Definitions

The following terms have the following meanings unless the context requires otherwise:—

A B C D E F G H I J K L M N O P Q R S T U V W X Y Z

| Term | Meaning |

| A | |

| "Accredited Investor" | Same meaning as in the Securities and Futures Act. |

| "Appeals Committee" | The committee appointed by the SGX RegCo Board to exercise the powers in the Supervisory Rules; |

| "ASEAN Trading Linkage" | Order-routing service provided by SGX-ST to Trading Members, whether directly or through any other person, through which: (a) a Trading Member may enter orders directly into a market of a Foreign ASEAN Exchange, as a customer of a member of such Foreign ASEAN Exchange; and (b) the customer of a Trading Member to whom the Trading Member has authorised Sponsored Access, may enter orders directly into SGX-ST. |

| "Associated Corporation" | Any body corporate formed in or out of Singapore in which a Trading Member and its related corporations hold directly or indirectly a beneficial interest of not less than 20% of the issued share capital; |

| "Authority" | The Monetary Authority of Singapore or other body responsible for the administration of the Securities and Futures Act; |

| B | |

| "Board" | Board of Directors of SGX-ST; |

| "broker-linked balance" | A sub-balance, in a Securities Account maintained directly with CDP, that is linked to a Trading Member and gives the Trading Member such control and rights over the securities contained in the sub-balance as CDP shall specify. |

| C | |

| "Cash Settlement Amount" | The meaning ascribed to it in Rule 9.4.2B. |

| "CDP" | The Central Depository (Pte) Limited; |

| "CDP Settlement Facility" | The settlement facility operated by CDP for settlement pursuant to the CDP Settlement Rules. |

| "CDP Settlement Rules" | CDP Settlement Rules as the same may be amended, modified, supplemented or replaced from time to time. |

| "Circuit Breaker" | in relation to a security or futures contract refers to such maximum allowable price advance or decline from a reference price for the security or futures contract during the Trading Phase. The maximum allowable price advance or decline from a reference price and the reference price shall be determined by SGX-ST. |

| "Clearing Member" | A Clearing Member in accordance with the Clearing Rules; |

| "Clearing Rules" | CDP Clearing Rules as in effect from time to time; |

| "collective investment scheme" | The meaning ascribed to it in the Securities and Futures Act; |

| "Connected Person" | The meaning ascribed to it in the Securities and Futures Act; |

| "Contract Specifications" | means the commercial and technical terms of a Marginable Futures Contract, including the contract size, contract month, underlying security, Last Trading Day and settlement basis. Unless otherwise stated, Contract Specifications are not subject to the rule amendment procedures specified under the SFA. |

| "Cooling-Off Period" | means a period prescribed by SGX-ST during which trading in a particular security or futures contract will be restricted in a manner prescribed by SGX-ST. |

| "Corporation" | Same meaning as in the Companies Act; |

| D | |

| "Dealer" | A Trading Representative who is employed by a Trading Member or its group of companies to deal in securities and/or trade in Futures Contracts; |

| "derivatives contracts" | The meaning ascribed to it in the Securities and Futures Act; |

| "Designated Market-Maker" | A market-maker registered with SGX-ST; |

| "Designated Instrument" | Shall have the meaning ascribed to it in Rule 8.8.1; |

| [deleted] | [deleted] |

| "Direct Business" | A trade which is not executed on the Trading System in accordance with Rule 8.7; |

| "Directives" | Requirements prescribed by SGX-ST; |

| "Direct Market Access" | Direct access to the Trading System, via an SGX-ST provided or SGX-ST approved order management system through which orders are routed to the Trading System. Direct Market Access does not include Internet Trading. |

| "Director" | Same meaning as in the Companies Act; |

| "Disciplinary Committee" | The committee appointed by the SGX RegCo Board to exercise the powers in the Supervisory Rules; |

| "Discretionary Account" | An account carried on the books of a Trading Member in which the customer gives a Trading Representative discretion, which may be absolute or with limits, to purchase or sell securities or trade in futures contracts. The discretion may extend to selection, timing terms and price; |

| "DVP settlement" | Settlement of affirmed trades where payment is made against the transfer; |

| E | |

| "Exchange Link" | The electronic means by which:— (a) SGX-SPV routes orders for Selected Foreign Securities to the Foreign Portal Dealer and receives orders for Selected SGX Securities from the Foreign Portal Dealer; and (b) A Foreign Portal Dealer routes orders for Selected SGX Securities to SGX-SPV and receives orders for Selected Foreign Securities from SGX-SPV; |

| "Expert Investor" | The meaning ascribed to it in the Securities and Futures Act; |

| F | |

| "Foreign ASEAN Exchange" | Shall have the meaning ascribed to it in Rule 10A.5.2. |

| "Foreign Exchange" | In relation to the Foreign Market Linkages Rule, means a securities exchange outside Singapore that has agreed to an electronic co-trading, clearing and settlement link of Selected Foreign Securities or Selected SGX Securities with SGX-ST; |

| "Foreign Market" | In relation to the Foreign Market Linkages Rule, means a market administered by the Foreign Exchange which has access to the market via the Exchange Link; |

| "Foreign Portal Dealer" | A Foreign Exchange or a related body corporate of Foreign Exchange that acts as an intermediary to allow:— (a) Singapore investors to trade, clear and settle Selected Foreign Securities on a Foreign Market; and (b) Foreign investors to trade, clear and settle Selected SGX Securities via a Foreign Market; |

| "futures contract" | The meaning ascribed to it in the Securities and Futures Act; |

| I | |

| "Immediate Bargains" | Any transaction for delivery at the trade date; |

| "Institutional Investor" | Same meaning as in the Securities and Futures Act. |

| "Intended Settlement Day" | In relation to a trade that is executed on the Trading System or reported to SGX-ST, the day on which the trade is first due for settlement. |

| "Internet Trading" | Trading access to SGX-ST through internet broking services provided by a Trading Member. |

| "Issuer" | An entity that is quoted or listed on SGX-ST; |

| L | |

| "Last Trading Day" | Refers to the last day on which a Marginable Futures Contract may be traded prior to its expiration; |

| "Limit Order" | An order to be executed at a specific price or better; |

| M | |

| "main balance" | The balance in a Securities Account maintained directly with CDP that is not a broker-linked balance. |

| "Marginable Futures Contract" | A futures contract approved for listing on SGX-ST and that is subject to margin requirements; |

| "Marginable Securities" | (a) Securities quoted on SGX-ST; (b) Securities quoted on the Non-Listed Securities market; (c) Securities quoted on the main board of a securities exchange, of a company with shareholders' funds of not less than $200 million (or equivalent); and (d) Any other securities that SGX-ST approves; |

| "Market Day" | A day on which SGX-ST is open for trading in securities and/or futures contracts; |

| "Marketable Securities" | (a) Securities quoted on SGX-ST; (b) Securities quoted on the Non-Listed Securities market; (c) Securities quoted on the main board of a securities exchange, of a company with shareholders' funds of not less than $200 million (or equivalent); and (d) Any other securities that SGX-ST approves; |

| "Maximum Spread" | In relation to a 2-sided market-making order, the maximum difference allowed by SGX-ST between the bid price and the ask price; |

| N | |

| "Non-Listed Security" | Refers to: (a) a security listed on an overseas exchange; or (b) Singapore Government Securities; which are approved by SGX-ST for quotation and trading on the Non-Listed Securities Market; |

| "Non-Listed Securities market" | A place at which, or a facility by means which, offers or invitations to sell, purchase or exchange a Non-Listed Security are regularly made; |

| O | |

| "Officer" | Same meaning as in the Companies Act; |

| "Official List" | The list of issuers maintained by SGX-ST in relation to the SGX Mainboard or SGX Catalist; |

| "organised market" | The meaning ascribed to it in the Securities and Futures Act; |

| P | |

| "Position Account" | Shall have the meaning ascribed to it in the Clearing Rules; |

| "Practice Notes" | Non-binding guidelines that seek to explain the application and interpretation of a Rule. |

| “Prescribed Instrument” | The meaning as ascribed to it under Rule 8.2A.1; |

| "product financing" | The meaning ascribed to it in the Securities and Futures Act; |

| "Public" | Persons other than:— (a) Directors, Officers, Employees, Trading Representatives, agents or shareholders of the Trading Member and its subsidiary companies; and (b) Connected persons to those mentioned in paragraph (a); |

| "Public Register of Representatives" | [Deleted] |

| Q | |

| "Qualification" | The guarantee of a Clearing Member to accept liability for all contracts executed on SGX-ST by a Trading Member which it has qualified; |

