Practice Note — Direct Market Access And Sponsored Access

| Issue Date | Cross Reference | Enquiries |

| Added on 18 September 201218 September 2012. | Definitions and Interpretation | Please contact Member Supervision: Facsimile No : 6538 8273 E-Mail Address: membersup@sgx.com |

1. Introduction

2. Direct Market Access

Added on 18 September 201218 September 2012.

Practice Note 4.6.7A(1)(b) — Pre-Execution Checks

| Issue Date | Cross Reference | Enquiries |

| Added on 18 September 201218 September 2012 and amended on 15 March 201315 March 2013 and 1 July 20161 July 2016. | Rule 4.6.7A(1)(b) | Please contact Member Supervision: Facsimile No : 6538 8273 E-Mail Address: membersup@sgx.com |

1. Introduction

2. Pre-Execution Checks

Added on 18 September 201218 September 2012 and amended on 15 March 201315 March 2013 and 1 July 20161 July 2016.

Practice Note 4.6.7A(1)(c) — Error Prevention

| Issue Date | Cross Reference | Enquiries |

| Added on 18 September 201218 September 2012 and amended on 24 February 201424 February 2014. | Rule 4.6.7A(1)(c) | Please contact Member Supervision: Facsimile No : 6538 8273 E-Mail Address: membersup@sgx.com |

as compared to the most recent of the last traded price, the previous settlement price, the closing price or the opening price, as the case may be.

Added on 18 September 201218 September 2012 and amended on 24 February 201424 February 2014.

Practice Note 4.6.7A(2) — Firm-Level Monitoring of Capital and Financial Requirements and Prudential Limits

| Issue Date | Cross Reference | Enquiries |

| Added on 18 September 201218 September 2012. | Rule 4.6.7A(2) | Please contact Member Supervision: Facsimile No : 6538 8273 E-Mail Address: membersup@sgx.com |

1. Introduction

2. Firm-Level Monitoring of Capital Requirements and Prudential Limits

Added on 18 September 201218 September 2012 and amended on 15 March 201315 March 2013.

Practice Note 4.6.21 — Business Continuity Requirements

| Issue Date | Cross Reference | Enquiries |

| Amended on 22 January 200922 January 2009 and 19 May 201419 May 2014 | Rule 4.6.21 | Please contact Member Supervision: Facsimile No : 6538 8273 E-Mail Address: membersup@sgx.com |

1. Introduction

2. Business Continuity Plan

* Critical functions refer to business functions whose failure or disruption may incapacitate the firm.

^ Key service providers refer to third-parties who are performing functions that are not normally carried out by Member firms internally, but are critical to Member firms' ability to carry on business operations. For example, IT system hardware/software vendors.

# Outsourcing service providers refer to third parties who are performing functions that would normally be performed by Members firms internally. For example, Operations and Technology.

3. Emergency Contact Persons

Refer to Appendix A of Practice Note 4.6.21.

Practice Note 4.6.21; 12.1.1; 12.3.6; 12.6.4; 12.7.2; 12.10A.2: Operational Requirements for Trading Members Who Do Not Conduct Business in Singapore

| Issue Date | Cross Reference | Enquiries |

| Added on 19 May 201419 May 2014 and amended on 1 July 20161 July 2016 and 8 October 20188 October 2018. | Rule 4.6.21 Rule 12.1.1 Rule 12.3.6 Rule 12.6.4 Rule 12.7.2 Rule 12.10A.2 | Please contact Member Supervision:— Facsimile No : 6538 8273 |

1. Introduction

2. Factors that SGX-ST considers relevant

3. Determination of Comparability of Operational Requirements Set Out in Paragraph 1.1

4. Business Continuity Requirements

Emergency Contact Persons

Added on 19 May 201419 May 2014 and amended on 1 July 20161 July 2016 and 8 October 20188 October 2018.

Appendix A to Practice Note 4.6.21; 12.1.1; 12.3.6; 12.6.4; 12.7.2; 12.10a.2

Please click herehere to view Appendix A to Practice Note 4.6.21; 12.1.1; 12.3.6; 12.6.4; 12.7.2; 12.10A.2

Added on 19 May 201419 May 2014.

Practice Note 8.2.1 — Application of Market Phases and Algorithm

| Issue Date | Cross Reference | Enquiries |

| Amended on 17 February 201217 February 2012, 15 April 201315 April 2013, 24 February 201424 February 2014, 16 September 201616 September 2016, 13 November 201713 November 2017 and 8 October 20188 October 2018. | Rules 8.2.1–8.2.3 | Please contact Securities Market Control:— Email: securities.mc@sgx.com |

1 Introduction

Amended on 16 September 201616 September 2016 and 13 November 201713 November 2017.

