1.1.1

These Clearing Rules apply to all Exchange Trades that are cleared or settled through CDP. The Clearing Rules operate as a binding contract between CDP and each Clearing Member, and between a Clearing Member and any other Clearing Member.

Amended on 3 April 20083 April 2008, 8 October 20188 October 2018 and 3 June 20193 June 2019.

1.1.3

Except where CDP, SGX RegCo, or any person or entity referred to under Rule 1.1.7 otherwise expressly agrees with or expressly commit to any party, the benefit of any performance of obligations under these Clearing Rules and/or Clearing Directives is restricted only to Clearing Members. None of CDP, its related corporations, SGX RegCo, any person or entity referred to under Rule 1.1.7, or their respective directors, officers, employees, representatives or agents (the "Relevant Persons") shall be liable to any other party (including Trading Members). In particular, the Relevant Persons shall have no liability to any party affected or aggrieved by any alleged action or omission.

Amended on 23 January 200923 January 2009, 15 September 201715 September 2017 and 3 June 20193 June 2019.

1.1.4

All Clearing Members are to note the foregoing and ensure that they are taking on membership, and/or carrying on business, as Clearing Members, and that they transact and will transact by reference to CDP or upon information or action referable to CDP, only on the foregoing basis, and will also ensure that they will not open or allow the continued operation of any account for any person with respect to any transaction unless such person has been notified of the foregoing provisions and has satisfied itself that the same is acceptable and accepts the same.

1.1.5

CDP may waive the application of a rule (or part of a rule) to suit the circumstances of a particular case, unless the rule specifies that CDP shall not waive it. CDP may grant a waiver subject to such conditions as it considers appropriate. A waiver is only effective if the conditions are satisfied.

CDP shall notify all Clearing Members of such waivers as soon as practicable.

1.1.6

The Clearing Rules may be amended or repealed by the Board in accordance with the SFA.

Amended on 3 June 20193 June 2019.

1.1.7

CDP may delegate, assign or grant authority to exercise any of its rights, powers, authorities and discretions under these Rules, including any right to enforce these Rules, to such person or entity as it may determine in its sole discretion, without consent from any Clearing Member.

Where these Rules provide that any power, authority or discretion is to be exercised by the Board, the Board may delegate, assign or grant authority to exercise such power, authority or discretion to any person or entity. The Board may authorise a delegate to sub-delegate.

Added on 15 September 201715 September 2017.

1.1.8

SGX RegCo shall have the authority to exercise any rights, powers, authorities and discretions under these Rules, including the right to enforce these Rules. In the exercise of any such rights, powers, authorities and discretions under these Rules, SGX RegCo shall be bound to the same extent as CDP in respect of any obligations arising from the exercise of such rights, powers, authorities and discretions.

Added on 15 September 201715 September 2017.

1.2.1

In these Clearing Rules, unless the context otherwise requires:—

Where a provision of these Clearing Rules refers to or has effect for the purposes of a particular provision of the SFA or the Companies Act — the word or expression has in that provision of these Clearing Rules the same meaning as it has in that provision of the SFA or the Companies Act; in any other case, the word or expression has the same meaning in these Clearing Rules as it has in the SFA or the Companies Act.

Unless the context requires otherwise, where the terms defined below are defined in relation to a holder of a Capital Markets Services Licence, such definitions shall, with the necessary modifications, apply to a Clearing Member as those definitions apply to a holder of a Capital Markets Services Licence whether or not that Clearing Member holds a Capital Markets Services Licence.

A B C D E F G H I J K L M N O P Q R S T U V W X Y Z

| Term | Meaning |

| A | |

| "acceptable government securities" | means securities issued by a government with a Moody's Investors Service sovereign rating of at least Aaa, Standard & Poor's Corporation sovereign rating of at least AAA, Fitch, Inc sovereign rating of at least AAA or such other rating or such other government security, as may otherwise be prescribed by and acceptable to CDP from time to time |

| “Adjusted Amount” | has the meaning ascribed to it in Rule 7.10.6. |

| "adjusted net head office funds" | has the meaning ascribed to it in Regulation 2 of the SFR (Financial and Margin Requirements). |

| "aggregate indebtedness" | has the meaning ascribed to it in Regulation 2 of the SFR (Financial and Margin Requirements). |

| "aggregate resources" | when used in reference to:— (1) a Clearing Member incorporated in Singapore, means its financial resources and qualifying letters of credit referred to in Rule 5.1C less its total risk requirement; and (2) a Clearing Member incorporated outside Singapore, means its adjusted net head office funds and qualifying letters of credit referred to in Rule 5.1G less its total risk requirement. |

| "Appeals Committee" | means the committee appointed by the SGX RegCo Board to exercise the powers set out in Rule 11. |

| "[Deleted]" | "[Deleted]" |

| "Authority" | means the Monetary Authority of Singapore or such other body that shall be responsible for the administration of the SFA. |

| "Average Aggregate Resources" | means the average of the aggregate resources on the last day of each of the 3 months preceding the previous month. |

| B | |

| "Bank Clearing Member" | means a Clearing Member who has such rights and obligations as set out in Chapter 3. For the avoidance of doubt, a reference to a Bank Clearing Member incorporated outside Singapore shall refer to the branch located in Singapore, of a parent bank incorporated outside Singapore. |

| "base capital" | when used in reference to:— (a) a General Clearing Member, has the meaning ascribed to it in Regulation 2 of the SFR (Financial and Margin Requirements); and (b) a Bank Clearing Member, means its paid-up ordinary share capital and unappropriated profit or loss. |

| "Board" | means the Board of Directors for the time being of CDP or such of them as have authority to act for the Board. |

| "business governed by this Clearing Rules" or "operations governed by this Clearing Rules" | when used in reference to:— (1) a Bank Clearing Member incorporated in Singapore or a Bank Clearing Member incorporated outside Singapore which has satisfied Rule 3.1.3(10)(c), means its business or operations (whichever is applicable) involving all securities and derivatives contracts traded on any exchange and OTC Contracts novated to any clearing facility; and (2) a Bank Clearing Member incorporated outside Singapore which has satisfied Rule 3.1.3(10)(a) or (b), means its business or operations (whichever is applicable) involving securities and derivatives contracts traded on the Exchange and SGX-DT and OTC Contracts novated to CDP and SGX-DC. |

| "buying-in market" | means the market operated by SGX-ST for the sale and purchase of securities to be bought-in by CDP pursuant to these Clearing Rules. |

| C | |

| "Capital Markets Services Licence" | has the meaning ascribed to it in the SFA. |

| “cash settle” | in relation to an obligation to deliver securities or a right to receive securities means the replacing of that obligation or right with an obligation to pay or a right to receive a Cash Settlement Amount. |

| “Cash Settlement Amount” | means the monetary sum, as set out in Practice Note 6.5.1B(2), 6.6.2, 6.7.11 and 8.2.2(3E), to be paid or received pursuant to a cash settlement under these Clearing Rules. |

| "CDP" | means The Central Depository (Pte) Limited. |

| “CDP First Contribution” | has the meaning ascribed to it in Rule 7.4.1(1). |

| “CDP Second Contribution” | has the meaning ascribed to it in Rule 7.4.1(2). |

| “CDP Settlement Facility” | means the settlement facility operated by CDP for settlement pursuant to the CDP Settlement Rules. |

| “CDP Settlement Rules” | means the Settlement Rules of CDP as the same may be amended, modified, supplemented or replaced from time to time. |

| “Chief Executive Officer” | has the meaning ascribed to it in the SFA. |

| [Deleted] | [Deleted] |

| "Circular" | means a binding notice issued by CDP regarding regulatory and non-regulatory matters pertaining to Clearing Members. |

| "Clearing Account" | means, in relation to a Clearing Member, the Securities Account maintained by it for settlement purposes. |

| "Clearing Directives" | means any Directives, Regulatory Notices, Circulars, and terms and conditions governing the operations, facilities and services provided by CDP. |

| "Clearing Fund" | means the fund referred to in Rule 7. |

| "Clearing House Examiner" | means the person appointed as such under Rule 11.1.5. |

| "Clearing House Inspector" | means the person appointed as such under Rule 11.2.1. |

| "Clearing Member" | means the corporation granted or admitted to be a member of CDP for clearing, pursuant to these Clearing Rules and shall include a General Clearing Member and a Bank Clearing Member. |