| R | |

| "Relevant Regulatory Authority" | Shall mean: (a) the authority(ies) or regulatory body(ies) that regulate(s) a Trading Member's or its Trading Representatives' activities in the country where it is carrying on such activities and from which it has applied for membership or registration with SGX-ST; and (b) where the Trading Member or its Trading Representatives are carrying on regulated activities in Singapore, the Authority, |

| "Remisier" | A Trading Representative who has a business arrangement with a Trading Member that holds a Capital Markets Services Licence for dealing in securities or trading in futures contracts. A Remisier is not an employee of a Trading Member; |

| "Rules" | SGX-ST Rules, including, save where expressly indicated otherwise, Directives and Regulatory Notices, and excluding practice notes or any notes or other annotations to the SGX-ST Rules, as the same may be amended, modified, supplemented or replaced from time to time; |

| S | |

| "securities" | (a) shares, units in a business trust or any instrument conferring or representing a legal or beneficial ownership interest in a corporation, partnership or limited liability partnership; (b) debentures; (c) units in a collective investment scheme; (d) derivative contracts that are not futures contracts and of which the underlying instrument or any of the underlying instruments are any of the instruments set out in (a), (b) or (c) or an index on any of those instruments; or (e) any other product or class of products as SGX-ST or CDP may prescribe; whether or not they are classified as "securities" under the SFA, but excludes: (i) bills of exchange; (ii) certificates of deposit issued by a bank or finance company, whether situated in Singapore or elsewhere; or (iii) any product or class of products as SGX-ST or CDP may prescribe. For the avoidance of doubt, "securities" include (but are not limited to) warrants, transferrable subscription rights, options to subscribe for stocks or shares, convertibles, depository receipts and exchange traded funds; |

| "Securities Account" | In relation to any person, an account maintained directly with CDP or through a Depository Agent or the CPF Board for holding securities for or on behalf of that person. |

| "Selected Foreign Security" | A security traded on a Foreign Market that is eligible to be traded via the Service, as agreed between SGX-ST and the Foreign Exchange from time to time; |

| "Selected SGX Security" | A security traded on SGX-ST that is eligible to be traded via the Service, as agreed between SGX-ST and the Foreign Exchange from time to time; |

| "Service" | In relation to the Foreign Market Linkages Rule, means the service offered to Trading Members or trading participants of a Foreign Exchange (as the case may be) for co-trading, clearing and settlement of Selected Foreign Securities or Selected SGX Securities; |

| "SGX" | Singapore Exchange Limited; |

| "SGXAccess" | The facility for trading on SGX-ST which allows a Trading Member's systems for order management and automated order routing to connect to the Trading System, and to capture market data and news feeds from SGX-ST; |

| "SGX RegCo" | means Singapore Exchange Regulation Pte. Ltd.; |

| "SGX RegCo Board" | means board of directors of SGX RegCo; |

| "SGX-SPV" | A subsidiary of SGX that operates the Service under the Foreign Market Linkages Rule; |

| "SGX-ST" | Singapore Exchange Securities Trading Limited; |

| "SGX-ST approved Order Management System" | An order management system that has passed conformance testing and meets appropriate technical specifications as required by SGX-ST. |

| "SGX Catalist" | The Catalist Board operated by SGX-ST; |

| "SGX Mainboard" | SGX-ST Mainboard; |

| "Short Sell Order" | The meaning ascribed to it in Rule 8A.1.1; |

| "Specified Capital Markets Products" | The meaning ascribed to it in Rule 8A.1.1; |

| "Specified Securities" | Securities, futures contracts or classes of securities or Futures Contracts that SGX-ST prescribes for trading by a Designated Market-Maker; |

| "Specified Product" | The meaning ascribed to it in the Securities and Futures Act; |

| "Sponsored Access" | A form of Direct Market Access in which a Trading Member permits its customer and any other persons to use its member ID to transmit orders for execution directly to SGX-ST without using the Trading Member's infrastructure. |

| "Stock Account" | The securities account maintained by a Trading Member to house its proprietary securities or structured warrants; |

| T | |

| "Trading Account" | An account used for sending orders to the Trading System through an SGX-ST provided or SGX-ST approved order management system. |

| "Trading Member" | An entity that has been approved as Trading Member in accordance with SGX-ST Rules; |

| "Trading Representative" | A person who is employed by or acts for or by arrangement with a Trading Member to deal in securities or trade in futures contracts; |

| "Trading System" | Any electronic trading system for the automatic matching of orders designated and approved by SGX-ST for transactions on SGX-ST. |

Amended on 3 April 20083 April 2008, 23 January 200923 January 2009, 29 November 201029 November 2010, 8 July 20118 July 2011, 18 September 201218 September 2012, 26 April 201326 April 2013, 24 February 201424 February 2014, 24 February 201424 February 2014, 19 May 201419 May 2014, 1 July 20141 July 2014, 29 December 201429 December 2014, 1 July 20161 July 2016, 16 September 201616 September 2016, 15 September 201715 September 2017, 1 October 20181 October 2018, 8 October 20188 October 2018, 10 December 201810 December 2018 and 22 April 201922 April 2019.

Interpretation

1.1.1

The Rules, and any Directives, operate as a binding contract between SGX-ST and each Trading Member, and between a Trading Member and any other Trading Member.

1.1.2

A person who is not a party to the Rules has no rights under the Contracts (Rights of Third Parties) Act (Cap. 53B) to enforce the Rules, regardless of whether such person has been identified by name, as a member of a class or as answering a particular description.

Amended on 23 January 200923 January 2009.

1.1.3

A person is deemed to be bound by the Rules and any Directives upon approval of the person's admission or registration (where applicable) by SGX-ST.

1.1.4

A person admitted or registered by SGX-ST must comply with the Rules:—

1.2.1

SGX-ST may waive a rule (or part of a rule) to suit the circumstances of a particular case, unless the rule specifies that SGX-ST will not waive it. SGX-ST may grant a waiver subject to such conditions as it considers appropriate. A waiver is only effective if the conditions are satisfied. If a waiver is granted, SGX-ST will notify all Trading Members of the waiver as soon as practicable.

1.3.1

The Rules may be amended by the Board in accordance with the Securities and Futures Act.

Amended on 23 January 200923 January 2009.

1.5.1

SGX-ST may, from time to time, issue Practice Notes to provide guidance on the interpretation and application of any rule. A practice note does not bind SGX-ST in the application of a rule.

1.6.1

SGX-ST may, from time to time, publish transitional arrangements in relation to any amended or new rule(s).

1.7.1

The order of precedence of the following instruments applicable to SGX-ST and Trading Members shall be (in descending order of precedence):

Added on 26 April 201326 April 2013

1.7.2

In the event of any conflict between the provisions of the aforesaid instruments, the provisions in an instrument with a higher level of precedence shall prevail over the provisions in an instrument with a lower level of precedence.

Added on 26 April 201326 April 2013

2.2.1

SGX-ST may delegate, assign or grant authority to exercise any of its rights, powers, authorities and discretions under these Rules, including any right to enforce these Rules, to such person or entity as it may determine in its sole discretion, without consent from any Trading Member.

Amended on 15 September 201715 September 2017.

2.2.2

Where these Rules provide that any power, authority or discretion is to be exercised by the Board, the Board may delegate, assign or grant authority to exercise such power, authority or discretion to any person or entity. The Board may authorise a delegate to sub-delegate.

Added on 15 September 201715 September 2017.

2.2.A.1

SGX RegCo shall have the authority to exercise any rights, powers, authorities and discretions under these Rules, including the right to enforce these Rules. In the exercise of any such rights, powers, authorities and discretions under these Rules, SGX RegCo shall be bound to the same extent as the Exchange in respect of any obligations arising from the exercise of such rights, powers, authorities and discretions.

Added on 15 September 201715 September 2017.

2.3.1

SGX-ST will consider (and, if practicable, give effect to) advice tendered by the Securities Industry Council on matters relating to the securities industry.

2.4.1

None of SGX-ST, SGX RegCo, or their respective Directors, Officers, employees, representatives or agents (the "Relevant Persons") shall be liable to any Trading Member, or any of its customers, for but not limited to:—

Amended on 3 April 20083 April 2008, 15 September 201715 September 2017 and 8 October 20188 October 2018.

2.4.2

Without prejudice to the generality of Rule 2.4.1, none of the Relevant Persons (i) makes any warranty, express or implied, or (ii) shall be liable to any person in respect of, or in connection with, any of the following:—

Amended on 15 September 201715 September 2017.

2.4.3

In Rule 2.4.2, a reference to an Index is a reference to making, calculating or compiling the Index, or any intra day proxies related or referable thereto, or any information or data included in or referable thereto.

2.4.4

SGX-ST may require a Trading Member to pay SGX-ST's costs of producing (pursuant to a court order or other legal process) records relating to the business or affairs of a Trading Member, any of its Directors, Officers, Trading Representatives, employees or agents. This applies regardless of who requires the production.