2 Application of Market Phases

* Please see Point 2.2(2) and (3).

^ Please see Point 2.3A(2) and (3)

** Please see Point 2.5(3) and (4)

* Please see Point 2.2(2) and (3).

** Please see Point 2.5(3) and (4)

Amended on 1 August 20111 August 2011, 26 September 201126 September 2011, 15 April 201315 April 2013 and 13 November 201713 November 2017.

Amended on 26 September 201126 September 2011 and 15 April 201315 April 2013, 16 September 201616 September 2016 and 13 November 201713 November 2017.

Amended on 1 August 20111 August 2011, 16 September 201616 September 2016 and 13 November 201713 November 2017.

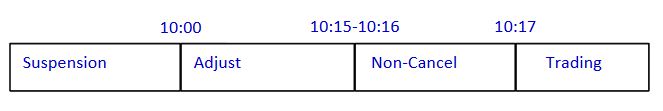

For illustrative purposes only:

SGX-ST specifies the Adjust Phase is to be followed immediately by a Non-Cancel Phase and further specifies that the Non-Cancel Phase will begin from 10:15h to 10:16h. In this case, the Adjust Phase will end simultaneously with the beginning of the Non-Cancel Phase at any time from 10:15h to 10:16h. Normal trading will begin at 10:17h.

Amended on 1 August 20111 August 2011 and 15 April 201315 April 2013, 16 September 201616 September 2016, 13 November 201713 November 2017 and 8 October 20188 October 2018.

Amended on 26 September 201126 September 2011 and 15 April 201315 April 2013 and 24 February 201424 February 2014, 16 September 201616 September 2016 and 13 November 201713 November 2017.

3 Algorithm Used by SGX-ST to Compute the Single Price at Which Orders at the End of the Opening Routine, Mid-Day Break, Closing Routine and Adjust Phase are Matched

Example 1

| Bid Volume | Price | Ask Volume | Cumulative Bid Volume (a) | Cumulative Ask Volume (b) | Tradable Volume | Imbalance (a)-(b) | Pressure |

| 0 | 3.750 | 10 | 340 | 10 | 10 | 330 | Buy |

| 0 | 3.760 | 20 | 340 | 30 | 30 | 310 | Buy |

| 50 | 3.770 | 50 | 340 | 80 | 80 | 260 | Buy |

| 100 | 3.780 | 80 | 290 | 160 | 160 | 130 | Buy |

| 70 | 3.790 | 30 | 190 | 190 | 190 | 0 | Nil |

| 30 | 3.800 | 40 | 120 | 230 | 120 | 70 | Sell |

| 90 | 3.810 | 20 | 90 | 250 | 90 | 160 | Sell |

Example 2

| Bid Volume | Price | Ask Volume | Cumulative Bid Volume (a) | Cumulative Ask Volume (b) | Tradable Volume | Imbalance (a)-(b) | Pressure |

| 0 | 3.750 | 10 | 340 | 10 | 10 | 330 | Buy |

| 0 | 3.760 | 20 | 340 | 30 | 30 | 310 | Buy |

| 50 | 3.770 | 50 | 340 | 80 | 80 | 260 | Buy |

| 100 | 3.780 | 110 | 290 | 190 | 190 | 100 | Buy |

| 70 | 3.790 | 20 | 190 | 210 | 190 | 20 | Sell |

| 30 | 3.800 | 40 | 120 | 250 | 120 | 130 | Sell |

| 90 | 3.810 | 20 | 90 | 270 | 90 | 180 | Sell |

If market orders are present a situation may arise in which the lowest imbalance occurs at “Market Price”, see sub-paragraph (2A).

If the highest tradable volume and lowest imbalance occur at more than one price the algorithm will then consider market pressure, see sub-paragraph (3).