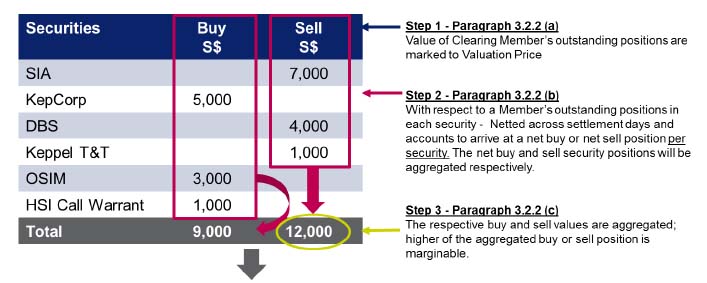

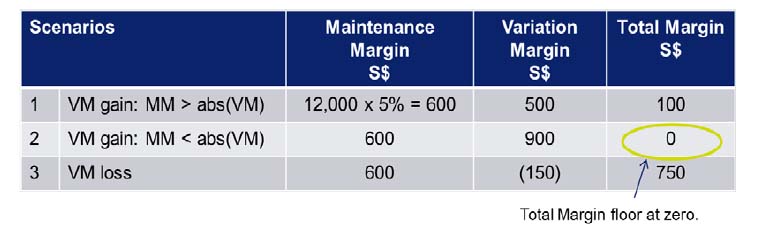

| "Clearing Member Maintenance Margins" | means that component of the Clearing Member Required Margins, as determined by CDP, deposited by the Clearing Member with CDP for or in relation to all Novated Contracts carried in its books. |

| "Clearing Member Required Margins" | means the sum of Clearing Member Maintenance Margins and Clearing Member Variation Margins. |

| "Clearing Member Variation Margins" | means that component of Clearing Member Required Margins comprising the mark-to-market gains and losses, in relation to the price at which the Novated Contract was bought and sold, arising from CDP's daily valuation of positions. A net loss increases the Clearing Member Required Margins amount, and a net profit decreases the Clearing Member Required Margins amount. |

| "Clearing Membership" | means membership of CDP pursuant to this Clearing Rules. |

| "Clearing Rules" | means the CDP Clearing Rules, including the Directives, Regulatory Notices and Circulars, as the same may be amended, modified, supplemented or replaced from time to time. |

| "Collateral" | means all or any of the monies and assets deposited with, or otherwise provided to, CDP by or for a Clearing Member as margin, credit support and/or security as may be required under these Clearing Rules or as otherwise directed by CDP and shall not include the monies and assets of the Clearing Fund. |

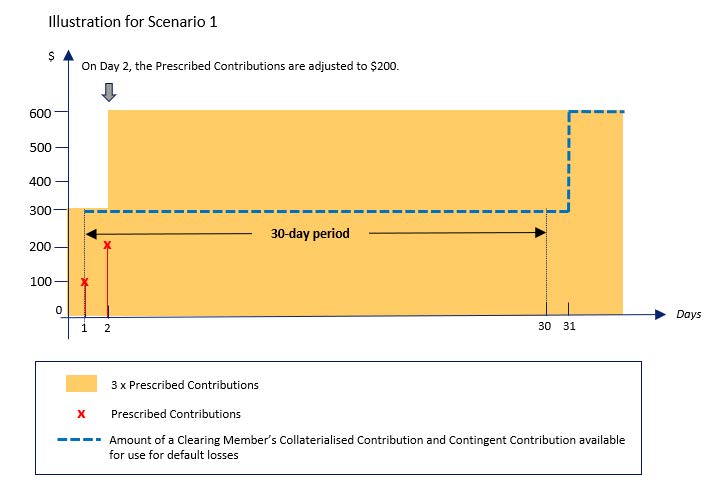

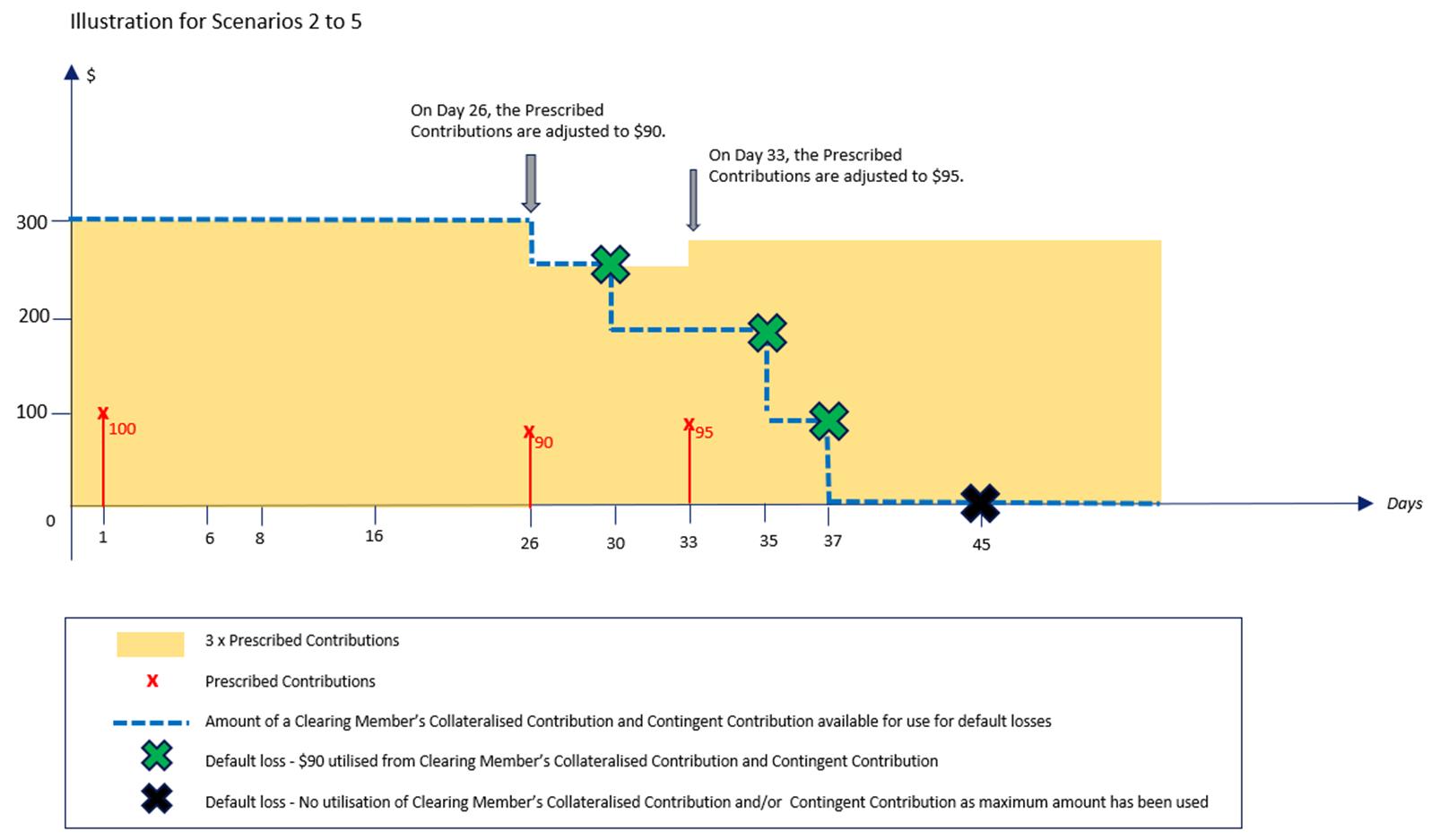

| “Collateralised Contribution” | has the meaning ascribed to it in Rule 7.2.1A(2). |

| "Common Banking Day" | in relation to settlement in a foreign currency means a day on which CDP is open for business and both the central bank in Singapore and the central bank for that foreign currency are open for settlement. |

| "Companies Act" | means the Companies Act 1967, or any statutory modification, amendment or re-enactment thereof for the time being in force, or any and every other act which may replace it, and unless the context otherwise requires, includes any subsidiary legislation or regulations made pursuant thereto. |

| "Confirmation" | has the meaning ascribed to it in Rule 6C.2.3. |

| “Contingent Contribution” | has the meaning ascribed to it in Rule 7.2.1A(3). |

| "Contract Specifications" | means the commercial and technical terms of a Marginable Futures Contract, including the contract size, contract month, underlying security, Last Trading Day and settlement basis. Unless otherwise stated, Contract Specifications are not subject to the rule amendment procedures specified under the SFA. |

| "CPF Trade Settlement" | means an Exchange Trade which is settled using the customer's CPF account as maintained by the CPF Agent Banks. |

| "Customer", | with respect to a Clearing Member, means:— (1) any person from whom, or on whose behalf, a Clearing Member has received or acquired or held moneys or securities for the account of such person and includes directors of the Clearing Member, their connected persons (as defined in section 2 of the SFA) and any other person with whom the Clearing Member has entered into a contract to sell or purchase securities or Futures Contracts; and (2) the Trading Members which are qualified by the Clearing Member but excludes:— (a) a person whose account is carried on the books of a Trading Member (where such person is not the Trading Member itself); (b) the Central Depository (Pte) Limited; and (c) [Deleted] (d) any other person approved by the Authority and which is established for the purpose of providing clearing and settlement facilities in respect of any dealing in securities or trade in Futures Contracts. |

| "Customer Account" | means, unless otherwise specified in these Clearing Rules, a trading account carried on the books of a Clearing Member for a Customer except where such Customer is:— (1) a director, officer, employee or representative of the Clearing Member; or (2) a related corporation of the Clearing Member with respect to accepted instructions to deal for an account belonging to, and maintained wholly for the benefit of, that related corporation. For the avoidance of doubt, a Clearing Member's own proprietary account is not a Customer Account. |

| "Customer Asset Value" | means the market value of the moneys and assets in a customer's account subject to such hair-cut as specified by CDP. |

| "Customer Maintenance Margins" | means that component of Customer Required Margins, as determined by CDP, which must be maintained in a customer's account subsequent to the deposit of Initial Margins for that customer's positions in Marginable Futures Contracts. |

| "Customer Required Margins" | means the sum of Customer Maintenance Margins and Customer Variation Margins. |

| "Customer Variation Margins" | means that component of Customer Required Margins arising from CDP's daily valuation of positions. It comprises the mark-to-market gains and losses, in relation to the price at which the Marginable Futures Contract was bought or sold. A net loss increases the Customer Variation Margins and Customer Required Margins amount, and a net profit decreases the Customer Variation Margins and Customer Required Margins amount. |