2.5.1

Each Trading Member indemnifies each of SGX-ST, SGX RegCo, and their respective Directors, Officers, employees, representatives and agents ("Indemnified Persons") against any loss or liability reasonably incurred or suffered by an Indemnified Persons where such loss or liability arose out of or in connection with:—

Amended on 26 April 201326 April 2013 and 15 September 201715 September 2017.

2.5.2

Without prejudice to the generality of Rule 2.5.1, in the event that any legal, arbitration or other proceedings are brought to impose any liability on all or any of the Indemnified Persons for an alleged failure on the part of any Indemnified Person to prevent or to require action by a Trading Member or any of its Directors, Officers, employees, representatives (including without limitation Trading Representatives) or agents, the Trading Member shall reimburse the relevant Indemnified Person for:—

The Trading Member shall render such co-operation as the Indemnified Person reasonably requires in respect of such proceedings including without limitation the production of any document or records.

Amended on 26 April 201326 April 2013 and 15 September 201715 September 2017.

2.5.3

Without prejudice to Rule 2.5.2, the Trading Member shall pay to an Indemnified Person, if the Indemnified Person so requires, the costs incurred by or on behalf of the Indemnified Person of producing or obtaining, pursuant to a court order or other legal process, records relating to the business or affairs of a Trading Member or any of its Directors, Officers, representatives (including without limitation Trading Representatives), employees or agents, regardless of the party requiring such production or obtainment.

Amended on 26 April 201326 April 2013 and 15 September 201715 September 2017.

2.6.1

SGX-ST may request a Trading Member to provide information or records for the discharge of SGX-ST's duties or the protection of investors and public interest. Such information or records include the terms and circumstances of, and parties to any dealings in securities or trades in futures contracts by a Trading Member's customers or former customers, and the terms of employment or contract and duties of a person acting for a Trading Member. The information or records must not contain untrue statements, be misleading or omit material statements.

Amended on 3 April 20083 April 2008 and 8 October 20188 October 2018.

2.7.1

SGX-ST will take all reasonable measures to protect information provided to it by or on behalf of a Trading Member under the Rules from unauthorised use or disclosure.

2.7.2

Disclosure of information by SGX-ST is not unauthorised use or disclosure if it:—

Amended on 3 April 20083 April 2008 and 23 January 200923 January 2009.

2.7.3

Nothing in Rule 2.7.2 limits what may at common law otherwise constitute authorised use or disclosure of information.

2.8.1

SGX-ST will maintain the following registers:—

2.8.2

An entry in a Register will be deleted by SGX-ST when a person ceases membership or registration.

2.9.1

SGX-ST will establish and administer a fidelity fund in accordance with Part XI of the Securities and Futures Act.

3.1.1

The Official List of SGX-ST consists of companies admitted to (and not removed from) the Official List of the SGX Mainboard and the Official List of SGX Catalist.

Amended on 3 April 20083 April 2008.

3.1.2

SGX-ST may, in its absolute discretion, admit, refuse, suspend or remove the official listing of an entity. The decision of SGX-ST is final. SGX-ST is not obliged to give any reasons.

3.1.3

SGX-ST's powers include:—

Amended on 1 February 20071 February 2007, 3 April 20083 April 2008 and 8 October 20188 October 2018.

3.1.4

Trading Members and Trading Representatives shall comply with all prescribed conditions and restrictions imposed under Rule 3.1.3(3).

Added on 1 February 20071 February 2007.

3.2.1

A Non-Listed Security may be quoted for trading on the Non-Listed Securities market on such conditions as SGX-ST prescribes.

Amended on 3 April 20083 April 2008.

3.2.2

All trades in Non-Listed Securities are subject to the Rules and any Directives.

Amended on 3 April 20083 April 2008.

3.2.3

A Non-Listed Security is quoted in the currency SGX-ST prescribes.

Amended on 3 April 20083 April 2008.

3.2.4

SGX-ST may, at its absolute discretion, approve, refuse, suspend or withdraw the quotation of a Non-Listed Security. The decision of SGX-ST is final. SGX-ST is not obliged to give any reasons.

Amended on 3 April 20083 April 2008.

3.2.5

Without limiting Rule 3.2.4, if a Non-Listed Security is declared a Designated Security (or equivalent) or is declared to be cornered (or equivalent) in the foreign stock exchange on which it is listed, SGX-ST will suspend it (including on such terms that it deems necessary) as soon as SGX-ST is aware of the declaration.

Amended on 3 April 20083 April 2008.

3.2.6

A contract note for a trade in a Non-Listed Security must state that the company:—

Amended on 3 April 20083 April 2008.

3.2.7

The delivery and settlement of trades in Non-Listed Securities are subject to the Settlement Rules in Chapter 9. SGX-ST may vary the delivery and settlement terms.

Amended on 3 April 20083 April 2008.

3.3.1

SGX-ST may operate a futures market and list futures contracts for trading on the Trading System.

Amended on 3 April 20083 April 2008 and 8 October 20188 October 2018.

4.1.1

To be eligible for admission as a Trading Member, an applicant must:—

Amended on 3 April 20083 April 2008, 19 May 201419 May 2014 and 29 December 201429 December 2014.

4.2.2

The applicant must inform SGX-ST in writing of the Clearing Member who has agreed to qualify it (unless it is admitted as a Clearing Member). The applicant must submit to SGX-ST the documentation supporting the agreement.

4.2.3

SGX-ST may, in its absolute discretion, approve or reject an application to be a Trading Member. SGX-ST is not obliged to give any reasons.

4.2.4

Without derogating from Rule 4.2.3, SGX-ST may reject an application to be a Trading Member if:—

Amended on 12 October 200512 October 2005 and 19 May 201419 May 2014.

4.3.1

If SGX-ST rejects an application to be a Trading Member, the applicant may, within 14 days after it is notified of SGX-ST's decision, appeal in writing to the SGX RegCo Board whose decision will be final.

Amended on 15 September 201715 September 2017.

4.4.1

An applicant approved by SGX-ST as a Trading Member will have its name entered in the Register of Trading Members. SGX-ST will notify all Trading Members of the effective date of a Trading Member's admission.

4.5.1

A Trading Member has access to organised markets established or operated by SGX-ST or such organised markets as SGX-ST specifies.

Amended on 8 October 20188 October 2018.

4.5.3

Subject to Rule 4.5.4, a Trading Member may deal in securities or futures contracts for 1 or more of the following:—

Amended on 3 April 20083 April 2008, 19 May 201419 May 2014 and 8 October 20188 October 2018.

4.5.4

A Trading Member that holds a licence specified in Rule 4.1.1(1)(b) shall not deal in securities or futures contracts for customers domiciled in Singapore.

Added on 19 May 201419 May 2014 and amended on 8 October 20188 October 2018.

4.5A.1

A Trading Member may authorise Direct Market Access for its customers in respect of markets established by or operated by SGX-ST or such markets as SGX-ST specifies.

Added on 18 September 201218 September 2012.

4.5A.2 Conditions Governing Direct Market Access

Added on 18 September 201218 September 2012 and amended on 15 March 201315 March 2013.

4.5A.3 Conditions Governing Sponsored Access

For the purpose of this Rule 4.5A.3, "recognised regulatory authority" refers to a signatory to the International Organization of Securities Commissions' Multilateral Memorandum of Understanding Concerning Consultation and Cooperation and the Exchange of Information, and “regulated activity” shall have the same meaning as in the Securities and Futures Act.

Added on 18 September 201218 September 2012 and amended on 15 March 201315 March 2013.

4.5A.4 Suspension and Termination of Direct Market Access

Added on 18 September 201218 September 2012 and amended on 15 March 201315 March 2013.

4.5B.1

A Trading Member must have security arrangements in place to ensure that unauthorised persons are denied access to markets established by or operated by SGX-ST or such markets as SGX-ST specifies.

Added on 18 September 201218 September 2012.

4.6.1 Compliance

A Trading Member must:—

4.6.2 Acts as Principal

A Trading Member contracts as principal as regards the other Trading Member when it trades on SGX-ST.

4.6.3 Contracts

Amended on 3 April 20083 April 2008.

4.6.4 Good Business Practice

A Trading Member must adhere to the principles of good business practice in the conduct of its business.

4.6.5 Responsibility to SGX-ST

A Trading Member is responsible to SGX-ST for:—

4.6.6 Supervision

A Trading Member must supervise its Trading Representatives, employees and agents.

4.6.7 Establish Procedures and Systems

A Trading Member must:—

Amended on 19 May 201419 May 2014.

4.6.7A Risk Management and Financial Controls

Refer to Practice Note 4.6.7A(2).