Example 2A

| Bid Volume | Price | Ask Volume | Cumulative Bid Volume (a) | Cumulative Ask Volume (b) | Tradable Volume | Imbalance (a)-(b) | Pressure |

| MKT | 50 | 0 | |||||

| 3.750 | 10 | 50 | 10 | 10 | 40 | Buy | |

| 3.760 | 50 | 10 | 10 | 40 | Buy | ||

| 3.770 | 10 | 50 | 20 | 20 | 30 | Buy | |

| 10 | 3.780 | 50 | 20 | 20 | 30 | Buy | |

| 3.790 | 40 | 20 | 20 | 20 | Buy | ||

| 10 | 3.800 | 40 | 20 | 20 | 20 | Buy | |

| 3.810 | 30 | 20 | 20 | 10 | Buy | ||

| 30 | MKT | 30 | 20 | 20 | 10 | Buy |

Example 3

| Bid Volume | Price | Ask Volume | Cumulative Bid Volume (a) | Cumulative Ask Volume (b) | Tradable Volume | Imbalance (a)-(b) | Pressure |

| 0 | 3.750 | 10 | 260 | 10 | 10 | 250 | Buy |

| 0 | 3.760 | 20 | 260 | 30 | 30 | 230 | Buy |

| 50 | 3.770 | 50 | 260 | 80 | 80 | 180 | Buy |

| 0 | 3.780 | 110 | 210 | 190 | 190 | 20 | Buy |

| 90 | 3.790 | 0 | 210 | 190 | 190 | 20 | Buy |

| 30 | 3.800 | 40 | 120 | 230 | 120 | 110 | Sell |

| 90 | 3.810 | 20 | 90 | 250 | 90 | 160 | Sell |

Example 4

| Bid Volume | Price | Ask Volume | Cumulative Bid Volume (a) | Cumulative Ask Volume (b) | Tradable Volume | Imbalance (a)-(b) | Pressure |

| 0 | 3.750 | 10 | 260 | 10 | 10 | 250 | Buy |

| 0 | 3.760 | 20 | 260 | 30 | 30 | 230 | Buy |

| 50 | 3.770 | 50 | 260 | 80 | 80 | 180 | Buy |

| 0 | 3.780 | 130 | 210 | 210 | 210 | 0 | Nil |

| 90 | 3.790 | 0 | 210 | 210 | 210 | 0 | Nil |

| 30 | 3.800 | 40 | 120 | 250 | 120 | 130 | Sell |

| 90 | 3.810 | 20 | 90 | 270 | 90 | 180 | Sell |

Amended on 15 August 201115 August 2011 and 17 February 201217 February 2012

1 The examples shown are not exhaustive.

Practice Note 8.2A.2 — Closing Price of Prescribed Instrument

| Issue Date | Cross Reference | Enquiries |

| Issued on 24 February 201424 February 2014, amended on 8 October 20188 October 2018. | Rule 8.2A.2 | Please contact Securities Market Control:— E-Mail Address : securities.mc@sgx.com |

1. Introduction

2 Closing Price of Prescribed Instruments

Added on 24 February 201424 February 2014, amended on 8 October 20188 October 2018.

Practice Note 8.2.2 — Procedures for Contingency Order Withdrawal

| Issue Date | Cross Reference | Enquiries |

| Added on 2 November 20052 November 2005, amended on 3 April 20083 April 2008, 26 March 201226 March 2012, 26 August 201326 August 2013, 19 May 201419 May 2014 and 15 September 201715 September 2017. | Rule 8.2.2 (1) Rule 8.2.2 (3) Rule 8.2.2 (4) | Please contact Securities Market Control:— Hotline: 6236 8820 |

1. Introduction

2. Technical Fault and Withdrawal by SGX on Reasonable Efforts Basis

| a) Individual Order level | : based on Order ID no. |

| b) Firm level | : based on Trading Member Company Code / SGX Access User ID no. (where the firm has more than one SGX Access connection, it is possible to withdraw orders based on specific SGX Access User ID no) |

| c) Client level | : based on Client Account no of a specific SGX Access User ID no. |

3. Operational Safeguards and Discrepancies

Practice Note 8.6 — Application of the Forced Order Range

| Issue Date | Cross Reference | Enquiries |

| Added on 4 July 20114 July 2011, amended on 25 October 201225 October 2012, 26 August 201326 August 2013, 19 May 201419 May 2014, 7 July 20157 July 2015, 23 December 201523 December 2015, 19 May 201619 May 2016, 13 November 201713 November 2017 and 8 October 20188 October 2018. | Rule 8.6 | Please contact Enforcement: E-Mail Address: enforcement@sgx.com |