| D | |

| "Defaulting Clearing Member" | has the meaning ascribed to it in Rule 8.1.2. |

| "Depository Agent" | has the meaning ascribed to it in the SFA. |

| "Directive" | means a binding notice directing Clearing Members to take corrective or other actions including actions in the interests of a safe and efficient clearing facility or in light of investor protection concerns. |

| "Disciplinary Committee" | means the committee appointed by the SGX RegCo Board to exercise the powers set out in Rule 11. |

| E | |

| "Effective Date" | means 1 December 2003. |

| "Event of Default" | means an event relating to a Clearing Member as referred to in Rule 8.1. |

| "Excess Margin" | means the amount of Customer Asset Value or deposited collateral value that is in excess of the sum of the Initial Margins and Customer Variation Margins. |

| "Exchange" | means SGX-ST or any other organised market or organisation (whether an exchange, association, body corporate or unincorporate or otherwise) the trades on which are cleared by, or novated to CDP. |

| "Exchange Trade" | means:— (1) a trade transacted on or through the Trading System pursuant to the SGX-ST Rules; or (2) a trade reported to SGX-ST pursuant to the SGX-ST Rules, including but not limited to Direct Business (as defined in the SGX-ST Rules); or (3) a trade reported by a Clearing Member to CDP, which CDP accepts for clearing; or (4) a trade transacted on such Exchange (other than SGX-ST) with which CDP may have direct or indirect clearing arrangements from time to time, or in relation to which trade CDP has clearing arrangements in place; with the exception of such trades as CDP may from time to time stipulate as not being "Exchange Trades" falling under these Clearing Rules. |

| "Exempt Person" | has the meaning ascribed to it in the SFA. |

| F | |

| "Final Settlement Balance" | has the meaning ascribed to it in Rule 6.3.2. |

| "financial resources" | has the meaning ascribed to it in Regulation 2 of the SFR (Financial and Margin Requirements). |

| [Deleted] | [Deleted] |

| "futures contract" | has the meaning ascribed to it in the SFA. |

| G | |

| "General Clearing Member" | means a Clearing Member who has such rights and obligations as set out in Chapter 3. |

| H | |

| "House Account" | means, unless otherwise specified in these Clearing Rules, a trading account carried on the books of a Clearing Member which is not a Customer Account. |

| I | |

| "Initial Margin" | means that minimum amount, as determined by CDP, required to be deposited for positions in Marginable Futures Contracts. This minimum amount is distinct from and in addition to Customer Variation Margins. |

| “Intended Settlement Day” | means, in relation to any Novated Contract, the day on which the Exchange Trade from which the Novated Contract arises is due for settlement, as provided in the SGX-ST Rules or the applicable rules or regulations of the relevant Exchange (as the case may be). |

| [Deleted] | [Deleted] |

| "Irredeemable and Non-Cumulative Preference Share Capital" | has the meaning ascribed to it in Regulations 2 of the SFR (Financial and Margin Requirements). |

| L | |

| "Last Trading Day" | means the last day on which a Marginable Futures Contract may be traded prior to its expiration. |

| M | |

| "Marginable Futures Contract" | means such futures contract, as CDP may prescribe, approved for listing on SGX-ST and which is subject to margin requirements. |

| "Market Day" | means in respect of any security or Futures Contract, a day on which the relevant Exchange is open for trading in the security or Futures Contract. |

| N | |

| "net head office funds" | has the meaning ascribed to it in Regulation 2 of the SFR (Financial and Margin Requirements). |

| [Deleted] | [Deleted] |

| "New Purchase Contract" | [Deleted] |

| "New Sale Contract" | [Deleted] |

| "Novated Contract" | means a contract between CDP and a Clearing Member arising as a result of the novation of an Exchange Trade referred to in Rule 6.2.1. |

| O | |

| "On-Line Transmission" | means the on-line transmission referred to in Rule 6.3.3. |

| "Operational Risk Requirement" | has the meaning ascribed to it in the Notice on Risk Based Capital Adequacy Requirements for Holders of Capital Markets Services Licences. |

| "organised market" | has the meaning ascribed to it in the SFA. |

| "OTC Contracts" | means contracts that are not listed or quoted for trading on any exchange, market or organisation (whether an exchange, association, corporation or otherwise) responsible for administering an organised market. |

| "Other Payment Method" | means any payment method other than Settlement Bank Payment. |

| P | |

| "Payment Instruction" | has the meaning ascribed to it in Rule 6C.2.2. |

| "Position Account" | means an account maintained by a Clearing Member with CDP in CDP's post-trade system, for carrying positions of trades to be cleared with CDP. |

| "Practice Note" | means a non-binding guideline that seeks to explain the application and interpretation of a Rule. |

| “Prescribed Contributions” | means the aggregate of a Clearing Member’s Collateralised Contribution and Contingent Contribution as determined by CDP pursuant to Rules 7.2.1A(2) and 7.2.1A(3) respectively. |

| Q | |

| "Qualifying Letter of Credit" | has the meaning ascribed to it in Regulation 2 of the SFR (Financial and Margin Requirements). |

| "Qualifying Subordinated Loan" | has the meaning ascribed to it in Regulation 2 of the SFR (Financial and Margin Requirements). |

| R | |

| "Recognised Group A Securities Exchange" | means an overseas securities exchange regulated by a financial services regulatory authority of a country or territory specified in Table 4 of Fourth Schedule of the SFR (Financial and Margin Requirements). |

| “Regulatory Notice” | means a binding notice issued by CDP on regulatory matters regarding the clearing facility operated by CDP, as the same may be amended, modified, supplemented or replaced from time to time. |

| "Relevant Period" | means a period of 1 year commencing from a specified day of a specified month (as determined by CDP) of any calendar year. |

| "Relevant Regulatory Authority" | means: (a) the authority(ies) or regulatory body(ies) that regulate(s) a Clearing Member's activities in the country where it is carrying on such activities and from which it has applied for Clearing Membership; and (b) where the Clearing Member are carrying on regulated activities in Singapore, the MAS. |

| "related corporation" | has the meaning ascribed to it in the SFA. |

| "Resignation Notice" | means the resignation notice referred to in Rule 3.10.1. |

| "RRA Financial Requirement" | means all applicable financial requirements (whether relating to capital, liquidity, risk or otherwise) imposed on a Clearing Member by its Relevant Regulatory Authority. |

| S | |

| "securities" | means:— (1) shares, units in a business trust, or any instrument conferring or representing a legal or beneficial ownership interest in a corporation, partnership, or limited liability partnership; (2) debentures; (3) units in a collective investment scheme; (4) derivative contracts (as defined in the SFA) that are not futures contracts and of which the underlying instrument or any of the underlying instruments are any of the instruments set out in (1), (2) or (3) or an index on any of those instruments; or (5) any other product or class of products as SGX-ST or CDP may prescribe; (a) bills of exchange; (b) certificates of deposit issued by a bank or finance company, whether situated in Singapore or elsewhere; or (c) any product or class of products as SGX-ST or CDP may prescribe. For the avoidance of doubt, "securities" include (but are not limited to) warrants, transferrable subscription rights, options to subscribe for stocks or shares, convertibles, depository receipts and exchange traded funds. |

| "Securities Account" | means, in relation to any person, an account maintained directly with CDP or through a Depository Agent or the CPF Board for holding securities for or on behalf of that person. |

| "Security Deed" | means the deed, in such form as prescribed by CDP, setting out the terms under which a Clearing Member's Collateral is provided to, and held by CDP. |

| "Security Interest" | means any mortgage, charge, assignment by way of security, pledge, encumbrance, lien, right of set-off, right of consolidation of accounts, retention of title, trust or flawed asset arrangement for the purpose of, or which has the effect of, granting security or credit support or other interests of any kind whatsoever over or in respect of Collateral. |

| "Settlement Bank" | means a bank approved by CDP to carry out Settlement Bank Payment. |

| "Settlement Bank Payment" | has the meaning ascribed to it in Rule 6C.2.1. |

| "Settlement Day" | means a day on which settlement occurs in CDP. |

| "SFA" | means the Securities and Futures Act 2001, or any statutory modification, amendment or re-enactment thereof for the time being in force, or every and any other act which may replace it, and unless the context otherwise requires, includes any subsidiary legislation or regulations made pursuant thereto. |

| "[Deleted]" | "[Deleted]" |

| "SFR (Financial and Margin Requirements)" | means the Securities and Futures (Financial and Margin Requirements for Holders of Capital Markets Services Licences) Regulations or any statutory modification, amendment or re-enactment thereof for the time being in force, or any regulations that replace the SFR (Financial and Margin Requirements), and any reference to any provision of the SFR (Financial and Margin Requirements) is to that provision as so modified, amended or re-enacted (or as contained in any replacement regulations). |

| "SFR (Licensing and Conduct of Business)" | means the Securities and Futures (Licensing and Conduct of Business) Regulations or any statutory modification, amendment or re-enactment thereof for the time being in force, or any regulations that may replace the SFR (Licensing and Conduct of Business), and any reference to any provision of the SFR (Licensing and Conduct of Business) is to that provision as so modified, amended or re-enacted (or as contained in any replacement regulations). |

| "SGX" | means Singapore Exchange Limited. |

| "SGX-DC" | means the Singapore Exchange Derivatives Clearing Limited. |

| "SGX-DT" | means the Singapore Exchange Derivatives Trading Limited. |

| "SGX RegCo" | means Singapore Exchange Regulation Pte. Ltd. |

| "SGX RegCo Board" | means the board of directors for the time being of SGX RegCo or such number of them as have authority to act for the SGX RegCo Board. |