Added on 18 September 201218 September 2012 and amended on 15 March 201315 March 2013.

4.6.8 Change in Control

Amended on 15 September 201715 September 2017.

4.6.9 Reporting

A Trading Member must inform SGX-ST in writing immediately if it or any of its Directors, Officers, Trading Representatives, employees, or agents:—

Notwithstanding the foregoing, SGX-ST may require a Trading Member to inform SGX-ST from time to time in respect of any other matters and in such form as SGX-ST determines.

Amended on 19 May 201419 May 2014 and 8 October 20188 October 2018.

4.6.10 Payment

A Trading Member must pay SGX-ST all fees, levies and charges SGX-ST prescribes. SGX-ST may reduce or waive any fee, levy or charge.

4.6.11 Approved Executive Director

A Trading Member must inform SGX-ST in writing at least 7 days before an Approved Executive Director ceases to act. If the cessation is with immediate effect, the Trading Member must inform SGX-ST in writing the same day.

4.6.12 Directors

A Trading Member must inform SGX-ST in writing of a change in the composition of its board of Directors within 7 days of the change.

4.6.13 Trading Representatives

A Trading Member must:—

Amended on 3 April 20083 April 2008, 29 November 201029 November 2010 and 8 October 20188 October 2018.

4.6.14 Memorandum and Articles of Association

A Trading Member must inform SGX-ST in writing at least 7 days before any change to its Memorandum and Articles of Association takes effect.

4.6.15 Other Businesses

Amended on 15 September 201715 September 2017 and 8 October 20188 October 2018.

4.6.16 Register of Securities

Amended on 3 April 20083 April 2008, 19 May 201419 May 2014, 29 December 201429 December 2014 and 8 October 20188 October 2018.

4.6.17 Business Name

A Trading Member must inform SGX-ST in writing at least 7 days before it effects any change in its business name or contact details.

4.6.19 Voluntary Liquidation

A Trading Member must not commence voluntary liquidation without the prior written approval of SGX-ST.

4.6.20 Trading Member Ceases to Carry on Business

Amended on 23 January 200923 January 2009 and 19 May 201419 May 2014.

4.6.21 Business Continuity Requirements

Refer to Practice Note 4.6.21.

Added on 22 January 200922 January 2009 and amended on 19 May 201419 May 2014.

4.6.22 Adequacy of Systems

A Trading Member must ensure that its systems and connections to the Trading System operate properly, and have adequate and scalable capacity to accommodate trading volume levels.

Refer to Directive No. 5.

Added on 18 September 201218 September 2012.

4.7.1 Qualified by a Clearing Member

4.7.2 Clearing of Contracts by Qualifying Clearing Member

A Trading Member must ensure all contracts concluded on SGX-ST are submitted to its qualifying Clearing Member for clearing.

4.8.1 Procedures

If a Trading Member intends to resign, it must:—

4.8.2 Acceptance of Resignation by SGX-ST

SGX-ST need not accept the resignation of a Trading Member if it is:—

4.8.3 Deletion from Register

If SGX-ST accepts a Trading Member's resignation, the Trading Member's name will be deleted from the Register of Trading Members upon the effective date of resignation.

4.9.1

A Trading Member's access to organised markets established or operated by SGX-ST ceases if:—

Amended on 29 November 201029 November 2010, 11 January 201111 January 2011, 19 May 201419 May 2014 and 8 October 20188 October 2018.

4.9.2

When a Trading Member's right to access organised markets established or operated by SGX-ST has ceased, SGX-ST will notify all Trading Members of the effective date of cessation and the date of reinstatement of access rights (if applicable).

Amended on 8 October 20188 October 2018.4.9.3

A Trading Member whose access to organised markets established or operated by SGX-ST has ceased must continue to comply with the relevant Rules, and any Directives.

Amended on 8 October 20188 October 2018.

4.10.1

A former Trading Member remains liable to SGX-ST and its customers for any liabilities incurred under the Rules or Directives during the period of its membership. The former Trading Member also remains subject to disciplinary actions for any offence committed during the period of its membership.

5.1.1

To be eligible for registration as a Designated Market-Maker, an applicant must be a Corporation that is deemed appropriate by SGX-ST.

5.2.1

To become a Designated Market-Maker in respect of Specified Securities, an applicant must apply to SGX-ST in the form SGX-ST prescribes.

5.2.2

SGX-ST may, in its absolute discretion, approve or reject an application to be a Designated Market-Maker. SGX-ST is not obliged to give any reasons.

5.2.4

Without derogating from Rule 5.2.2, SGX-ST may reject an application to be a Designated Market-Maker if:—

Amended on 12 October 200512 October 2005 and 19 May 201419 May 2014.

5.3.1

If SGX-ST rejects an application to be a Designated Market-Maker, the applicant may, within 14 days after it is notified of SGX-ST's decision, appeal in writing to the SGX RegCo Board whose decision will be final.

Amended on 15 September 201715 September 2017.

5.4.1

An applicant approved by SGX-ST as a Designated Market-Maker will have its name entered in the Register of Designated Market-Makers. SGX-ST will notify all Designated Market-Makers and Trading Members of the effective date of the Designated Market-Maker's registration.

5.5.1 Compliance

A Designated Market-Maker must:—

5.5.2 Proprietary Accounts

A Designated Market-Maker may make a market in Specified Securities for 1 or more of the following:—

In this Rule, an Associated Corporation means any body corporate formed in or out of Singapore in which the Designated Market-Maker and its related corporations hold directly or indirectly a beneficial interest of not less than 20% of the issued share capital.

Amended on 29 December 201429 December 2014.

5.5.3 Bid and Offer Quotations

A Designated Market-Maker must publish on the Trading System competitive bid and offer quotations:—

Refer to Directive No. 3.

Amended on 3 April 20083 April 2008.

5.5.4 Execution of Trades

If a Designated Market-Maker is not a Trading Member, its trades in any Specified Securities must be routed through a Trading Member.

5.5.5 Market-Making Representative

A Designated Market-Maker must appoint at least 1 person as its market-making representative to receive and execute orders on its behalf. The person must be registered with SGX-ST as a market-making representative.

5.5.7 Auditors' Report

If asked, a Designated Market-Maker must provide an independent auditors' report to SGX-ST. This is for SGX-ST to review the Designated Market-Maker's performance or suitability as a Designated Market-Maker. The report may relate to the Designated Market-Maker's financial standing, personnel or internal control procedures.

5.5.8 Payment

A Designated Market-Maker must pay all fees, levies and charges SGX-ST prescribes. SGX-ST may reduce or waive any fee, levy or charge.

5.5.9 Notification of Adverse Changes

A Designated Market-Maker shall immediately notify SGX-ST if any of the following occurs, or is likely to occur:

Added on 27 May 201327 May 2013.

5.6.2

Specified Securities which have been suspended from trading or subject to a trading halt cease to be traded on the Trading System.

Amended on 3 April 20083 April 2008.

5.6.3

Except with SGX-ST's approval, a Designated Market-Maker must not make a market in a Specified Security which is suspended or subject to a trading halt. SGX-ST may specify conditions under which the Designated Market-Maker is permitted to do so.

5.6.4

If SGX-ST imposes restrictions on trades in any Specified Securities, a Designated Market-Maker must not make a market in Specified Securities that will breach the restrictions.

5.7.1

SGX-ST may suspend or restrict the activities of a Designated Market-Maker for such period as SGX-ST specifies if the Designated Market-Maker:—

Amended on 3 April 20083 April 2008 and 8 October 20188 October 2018.

5.8.1

SGX-ST may revoke the registration of a Designated Market-Maker in the circumstances under Rules 5.7.1(1)–(7) or if the Designated Market-Maker:—

5.9.1

If SGX-ST takes action against a Designated Market-Maker under Rule 5.7.1 or 5.8.1, it will inform the Designated Market-Maker in writing. Such action shall be effective on the date specified in the written notification.

5.9.2

If SGX-ST revokes the registration of a Designated Market-Maker under Rule 5.8.1, the Designated Market-Maker may, within 14 days after it is notified of SGX-ST's decision, appeal in writing to the SGX RegCo Board whose decision will be final.

Amended on 15 September 201715 September 2017.

5.10.1

A failure to comply with Chapter 5, or any applicable Rules or Directives, is a breach and may be subject to disciplinary action.

5.10.2

A Designated Market-Maker and a registered market-making representative are bound by the Supervisory Rules in Chapter 14 of these Rules and must comply with any disciplinary decision as if it were a Trading Member and he or she were a Trading Representative respectively.

Amended on 23 January 200923 January 2009.