1 Introduction

| S/N | Product | Price Range ($) | Minimum Bid Size ($) | Forced Order Range |

| 1 | Stocks (excluding preference shares), Real Estate Investment Trusts (REITS), business trusts, company warrants and any other class of securities or futures contracts not specified in Rule 8.3.3 | Below 0.20 | 0.001 | +/- 30 bids |

| 0.20 – 0.995 | 0.005 | |||

| 1.00 and above | 0.01 | |||

| 1A | Structured warrants | Below 0.20 | 0.001 | +/- 30 bids |

| 0.20 – 1.995 | 0.005 | |||

| 2.00 and above | 0.01 | |||

| 2 | Exchange traded funds and exchange traded notes | All | 0.01 or 0.001 as determined by SGX-ST | +/- 30 bids |

| 3 | Debentures, bonds, loan stocks and preference shares quoted in the $1 price convention | All | 0.001 | |

| 4 | Debentures, bonds, loan stocks and preference shares quoted in the $100 price convention | All | 0.001 | +/- 1,000 bids |

2. Risk Management Controls

Added on 4 July 20114 July 2011 and amended on 25 October 201225 October 2012, 26 August 201326 August 2013, 19 May 201419 May 2014, 7 July 20157 July 2015, 23 December 201523 December 2015, 19 May 201619 May 2016, 13 November 201713 November 2017 and 8 October 20188 October 2018.

Practice Note 8.6.12(4) — Computation of Monetary Loss

| Issue Date | Cross Reference | Enquiries |

| Issued on 24 February 201424 February 2014, amended on 8 October 20188 October 2018 | 8.6.12(4) | Please contact Enforcement:— E-Mail Address : enforcement@sgx.com |

1. Introduction

Added on 24 February 201424 February 2014, and amended on 8 October 20188 October 2018.

Practice Note 8.6.13A(3) — Alternative Reference Price For No-Cancellation Range

| Issue Date | Cross Reference | Enquiries |

| Issued on 24 February 201424 February 2014, amended on 23 December 201523 December 2015 and 15 September 201715 September 2017. | 8.6.13(3) | Please contact Enforcement:— E-Mail Address : enforcement@sgx.com |

1. Introduction

| Instrument | Alternative prices that may be adopted as the Reference Price |

| Extended Settlement Contracts | • The previous closing price. • The price of the last good trade in the underlying stock. |

| American Depository Receipts | • The previous closing price of the underlying stock in home market. • The previous closing price of the ADR in the US market. |

| Exchange Traded Funds | • The previous closing price as determined in accordance with Rule 8.2A. • The average of the last quoted bid price and the last quoted offer price for the Exchange Traded Fund immediately preceding the error trade. The selection will not include the quotes provided by the Designated Market-Maker who is involved in the error trade which is under review. • The Indicative Net Asset Value. |

| Exchange Traded Notes | • The average of the last quoted bid and the last quoted offer price for the Exchange Traded Note immediately preceding the error trade. The selection will not include the quotes provided by the Designated Market-Maker who is involved in the error trade which is under review. • The price of other debt papers with a similar credit rating. |

| All other securities (excluding bonds and structured warrants) | • The previous closing price. • The average of the last quoted bid price and the last quoted offer price for the security immediately preceding the error trade. The selection will not include the quotes provided by the parties who are involved in the error trade which is under review. • A price derived from a pricing model established by SGX-ST. For example, in the case of a share consolidation, SGX-ST may use the last traded price prior to the effective date of the consolidation, adjusted for the consolidation ratio. |

3. Alternative Prices Unsuitable

Added on 24 February 201424 February 2014 and amended on 24 February 201424 February 2014, 23 December 201523 December 2015 and 15 September 201715 September 2017.

Practice Note 8.8.1 — Designated Instruments

| Issue Date | Cross Reference | Enquiries |

| Added on 1 July 20141 July 2014 and amended on 15 September 201715 September 2017 and 8 October 20188 October 2018. | Rule 8.8.1 Rule 8.8.2 | Please contact Surveillance: E-Mail Address: msursec@sgx.com |

1. Introduction

3. Conditions that may be imposed on a Designated Instrument

Added on 1 July 20141 July 2014 and amended on 15 September 201715 September 2017 and 8 October 20188 October 2018.