| "SGX-ST" | means the Singapore Exchange Securities Trading Limited, an approved exchange under the SFA. |

| "SGX-ST Directives" | means the Directives of SGX-ST as the same may be varied, amended or supplemented from time to time. |

| "SGX-ST Trading Member" | refers to a "Trading Member" as defined in the SGX-ST Rules. |

| "SGX-ST Rules" | means the Rules of SGX-ST as the same may be varied, amended or supplemented from time to time. |

| "Stock Account" | means, in relation to a Clearing Member, the Securities Account maintained by it to house its proprietary securities. |

| "$" | means Singapore Dollar. |

| T | |

| "Third Party" | means any party other than CDP and a Clearing Member. |

| "total risk requirement" | has the meaning ascribed to it in Regulation 2 of the SFR (Financial and Margin Requirements). |

| "Total Turnover" | means at any time the aggregate of the Turnover of all Clearing Members at that time. |

| "Trading Member" or "TM" | means a person who is not a Clearing Member and whose Exchange Trades that has been qualified by a Clearing Member in accordance with Rule 3.10. |

| "Trading System" | means any electronic trading system for the automatic matching of orders designated and approved by SGX-ST for transactions on SGX-ST. |

| "Turnover" | means at any time and in respect of a Clearing Member, the volume of Exchange Trades cleared by such Clearing Member multiplied by the prices of the respective Exchange Trades for the immediately preceding 12 months and if such Clearing Member has traded for less than 12 months, the turnover of Exchange Trades cleared by such Clearing Member for its immediately preceding trading period calculated as aforesaid (adjusted to a 12-month period). |

| V | |

| "Valuation Price" | means the official price of Novated Contracts determined by CDP for the purpose of determining Customer Variation Margins or Clearing Member Variation Margins. |

Amended on 12 October 200512 October 2005, 3 April 20083 April 2008, 23 January 200923 January 2009, 3 May 20113 May 2011, 21 January 201321 January 2013, 22 April 201322 April 2013, 26 April 201326 April 2013, 29 December 201429 December 2014, 1 July 20161 July 2016, 15 September 201715 September 2017, 8 October 20188 October 2018, 10 December 201810 December 2018, 22 April 201922 April 2019 and 3 June 20193 June 2019, 6 September 2021, 18 January 2022, 26 May 2023 and 31 October 2024.

1.3.1

Unless expressly provided to the contrary, all questions concerning the interpretation or application of or any other matter in connection with these Clearing Rules (including, without limitation, CDP Directives) shall be determined by CDP, whose decision shall be final and binding on all parties.

1.3.2

In the interpretation of any provision of the Clearing Rules, a construction that would promote the purpose or object underlying the Clearing Rules (whether the purpose is expressly stated in the Clearing Rules or not) is to be preferred to a construction that would not promote that purpose or object.

1.4.1

Any word signifying any gender shall include all genders and the singular shall include the plural and vice versa.

1.4.2

Any reference to a particular rule in these Clearing Rules shall include the subsections of that rule.

1.4.3

A reference to any legislation or legislative provision includes any subordinate provisions made thereunder and any statutory modification, amendment or re-enactment thereof for the time being in force.

1.4.4

References to a person shall, where the context permits, include references to an individual, partnership, corporate entity, unincorporated association and/or statutory or governmental authority or division.

1.5.1

Headings, titles and sub-titles are provided for ease of reference only and shall not affect the interpretation or construction of the provisions of these Clearing Rules.

1.6.1

If these Clearing Rules include an example of the operation of a rule:—

1.7.1

If there is any conflict between any Clearing Rule and the Clearing Directives, unless specifically provided otherwise in the Clearing Directives, the Clearing Rules shall prevail.

1.8.1

CDP may from time to time issue Clearing Directives which operate as a binding contract between CDP and each Clearing Member, and between a Clearing Member and any other Clearing Member.

1.8.2

CDP may, from time to time, issue Practice Notes (or amend existing Practice Notes) to provide guidance on the interpretation and application of any rule. A Practice Note does not bind CDP in the application of a rule.

1.9.1

CDP may, from time to time, publish transitional arrangement in relation to any amended or new rule.

1.10.1

The order of precedence of the following instruments applicable to the CDP and Clearing Members shall be (in descending order of precedence):

Amended on 26 April 201326 April 2013 and 10 December 201810 December 2018.

1.10.2

Subject to Rule 1.7.1, in the event of any conflict between the provisions of the aforesaid instruments, the provisions in an instrument with a higher level of precedence shall prevail over the provisions in an instrument with a lower level of precedence.

Added on 26 April 201326 April 2013

2.1.1

CDP shall maintain the following registers:—

Amended on 3 June 20193 June 2019.

3.1.1

Clearing Membership in CDP shall comprise such classes of membership(s) as may from time to time be provided in this Clearing Rules. All memberships to CDP are granted pursuant, and subject, to this Clearing Rules and such other terms and conditions as may be prescribed at CDP's discretion.

Added on 1 July 20081 July 2008 and 10 December 201810 December 2018.

3.1.2 Eligibility Criteria for General Clearing Member

Unless otherwise prescribed by CDP, to be eligible for Clearing Membership as a General Clearing Member, an applicant must satisfy CDP that:—

Amended on 3 April 20083 April 2008, 1 July 20081 July 2008, 8 October 20188 October 2018, 10 December 201810 December 2018 and 3 June 20193 June 2019.

3.1.3 Eligibility Criteria for Bank Clearing Members

Unless otherwise prescribed by CDP, to be eligible for Clearing Membership as a Bank Clearing Member, an applicant must satisfy CDP that:—

Added on 1 July 20081 July 2008. Amended on 26 April 201326 April 2013, 22 April 2019 and 18 January 2022.

3.1.3A

Upon admission as a Bank Clearing Member, if there is any downgrade in the rating of the Bank Clearing Member or its parent bank such that it falls below the minimum prescribed rating, CDP may, at its absolute discretion, impose additional conditions as it deems fit, for permitting the Bank Clearing Member to continue to clear contracts through CDP.

Added on 1 July 20081 July 2008.

3.2.2

CDP may, in its absolute discretion, approve or reject an application for clearing membership. CDP is not obliged to give any reasons.

3.2.3

Without derogating from Rule 3.2.2, CDP may reject an application for clearing membership if:—

Amended on 12 October 200512 October 2005.

3.3.1

If CDP rejects an application to be a Clearing Member, the applicant may, within 14 days after it is notified of CDP's decision, appeal in writing to the SGX RegCo Board whose decision shall be final.

Amended on 15 September 201715 September 2017.

3.4.1 Clearing Right

A Clearing Member shall have the right to clear and settle its own Exchange Trades transacted by it or its own customers or the Exchange Trades of 1 or more Trading Members qualified by it subject to the Clearing Rules and the Clearing Directives.

3.4.2 No Distributive Right to Assets

A Clearing Member shall have no right to participate in the assets or profits of CDP.

3.4.3 No Voting Right

A Clearing Member shall have no right to receive notice of any general meeting of CDP or to attend and vote thereat.

3.4.4 Transferability

A Clearing Member may not assign, transfer or otherwise dispose of any of its membership rights or other rights conferred under the Clearing Rules and the Clearing Directives.

3.5.1

Each Clearing Member undertakes and agrees to:—

Amended on 1 July 20081 July 2008, 1 July 20161 July 2016 and 10 December 201810 December 2018.

3.5.2 Provision of Information

Amended on 1 July 20081 July 2008.

3.5.3

A Clearing Member must:—

Amended on 1 July 20081 July 2008.

3.5.4 Business Continuity Requirements

Refer to Practice Note 3.5.4.

Added on 22 January 200922 January 2009

3.5.5 Records of Customer Monies and Assets in Relation to Trades Cleared or Settled through CDP

In relation to monies and assets received from its Customers, a Clearing Member must:

Amended on 22 April 201322 April 2013 and 10 December 201810 December 2018.

3.6 Clearing Members to Act as Principals

Each Clearing Member shall be responsible and liable to CDP as principal and not as agent in respect of the clearing and settlement of any Exchange Trade and in respect of its obligations to CDP under these Clearing Rules.

3.7.1

Notwithstanding anything to the contrary in the SGX-ST Rules or the Clearing Rules, a Clearing Member shall be responsible and liable to CDP as a principal and not merely as a guarantor for the clearing and settlement of all Exchange Trades transacted by a Trading Member qualified by it. Trading Members shall have no right to clear and settle their Exchange Trades through CDP.

3.7.2

Notwithstanding any notice to the contrary, CDP shall be entitled to deem and treat the Exchange Trades transacted by a Trading Member qualified by a Clearing Member as the Exchange Trades of the qualifying Clearing Member for all purposes, including the purposes of these Clearing Rules and the Clearing Directives.

3.7.3

In these Clearing Rules, unless the context otherwise requires, a reference to the Exchange Trade of a Clearing Member shall include a reference to the Exchange Trade of any Trading Member qualified by the Clearing Member.

