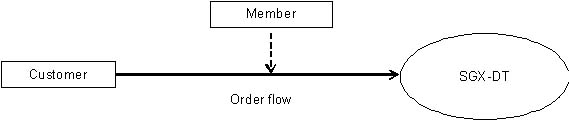

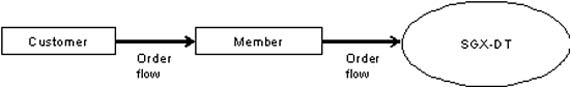

1. Introduction

2. Direct Market Access

Amended on 15 March 201315 March 2013.

Practice Note 3.3.5 — Customer Education

| Issue Date | Cross Reference | Enquiries |

| Added on 22 September 2006 and amended on 15 March 201315 March 2013. | Rule 3.3.5 | Please contact Member Supervision: Facsimile No : 6538 8273 E-Mail Address: membersup@sgx.com |

1. Introduction

2. Information, Guidance and Training

Amended on 15 March 201315 March 2013.

Practice Note 3.3.16 — Transfer of Unsuccessful Give-Up Trades to House Account

| Issue Date | Cross Reference | Enquiries |

| Added on 22 September 2006. | Rule 3.3.16 | Please contact Member Supervision: Facsimile No : 6538 8273 E-Mail Address: membersup@sgx.com |

1. Introduction

2. Treatment of Unsuccessful Give-Up Trades

Practice Note 3.4.3A — Processes for Review of Orders and Trades

| Issue Date | Cross Reference | Enquiries |

| Added on 15 March 201315 March 2013. | Rule 3.4.3A | Please contact Member Supervision: Facsimile No : 6538 8273 E-Mail Address: membersup@sgx.com |

1. Introduction

2. Guidance on processes

3. Parameters to assist in detecting suspicious trading behaviour

Amended on 15 March 201315 March 2013.

Practice Note 3.4.8 — Good Faith Bids and Offers

| Issue Date | Cross Reference | Enquiries | |

| Added on 22 September 2006. | Rule 3.4.8 | Please contact: Market Surveillance Mr Christopher Chong 6236-8316 Ms Sally Lim 6236-5172 Enforcement E-Mail Address : enforcement@sgx.com |

1. Introduction

2. Good Faith Bids and Offers

Market is at 2505 bid and 2507 offer. The Approved Trader enters a 2506 bid and withdraws it within a short span of time with the intention to trigger stop orders or to give a false impression of the market.

Amended on 25 October 201225 October 2012 and 7 July 20157 July 2015.

Practice Note 3.4.9 — Fictitious Transactions Without Change in Ownership

| Issue Date | Cross Reference | Enquiries |

| Added on 22 September 2006. | Rule 3.4.9 | Please contact: Market Surveillance Mr Christopher Chong 6236-8316 Ms Sally Lim 6236-5172 Enforcement E-Mail Address : enforcement@sgx.com |

1. Introduction

2. Recommended Practice

Amended on 25 October 201225 October 2012, 7 July 20157 July 2015 and 14 November 201614 November 2016.

Practice Note 4.1.9 — Procedures for Order Withdrawal

| Issue Date | Cross Reference | Enquiries |

| Added on 22 September 2006 and amended on 19 January 201519 January 2015. | Rule 4.1.9 | Please contact Derivatives Market Control ("DMC"): Telephone No. : 6236 8433 Facsimile No : 6536 6480 E-Mail Address : derivatives.mc@sgx.com |

1. Introduction

2. Technical Fault and Withdrawal by Exchange on Reasonable Efforts Basis

3. Operational Safeguards and Discrepancies

Practice Note 4.1.10 — Cross Trades

| Issue Date | Cross Reference | Enquiries |

| Added on 22 September 2006 and amended on 2 July 20072 July 2007. | Rule 4.1.10 | Please contact: Market Surveillance Mr Christopher Chong 6236-8316 Ms Sally Lim 6236-5172 Enforcement E-Mail Address : enforcement@sgx.com |

1. Cross Trades

The Contract is NKH'06 with a tick size of 5 points.

| Example | Existing Bid | Existing Offer | Last traded price |

| (a) | 11710 | 11740 | 11740 |

| (b) | 11710 | 11740 | 11740 |

| (c) | None | None | 11740 |

Example (a)

The Approved Trader receives buy and sell orders at the same time and at price of 11715. The Approved Trader can expose either the buy or the sell order first.

Reason: Both the price of buy and sell orders are better than the prevailing 11710 bid and 11740 offer respectively.

Example (b)

The Approved Trader receives buy and sell orders at the same time and price at 11740. The Approved Trader shall expose the buy order first.

Reason: The buy order is a more attractive order than the sell order because there was an existing 11740 offer waiting to be "lifted".

Example (c)

The Approved Trader receives buy and sell orders at the same time and price at 11715. The Approved Trader shall expose the sell order first.

Reason: The sell order has a more attractive price because the opposite trader who "lifts" the offer will be buying at a price lower than the last traded price of 11740. On the contrary, the buy order has a less attractive price because the opposite trader who "hits" the bid will be selling at a price lower than the last traded price of 11740.

Amended on 25 October 201225 October 2012 and 7 July 20157 July 2015.