Practice Note 8.10.1 — Characteristics of Suspension and Trading Halt

| Issue Date | Cross Reference | Enquiries |

| Added on 3 April 20083 April 2008, amended on 21 September 201121 September 2011, 26 March 201226 March 2012, 16 September 201616 September 2016 and 8 October 20188 October 2018. | Rules 8.10.1–8.11.1A | Please contact: Member Supervision Facsimile No : 6538 8273 E-Mail Address: membersup@sgx.com Securities Market Control E-Mail Address: securities.mc@sgx.com |

This Practice Note explains the characteristics of a suspension and a trading halt.

| ITEM | CHARACTERISTIC | SUSPENSION | TRADING HALT |

| 1 | Initiating party | A suspension can be imposed by SGX-ST under the circumstances stated in Rule 8.10.1. An Issuer may also request a suspension if its request for extension of a trading halt is not approved by SGX-ST. | A trading halt can be imposed by SGX-ST under the circumstances stated in Rules 8.11.1 and 8.11.1A. |

| 2 | Status of unmatched orders | During a market suspension, unmatched orders in the Trading System may lapse, as determined by SGX-ST. SGX-ST will notify Trading Members of the status of their unmatched orders before the lifting of a market suspension. During a suspension of a single security or futures contract, all unmatched orders will lapse. | During a trading halt, all existing orders in the ready and unit share markets remain valid. Orders can still be entered, modified or withdrawn in the ready and unit share markets but are not matched. |

| 3 | Duration of suspension or trading halt | A suspension may persist for a prolonged period. | A trading halt is usually intra-day, with a minimum duration of 30 minutes. SGX-ST may extend the duration of a trading halt beyond 3 Market Days upon the Issuers' request. |

| 4 | Upon lifting of suspension or trading halt | Upon lifting of a suspension, the suspended security or futures contract will enter into an Adjust Phase for at least 15 minutes. | Upon lifting of a trading halt, orders that can be matched will be matched at a single price computed based on the algorithm set by SGX-ST. Unmatched orders are carried forward into the respectiv e phase t he market is in when the trading halt is lifted. |

Practice Note 8.10A — Circuit Breaker

| Issue Date | Cross Reference | Enquiries |

| Issued on 24 February 201424 February 2014, amended on 23 December 201523 December 2015, 13 November 201713 November 2017 and 8 October 20188 October 2018. | Rule 8.10A | Please contact Securities Market Control:— Email: securities.mc@sgx.com |

1. Introduction

2. Coverage of Circuit Breaker

3. Characteristics of Circuit Breakers and Cooling-Off Periods

4. Calculation of the Circuit Breaker

5. Illustration of Circuit Breaker operation

Scenario 1

The lower limit is:

$1.00 − (10% x $1.00) = $0.90.

Scenario 2

$0.90 − (10% of $0.90) = $0.81.

The upper limit is:

$0.90 + (10% of $0.90) = $0.99.

6. Exemption of New Listings from circuit breaker

Added on 24 February 201424 February 2014, and amended on 24 February 201424 February 2014, 23 December 201523 December 2015, 13 November 201713 November 2017 and 8 October 20188 October 2018.

Practice Note 8.10.3 — Approval of Off-Market Trades in a Security or Futures Contract Subject to Suspension or Trading Halt

| Issue Date | Cross Reference | Enquiries |

| Amended on 3 April 20083 April 2008 and 8 October 20188 October 2018. | Rules 8.10.3–8.11.6 | Please contact Member Supervision: Facsimile No : 6538 8273 E-Mail Address: membersup@sgx.com |

1 Introduction

2 Rationale for Rules

3 Circumstances Under Which SGX-ST May Approve Off-Market Trades in A Security or Futures Contract Subject to Suspension or Trading Halt

Practice Note 8A — Obligations of Trading Members to Mark Sell Orders

| Issue Date | Cross Reference | Enquiries |

| Added on 11 March 201311 March 2013, amended on 15 September 201715 September 2017, 1 October 20181 October 2018 and 10 December 201810 December 2018. | Rule 8A.1 – 8A.6 | Please contact Member Supervision: Facsimile No : 6538 8273 E-Mail Address: membersup@sgx.com |

1. INTRODUCTION

2. MARKING OF SELL ORDERS

Clear procedures should be in place to require Trading Representatives to ask a customer whether a sell order is a Short Sell Order or a normal sell order. Procedures should also be in place to ensure that the Trading Representative or the dealing assistant correctly enters the sell order into the Trading System. The Trading Member is not required to put in place voice recording facilities beyond its existing practices.

The trading interface should require the customer to indicate whether a sell order is a Short Sell Order or a normal sell order at the point of order entry. It should also ensure that a sell order cannot be transmitted to the Trading System if it is not marked either as a Short Sell Order or a normal sell order.

A Trading Member must ensure that all customers with Sponsored Access to the Trading System ("Sponsored Customers") can fulfil the requirements of Rule 8A.3.3. A Trading Member must ensure that all Sponsored Customers have the necessary operational and technical systems and procedures in place:

A Trading Member's daily record of orders received from customers, maintained in accordance with Rule 13.9, should show whether a sell order is a Short Sell Order or a normal sell order.