5.11.1 Procedures

5.11.2 Acceptance of Resignation by SGX-ST

SGX-ST needs not accept the resignation of a Designated Market-Maker if it is:—

5.11.3 Deletion from Register

If SGX-ST accepts a Designated Market-Maker's resignation, the Designated Market-Maker's name will be deleted from the Register of Designated Market-Makers upon the effective date of resignation.

5.12.1

A former Designated Market-Maker remains liable to SGX-ST and its customers (if applicable) for any liabilities incurred under the Rules or Directives during the period of its registration in respect of a Specified Security. The former Designated Market-Maker also remains subject to disciplinary action for any offence committed during the period of its registration.

6.1.1

Amended on 19 May 201419 May 2014 and 29 December 201429 December 2014.

6.1.2

Upon registration, an Approved Executive Director is deemed to have agreed to be bound by the Rules, or any Directives SGX-ST prescribes.

6.2.1 Compliance

An Approved Executive Director must comply with the Rules, and any Directives SGX-ST prescribes.

6.2.2 Payment of Fees

An Approved Executive Director must pay SGX-ST all fees, levies and charges as SGX-ST prescribes. SGX-ST may reduce or waive any fee, levy or charge.

6.2.3 Other Businesses

Refer to Directive No. 1.

Amended on 15 September 201715 September 2017.

6.3.1

An Approved Executive Director will automatically cease to be registered as an Approved Executive Director if he or she:—

Amended on 19 May 201419 May 2014.

6.4.1

An Approved Executive Director who ceases to hold office will have his or her name deleted from the Register of Approved Executive Director upon the effective date of cessation.

6.5.1

A former Approved Executive Director remains liable to SGX-ST for any liabilities incurred under the Rules or Directives during the period of his or her registration. The former Approved Executive Director also remains subject to disciplinary actions for any offence committed during the period of his or her registration.

7.1.1

To be eligible for registration as a Trading Representative, an applicant must:—

Amended on 3 April 20083 April 2008, 29 November 201029 November 2010 and 19 May 201419 May 2014.

* SGX-ST shall evaluate "fit and proper" criteria in this Rule 7.1.1 in a manner similar to the MAS Guidelines on Fit and Proper Criteria.

7.2.1

To become a Trading Representative, an applicant must apply to SGX-ST in the form SGX-ST prescribes. The application must be supported by a Trading Member as his or her principal.

7.2.2

SGX-ST may, in its absolute discretion, approve or reject an application to be a Trading Representative. SGX-ST is not obliged to give any reasons.

7.2.3

In approving an application to be a Trading Representative, SGX-ST may consult the Relevant Regulatory Authority.

Amended on 19 May 201419 May 2014.

7.2.4

Without derogating from Rule 7.2.2, SGX-ST may reject an application to be a Trading Representative if:—

Amended on 12 October 200512 October 2005 and 19 May 201419 May 2014.

7.3.1

If SGX-ST rejects an application to be a Trading Representative, the applicant's principal Trading Member may, within 14 days after it is notified of SGX-ST's decision, appeal in writing to the SGX RegCo Board whose decision will be final.

Amended on 15 September 201715 September 2017.

7.4.1

An applicant approved by SGX-ST as a Trading Representative will have his or her name entered in the Register of Trading Representatives.

7.4.2

Upon registration, a Trading Representative is deemed to have agreed to be bound by the Rules, or any Directives SGX-ST prescribes.

7.5.1 Compliance

A Trading Representative must comply with the Rules, and any Directives SGX-ST prescribes.

7.5.3 Good Business Practice

A Trading Representative must adhere to the principles of good business practice in the conduct of his or her business affairs.

7.5.4 Payment of Fees

A Trading Representative must pay SGX-ST all fees, levies and charges as SGX-ST prescribes. SGX-ST may reduce or waive any fee, levy or charge.

7.5.5 Register of Securities

Amended on 3 April 20083 April 2008, 19 May 201419 May 2014, 29 December 201429 December 2014 and 8 October 20188 October 2018.

7.5.6 Other Businesses

Refer to Directive No. 1.

Amended on 15 September 201715 September 2017.

7.5.7 Contact Details

A Trading Representative must inform SGX-ST in writing of any change in his or her residential or mailing address or contact numbers within 7 days of the change.

7.6.1

A Remisier must give a deposit of at least $30,000 to the Trading Member. It must be in the form of cash, Marketable Securities or a guarantee from a bank or financial institution operating in Singapore.

Amended on 23 January 200923 January 2009.

7.6.2

A Trading Member may require a Remisier to increase the amount of deposit or restrict the Remisier's volume of business if, in the Trading Member's opinion, the deposit is not enough for the volume of business transacted by the Remisier.

7.7.1

A Trading Representative will automatically cease to be registered as a Trading Representative if he or she:—

Amended on 29 November 201029 November 2010 and 19 May 201419 May 2014.

7.7.2

The Exchange may terminate the registration of a Trading Representative if the Relevant Regulatory Authority imposes conditions or restrictions on the Trading Representative in respect of the relevant regulated activities.

Added on 19 May 201419 May 2014.

7.8.1

A Trading Representative who ceases to act for his or her Trading Member will have his or her name deleted from the Register of Trading Representatives upon the effective date of cessation.

7.9.1

A former Trading Representative remains liable to SGX-ST for any liabilities incurred under the Rules or Directives during the period of his or her registration. The former Trading Representative also remains subject to disciplinary actions for any offence committed during the period of his or her registration.

8.1.1

A security or futures contract listed or quoted on SGX-ST must be traded through the Trading System or as otherwise allowed under this Chapter.

Amended on 3 April 20083 April 2008 and 8 October 20188 October 2018.

8.2.1

The trading hours and the application of the market phases are as published by SGX-ST. SGX-ST may vary the trading hours and application of the market phases.

Refer to Practice Note 8.2.1.

8.2.2

The market phases are as follows:—

This phase allows order entry, order modification, and withdrawal of orders but no matching of orders.

No order entry and amendment are allowed in this phase. All existing orders are matched at a single price according to the algorithm set by SGX-ST. All unmatched orders, except at the close of trading, are carried over to the next phase.

This phase allows order entry, order modification, and withdrawal of orders. All orders are matched in accordance with price priority, subject to Rule 8.10A, followed by time priority.

This phase allows order entry, order modification, and withdrawal of orders. At the end of the phase, orders will be matched at a single price based on the algorithm set by SGX-ST. All unmatched orders will be carried over to the next phase.

Refer to Practice Note 8.2.2.

Amended on 24 February 201424 February 2014 and 16 September 201616 September 2016.

8.2A.1

"Prescribed Instrument" refers to such security or futures contract or product or class of securities, futures contracts or products that SGX-ST may prescribe.

Refer to Practice Note 8.2A.2.

Added on 24 February 201424 February 2014 and amended on 8 October 20188 October 2018.

8.2A.2

The closing price of a Prescribed Instrument shall be determined in accordance with the relevant formula and procedures applicable to each Prescribed Security, as determined by SGX-ST from time to time. In arriving at such formula and procedure, SGX-ST may take into account factors, including but not limited to:

Refer to Practice Note 8.2A.2.

Added on 24 February 201424 February 2014 and amended on 8 October 20188 October 2018.

8.2A.3

Notwithstanding the foregoing, SGX-ST shall reserve the right to amend the closing price of any Prescribed Instrument if it so deems necessary.

Added on 24 February 201424 February 2014 and amended on 8 October 20188 October 2018.

8.2A.4

Without limiting Rule 2.4.1, SGX-ST (including SGX-ST's subsidiaries, related companies and holding company), its Directors, Officers, employees and agents make no warranty, express or implied, and shall have no liability to any person in respect of, or in connection with, the closing price of a Prescribed Security, including without limitation:

Added on 24 February 201424 February 2014.

8.3.1

Except for the unit share market, the minimum order size is 1 board lot. Orders may be in multiples of a board lot.

8.3.3

Unless otherwise determined by SGX-ST, the minimum bid size of the following products shall be as follows:

| S/N | Product | Price Range ($) | Minimum Bid Size ($) |

| 1 | Stocks (excluding preference shares), Real Estate Investment Trusts (REITS), business trusts, company warrants and any other class of securities or futures contracts not specified in this Rule 8.3.3 | Below 0.20 | 0.001 |

| 0.20–0.995 | 0.005 | ||

| 1.00 and above | 0.01 | ||

| 1A | Structured warrants | Below 0.20 | 0.001 |

| 0.20–1.995 | 0.005 | ||

| 2.00 and above | 0.01 | ||

| 2 | Exchange traded funds and exchange traded notes | All | $0.01 or $0.001 as determined by SGX-ST |

| 3 | Debentures, bonds, loan stocks and preference shares | All | $0.001 |

For the avoidance of doubt, the minimum bid sizes above apply to securities and futures contracts denominated in all currencies, except the Hong Kong Dollar ("HKD"), Renminbi ("RMB") or Japanese Yen ("JPY"). For securities and futures contracts traded in HKD, RMB and JPY, the minimum bid sizes shall as far as practicable be aligned to the minimum bid sizes applicable in Hong Kong and Japan respectively.