3.7A.1 Settlement Timelines

Unless the Trading Member has in place arrangements to settle Exchange Trades with its Clearing Member on a delivery-versus-payment basis through the CDP Settlement Facility, the Clearing Member must make payment (whether of sale proceeds, Cash Settlement Amounts, corporate action entitlements or compensation for corporate action entitlements) or deliver securities to a Trading Member in respect of any Exchange Trade, by such time as to enable payment or delivery by the Trading Member to the Trading Member's customers within any timelines specified in the SGX-ST Rules, save that a Clearing Member may:

Added on 10 December 201810 December 2018.

3.7A.2 Force Sale

Subject to Rules 3.7A.3 and 3.7A.4, if a buying Trading Member fails to meet any of the timelines set out in the SGX-ST Rules for payment to its Clearing Member, the Clearing Member shall force-sell the securities of the buying Trading Member on the following Market Day.

Added on 10 December 201810 December 2018.

3.7A.3

Rule 3.7A.2 does not apply if the Clearing Member has allowed the buying Trading Member to effect a corresponding sale position after the purchase but not later than the Intended Settlement Day of the Exchange Trade for such purchase.

Added on 10 December 201810 December 2018.

3.7A.4

If the Clearing Member reasonably expects full payment from the buying Trading Member, the Clearing Member may defer force-sale for up to two Market Days.

Added on 10 December 201810 December 2018.

3.7A.5

A Clearing Member exercising its discretion under Rule 3.7A.4 must not engage in imprudent credit practices.

Added on 10 December 201810 December 2018.

3.7A.6

The following rules apply to all force-sales by a Clearing Member:

Added on 10 December 201810 December 2018.

3.7A.7

A Clearing Member shall, if informed by CDP that a right to receive securities pursuant to an Exchange Trade is to be cash settled, immediately inform the relevant buying Trading Member.

Added on 10 December 201810 December 2018.

3.8 Reporting Requirements

A Clearing Member shall notify CDP in writing upon or where practicable, pre-notify CDP of, the happening of all or any of the following events and supply full particulars thereof together with such further information as CDP may require:—

Amended on 3 April 20083 April 2008, 1 July 20081 July 2008, 10 December 201810 December 2018 and 3 June 20193 June 2019.

3.9.1 Qualification Procedures

In order to qualify a Trading Member, a Clearing Member shall:—

Amended on 18 September 201218 September 2012.

3.9.2 Procedures to Cease Qualifying a Trading Member

If a Clearing Member wishes to cease qualifying its Trading Member, it shall:—

Amended on 11 January 201111 January 2011

3.9.2A Procedures to Suspend Qualification of a Trading Member

Added on 11 January 201111 January 2011

3.9.3

Notwithstanding the cessation or suspension of the qualification, the Clearing Member shall clear and settle all the Exchange Trades of the Trading Member which are done right up to the point when the Trading Member has been disabled from entering Exchange Trades to be qualified by the Clearing Member.

Amended on 11 January 201111 January 2011

3.10.1 Procedure

A Clearing Member who wishes to resign shall give CDP at least 30 days’ written notice (inclusive of the day that notice is given) of its intention to resign and the effective date of resignation. CDP may vary or waive the requirement to give such resignation notice. The Clearing Rules, and any Clearing Directives as may be imposed by CDP, shall continue to apply, and the Clearing Member shall be required to comply with them, until the effective date of resignation.

- [Rule has been deleted.]

- [Rule has been deleted.]

Amended on 31 October 2024.

3.10.2 Acceptance of Resignation by CDP

CDP need not accept the resignation of a Clearing Member if it is:—

- conducting an investigation under this Clearing Rules, investigating a complaint, or has initiated disciplinary proceedings against the Clearing Member; or

- not satisfied that the Clearing Member has fulfilled or is able to fulfil:—

- its obligations to CDP and such obligations to Trading Members, as CDP may specify; and

- its obligation to its customers, or in the case of a Bank Clearing Member, its customers in relation to its business governed by this Clearing Rules, as CDP may specify.

Amended on 1 July 2008 and 31 October 2024.

3.10.3 Deletion from Register

If CDP accepts a Clearing Member's resignation, the Clearing Member's name shall be deleted from the Register of Clearing Members upon the effective date of resignation.

3.10.4 Notification of Resignation

3.10.5 Cessation of Clearing Rights

Amended on 1 July 20081 July 2008.

4.1.1

Amended on 1 July 20081 July 2008 and 3 June 20193 June 2019.

4.1.2

Upon registration, a Chief Executive Officer is deemed to have agreed to be bound by this Clearing Rules, or any Clearing Directives (where applicable).

Amended on 1 July 20081 July 2008 and 3 June 20193 June 2019.

4.2.1 Compliance

A Chief Executive Officer shall comply with the Clearing Rules, and any Clearing Directives CDP prescribes.

Amended on 3 June 20193 June 2019.

4.2.2 Payment of Fees

A Chief Executive Officer shall pay CDP all fees, levies and charges as CDP prescribes. CDP may reduce or waive any fee, levy or charge.

Amended on 3 June 20193 June 2019.

4.2.3 Other Businesses

Amended on 1 July 20081 July 2008, 15 September 201715 September 2017 and 3 June 20193 June 2019.

4.3 Automatic De-Registration

A Chief Executive Officer shall automatically cease to be registered as a Chief Executive Officer, and the Clearing Member shall immediately notify CDP, if he or she:—

Amended on 1 July 20081 July 2008 and 3 June 20193 June 2019.

4.4 Deletion from Register

A Chief Executive Officer who ceases to hold office shall have his or her name deleted from the Register of Chief Executive Officers upon the effective date of cessation.

Amended on 3 June 20193 June 2019.

4.6 Obligations of a Former Chief Executive Officer

A former Chief Executive Officer remains liable to CDP for any liabilities incurred under the Clearing Rules or Clearing Directives during the period of his or her registration. The former Chief Executive Officer also remains subject to disciplinary actions for any offence committed during the period of his or her registration.

Amended on 3 June 20193 June 2019.

5.1.1

Each General Clearing Member incorporated in Singapore shall at all times:—

Amended on 1 July 20081 July 2008.

5.1.1A

Each Bank Clearing Member incorporated in Singapore shall at all times:—

comply with all applicable RRA Financial Requirements; and

comply with the accounting, reporting, book-keeping and any other financial and operational requirements prescribed by CDP in relation to the Bank Clearing Member's business governed by this Clearing Rules.

Added on 1 July 20081 July 2008. and amended on 22 April 201922 April 2019.

5.1.1B

A Clearing Member shall immediately notify CDP if it fails to comply with the minimum capital and financial requirements prescribed in the preceding paragraphs or becomes aware that it will fail to comply with such requirements.

Added on 1 July 20081 July 2008.

5.1.1C

If CDP is notified by a Clearing Member under Rule 5.1.1B or becomes aware (whether or not there has been any notification by the Clearing Member under Rule 5.1.1B) that such Clearing Member has failed to comply with the minimum capital and financial requirements prescribed in the preceding paragraphs, CDP may direct the Clearing Member to do one (1) or more of the following actions:—

5.1A.1

Each General Clearing Member incorporated in Singapore shall immediately notify CDP:—

Added on 1 July 20081 July 2008 and amended on 22 April 201922 April 2019.

5.1A.2

If CDP is notified by a Clearing Member under Rule 5.1A.1(1) or becomes aware (whether or not there has been any notification by the Clearing Member under Rule 5.1A.1(1)) that such Clearing Member's financial resources have fallen below 120% of its total risk requirement, CDP may direct such Clearing Member to comply with one (1) or more of the directions prescribed under Regulation 7(3) of the SFR (Financial and Margin Requirements).

Added on 1 July 20081 July 2008 and amended on 22 April 201922 April 2019.

5.1A.3

If CDP is notified by a Clearing Member under Rule 5.1A.1(2) or becomes aware (whether or not there has been any notification by such Clearing Member under Rule 5.1A.1(2)) that such Clearing Member's aggregate indebtedness has exceeded 600% of its aggregate resources, CDP may direct such Clearing Member to comply with one (1) or more of the directions prescribed under Regulation 17(2) of the SFR (Financial and Margin Requirements).

Added on 1 July 20081 July 2008 and amended on 22 April 201922 April 2019.

5.1B.1

Each Clearing Member incorporated in Singapore shall:

Added on 1 July 20081 July 2008 and amended on 22 April 201922 April 2019.

5.1B.2

CDP may from time to time prescribe other notification requirements and conditions for exemptions or exceptions therefrom on all or any of the Clearing Members.

Added on 1 July 20081 July 2008.

5.1B.3

If CDP is notified by a Clearing Member under Rule 5.1B.1 or becomes aware (whether or not there has been any notification by the Clearing Member under Rule 5.1B.1) that such Clearing Member's financial resources have fallen below 150% of its total risk requirement or that a reportable event in relation to its regulatory capital and liquidity ratios has occurred, CDP may direct such Clearing Member to do one (1) or more of the following actions:—

Added on 1 July 20081 July 2008 and amended on 22 April 201922 April 2019.

5.1C.1

For the purpose of Rules 5.1 and 5.1A, a Clearing Member may include one (1) or more Qualifying Letter(s) of Credit deposited with CDP or SGX-DC in its calculation of aggregate resources, subject to the total amount payable under the Qualifying Letter(s) of Credit or 50% of its total risk requirement, whichever is lower. In the case of a Clearing Member admitted as a clearing member of CDP and SGX-DC, and which has deposited such Qualifying Letter(s) of Credit with SGX-DC, pursuant to the corresponding provision in the SGX-DC Clearing Rules, it need not deposit another Qualifying Letter(s) of Credit with CDP.