3. DEFINITION OF A SHORT SELL ORDER

Compliance with Rule 8A.3.1 under specific circumstances

4. REPORTING OF ERRONEOUSLY MARKED SELL ORDERS

The customer has actually short sold only 6,000 shares (8,000 executed minus 2,000 owned). He will have to report the erroneously marked Short Sell Order, stating the volume that was disclosed as short sold (8,000 shares) and the actual short sales volume (6,000 shares).

The customer has actually short sold only 2,000 shares (4,000 executed minus 2,000 owned). He will have to report the erroneously marked Short Sell Order, stating the volume that was disclosed as short sold and that was executed (4,000 shares) and the actual short sales volume (2,000 shares).

5. EXEMPTION FROM MARKING OF SELL ORDERS

Practice Note 9.4.3A(b) Money Received on Account of Customer

| Issue Date | Cross Reference | Enquiries |

| Added on 10 December 201810 December 2018. | Rule 9.4.3A(b) | Please contact Member Supervision:— E-Mail Address: membersup@sgx.com |

Practice Note 11.7A.1, 11.8A.1 — Exposure to Single Customer and Single Security

| Issue Date | Cross Reference | Enquiries |

| Added on 19 May 201419 May 2014 | Rule 11.7A.1, Rule 11.8A.1 | Please contact Securities Market Control:— Facsimile No : 6538 8273 |

1. Introduction

2. Adequate Tools and Procedures

Practice Note 12.3.1 — Verification Procedure in Respect of Customer's Identity

| Issue Date | Cross Reference | Enquiries |

| Added on 1 December 2003 Amended on 19 May 201419 May 2014 | Rule 12.3.1 | Please contact Member Supervision: Facsimile No : 6538 8273 E-Mail Address: membersup@sgx.com |

1 Introduction

2 Verification Procedure

3 Digital Signature

Practice Note 12.3A.1 — Customer Education

| Issue Date | Cross Reference | Enquiries |

| Added on 18 September 201218 September 2012. | Rule 12.3A.1 | Please contact Member Supervision: Facsimile No : 6538 8273 E-Mail Address: membersup@sgx.com |

1. Introduction

2. Information, Guidance and Training

Added on 18 September 201218 September 2012.

Practice Note 12.3.1, 12.3.2 —Customer Account

| Issue Date | Cross Reference | Enquiries |

| Added on 21 June 200621 June 2006 and amended on 3 April 20083 April 2008, 19 May 201419 May 2014, 29 December 201429 December 2014, 1 July 20161 July 2016 and 8 October 20188 October 2018. | Rule 12.3.1, Rule 12.3.2 | Please contact Member Supervision: Facsimile No : 6538 8273 E-Mail Address: membersup@sgx.com |

1. Introduction

2. Customer Account

Practice Note 12.3.1, 12.3.4 — Additional Safeguards for Trading by Young Investors

| Issue Date | Cross Reference | Enquiries |

| Added on 14 May 200914 May 2009 Amended on 19 May 201419 May 2014 and 1 July 20161 July 2016. | Rule 12.3.1, Rule 12.3.4 | Please contact Member Supervision: Facsimile No : 6538 8273 E-Mail Address: membersup@sgx.com |

1. Introduction

2. Account Opening Procedures

3. Supervision

4. Investor Education

Practice Note 12.6.1 — Contract Notes

| Issue Date | Cross Reference | Enquiries |

| Added on 1 July 20161 July 2016, amended on 8 October 20188 October 2018. | Rule 12.6.1 | Please contact Member Supervision: Facsimile No : 6538 8273 |

1. Introduction

2. Other Relevant Rules

3. Internal Controls with Respect to Contract Notes

Practice Note 12.6.3(2) — Evidence of Informed Consent for Contract Notes in Electronic Form

| Issue Date | Cross Reference | Enquiries |

| Added on 12 August 201612 August 2016. | Rule 12.6.3(2) | Please contact Member Supervision: Facsimile No : 6538 8273 |

1. Introduction

2. Evidence of Informed Consent

Added on 12 August 201612 August 2016.

Practice Note 12.14.1 — Conflicts of Interest

| Issue Date | Cross Reference | Enquiries |

| Added on 18 September 201218 September 2012. | Rule 12.14.1 | Please contact Member Supervision: Facsimile No : 6538 8273 E-Mail Address: membersup@sgx.com |

1. Introduction

2. Separation of Key Functions

Added on 18 September 201218 September 2012.