Amended on 24 December 200724 December 2007, 3 April 20083 April 2008, 4 July 20114 July 2011, 20 July 201220 July 2012, 13 November 201713 November 2017 and 8 October 20188 October 2018.

8.3.4

Each order entered into the Trading System must specify the Position Account code, the Trading Account code and the price and quantity of the security or futures contract.

Amended on 3 April 20083 April 2008, 1 July 20161 July 2016 and 8 October 20188 October 2018.

8.3.5

Each entered order is given a unique order number by the Trading System.

Amended on 3 April 20083 April 2008.

8.4.2

All securities that are designated by CDP as eligible for clearing will be traded on an "ex" basis for two Market Days before and up to the books closure date for an entitlement.

Amended on 3 April 20083 April 2008 and 10 December 201810 December 2018.

8.4.4

A buyer (seller) of securities on a "cum" ("ex") basis who has not received that entitlement may claim the entitlement from the seller (buyer).

8.5.1

A contract made on SGX-ST can be cancelled only in accordance with this Rule. For avoidance of doubt, a contract is not cancelled if:—

8.5.2

SGX-ST may cancel a contract in any of the following circumstances:—

8.5.4

SGX-ST may reprimand or impose a fine not exceeding $2,000 on a Trading Representative or Trading Member who causes a contract to be cancelled. Action under this Rule is in addition to other actions which SGX-ST is entitled to take against the Trading Representative or Trading Member.

8.6.1

An error trade refers to a transaction effected on the Trading System as follows:

Amended on 3 April 20083 April 2008 and 15 September 201715 September 2017.

8.6.2

If an error trade occurs:—

Amended on 3 April 20083 April 2008 and 8 October 20188 October 2018.

8.6.3

Where the Trading Members cannot agree to the cancellation of an error trade, a Trading Member may request SGX-ST to review the error trade. The following procedures apply:

Amended on 3 April 20083 April 2008.

8.6.3A

Notwithstanding Rules 8.6.2(3) and 8.6.3(1), SGX-ST may in its discretion allow such extension of time for the submitting of information or requests relating to error trades as it deems appropriate, taking into account:

Added on 24 February 201424 February 2014.

8.6.4

SGX-ST will not review an error trade referred to it by a Trading Member, where the error trade falls at or within the upper and lower limits of a no-cancellation range applied pursuant to Rule 8.6.4A

Amended on 24 February 201424 February 2014.

8.6.4A

Subject to Rule 8.6.4B, a no-cancellation range will be applied to the following instruments:

Added on 24 February 201424 February 2014 and amended on 8 October 20188 October 2018.

8.6.4B

SGX-ST retains the discretion to apply or remove no-cancellation ranges from instruments listed for trading on SGX-ST.

Added on 24 February 201424 February 2014.

8.6.7

The requesting Trading Member must pay a trade review fee of $1,000 for each referral accepted for review by SGX-ST, regardless of the outcome of the review.

Amended on 24 February 201424 February 2014.

8.6.8

Notwithstanding Rule 8.6.7, SGX-ST may grant a waiver of the trade review fee where it deems appropriate.

8.6.9

Notwithstanding Rules 8.6.4, 8.6.13, 8.6.13A and 8.6.13B, SGX-ST may review the validity of any transaction effected on the Trading System where SGX-ST deems that the cancellation of the error trade is necessary for the proper maintenance of a fair and orderly market.

Amended on 24 February 201424 February 2014.

8.6.12

SGX-ST may consider the following factors when deciding whether to cancel an error trade under Rules 8.6.13, 8.6.13A and 8.6.13B:

Amended on 24 February 201424 February 2014 and 8 October 20188 October 2018.

8.6.13

Error trades in structured warrants that are referred to SGX-ST will be reviewed in accordance with the following Rules:

Amended on 24 February 201424 February 2014.

8.6.13A

Error trades in all other securities or futures contracts, excluding bonds, will be reviewed in accordance with the following Rules:

Added on 24 February 201424 February 2014 and amended 8 October 20188 October 2018.

8.6.13B

Upon receipt of a request to review an error trade in bonds, SGX-ST will consider the validity of the error trade. SGX-ST may, in its discretion, make a determination that the error trade is to be cancelled, having regard to the factors in Rule 8.6.12.

Added on 24 February 201424 February 2014.

8.6.17

SGX-ST will:

Added on 24 February 201424 February 2014.

8.6.18

SGX-ST will not consider any request to review its decision following the notifications under Rule 8.6.17.

Added on 24 February 201424 February 2014.

8.7.1

A Trading Member may only execute Direct Business that is:—

Amended on 3 April 20083 April 2008, 23 January 200923 January 2009 and 8 October 20188 October 2018.

8.7.2

Direct Business may be transacted between:—

8.7.4

Direct Business must be reported through the married trade reporting system of the Trading System under Rule 8.7.5. The price, quantity, counterparty, and other details as required under Rule 8A.3.1 must be reported.

Amended on 3 April 20083 April 2008 and 11 March 201311 March 2013.

8.7.5

Direct Business must be reported within 10 minutes of execution save that Direct Business executed after market close must be reported in the first 20 minutes of the Opening Routine on the following Market Day.

Amended on 7 June 20107 June 2010 and 13 November 201713 November 2017.

8.7.6

SGX-ST may suspend Direct Business on any or all securities or futures contracts. SGX-ST may specify conditions under which Direct Business is permitted for securities or futures contracts.

Amended on 3 April 20083 April 2008 and 8 October 20188 October 2018.

8.8.1

The Board may declare publicly a listed or quoted security or futures contract to be a "Designated Instrument" if, in its opinion, there has been manipulation of the security or futures contract (or its underlying), excessive speculation in the security or futures contract (or its underlying), or it is otherwise desirable in the interests of organised markets established or operated by SGX-ST.

Refer to Practice Note 8.8.1.

Amended on 3 April 20083 April 2008 and 8 October 20188 October 2018.

8.8.2

The Board may impose any conditions it thinks fit on dealing or trading in a Designated Instrument. A condition applies from the date of declaration to all contracts of the Designated Instrument entered into on or after the date of declaration, or as indicated by the Board. For avoidance of doubt, the conditions may include:

Amended on 3 April 20083 April 2008, 1 July 20141 July 2014 and 8 October 20188 October 2018.

8.8.3

If asked, a Trading Member must give SGX-ST particulars of all its dealings or trades in Designated Instruments and of the customers involved. The Trading Member must do so by the next business day after being asked or as required.

Amended on 3 April 20083 April 2008 and 8 October 20188 October 2018.

8.9.1

The Board may declare a corner in a listed or quoted security if, in its opinion:—

8.9.2

The Board may impose any conditions it thinks fit on existing ready market or futures contracts on a cornered security or on dealing in a cornered security. For avoidance of doubt, the conditions may include:—

Amended on 3 April 20083 April 2008 and 8 October 20188 October 2018.

8.9.3

If the Board imposes a condition that contracts are to be cash settled, it must establish a Settlement Committee to advise on the fair settlement price.

8.9.4

A Settlement Committee must comprise no less than 5 persons, including at least:—

The quorum of the Settlement Committee is all members when the meeting proceeds to business, but the Settlement Committee may complete the business with any 3 present.

8.9.6

A Settlement Committee may hear evidence as it thinks proper and relevant to the discharge of its functions.

8.9.7

A Settlement Committee must report its findings to the Board. The findings are advisory only. The Board will accept the Settlement Committee's recommendation on the fair settlement price, unless it has good reasons to reject it. The Board may refer a matter to the Settlement Committee for further consideration, before deciding on the fair settlement price.

8.9.8

The fair settlement price determined by the Board is final and binding on all parties to any outstanding ready market or futures contract on the cornered security.

Amended on 3 April 20083 April 2008 and 8 October 20188 October 2018.

8.10.1

SGX-ST may suspend or restrict trading in any or all listed or quoted securities or futures contracts. It may do so for 1 or more markets or 1 or more trading sessions or any part of a trading session. It may do so in any of the following circumstances:—

Refer to Practice Note 8.10.1.

Amended on 3 April 20083 April 2008, 24 February 201424 February 2014 and 8 October 20188 October 2018.

8.10.1A

SGX-ST may restrict trading by such means as it considers appropriate, including placing the market into an Adjust Phase.

Added on 16 September 201616 September 2016.