Added on 1 July 20081 July 2008 and amended on 25 August 200925 August 2009 and 29 December 201429 December 2014.

5.1C.2

For the purpose of Rule 5.1C.1, a qualifying letter of credit is a legally enforceable and irrevocable letter of credit that:—

Added on 1 July 20081 July 2008.

5.1C.3

CDP reserves the right to call on any of the qualifying letters of credit furnished pursuant to this Clearing Rules and apply the proceeds thereof in respect of the Clearing Member's default to CDP. In the case of a Clearing Member admitted as a clearing member of CDP and SGX-DC, CDP shall have the discretion to apportion in any manner, the use of the proceeds between CDP and SGX-DC. In deciding on the apportionment, CDP may, in consultation with SGX-DC, take into account factors, including but not limited to, the amount owed by the Clearing Member to CDP and SGX-DC respectively.

Added on 1 July 20081 July 2008.

5.1D.1

Each General Clearing Member incorporated outside Singapore shall at all times:—

not cause or permit its adjusted net head office funds to fall below its total risk requirement;

not cause or permit its aggregate indebtedness to exceed 1,200% of its aggregate resources; and

comply with the accounting, reporting, book-keeping and any other financial and operational requirements prescribed by CDP.

Added on 1 July 20081 July 2008.

5.1D.2

Each Bank Clearing Member incorporated outside Singapore shall at all times:—

comply with all applicable RRA Financial Requirements; and

comply with the accounting, reporting, book-keeping and any other financial and operational requirements prescribed by CDP in relation to the Bank Clearing Member's business governed by this Clearing Rules.

Added on 1 July 20081 July 2008 and amended on 25 August 200925 August 2009 and 22 April 201922 April 2019.

5.1D.3

A Clearing Member shall immediately notify CDP if it fails to meet the minimum capital and financial requirements prescribed in the preceding paragraphs or becomes aware that it will fail to comply with such requirements.

Added on 1 July 20081 July 2008.

5.1D.4

If CDP is notified by a Clearing Member under Rule 5.1D.3 or becomes aware (whether or not there has been any notification by the Clearing Member under Rule 5.1D.3) that such Clearing Member has failed to comply with the minimum capital and financial requirements prescribed in the preceding paragraphs, CDP may direct the Clearing Member to do one (1) or more of the following actions:—

Added on 1 July 20081 July 2008.

5.1DA Liquidity Resource Requirement

Each Bank Clearing Member incorporated outside Singapore shall deposit liquidity resources with CDP upon CDP's request, if CDP determines that any conditions exist which may threaten the ability of the Bank Clearing Member to satisfy its obligations to CDP and/or SGX-DC under this Clearing Rules and the SGX-DC Clearing Rules respectively. Such liquidity resources shall be an amount up to S$5,000,000, or S$8,000,000 in the case of a Bank Clearing Member who is also a clearing member of SGX-DC, and shall be paid in cash and/or acceptable government securities within such time as determined by CDP.

Added on 22 April 201922 April 2019.

5.1E.1

Each General Clearing Member incorporated outside Singapore shall immediately notify CDP:—

Added on 1 July 20081 July 2008 and amended on 25 August 200925 August 2009 and 22 April 201922 April 2019.

5.1E.2

If CDP is notified by a Clearing Member under Rule 5.1E.1(1) or becomes aware (whether or not there has been any notification by the Clearing Member under Rule 5.1E.1(1)) that such Clearing Member's adjusted net head office funds have fallen below 120% of its total risk requirement, CDP may direct such Clearing Member to comply with one (1) or more of the directions prescribed under Regulation 7(3) of the SFR (Financial and Margin Requirements).

Added on 1 July 20081 July 2008 and amended on 25 August 200925 August 2009 and 22 April 201922 April 2019.

5.1E.3

If CDP is notified by a Clearing Member under Rule 5.1E.1(2) or becomes aware (whether or not there has been any notification by such Clearing Member under Rule 5.1E.1(2)) that such Clearing Member's aggregate indebtedness has exceeded 600% of its aggregate resources, CDP may direct such Clearing Member to comply with one (1) or more of the directions prescribed under Regulation 17(2) of the SFR (Financial and Margin Requirements).

Added on 1 July 20081 July 2008 and amended on 22 April 201922 April 2019.

5.1F.1

Each Clearing Member incorporated outside Singapore shall:

Added on 1 July 20081 July 2008 and amended on 25 August 200925 August 2009 and 22 April 201922 April 2019.

5.1F.2

CDP may from time to time prescribe other notification requirements and conditions for exemptions or exceptions therefrom on all or any of the Clearing Members.

Added on 1 July 20081 July 2008.

5.1F.3

If CDP is notified by a Clearing Member under Rule 5.1F.1 or becomes aware (whether or not there has been any notification by the Clearing Member under Rule 5.1F.1) that such Clearing Member's adjusted net head office funds have fallen below 150% of its total risk requirement, or that a reportable event in relation to its regulatory capital and liquidity ratios has occurred, CDP may direct such Clearing Member to do one (1) or more of the following actions:—

Added on 1 July 20081 July 2008 and amended on 25 August 200925 August 2009 and 22 April 201922 April 2019.

5.1G.1

For the purpose of Rules 5.1D and 5.1E, a Clearing Member may include one (1) or more Qualifying Letter(s) of Credit deposited with CDP or SGX-DC in its calculation of aggregate resources subject to the total amount payable under the Qualifying Letter(s) of Credit or 50% of its total risk requirement, whichever is lower. In the case of a Clearing Member admitted as a clearing member of CDP and SGX-DC, and which has deposited such Qualifying Letter(s) of Credit with SGX-DC, pursuant to the corresponding provision in the SGX-DC Clearing Rules, it need not deposit another Qualifying Letter(s) of Credit with CDP.

Amended on 1 July 20081 July 2008, 25 August 200925 August 2009 and 29 December 201429 December 2014.

5.1G.2

For the purpose of Rule 5.1G.1, a qualifying letter of credit is a legally enforceable and irrevocable letter of credit that:—

Amended on 1 July 20081 July 2008.

5.1G.3

CDP reserves the right to call on any of the Qualifying Letter of Credit furnished pursuant to this Clearing Rules and apply the proceeds thereof in respect of the Clearing Member's default to CDP. In the case of a Clearing Member admitted as a clearing member of CDP and SGX-DC, CDP shall have the discretion to apportion in any manner, the use of the proceeds between CDP and SGX-DC. In deciding on the apportionment, CDP may, in consultation with SGX-DC, take into account factors, including but not limited to, the amount owed by the Clearing Member to CDP and SGX-DC respectively.

Amended on 1 July 20081 July 2008 and 29 December 201429 December 2014.

5.1I.1

Amended on 3 April 20083 April 2008, 1 July 20081 July 2008, 23 January 200923 January 2009 and 29 December 201429 December 2014.

5.1J

Every Clearing Member shall:—

Added on 22 April 201922 April 2019.

5.2 [Rule has been deleted.]

Amended on 3 April 20083 April 2008 and deleted on 1 July 20081 July 2008.

5.4.1

If CDP is notified by the Clearing Member or becomes aware that the Clearing Member has failed to comply with the minimum capital and financial requirements prescribed in these Rules, CDP may exercise any of the powers described in Rules 6A.9A and 6.10.

Added on 23 January 200923 January 2009 and amended on 21 January 201321 January 2013.

5.4.2

CDP may prescribe for 1 or more Clearing Members, capital, financial and other requirements in excess of the minimum prescribed under Rule 5 herein on the basis of volume, risk exposure of positions carried, risk concentration, margin policies, nature of business conducted or to be conducted or its membership in any exchange or market and such other criteria as deemed necessary by CDP.

Amended on 23 January 200923 January 2009.

5.5.1

A General Clearing Member shall maintain a reserve fund to which a sum of not less than 30% of the audited net profits of each year shall be transferred out of its net profits after due provision has been made for taxation, so long as:—

Amended on 1 July 20081 July 2008.

5.5.2

The reserve fund shall not be available for declaration of dividends without the prior approval of CDP.

5.6.1

A General Clearing Member shall immediately notify CDP if the General Clearing Member's exposure to a single customer exceeds 20% of its average aggregate resources. To reduce the General Clearing Member's risk exposure to a single customer, CDP shall have the right to impose on the General Clearing Member such risk management measures as it deems necessary.

Amended on 1 July 20081 July 2008.

5.6.2

For the purpose of Rule 5.6.1, the full amount of the letter(s) of credit or any part thereof deposited pursuant to Rules 5.1C or 5.1G may be taken into account for the calculation of aggregate resources.

Amended on 1 July 20081 July 2008.

5.6.3

In Rule 5.6.1, "exposure to a single customer" means:—

Amended on 3 April 20083 April 2008, 1 July 20081 July 2008, 23 January 200923 January 2009, 20 November 200920 November 2009 and 1 July 20161 July 2016.

5.6.4

For the purposes of Rule 5.6.3, a security or futures contract is deemed to be carried in a customer's account (other than a margin financing account) carried on the books of the General Clearing Member on the contract date specified in the contract note in respect of the transaction in that security or futures contract or on the exercise date specified in the exercise notice in respect of an option in that security which has been exercised.

Amended on 1 July 20081 July 2008, 23 January 200923 January 2009 and 1 July 20161 July 2016.

5.6.5

In Rule 5.6, "single customer" means, in relation to a customer who is:—

but shall not include the General Clearing Member itself.