Practice Note 12.17.1 — Review of Remisier's Personal Trades

| Issue Date | Cross Reference | Enquiries |

| Added on 1 December 2003. | Rules 12.17.1 and 12.17.6 | Please contact Member Supervision: Facsimile No : 6538 8273 E-Mail Address: membersup@sgx.com |

1 Introduction

2 Need for More Frequent Reviews

Practice Note 12.20.1 — Soft Dollar Receipts or Payments

| Issue Date | Cross Reference | Enquiries |

| Added on 1 December 2003. | Rules 12.20.1 and 12.20.2 | Please contact Member Supervision: Facsimile No : 6538 8273 E-Mail Address: membersup@sgx.com |

1 Introduction

2 Good and Services that Do Not Qualify as Soft Dollar Receipts or Payments

Practice Note 12A.4.1, 12A.5.2 — Position Account Allocation

| Issue Date | Cross Reference | Enquiries |

| Added on 1 July 20161 July 2016 and amended on 10 December 201810 December 2018. | Rules 12A.4.1, 12A.5.2. | Please contact Member Supervision Facsimile No : 6538 8273 |

1. Rule 12A.4.1 requires each TPC Trading Member to instruct its qualifying Clearing Member to allocate the position of each trade executed by the Trading Member to the Trading Member's Position Account or, where the position is of a trade executed for a customer, in accordance with that customer's instructions, as soon as practicable, and in any event no later than such time as may be required for timely and orderly settlement of the relevant trade into the intended Securities Account. This Practice Note provides guidance on the timelines within which such allocation is to be completed by in various circumstances.

2. With the exception of warehoused trades, each Trading Member shall instruct its qualifying Clearing Member to allocate the position of each trade cleared by the Clearing Member for the Trading Member to a specified Position Account immediately upon the trade being cleared, or at the latest by the end of the next Market Day immediately following the trade date.

3. For warehoused trades under Rule 12A.5.2, each Trading Member must ensure that no customer's trade is warehoused for more than one Market Day, unless under exceptional circumstances. The Trading Member shall instruct its qualifying Clearing Member to allocate the position of each trade to a specified Position Account immediately after the order is completed, or at the latest by the end of the Market Day on which the order is completed.

Practice Note 13.4.1 — Customer Orders — Precedence

| Issue Date | Cross Reference | Enquiries |

| Amended on 1 July 20051 July 2005, 3 April 20083 April 2008 23 January 200923 January 2009 1 July 20161 July 2016 and 8 October 20188 October 2018. | Rule 13.4.1 | Please contact Member Supervision: Facsimile No : 6538 8273 E-Mail Address: membersup@sgx.com |

1 Introduction

2 Application of Rule 13.4.1

Practice Note 13.8.1 — Market Manipulation and False Market

| Issue Date | Cross Reference | Enquiries |

| Amended on 3 April 20083 April 2008, 7 July 20157 July 2015 and 8 October 20188 October 2018. | Rules 13.8.1–13.8.3 | Please contact Enforcement:— E-Mail Address: enforcement@sgx.com |

1 Introduction

2 Market Manipulation and False Market

3 Guidance on Rule 13.8.2

Trading Members and Trading Representatives would generally be familiar with the patterns of trading in each security or futures contract. They are therefore expected to exercise judgment, based on their experience and knowledge of trading in the security or futures contract, in assessing the likely impact of a proposed transaction on the market for a security or futures contract.

The Rule does not prevent a Trading Member or Trading Representative from executing an order simply because it will have an impact on the market for, or price of, a security or futures contract.

In the absence of a good reason to buy or sell quickly, customers generally want to obtain the best price. A Trading Member or Trading Representative who receives an order that would materially alter the market for, or price of, the security or futures contract, should consider whether it is genuine or manipulative.

Trading Members and Trading Representatives must also know their customers. Orders placed by a customer or a related party of that customer, who may have an interest in creating a material change in the market for, or price of, a particular security or futures contract, should be closely examined.

Examples

A Trading Member or Trading Representative should not make large entries above or below the prevailing spread to facilitate filling an order on the other side of the market. The placing of buy (sell) orders at various price steps below (above) the market may create a false or misleading appearance that the entries are on behalf of genuine buyers (sellers). The layering of orders also translates into a change in the depth screen and may mislead market participants with respect to interest in the counter.