8.10.2

A suspension and a trading restriction may be lifted by SGX-ST at any time.

Amended on 16 September 201616 September 2016.

8.10.3

Securities or futures contracts which have been suspended from trading cease to be traded on the Trading System. Except with SGX-ST's approval, a Trading Member must not execute any transactions in a suspended security or futures contract.

Refer to Practice Note 8.10.3.

Amended on 3 April 20083 April 2008 and 8 October 20188 October 2018.

8.10.4

Unmatched orders in a security or futures contract in the Trading System may lapse in the event of a suspension of that security or futures contract, as determined by SGX-ST.

Refer to Practice Note 8.10.1

Amended on 3 April 20083 April 2008, 16 September 201616 September 2016 and 8 October 20188 October 2018.

8.10.5

Where SGX-ST has suspended or restricted trading in all listed or quoted securities or futures contract in 1 or more markets, SGX-ST may extend a trading session for the market when trading recommences.

Amended on 3 April 20083 April 2008, 8 April 20148 April 2014, 16 September 201616 September 2016 and 8 October 20188 October 2018.

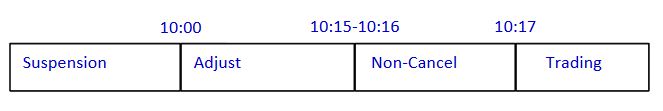

8.10.6

Securities or futures contracts subject to suspension will be placed in Adjust Phase for a minimum of 15 minutes before trading recommences.

Amended on 3 April 20083 April 2008 and 8 October 20188 October 2018.

8.10A.1

SGX-ST may prescribe, for certain securities and futures contracts, Circuit Breakers which are designed to temporarily restrict trading in these securities and futures contracts.

Added on 24 February 201424 February 2014 and 8 October 20188 October 2018.

8.10A.2

SGX-ST shall impose a Cooling-Off Period on such security or futures contract referred to in Rule 8.10A.1 if an incoming order seeks to be matched, either partially or fully, with an existing order in the Trading System at a price outside the Circuit Breaker.

Added on 24 February 201424 February 2014 and 8 October 20188 October 2018.

8.10A.3

Where the Cooling-Off Period is activated pursuant to Rule 8.10A.2, the following will apply:

Added on 24 February 201424 February 2014.

8.11.1

A trading halt may be imposed by SGX-ST at the request of an Issuer.

Refer to Practice Note 8.10.1.

8.11.1A

A trading halt may be imposed by SGX-ST on a security or futures contract when its underlying, or such instrument on the same underlying as SGX-ST may prescribe, is subject to a Cooling-Off Period pursuant to Rule 8.10A.2.

Added on 24 February 201424 February 2014 and amended on 8 October 20188 October 2018.

8.11.4

A trading halt may be imposed for up to 3 Market Days or such other short extension as SGX-ST agrees.

8.11.5

A trading halt is for a minimum duration of 30 minutes or such period SGX-ST prescribes.

Amended on 21 September 201121 September 2011.

8.11.7

Securities or futures contracts which are subject to a trading halt cease to be traded on the Trading System. Except with SGX-ST's approval, a Trading Member must not execute any transactions in a security or futures contract subject to a trading halt.

Refer to Practice Note 8.10.3.

Amended on 3 April 20083 April 2008 and 8 October 20188 October 2018.

8.12.1

SGX-ST may prohibit or limit a Trading Member from entering orders on the Trading System for a period not exceeding 14 days if the Trading Member:—

Amended on 3 April 20083 April 2008 and 8 October 20188 October 2018.

8.12.2

If SGX-ST takes action against a Trading Member under Rule 8.12.1, it will inform the Trading Member in writing.

8.13.1

A Trading Member who has access into the Trading System via SGXAccess or such other open interface applications must comply with the requirements SGX-ST prescribes.

Amended on 3 April 20083 April 2008.

8A.1.1

In this Rule:

Refer to Practice Note 8A.

Added on 11 March 201311 March 2013 and amended on 1 October 20181 October 2018.

8A.3.1

Each sell order for Specified Capital Markets Products shall be marked to indicate to SGX-ST whether it is a Short Sell Order or a normal sell order. The quantity, volume or value of the Specified Capital Markets Product in which a person intends to make or is making a Short Sell Order shall also be indicated.

Added on 11 March 201311 March 2013 and amended on 1 October 20181 October 2018.

8A.3.1A

A Trading Member and its Trading Representative shall not enter a sell order in the Trading System if a customer has not indicated whether the sell order is a Short Sell Order or a normal sell order and/or has not provided the information relating to the quantity, volume or value of the Specified Capital Markets Product in which the customer intends to make or is making a Short Sell Order.

Added on 1 October 20181 October 2018.

8A.3.2

The requirement to mark sell orders as set out in this Rule shall include Direct Business reported through the married trade reporting system of the Trading System pursuant to Rule 8.7

Added on 11 March 201311 March 2013 and amended on 1 October 20181 October 2018.

8A.3.3

A Trading Member shall ensure that the necessary procedures and systems are implemented to facilitate compliance with the obligations set out in this Rule.

Refer to Practice Note 8A.

Added on 11 March 201311 March 2013 and amended on 1 October 20181 October 2018.

8A.4.1

SGX-ST may, at its discretion, exempt any specific Specified Capital Markets Product from the requirement to mark sell orders as set out in this Rule.

Added on 11 March 201311 March 2013 and amended on 1 October 20181 October 2018.

8A.4.2

SGX-ST may, at its discretion, waive the requirement to mark sell orders for specific classes of market participants.

Refer to Practice Note 8A.

Added on 11 March 201311 March 2013 and amended on 1 October 20181 October 2018.

8A.4.3

A Trading Member and its Trading Representatives shall not be required to comply with this Rule in respect of sell orders from the market participants for whom SGX-ST has waived the requirement to mark sell orders for or in such Specified Capital Markets Products as exempted by SGX-ST.

Added on 11 March 201311 March 2013 and amended on 1 October 20181 October 2018.

8A.5.1

SGX-ST shall report before the start of each Market Day the aggregate volume of Short Sell Orders matched and executed for the preceding Market Day and in respect of each Specified Capital Markets Product for which marking is required.

Added on 11 March 201311 March 2013 and amended on 1 October 20181 October 2018.

8A.5.2

SGX-ST may subsequently report corrections to such aggregate volume of Short Sell Orders matched and executed that have been reported pursuant to Rule 8A.5.1.

Added on 11 March 201311 March 2013.

8A.6.1

A Trading Member may submit a report of erroneously marked sell orders through such facility that is provided by SGX-ST.

Added on 11 March 201311 March 2013.

8A.6.2

A Trading Member shall ensure that the report:

Refer to Practice Note 8A.

Added on 11 March 201311 March 2013 and amended on 1 October 20181 October 2018.

9.1.1

Unless otherwise specified by SGX-ST, delivery of securities for settlement of trades in securities or deliverable futures contracts which are designated by CDP as eligible for clearing is by book entry at CDP.

Amended on 3 April 20083 April 2008, 8 October 20188 October 2018 and 10 December 201810 December 2018.

9.1.2

Delivery of physical certificates is not accepted for settlement of trades in securities or deliverable futures contracts that are designated by CDP as eligible for clearing.

Amended on 3 April 20083 April 2008, 8 October 20188 October 2018 and 10 December 201810 December 2018.

9.1.3

A Securities Account must be maintained with CDP by or for customers who trade in securities or deliverable futures contracts that are designated by CDP as eligible for clearing and by or for each Trading Member who trades in such securities or futures contracts for their own account. The Securities Account may be maintained directly with CDP or through a depository agent.

Amended on 3 April 20083 April 2008, 8 October 20188 October 2018 and 10 December 201810 December 2018.

9.1.4

Unless otherwise agreed between a customer and a Trading Member, trades are settled in the currency of quotation at the exchange rate determined by the Trading Member.

Amended on 10 December 201810 December 2018.

9.1A.1

Unless otherwise stated by SGX-ST and subject to Rule 9.1A.2, the Intended Settlement Day and eligibility for clearing of a trade that is executed on the Trading System or reported to SGX-ST is as indicated below:

| Ready market (for securities other than wholesale corporate bonds) | T+2 | Eligible for clearing by CDP |

| Market for Marginable Futures Contracts | LTD+2 | Eligible for clearing by CDP |

| Market for wholesale corporate bonds | T+2 | Not eligible for clearing by CDP |

| Unit share market (for securities other than wholesale corporate bonds) | T+2 | Eligible for clearing by CDP |

| Buying-in market | T+1 | Eligible for clearing by CDP |

Where T is the date on which the trade is executed and LTD is the Last Trading Day.

Added on 10 December 201810 December 2018.

9.1A.2

SGX-ST may change the trading period and settlement date.