Provided always that a single customer of a General Clearing Member shall not include the end customers of any Trading Member who is qualified by the General Clearing Member.

Amended on 1 July 20081 July 2008.

5.7.1

A General Clearing Member shall immediately notify CDP if the General Clearing Member's exposure to a single security (including in respect of any Exchange Trade of any Trading Member qualified by the General Clearing Member) exceeds:—

Amended on 1 July 20081 July 2008.

5.7.2

To reduce the General Clearing Member's risk exposure to a single security, CDP shall have the right to impose on the General Clearing Member such risk management measures as it deems necessary.

Amended on 1 July 20081 July 2008.

5.7.3

For the purpose of Rule 5.7.1, the full amount of the letter(s) of credit or any part thereof deposited pursuant to Rules 5.1C or 5.1G may be taken into account for the calculation of aggregate resources.

Amended on 1 July 20081 July 2008.

5.7.4

For the purpose of Rule 5.7.1, "exposure to a single security" means:—

Amended on 1 July 20081 July 2008, 23 January 200923 January 2009, 1 July 20161 July 2016 and 8 October 20188 October 2018.

5.7.5

For the purpose of Rule 5.7.4, a security is deemed to be carried in a customer's cash account or a General Clearing Member's own account (such account being an account carried on the books of the General Clearing Member) on the contract date specified in the contract note in respect of the transaction in that security or on the exercise date specified in the exercise notice in respect of an option in that security which has been exercised.

Amended on 1 July 20081 July 2008 and 1 July 20161 July 2016.

5.7.6

For the purposes of Rule 5.7, in calculating exposure in any particular security, all outstanding options exercisable into that security shall be included in such computation.

5.7.6A

For the purposes of Rule 5.7.4(2) and Rule 5.7.4(4), in calculating exposure in any particular security, all futures contracts listed on any exchange with that security as an underlying shall be included in such computation.

Added on 3 April 20083 April 2008.

5.7.7

Rule 5.7 shall not apply to:—

Amended on 1 July 20081 July 2008.

5.7.8

For the purpose of Rule 5.7, where a security quoted on SGX-ST or any recognised group A securities exchange has been suspended for more than thirty (30) consecutive days, a General Clearing Member shall not permit its exposure to the security to increase in monetary value above the level subsisting on the 30th consecutive day of suspension until such time that the suspension has been lifted.

Amended on 1 July 20081 July 2008.

5.7.9

In Rule 5.7, "single security" includes ordinary and preference shares, loan stocks, company warrants, structured warrants, transferable subscription rights, bonds, debentures, depository receipts, options and any other debt instruments or equity securities.

Amended on 3 April 20083 April 2008.

5.8.1

Each Clearing Member must make and keep as a record formal computations of its capital and financial requirements pursuant to:—

as of the close of business each month, or in the case of capital adequacy report of Bank Clearing Members, quarterly. The computations must be in such form as CDP may prescribe and submitted to CDP within fourteen (14) calendar days after the end of each month, or such time frame as CDP may prescribe.

Amended on 1 July 20081 July 2008 and 29 December 201429 December 2014 and 22 April 201922 April 2019.

5.8.2

Where the Clearing Member fails to submit the statements required in Rule 5.8.1 within the prescribed time, there shall be imposed upon the Clearing Member a late fee of $100 for each day that the statements are not submitted in the prescribed time, unless an extension of time has been granted.

5.8.3

Requests for extension of time shall be submitted to CDP at least 3 Market Days prior to the due date for submission of the statements.

5.8.4

The Clearing Member shall be required to resubmit the statements and documents prescribed under Rule 5.8.1 and take such other steps as CDP may require upon CDP's notification that the statements and documents are inaccurate or incomplete.

5.9.1

A Clearing Member, except for a Bank Clearing Member, shall seek the approval of CDP prior to any appointment of new auditors.

Amended on 1 July 20081 July 2008.

5.9.1A

A Bank Clearing Member shall inform CDP of the appointment of any new auditors within seven (7) days of such appointment.

Added on 1 July 20081 July 2008.

5.9.2 Statutory Audit Report For General Clearing Members

Without prejudice to such audit and/or reporting requirements as may be imposed by CDP from time to time, a General Clearing Member shall furnish to CDP, within five (5) months of the end of its financial year or within such longer period as may be permitted in writing by CDP, the relevant forms which a General Clearing Member is required to lodge in the prescribed format under Regulation 27(9) of the SFR (Financial and Margin Requirements), the annual accounts duly audited by, and the certificate of, its auditor or auditors who shall be a public accountant or a firm of public accountants approved by CDP. The certificate shall pertain to the audit conducted by such auditor or auditors in respect of the financial year aforesaid and shall be in such form prescribed by the Relevant Regulatory Authority.

Amended on 12 October 200512 October 2005 and 1 July 20081 July 2008 and 22 April 201922 April 2019.

5.9.3

Where, in the performance of his or their duties, the General Clearing Member's auditor or auditors becomes or become aware:—

the auditor or auditors shall immediately report the matter to CDP.

Amended on 1 July 20081 July 2008.

5.9.4

5.9.5 Audit Report For Bank Clearing Members

Without prejudice to such audit and/or reporting requirements as may be imposed by CDP from time to time, a Bank Clearing Member shall furnish to CDP within five (5) months of the end of its financial year or within such longer period as may be permitted in writing by CDP, the annual accounts duly audited by, and the certificate of its auditor or auditors. The certificate shall pertain to the audit conducted by such auditor or auditors in respect of the financial year aforesaid and shall be in such form prescribed by the Relevant Regulatory Authority.

Added on 1 July 20081 July 2008 and amended on 22 April 201922 April 2019.

5.9.6

Where, in the performance of his or their duties, the Bank Clearing Member's auditor or auditors becomes or become aware:—

the auditor or auditors shall immediately report the matter to CDP.

Added on 1 July 20081 July 2008.

5.11.1 Reduction in Paid-Up Ordinary Share Capital or Paid-Up Irredeemable and Non-Cumulative Preference Share Capital

Each General Clearing Member incorporated in Singapore shall not reduce its paid-up ordinary share capital or paid-up irredeemable and non-cumulative preference share capital without the prior written approval of CDP.

Amended on 1 July 20081 July 2008 and 29 December 201429 December 2014.

5.11.2 Preference Shares

Amended on 1 July 20081 July 2008 and 29 December 201429 December 2014.

5.11.3 Qualifying Subordinated Loan

Amended on 1 July 20081 July 2008, 29 December 201429 December 2014 and 22 April 201922 April 2019.

5.11.4 Making of Unsecured Loan or Advance, Payment of Dividend or Director's Fees or Increase in Director's Remuneration by General Clearing Member

Each General Clearing Member shall not, without the prior written approval of CDP, make any unsecured loan or advance, pay any dividend or director's fees or increase any director's remuneration if:—

Amended on 1 July 20081 July 2008 and 29 December 201429 December 2014.

5.11.5 Credit Facilities

Each Clearing Member shall submit to CDP, in the manner as prescribed from time to time:

Added on 23 January 200923 January 2009.

5.12 Register of Connected Persons

Each Clearing Member shall keep a register of its directors and their connected persons.

For the purpose of this Rule, a "connected person" has the meaning ascribed to it in Section 2 of the SFA.

5.13 Exemption for SGXlink Pte Ltd

Subject to the conditions specified in writing by the Authority, Rule 5 shall not apply to SGXLink Pte Ltd.

5A.1.1

A Clearing Member must maintain separate Position Accounts for each Customer or each group of joint Customers whose account is carried on the books of the Clearing Member.

Added on 1 July 20161 July 2016.

5A.1.2

Each Position Account must be identified and designated, by the full name of the Customer(s) whose account is carried on the books of the Clearing Member and by a unique account code.

Added on 1 July 20161 July 2016.

5A.2.1

Each Clearing Member shall report to CDP such information as CDP may require for each Position Account opened with CDP as soon as practicable, and in any event, no later than such time as may be required for timely and orderly settlement of the first trade cleared by the Clearing Member for the holder of such Position Account into the intended Securities Account.

Refer to Practice Note 5A.2.1, 5A.2.2.

Added on 1 July 20161 July 2016.

5A.2.2

Each Clearing Member shall report to CDP any change in information previously reported to CDP for any Position Account as soon as practicable.

Refer to Practice Note 5A.2.1, 5A.2.2.

Added on 1 July 20161 July 2016.

5A.3.1

Each Clearing Member shall allocate the position of each trade cleared by the Clearing Member for a Customer to that Customer's Position Account or in accordance with that Customer's instructions, as soon as practicable, and in any event no later than such time as may be required for timely and orderly settlement of such trade into the intended Securities Account.

Refer to Practice Note 5A.3.1, 5A.3.4.

Added on 1 July 20161 July 2016.

5A.3.2

A Customer's Position Account must only be used for that Customer's positions. However, a Clearing Member may sub-allocate a position carried in a Customer's Position Account (the "originating Position Account") to another Position Account (the "destination Position Account"), provided that:

Added on 1 July 20161 July 2016.

5A.3.3

A Position Account may be used to hold positions for different Customers, provided that such positions are allocated out in accordance with the requirements provided in Rules 5A.3.1 and 5A.3.2.

Added on 1 July 20161 July 2016.

5A.3.4

For cases in which an SGX-ST Trading Member is warehousing its customer's trades, the Clearing Member shall ensure that no trades are warehoused for more than one Market Day, unless under exceptional circumstances. In such cases, the Clearing Member must document the reasons for the extension of time.