A Trading Member or Trading Representative should consider carefully any orders placed with instructions to execute them at or near the close of trading, particularly if a price target is set. A Trading Member or Trading Representative should also be alert to orders placed near the close on the last trading day of the month, quarter or year, or on the expiry dates of options, warrants or futures contracts, which will move the price when executed.

A customer who, to the knowledge of the Trading Member or Trading Representative, declines the opportunity to obtain a better price during the day and prefers to pay a higher (lower) price near the close should be queried as to the strategy. This is important if the order is to buy or sell a small volume of the security or futures contract, which is likely to move the price and possibly fix the closing price. Further, if the Trading Member or Trading Representative received a series of similar orders over a number of days, each of which generates a price movement near the close of trading, the Trading Member or Trading Representative should be satisfied that the customer is not attempting to create a false or misleading appearance with respect to the price of the security or futures contract.

Examples

A concern here might arise if the security or futures contract is held in the name of a colluding party but the market risk actually remains with the seller. There may effectively be no change in beneficial interest.

The time proximity of orders and the fact that they are for about the same price (particularly if the price is out-of-range) and quantity may suggest that the transaction is pre-arranged. Pre-arranged transactions have the effect of creating a misleading appearance of active trading, or improperly excluding other market participants from the transaction since the first bid or offer was not adequately exposed to the market. The execution of crossings or transactions between the same parties for the same volumes, which are subsequently reversed at the same prices, also raises questions whether the transactions involve a change in beneficial ownership, or are for rollover of trades to extend settlement, or for a purpose of engaging in a circular trading scheme to create the impression of turnover.

The key question in this area is whether there appears to be any logical trading pattern to the price and volume of the security or futures contract, or whether it seems erratic. Trading is manipulative if it is intended to move the price of the security or futures contract.

This could indicate that the order is not genuine, especially where a distinctive pattern of such orders is observed. At the time the bid (offer) was made, the Trading Member or Trading Representative did not intend to buy (sell), but intended that the bid (offer) would not trade and would be cancelled. Sometimes, such orders are entered to induce buyers (sellers) into the market to facilitate the filling of an order on the other side of the market.

This Rule does not restrict Trading Members and Trading Representatives trading significant volumes where there is a legitimate purpose for the transaction and where the transaction is executed in a proper manner. However, trading significant volumes with the purpose of controlling the price of a security or futures contract will amount to manipulative trading.

Example

A Trading Representative purchased substantial volume in a thinly traded counter, which accounted for a large proportion of the market volume, to establish a predetermined price. Sometimes, this may be followed by up-ticking the bid despite the absence of bona fide investor demand for the security or futures contract.

If a customer regularly buys (sells) on the up-tick (down-tick) in the face of consistent selling (buying) pressure, the Trading Member or Trading Representative should query whether the customer is a bona fide purchaser (seller). Repetitive orders to clear the best offer (bid) volume, particularly within a short time, suggest that the Trading Member or Trading Representative might be attempting to break the market. The trading spikes or troughs were meant to excite the market and attract spectators to join in.

If a customer places a sell order well above the best ask and one or more buy orders which would increase the price towards the customer's ask price, a Trading Member or Trading Representative should query the customer as to the strategy. It may be that the buy orders are intended to get the price running and facilitate the sale at the higher price. Illiquid securities or futures contracts, in particular, are susceptible to this type of improper trading.

Many orders for legitimate commercial reasons can change the market for, or price of, a security or futures contract when executed. Such orders are acceptable despite the price impact, but the Trading Member or Trading Representative must execute the order in an appropriate manner, bearing in mind its or his obligations.

Examples

4 Guidance on SGX-ST Rule 13.8.3

A Trading Member or a Trading Representative must not enter a buy order or a sell order on the Trading System if there is an existing opposite order from that same Trading Member or Trading Representative in the same security or futures contract for the same price. This Rule does not apply if:

5 Conclusion

Amended on 25 October 201225 October 2012. and 8 October 20188 October 2018.

Practice Note 13.8.9 — Processes for Review of Orders and Trades

| Issue Date | Cross Reference | Enquiries |

| Added on 18 September 201218 September 2012 and amended on 1 July 20161 July 2016. | Rule 13.8.9 | Please contact Member Supervision: Facsimile No : 6538 8273 E-Mail Address: membersup@sgx.com |

1. Introduction

2. Guidance on processes

3. Parameters to assist in detecting suspicious trading behaviour

Added on 18 September 201218 September 2012 and amended on 1 July 20161 July 2016.