Added on 10 December 201810 December 2018.

9.1A.3

If the day indicated in Rule 9.1A.1 is a holiday for the foreign currency in which a trade is to be settled, the Intended Settlement Day for that trade will be the next common banking day on which CDP is open for business.

In this Rule, "common banking day" means a day on which (a) Singapore banks and (b) the relevant bank transfer clearing system designated by CDP for the foreign currency, are both open for settlement.

Added on 10 December 201810 December 2018.

9.1B.1

Trades that have not been designated by CDP as eligible for clearing will be settled as agreed between the parties.

Added on 10 December 201810 December 2018.

9.2 Relationship Between Trading Member and Selling Customer

Amended on 10 December 201810 December 2018.

9.2.1

A selling customer must look only to its Trading Member, who executes the trade, in relation to all obligations in connection with that trade, including payment of sale proceeds.

Amended on 23 January 200923 January 2009 and 10 December 201810 December 2018.

9.2.2A

Unless a selling customer has in place arrangements to settle trades with its Trading Member on a delivery-versus-payment basis through the CDP Settlement Facility, the Trading Member must make payment of the sale proceeds to the selling customer on the banking day after the day that CDP makes payment to the Trading Member, save that the Trading Member may withhold payment until the selling customer has made delivery.

In this Rule, "banking day" means a day on which the bank(s) used by the Trading Member for payment to its customer is(are) open for settlement.

Added on 10 December 201810 December 2018.

9.2.3

If a selling customer fails to make securities available on Intended Settlement Day and buying-in is conducted under the Clearing Rules in respect of those securities, the selling customer shall be liable to the Trading Member for any costs or losses incurred by the Trading Member in relation to the buying-in.

Amended on 10 December 201810 December 2018.

9.3 Relationship Between Trading Member and Clearing Member

This Rule 9.3 applies only to trades that are cleared with CDP.

Amended on 10 December 201810 December 2018.

9.3.1

A selling Trading Member must look only to its Clearing Member who qualifies it in relation to all obligations in connection with trades that the selling Trading Member executes, including payment of sale proceeds.

Amended on 23 January 200923 January 2009 and 10 December 201810 December 2018.

9.3.2

A buying Trading Member must look only to its Clearing Member who qualifies it in relation to all obligations in connection with trades that the buying Trading Member executes, including delivery of securities or in the case of a deliverable futures contract, the relevant underlying.

Amended on 3 April 20083 April 2008, 23 January 200923 January 2009, 8 October 20188 October 2018 and 10 December 201810 December 2018.

9.3.3

If a selling Trading Member fails to make securities available on Intended Settlement Day and buying-in is conducted under the Clearing Rules in respect of those securities, the selling Trading Member shall be liable to the Clearing Member for any costs or losses incurred by the Clearing Member in relation to the buying-in.

Added on 10 December 201810 December 2018.

9.3.4

A buying Trading Member must pay its Clearing Member for its trade as follows:

Added on 10 December 201810 December 2018.

9.4 Relationship Between Trading Member and Buying Customer

Amended on 10 December 201810 December 2018.

9.4.2A

A buying customer must look only to its Trading Member, who executes the trade, in relation to all obligations in connection with that trade, including delivery of securities or in the case of deliverable futures contracts, the relevant underlying. A buying customer must pay its Trading Member who executes the trade.

Added on 10 December 201810 December 2018.

9.4.2B

A Trading Member shall, if informed by CDP or its Clearing Member that a right to receive securities pursuant to an Exchange Trade is to be replaced with a right to receive a monetary sum ("Cash Settlement Amount") pursuant to the Clearing Rules, immediately inform the relevant buying customer.

Added on 10 December 201810 December 2018.

9.4.3

Unless a buying customer has in place arrangements to settle trades with its Trading Member on a delivery-versus-payment basis through the CDP Settlement Facility, the Trading Member must:

In this Rule, "banking day" means a day on which the bank(s) used by the Trading Member for payment to its customer is(are) open for settlement.

Amended on 10 December 201810 December 2018.

9.4.3A

A buying customer must pay its Trading Member for its trade as follows:

See Practice Note 9.4.3A(b).

Added on 10 December 201810 December 2018.

9.4.3B

Subject to Rules 9.4.4, if a buying customer fails to meet any of the timelines in Rule 9.4.3A, the Trading Member shall force-sell the securities of the buying customer on the following Market Day.

Added on 10 December 201810 December 2018.

9.4.4

Amended on 10 December 201810 December 2018.

9.4.5

A Trading Member exercising its discretion under Rule 9.4.4 must not engage in imprudent credit practices.

9.4.6

The following rules apply to all force-sales by a Trading Member:—

Amended on 10 December 201810 December 2018.

9.5 Trades Under Physical Delivery [Rule has been deleted.]

Deleted on 10 December 201810 December 2018.

9.6 Delivery Versus Payment ("DVP") Settlement [Rule has been deleted.]

Deleted on 10 December 201810 December 2018.

10.1.1

In this Chapter, "Order" means:—

Amended on 23 January 200923 January 2009.

10.2.1

A Trading Member (except SGX-SPV) and a Trading Representative are bound by this Chapter or any Directives when accessing a Foreign Market via the Exchange Link to execute Orders in a Selected Foreign Security.

10.2.3

Added on 18 September 201218 September 2012.

10.3.1

Subject to the provisions of this Chapter, a Trading Member may access a Foreign Market via the Exchange Link to execute Orders in a Selected Foreign Security.

10.3.2

SGX-ST may at any time, if it thinks fit:—

10.4.1

SGX-SPV must be a Trading Member and a Clearing Member for the purpose of facilitating Orders pertaining to a Selected SGX Security for execution in SGX-ST (inbound) and Orders pertaining to a Selected Foreign Security for execution in a Foreign Exchange (outbound).

10.4.2

SGX-SPV must be admitted as a Trading Member of SGX-ST if SGX-ST is satisfied that the following conditions have been, or will be, met:—

10.4.3

In relation to SGX-SPV as a Trading Member, SGX-ST will carry out its functions and exercise its powers in a like manner to the way it would carry out its functions in respect of other Trading Members, recognising the limited functions that SGX-SPV is intended to perform. SGX-SPV will not apply for an exemption, waiver or other exercise of discretion under the SGX-ST Rules unless it has first notified the Authority.

10.4.4

For outbound Orders, SGX-SPV:—

10.4.5

For inbound Orders, SGX-SPV, in its capacity as agent for the Foreign Portal Dealer, must:—

Amended on 3 April 20083 April 2008.

10.4.6

SGX-SPV may close out a position or correct an error if, in its opinion, it is necessary or desirable to manage risks prudently or meet requirements for the operation of the Service.

10.4.7

| Rule | Heading |

| 4.1.1 | Admission Criteria (as a Trading Member) |

| 4.6.1(2) | Compliance (with admission criteria) |

| 4.6.5 | Responsibility to SGX-ST |

| 4.6.11 | Approved Executive Director |

| 4.6.12 | Directors |

| 4.6.14 | Memorandum and Articles of Association |

| 4.6.17 | Business Name |

| 4.6.18 | Issue of Shares |

| 4.6.19 | Voluntary Liquidation |

| 6.1–6.5 | Approved Executive Director |

| 9.5 | Trades under Physical Delivery |

| 11.1–11.14 | Capital and Financial Requirements |

| 12.3 | Customer Accounts |

| 12.4 | Trading Authority |

| 12.6 | Contract Notes |

| 12.7 | Statement of Account to Customers |

| 12.11 | Customer's and Remisier's Money |

| 12.12 | Customer's and Remisier's Assets |

| 12.17.4 | Trading by Employees and Agents |

| 12.21 | Use of Office Premises |

| 13.5 | Arrangement with Customers |

| 13.12 | Identification & Password |

| Chapter 19 of these Rules |

Amended on 23 January 200923 January 2009.

10.5.1

When accessing a Foreign Market via the Exchange Link to trade in Selected Foreign Securities, a Trading Member:—

10.5.2

The following Rules apply to an Order executed on a Foreign Market via the Exchange Link by SGX-SPV:—

10.5.3

A Trading Member is responsible for its Order, regardless of whether the Trading Member authorised the sending of the Order.

10.6.1

The primary object of the core trading principles is to promote proper and orderly trading of Selected Foreign Securities via the Exchange Link.

10.6.2

Rule 10.6 applies to:—

10.6.3 Prevention of Disorderly Markets

10.6.4 Market Manipulation and False Market

10.6.5 Dealings in Suspended Securities

Unless agreed by the Foreign Exchange concerned, a Trading Member and a Trading Representative must not trade, or make a market in, any Selected Foreign Security on the Foreign Market via the Exchange Link if that security is suspended.