| Issue Date | Cross Reference | Enquiries |

| Amended on 17 February 201217 February 2012, 15 April 201315 April 2013, 24 February 201424 February 2014 and 16 September 201616 September 2016. | Rules 8.2.1–8.2.3 | Please contact Securities Market Control:— Email: securities.mc@sgx.com |

1 Introduction

Amended on 16 September 201616 September 2016.

2 Application of Market Phases

* Please see Point 2.2(2) and (3).

** Please see Point 2.5(3) and (4)

* Please see Point 2.2(2) and (3).

** Please see Point 2.5(3) and (4)

Amended on 1 August 20111 August 2011, 26 September 201126 September 2011 and 15 April 201315 April 2013.

Amended on 26 September 201126 September 2011 and 15 April 201315 April 2013 and 16 September 201616 September 2016.

Amended on 1 August 20111 August 2011 and 16 September 201616 September 2016.

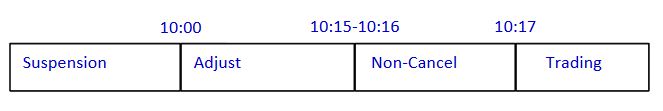

For illustrative purposes only:

SGX-ST specifies the Adjust Phase is to be followed immediately by the Non-Cancel Phase and further specifies that the Non-Cancel Phase will begin from 10:15h to 10:16h. In this case, the Adjust Phase will end simultaneously with the beginning of the Non-Cancel Phase at any time from 10:15h to 10:16h. Normal trading will begin at 10:17h.

Amended on 1 August 20111 August 2011 and 15 April 201315 April 2013 and 16 September 201616 September 2016.

Amended on 26 September 201126 September 2011 and 15 April 201315 April 2013 and 24 February 201424 February 2014 and 16 September 201616 September 2016.

3 Algorithm Used by SGX-ST to Compute the Single Price at Which Orders at the End of the Opening Routine, Closing Routine and Adjust Phase are Matched

Example 1

| Bid Volume | Price | Ask Volume | Cumulative Bid Volume (a) | Cumulative Ask Volume (b) | Tradable Volume | Imbalance (a)-(b) | Pressure |

| 0 | 3.750 | 10 | 340 | 10 | 10 | 330 | Buy |

| 0 | 3.760 | 20 | 340 | 30 | 30 | 310 | Buy |

| 50 | 3.770 | 50 | 340 | 80 | 80 | 260 | Buy |

| 100 | 3.780 | 80 | 290 | 160 | 160 | 130 | Buy |

| 70 | 3.790 | 30 | 190 | 190 | 190 | 0 | Nil |

| 30 | 3.800 | 40 | 120 | 230 | 120 | 70 | Sell |

| 90 | 3.810 | 20 | 90 | 250 | 90 | 160 | Sell |

Example 2

| Bid Volume | Price | Ask Volume | Cumulative Bid Volume (a) | Cumulative Ask Volume (b) | Tradable Volume | Imbalance (a)-(b) | Pressure |

| 0 | 3.750 | 10 | 340 | 10 | 10 | 330 | Buy |

| 0 | 3.760 | 20 | 340 | 30 | 30 | 310 | Buy |

| 50 | 3.770 | 50 | 340 | 80 | 80 | 260 | Buy |

| 100 | 3.780 | 110 | 290 | 190 | 190 | 100 | Buy |

| 70 | 3.790 | 20 | 190 | 210 | 190 | 20 | Sell |

| 30 | 3.800 | 40 | 120 | 250 | 120 | 130 | Sell |

| 90 | 3.810 | 20 | 90 | 270 | 90 | 180 | Sell |

If market orders are present a situation may arise in which the lowest imbalance occurs at “Market Price”, see sub-paragraph (2A).

If the highest tradable volume and lowest imbalance occur at more than one price the algorithm will then consider market pressure, see sub-paragraph (3).

Example 2A

| Bid Volume | Price | Ask Volume | Cumulative Bid Volume (a) | Cumulative Ask Volume (b) | Tradable Volume | Imbalance (a)-(b) | Pressure |

| MKT | 50 | 0 | |||||

| 3.750 | 10 | 50 | 10 | 10 | 40 | Buy | |

| 3.760 | 50 | 10 | 10 | 40 | Buy | ||

| 3.770 | 10 | 50 | 20 | 20 | 30 | Buy | |

| 10 | 3.780 | 50 | 20 | 20 | 30 | Buy | |

| 3.790 | 40 | 20 | 20 | 20 | Buy | ||

| 10 | 3.800 | 40 | 20 | 20 | 20 | Buy | |

| 3.810 | 30 | 20 | 20 | 10 | Buy | ||

| 30 | MKT | 30 | 20 | 20 | 10 | Buy |

Example 3

| Bid Volume | Price | Ask Volume | Cumulative Bid Volume (a) | Cumulative Ask Volume (b) | Tradable Volume | Imbalance (a)-(b) | Pressure |

| 0 | 3.750 | 10 | 260 | 10 | 10 | 250 | Buy |

| 0 | 3.760 | 20 | 260 | 30 | 30 | 230 | Buy |

| 50 | 3.770 | 50 | 260 | 80 | 80 | 180 | Buy |

| 0 | 3.780 | 110 | 210 | 190 | 190 | 20 | Buy |

| 90 | 3.790 | 0 | 210 | 190 | 190 | 20 | Buy |

| 30 | 3.800 | 40 | 120 | 230 | 120 | 110 | Sell |

| 90 | 3.810 | 20 | 90 | 250 | 90 | 160 | Sell |

Example 4

| Bid Volume | Price | Ask Volume | Cumulative Bid Volume (a) | Cumulative Ask Volume (b) | Tradable Volume | Imbalance (a)-(b) | Pressure |

| 0 | 3.750 | 10 | 260 | 10 | 10 | 250 | Buy |

| 0 | 3.760 | 20 | 260 | 30 | 30 | 230 | Buy |

| 50 | 3.770 | 50 | 260 | 80 | 80 | 180 | Buy |

| 0 | 3.780 | 130 | 210 | 210 | 210 | 0 | Nil |

| 90 | 3.790 | 0 | 210 | 210 | 210 | 0 | Nil |

| 30 | 3.800 | 40 | 120 | 250 | 120 | 130 | Sell |

| 90 | 3.810 | 20 | 90 | 270 | 90 | 180 | Sell |

Amended on 15 August 201115 August 2011, 17 February 201217 February 2012.

1 The examples shown are not exhaustive.