Refer to Practice Note 5A.3.1, 5A.3.4

Amended on 1 July 20161 July 2016 and 10 December 201810 December 2018.

5A.4 — Authorisation of SGX-ST Trading Member to Maintain Position Accounts

Amended on 10 December 201810 December 2018.

5A.4.1

For third-party clearing arrangements, a Clearing Member may authorise an SGX-ST Trading Member it qualifies (referred to in this Rule 5A.4. as the "Authorised Trading Member") to:

the SGX-ST Trading Member and/or the SGX-ST Trading Member's customers (such Position Accounts referred to in this Rule 5A.4 as the "Authorised Accounts"), in accordance with such procedures as CDP may require.

Amended on 1 July 20161 July 2016 and 10 December 201810 December 2018.

5A.4.2

Where a Clearing Member authorises an Authorised Trading Member to open and maintain Authorised Accounts under Rule 5A.4.1(a), Rules 5A.1and 5A.2 shall, with the necessary modifications, apply to an Authorised Trading Member in respect of each Authorised Account, as those provisions apply to a Clearing Member. The Clearing Member who authorises the Authorised Trading Member under Rule 5A.4.1(a) shall ensure that the Authorised Trading Member performs the obligations under Rules 5A.1 and 5A.2, as they apply to the Authorised Trading Member in respect of each Authorised Account.

Refer to Practice Note 5A.4.2, 5A.4.3.

Amended on 1 July 20161 July 2016 and 10 December 201810 December 2018.

5A.4.3

Where a Clearing Member authorises an Authorised Trading Member to open, maintain and allocate positions to the Authorised Accounts under Rule 5A.4.1(b), Rules 5A.1, 5A.2, 5A.3 and 5A.6 shall, with the necessary modifications, apply to an Authorised Trading Member in respect of each Authorised Account, as those provisions apply to a Clearing Member. The Clearing Member who authorises the Authorised Trading Member under Rule 5A.4.1(b) shall ensure that the Authorised Trading Member performs the obligations under Rules 5A.1, 5A.2, 5A.3 and 5A.6, as they apply to the Authorised Trading Member in respect of each Authorised Account.

Refer to Practice Note 5A.4.2, 5A.4.3.

Amended on 1 July 20161 July 2016 and 10 December 201810 December 2018.

5A.4.4

If a Clearing Member wishes to cease authorising an Authorised Trading Member, it shall:-

Added on 1 July 20161 July 2016 and amended on 10 December 201810 December 2018.

5A.5.1

Subject to Rule 5A.5.2, a Clearing Member shall identify the beneficial owner(s) and/or controlling party(ies) of any Position Account to CDP upon request by CDP within such time as CDP may require.

Amended on 1 July 20161 July 2016 and 10 December 201810 December 2018.

5A.5.2

If the Position Account holder does not want the identity of any underlying beneficial owner and/or any controlling party of such account to be disclosed to its carrying Clearing Member, the Position Account holder may apply to the CDP, through its carrying Clearing Member, to provide such information as CDP may require directly to CDP.

Added on 1 July 20161 July 2016.

5A.6.1

Each Clearing Member shall ensure that positions in each Position Account maintained with CDP are accurate. If any discrepancy between CDP's and the Clearing Member's records is noted, the Clearing Member must inform CDP and if required rectify the discrepancy immediately.

Amended on 1 July 20161 July 2016 and 10 December 201810 December 2018.

5A.7.1

Each Clearing Member irrevocably authorises CDP to disclose the contents of any information reported to CDP under this Rule 5A to any Exchange in so far as such information relates to trades executed on that Exchange or to any Position Account carrying such trades.

Added on 1 July 20161 July 2016 and amended 10 December 201810 December 2018.

Rule 6 — Clearing and Settlement between Clearing Members and CDP

Amended on 10 December 201810 December 2018.

6.1.1

All Exchange Trades shall be cleared and settled with CDP in accordance with these Clearing Rules.

Amended on 23 January 200923 January 2009 and 10 December 201810 December 2018.

6.1.2

Only Clearing Members shall be permitted to clear and settle Exchange Trades with CDP.

Amended on 10 December 201810 December 2018.

6.2.1

Subject to Rule 6.2.1A, when a transaction between 2 SGX-ST Trading Members is matched on the Trading System, or is reported to SGX-ST pursuant to the SGX-ST Rules on "Direct Business", or is otherwise accepted for clearing by the CDP, the following occurs:—

A, a Trading only Member, contracts to buy 1,000 shares and the trade is matched on the Trading System with B, a Trading only Member. The Clearing Member who has qualified A is C. The Clearing Member who has qualified B is D. Immediately upon the matching of the trade on the Trading System, the following occurs:—

Amended on 3 April 20083 April 2008, 23 January 200923 January 2009 and 10 December 201810 December 2018 .

6.2.1A

For transactions in Marginable Futures Contracts between 2 SGX-ST Trading Members which are reported to SGX-ST pursuant to the SGX-ST Rules on "Direct Business", novation under Rules 6.2.1(1)–(3) shall take place only upon:

Added on 23 January 200923 January 2009. Amended on 26 April 201326 April 2013.

6.2.2

Upon novation of an Exchange Trade to CDP:—

6.2.3

The obligations and rights in respect of the Novated Contracts:—

are owed by and to the parties as principals to each other notwithstanding that the buying and selling Clearing Members may have acted as agents for their respective customers in executing or clearing and settling the relevant Exchange Trade.

Amended on 23 January 200923 January 2009 and 10 December 201810 December 2018.

6.2.4

Subject as otherwise provided in these Clearing Rules the terms of the Novated Contracts shall be on the same terms as the relevant Exchange Trade replaced by such Novated Contracts.

Amended on 23 January 200923 January 2009.

6.2A.1

Save as provided in these Clearing Rules, the obligations in respect of a Novated Contract are due for settlement as follows:

Refer to Regulatory Notice 6.5.

Added on 10 December 2018 and Amended on 6 September 2021.

6.3 Set-Off of Payment Obligations in respect of Novated Contracts and Determination of Payment Obligations between CDP and Clearing Members

Amended on 10 December 201810 December 2018.

6.3.1

A Clearing Member's obligation to make payment to and right to receive payment from CDP in respect of Novated Contracts (including any obligation or right to pay or receive a Cash Settlement Amount or to make or receive compensation of corporate action entitlements as provided in these Clearing Rules) shall be settled by net payment in accordance with these Clearing Rules.

Amended on 23 January 200923 January 2009 and 10 December 201810 December 2018.

6.3.2

A Clearing Member's obligation to make payment and its entitlement to receive payment in respect of Novated Contracts on any Settlement Day shall be set off for each settlement currency.

The resultant net amount shall be known as the "Final Settlement Balance" for that Settlement Day and currency.

Amended on 23 January 200923 January 2009, 25 February 201125 February 2011, 26 April 201326 April 2013 and 10 December 201810 December 2018.

6.3.2A

(1) On each Settlement Day, CDP shall make available to each Clearing Member, a record of the Novated Contracts and the rights and obligations in respect of those Novated Contracts to be settled with CDP (including any obligation or right to pay or receive a Cash Settlement Amount or to make or receive compensation for corporate action entitlements as provided in these Clearing Rules), the Clearing Member's Final Settlement Balance(s), and the status of settlement.

(2) Save for manifest error, the record shall be binding and conclusive on the Clearing Member as to the Novated Contracts to be settled between the Clearing Member and CDP, the details and rights and obligations in respect of such Novated Contracts, the Clearing Member's Final Settlement Balance(s) and the status of settlement.

(3) Notwithstanding any manifest error in the record or any dispute as to the contents stated in the record, payment of each Final Settlement Balance shall be made by or to a Clearing Member in accordance with Rule 6.4. Any moneys to be refunded or deducted shall be refunded or deducted free of interest as soon as practicable after the dispute is resolved.

Added on 10 December 2018 and Amended on 6 September 2021.

6.4.1

(1) Unless otherwise notified by CDP to the Clearing Members, settlement of the Final Settlement Balance for each Settlement Day between a Clearing Member and CDP shall, subject to (2), be effected and final upon the execution of all settlement instructions submitted by CDP under the CDP Settlement Rules for settlement between CDP and that Clearing Member in respect of Novated Contracts, in that settlement currency, and which are due to settle on that Settlement Day.

(2) A settlement instruction, if not executed only by reason of there being insufficient securities available, shall not be taken into account for the purposes of (1).

(3) Failure by a Clearing Member to settle a Final Settlement Balance for a Settlement Day, on that Settlement Day, shall constitute a breach by the Clearing Member of these Clearing Rules.

Amended on 25 February 201125 February 2011, 26 April 201326 April 2013 and 10 December 201810 December 2018.

6.4.4

CDP shall be entitled to charge interest on any amount owing to CDP which is not settled when due, at such rate as may be determined by CDP.

Amended on 25 February 201125 February 2011 and 10 December 201810 December 2018.

6.4.5

Settlement of transactions between Clearing Members and CDP shall be in the currency as determined by CDP.

Added on 10 December 201810 December 2018.

6.5 Settlement of Securities in respect of Novated Contracts

Amended on 10 December 201810 December 2018.

6.5.1

Settlement of a Clearing Member's right on any Settlement Day to receive securities in respect of Novated Contracts (including any right to receive securities as compensation for corporate action entitlements as provided in these Clearing Rules) shall be effected and final upon CDP crediting such securities into the Clearing Member's Clearing Account.